How to Build Credit: 3 Essential Tools

By Heidi Unrau | Published on 01 Jun 2023

In collaboration with Borrowell

“How to build credit” is one of the most searched credit questions on Google. Why? A good credit score is your ticket to great things like better interest rates, your own apartment, a brand new smartphone, and even your dream job. A bad credit score will slam a lot of doors in your face. Unfortunately, not many people understand how to build credit. That’s why an app like Borrowell is an essential tool for anyone who wants to build credit and control their financial future. Here’s how to build credit with the right tools and The 5 Golden Rules:

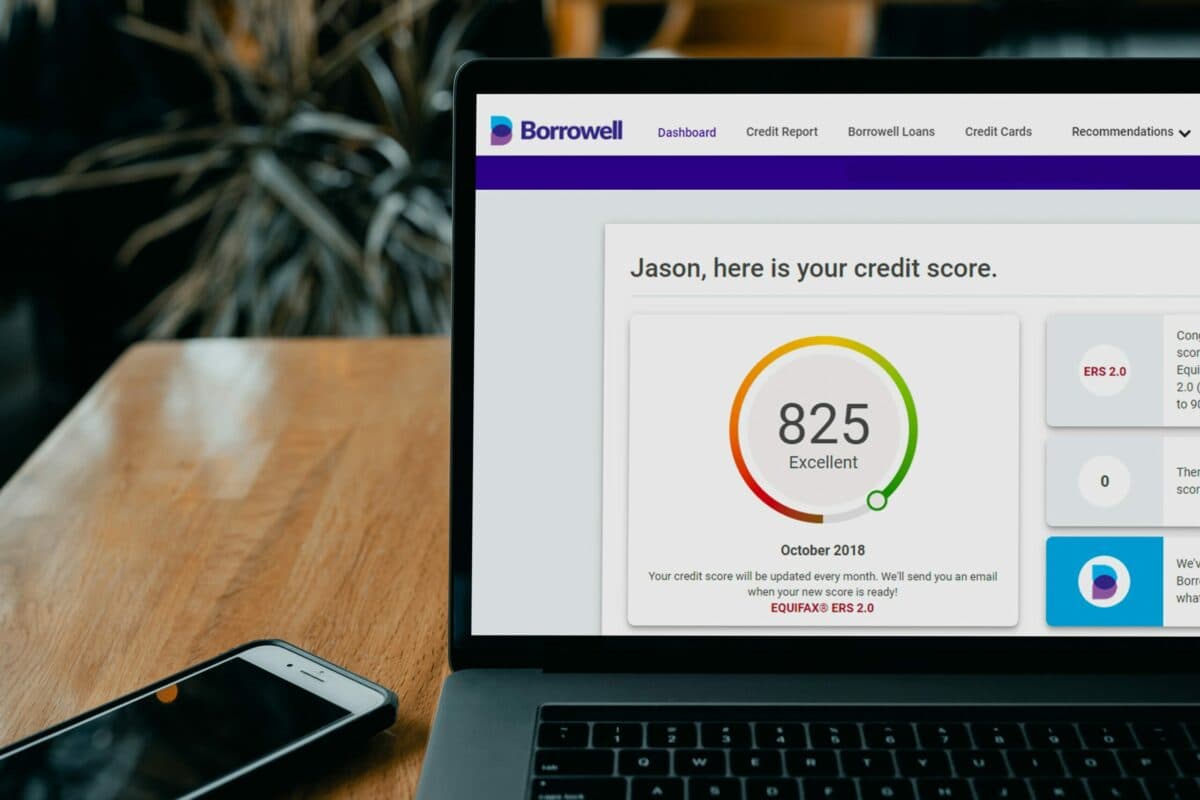

Tool #1: use a free credit score app

Ignorance is not bliss, so check your credit score often. You need to know what’s impacting it so you can make the right plan. But if credit checks hurt your score, this may seem a little backwards. Hard credit checks happen every time you apply for credit and consent to a credit check. They can hurt your score, especially if there are a lot of them in a short period of time.

Soft credit checks happen for reasons other than a credit application, don’t require your consent, and don’t hurt your credit score. An app like Borrowell lets you check your credit as often as you want without hurting your score because you’re not applying for credit. Here are 10 reasons you should monitor your credit score regularly:

- To see how your financial behaviour impacts your credit score

- To identify and fix mistakes that could be damaging your credit

- To know where you stand before you apply for new credit

- To avoid rejected credit applications that can lower your score

- To protect yourself against fraud and identity theft

- To spot changes on your file and respond quickly

- To know when you qualify for better rates and offers

- To see who is checking your credit file

- To understand what creditors see

- To help you set and achieve realistic goals

Tool #2: use guaranteed credit products

Of course, the best way to build credit is to use it. But if you have a bad credit score or no history, it’s almost impossible to access credit. It’s really quite a conundrum. So how do you build credit when lenders say no?

[Offer productType=“OtherProduct” api_id=“6511dc04a4ba41238225b316″]How to build credit with Borrowell Credit Builder

Borrowell provides a lending solution. Your approval is guaranteed, whether you’re new to credit or have a bad credit score. The credit-building loan works like a savings account. You make deposits, which are reported as payments to Equifax. You get your money back at the end of the term, minus some program fees. To qualify, you must be the age of majority in your province or territory and live in a province or territory where the product is offered.

[Offer productType=”OtherProduct” api_id=”64e600582bb7ed64e70ab28d”]Tool #3: the 5 golden rules of credit

Of course, none of that matters if you don’t manage credit responsibly. Borrowell and Refresh Financial are great tools, but they’re not enough on their own. To build credit, you also need to follow these 5 golden rules:

1. Always make your payments on time

Your payment history makes up about 35% of your credit score and it’s the first thing creditors look at. It tells them how likely you are to pay them back as agreed based on your past behaviour. Late or missed payments hurt your score the most and tell creditors you are a risky borrower. When you monitor your credit with Borrowell, you can keep track of your payment history, and make sure creditors are reporting accurate payment information on your file.

2. Keep balances low or pay them off

Credit utilization makes up 30% of your score. It refers to how much credit is available to you versus how much you already owe on things like credit cards and lines of credit (LOC). The more credit you use, the more it hurts your score, and the riskier you look to potential lenders.

A good rule of thumb is to keep balances below 30% of your credit limit. For example, if you have a credit card or LOC with a $3,000 limit, don’t carry a balance over $1,000. The best strategy is to pay off the balance in full every month. An app like Borrowell can help you keep track of your total credit utilization and the balances you owe.

3. Avoid closing credit cards and LOCs

The average age of your credit accounts makes up 15% of your credit score, and older is better. That’s because older accounts give lenders a much better idea of how you handle credit long term. It’s a good idea to keep certain types of credit accounts open like credit cards and lines of credit (LOCs), even if you don’t owe anything or use them often.

As the account ages, it will have a positive impact on your credit score. And if you don’t owe a balance, the available credit will reduce your utilization ratio for added benefit. If you’re worried about keeping old accounts open, an app like Borrowell helps you monitor all your open credit accounts for suspicious or unusual activity.

4. Pay what you owe, period

Public records make up 10% of your credit score and include items in collections, bankruptcies, overdue taxes you owe the government, and court judgments for things like unpaid alimony, child support, and even speeding tickets. It kills your score and looks really bad to potential lenders. It indicates a pretty serious default on the money you owe which tells lenders you can manage credit. Pay your accounts as agreed to avoid bad debt and public records tanking your credit score.

If you already have bad debt and public records, work on paying them off as soon as possible. Sometimes, you may not even know an account went to collections. Like if you moved and forgot to pay a utility bill from your old address. With an app like Borrowell, you can stay on top of your obligations and clear up mishaps.

5. Don’t apply for credit you don’t need

Every time you apply for credit there’s a hard credit check on your file. Hard credit checks are called inquiries and account for 10% of your credit score. A few inquiries a year make sense and don’t have a major impact on your credit. And credit bureaus also take into account if you’re house hunting or car shopping. But if you apply for multiple loans or credit cards within a short period of time, it’ll really hurt your credit score, especially if it’s lower, to begin with. Indicates you are desperate for credit which makes you look high risk.

Avoid applying for credit unless you actually need it in order to keep your credit inquiries low. An app like Borrowell lets you know who’s checking your credit file and how it impacts you. Don’t forget, you can check your own credit score as often as you want without hurting it.