Coinbase Review Canada (2026): Pros, Cons, Fees & Real Canadian Testing

By David Szemerda | Published on 29 Jan 2026

Coinbase is one of the most well-known cryptocurrency platforms worldwide, with more than 110 million verified users and millions of people using the service every month. Many Canadians choose Coinbase for its simple interface, strong reputation, and reliable way to buy, sell, and store digital assets.

To understand how well it actually performs in Canada, we tested the platform directly. We explored its funding options, ease of trading, feature set, and overall reliability, with special attention to the areas that matter most to Canadians such as Interac behaviour, PayPal friction, staking availability, and the quality of the advanced charting tools.

What we found is a platform that feels polished and accessible, with tools that work for both beginners and more experienced crypto investors. At the same time, a few early hurdles and Canada-specific limitations are worth knowing about before you start. This review brings together everything we learned so you can decide whether Coinbase is the right exchange for your needs.

Coinbase Overall Rating (Canada)

4.9 / 5

⭐ Ease of use: 5.0

⭐ Fees: 4.5

⭐ Funding & deposits: 4.7

⭐ Crypto selection: 5.0

⭐ Staking & rewards: 4.3

⭐ Mobile app experience: 4.8

⭐ Beginner-friendly: 5.0 Bottom line: Coinbase is ideal for new Canadian crypto users who want fast trading, clean design, and strong security, especially if they subscribe to Coinbase One for lower trading costs.

What Is Coinbase?

Coinbase is a globally recognized cryptocurrency exchange that provides a complete suite of services for managing digital assets, including buying, selling, converting, and securely storing cryptocurrencies through an easy to use platform. Founded in 2012, it has grown into one of the largest and most trusted crypto companies in the world, serving customers in more than 100 countries.

Users can buy and sell over 250 cryptocurrencies and access a wide range of crypto to crypto trading pairs. For Canadians, Coinbase offers a clean, beginner friendly interface along with access to a large selection of digital assets. Users who want deeper market data can switch to the optional advanced trading view, which includes professional grade charting tools and real time analytics.

As a publicly traded company on the NASDAQ, Coinbase offers a level of transparency and oversight that many exchanges cannot match. Its scale, long track record, and global infrastructure make it a strong choice for users who want a platform that is simple to navigate while still supporting more sophisticated trading strategies as their experience grows.

Is Coinbase Legit and Safe?

Coinbase is widely regarded as one of the safest and most reputable cryptocurrency exchanges available to Canadians. As a publicly traded company on the NASDAQ, it operates with a level of transparency that is uncommon in the crypto industry, including audited financial statements and regular regulatory disclosures. This gives users added confidence that Coinbase follows strong security and governance standards.

The platform uses industry-standard protections such as two factor authentication, encrypted storage systems, and a custody model where most customer assets are held offline. Coinbase also offers both a custodial wallet for convenience and a separate non custodial Coinbase Wallet for users who prefer to control their own private keys. The company maintains crime insurance on custodial assets, although this should be viewed as a complement to personal security habits, not a substitute for them.

In our own testing, Coinbase felt secure and stable. Once a payment method approved a transaction, trade execution was fast, and we did not encounter platform instability or behavior that raised concerns about safety.

From a personal standpoint, the Coinbase platform is a safe choice for Canadians who plan to use a centralized exchange. At the same time, it is worth remembering a widely accepted crypto principle. Long term holdings are safest in your own wallet rather than stored on any exchange. This is not specific to Coinbase but reflects general best practices for crypto custody.

For Canadians who value platform security, reputation, and straightforward user protections, Coinbase remains one of the most trustworthy and well-established options available.

Coinbase Pros and Cons

Pros

Beginner friendly interface

Coinbase has one of the cleanest and simplest interfaces we have used, making it easy for Canadians to buy their first crypto without feeling overwhelmed.

Advanced Trading View for experienced investors

The advanced interface includes MACD, RSI, Bollinger Bands, depth charts, real time order books, and multiple order types. This was one of the standout features during our testing.

Strong reputation and global transparency

As a publicly traded company with audited financials, Coinbase offers a level of oversight and credibility that many exchanges do not match.

Fast trade execution once payment is approved

Whenever PayPal or a card purchase was approved, trades executed instantly and the interface remained smooth.

Auto Buy for long term accumulation

Coinbase makes dollar cost averaging simple, allowing Canadians to automate recurring purchases with just a few taps.

Meaningful value through Coinbase One

The subscription can reduce fees significantly and provides boosted staking rewards. In our own testing, a single $500 purchase saved us more than two months of subscription cost.

Cons

Higher standard fees on the basic interface

The simple buy interface can be more expensive than platforms that rely solely on maker taker pricing.

Early friction with some Canadian payment methods

Some PayPal purchases were blocked by PayPal’s security checks, and Interac deposits failed due to strict name matching requirements.

Staking not intuitive at first

Staking is promoted in the menu, but initially we could not access a proper staking dashboard or see eligible assets. The experience only became clear after subscribing to Coinbase One and holding an eligible asset.

Customer support experience can vary

Our support interaction was slow to resolve and the initial agent was unfamiliar with Canadian banking terminology. The issue was resolved after escalation.

Our Real Testing as Canadians

To understand how Coinbase performs in real Canadian conditions, we went beyond the basics and tested how the platform behaves in practice. This included onboarding, identity verification, investor profiling, Interac funding attempts, PayPal purchases, staking, and day to day use of both the basic and advanced trading interfaces. Here is what actually happened during our testing.

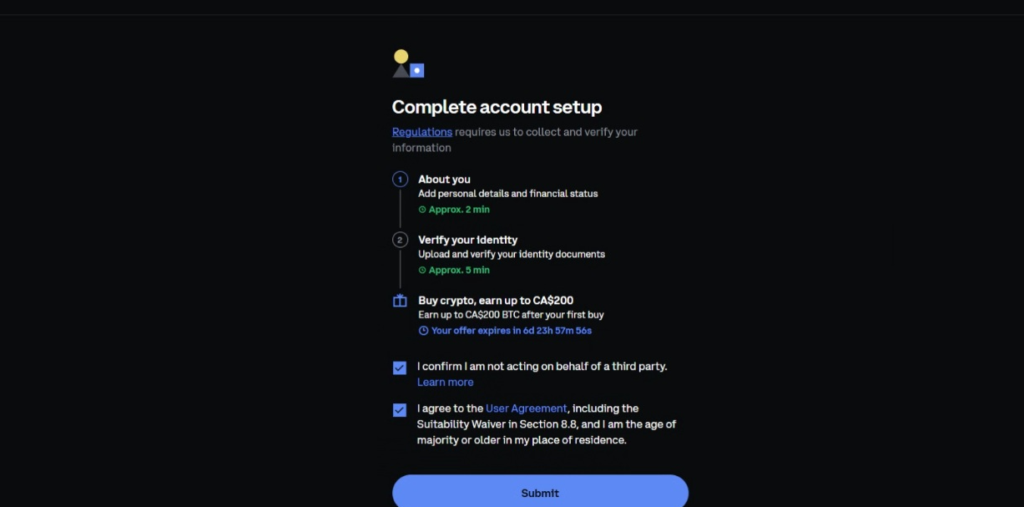

Account Setup and Verification

Getting started with Coinbase was straightforward. The platform guides you through each step, and identity verification was completed quickly. This part of the process feels similar to opening an account with any regulated financial service in Canada.

During onboarding, Coinbase also asks a series of investor profile questions about your experience level, financial situation, and account purpose. These are part of Coinbase’s KYC requirements. Canadians should answer them accurately, especially since crypto gains may be subject to tax reporting. It is not a questionnaire you can simply skip.

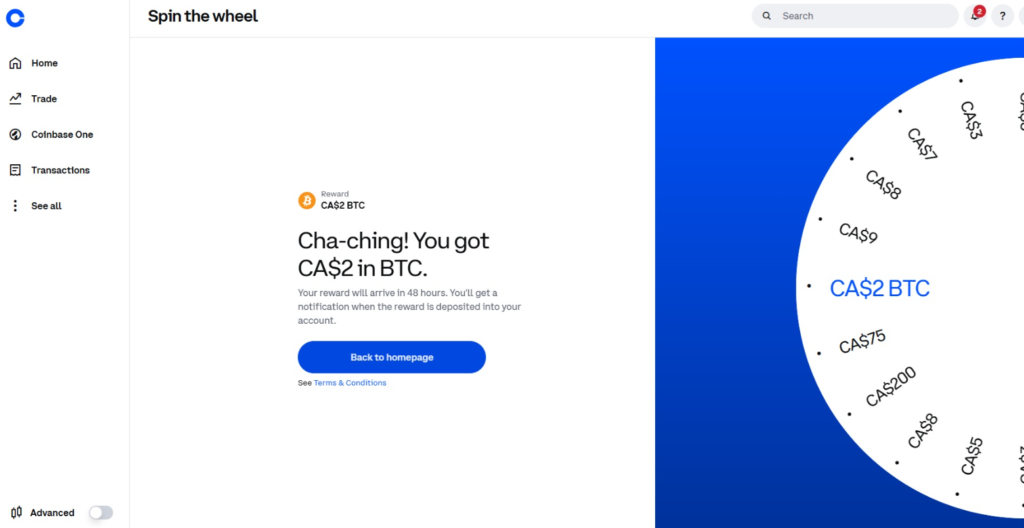

Once verification was completed, Coinbase greeted us with a small “Spin the Wheel” reward. We won two dollars worth of Bitcoin. It was a light, fun touch that gave a positive first impression. After that, we were able to access the dashboard and begin exploring the platform within minutes.

Interac Testing

Interac is one of the most common funding methods in Canada, so we began by trying to deposit $2,000 into our Coinbase account. The first transfer was withdrawn from our bank but never appeared in Coinbase. To confirm it was not a one time issue, we attempted the same deposit a second time, and it failed in the exact same way.

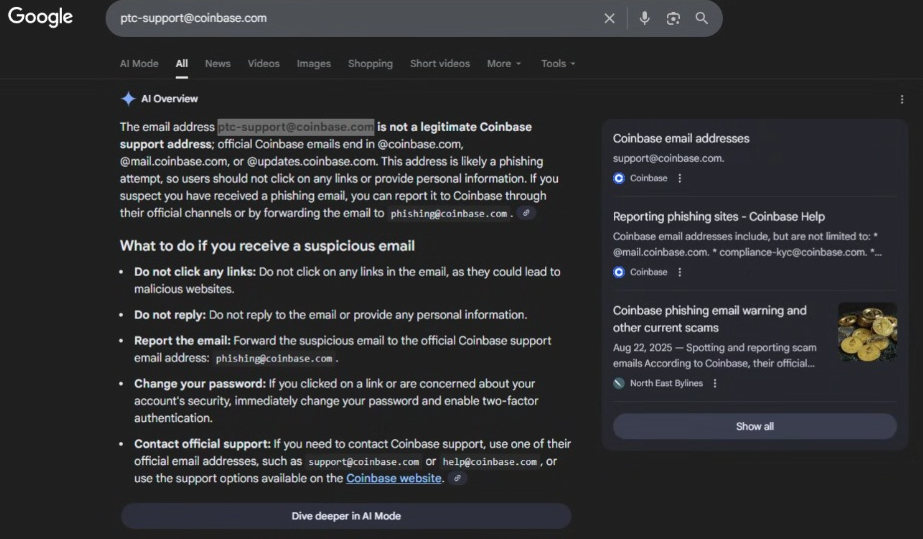

We reached out to Coinbase support, and the initial agent suggested it might be a bank side issue. RBC’s fraud team then flagged the Interac email used for the transfer as suspicious, even though the transaction was initiated inside Coinbase. Part of the confusion came from the way the email appears in Google’s AI Overview. The first line incorrectly suggests it is not a legitimate Coinbase email, while the next line confirms that official Coinbase emails end with @coinbase.com, which matched the address we used. This conflicting information made troubleshooting more difficult.

After escalating the issue with screenshots, a Coinbase specialist identified the root cause. The legal name on our bank account did not match the name on our Coinbase profile exactly. Even a small variation, such as using a shortened first name, will cause Coinbase’s system to automatically reject an Interac deposit.

The explanation made sense once we reached it, but getting there involved unnecessary confusion across both the banking and platform sides. Canadians planning to use Interac should ensure their names match perfectly to avoid similar issues.

PayPal Testing

After our Interac deposits failed, we turned to PayPal as the next available funding option. PayPal has a daily limit of $1,000 for Coinbase purchases, which is why we had planned to use Interac first. Since Interac was not working for us, PayPal became our main fallback method.

Our first PayPal transaction went through immediately, and the crypto appeared in our Coinbase account right away. However, when we tried to make additional purchases, the transactions began failing even though we were still well under the $1,000 daily limit. There was no clear explanation for why the payments were being declined.

We contacted PayPal support to investigate. They confirmed that the transactions were being blocked by their automated security system. The representative attempted to override the block so we could retry the purchase during the call, but even with the override active, the payment still did not go through. The agent advised us to wait 72h before trying again.

A few days later, we attempted more purchases. The first two went through without issues and arrived in our Coinbase account instantly. The third was blocked again in the same way as before. PayPal did not offer any detailed explanation for the pattern. Based on our experience, early activity on a newly linked PayPal account can trigger inconsistent approvals until more transaction history has been established.

PayPal does work with Coinbase, but Canadian users should expect some irregular approval behavior in the first few days. Once PayPal approves a purchase, Coinbase executes it instantly and the crypto arrives right away. All of the friction occurred on PayPal’s side rather than within Coinbase.

Overall Interpretation

Our testing showed that Coinbase feels stable and responsive once a transaction is approved by the payment method. Successful PayPal purchases executed instantly, the interface remained smooth, and we did not encounter platform side issues while trading.

The friction occurred before the funds reached Coinbase. Interac deposits failed because the legal name on our bank account did not match our Coinbase profile exactly, and PayPal repeatedly blocked transactions for security reasons even when we were under the $1,000 limit. These hurdles came from both the payment providers and our own oversight during setup, but they still shaped the early experience.

For Canadians, the main takeaway is that the first few days on Coinbase may feel inconsistent if you rely on funding methods with tighter controls. Once a payment is approved, Coinbase handles the rest quickly. If you plan to make time sensitive buys or react to market movements, it is important to keep this early funding friction in mind and choose the method that works most reliably for you.

Coinbase Fees (Explained Clearly)

Coinbase fees vary depending on how you buy crypto, which can make the cost difficult to predict for new users. The most important distinction is whether you use the simple buy interface or Coinbase Advanced Trade. We tested the fees ourselves and reviewed Coinbase’s official documentation to give Canadians a clearer picture of what to expect.

Fees on the Basic Buy Interface

When you use the basic “Buy” button, every transaction includes two costs:

1. A spread

This is built directly into the displayed price. In our test purchase, Coinbase showed:

“Price includes a 1.00% spread.”

2. A Coinbase fee

This is an additional fee that varies depending on factors such as:

- Payment method

- Order size

- Market conditions

- Liquidity at the time

In our CA$100 test purchase:

- Crypto cost after spread: CA$96.16

- Coinbase fee: CA$3.84

- Total: CA$100.00

This resulted in an effective fee of about 3.84%, on top of the 1% spread. The exact numbers will differ across transactions.

What this means for Canadians

The basic interface is convenient and beginner friendly, but the cost can be higher than platforms that rely strictly on maker taker pricing. Because both the spread and the Coinbase fee can change based on payment method and market conditions, the final cost is only visible at the confirmation screen.

If simplicity is your priority, the basic interface works well. If minimizing fees matters more, Coinbase Advanced Trade is usually a better option.

Fees on Coinbase Advanced Trade

Coinbase Advanced Trade removes the convenience fee and uses a transparent maker taker model, which is common among global exchanges.

- Maker orders (adding liquidity) usually have lower fees

- Taker orders (executing immediately) cost slightly more

- Your exact fee depends on your 30 day trading volume

This structure tends to be more predictable and cost effective, especially for Coinbase users who place multiple trades or prefer limit orders.

Why Advanced Trade is usually cheaper

- No added convenience fee

- No hidden spread markup on basic CAD buys

- Maker and taker fees are clearly stated

- Ability to place limit orders, which can reduce costs

- Allows crypto-to-crypto transactions

For Canadians who trade more than occasionally, Advanced Trade generally results in lower effective fees.

Are Coinbase Fees High in Canada

On the basic interface, total costs can be higher than exchanges that rely solely on maker taker pricing. This does not make Coinbase unreasonably expensive, but it does mean that your choice of interface and funding method affects how much you pay.

On Advanced Trade, fees are competitive with other global exchanges.

How Canadians Can Pay Less

1. Use Coinbase Advanced Trade

Switching to Advanced Trade removes convenience fees and applies transparent maker taker pricing, which usually leads to lower total costs.

2. Consider Coinbase One

Coinbase One offers zero fee trading on eligible transactions within a monthly allowance. For Canadians who buy crypto regularly or use a dollar cost averaging strategy, the subscription can reduce overall costs and often pays for itself.

Staking on Coinbase Canada

Staking was one of the features we were most excited to test, because as long-term crypto believers, we do not plan to sell our assets anytime soon. If we are going to hold them, earning passive rewards feels like a natural fit. Coinbase promotes staking clearly in the interface, so we expected to explore available assets and start staking right away. In practice, the experience was more confusing than we anticipated.

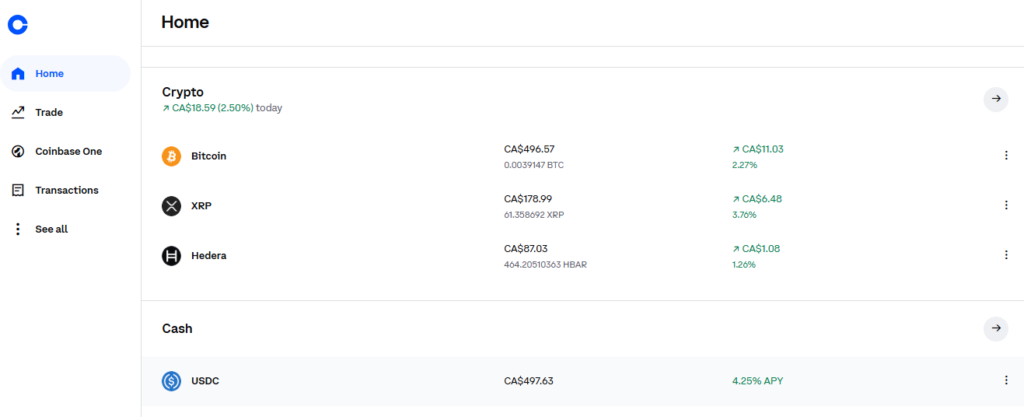

When selecting “Staking” from the main menu, we saw banners promoting yields and a button to “Explore assets.” Based on the layout, it looked as if staking should have been available immediately. Instead, every time we clicked “Explore assets,” the platform redirected us back to the main Trade page. None of the assets in our portfolio at the time, such as Bitcoin, XRP, or Hedera, displayed staking options either. There was no explanation about whether this was related to regional rules, unsupported assets, or temporary unavailability, which made it difficult to understand what was actually possible.

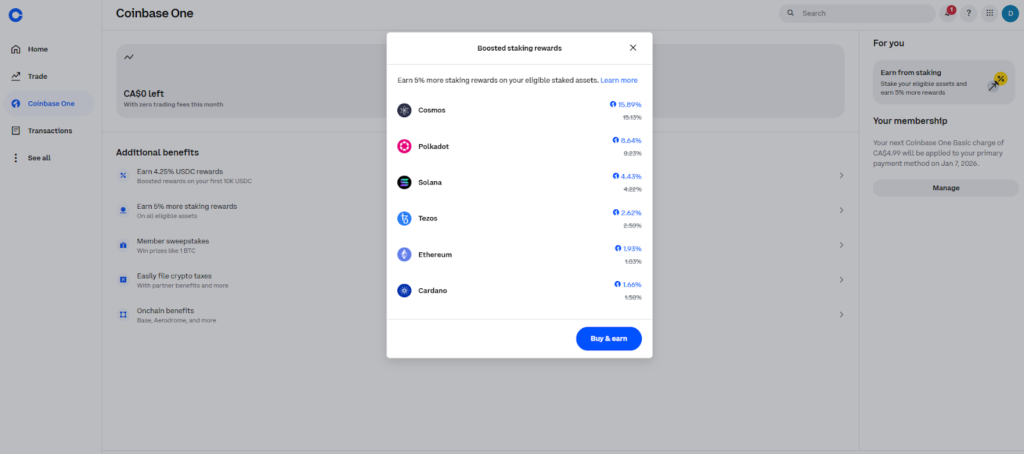

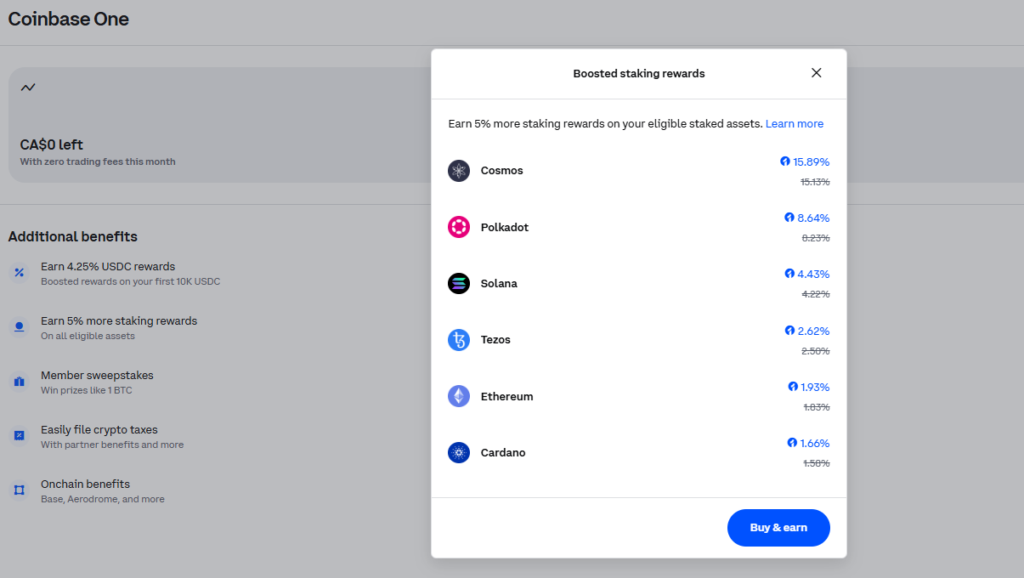

The experience changed once we subscribed to Coinbase One. Inside the Coinbase One benefits panel, the staking information became much clearer. We were able to see which assets were eligible for rewards and which ones offered boosted rates. This made it easier to understand how staking works on Coinbase and which coins we could realistically stake as Canadian users.

The final piece clicked when we purchased USDC. Once USDC appeared in our portfolio, the APY showed up directly on our home dashboard with a clear “4.25 percent APY” label. This was the first time staking felt intuitive, with visible yields and no redirect loops or uncertainty about eligibility.

For Canadians, staking on Coinbase is available, but the path to discovering it may not be straightforward at first. Once you view the staking options through Coinbase One or hold an eligible asset in your account, the experience becomes much easier to navigate. In our case, we were happy to finally understand how it worked, and earning APY on assets we plan to hold long term is a meaningful benefit. For some Coinbase users, these rewards alone could help offset the Coinbase One subscription cost.

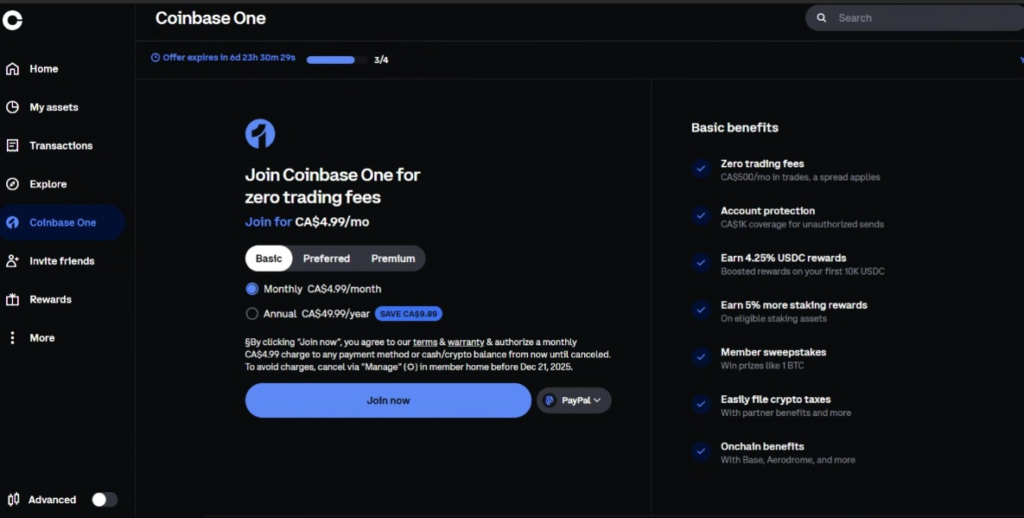

Coinbase One Review: Is It Worth It in Canada?

After testing Coinbase One firsthand, we found that it delivers far more value than simply lowering trading fees. The subscription improves the overall experience on Coinbase, especially for Canadians who buy crypto regularly or plan to hold assets long term. In our case, subscribing immediately unlocked clearer staking options, boosted rewards, and meaningful savings on trading costs.

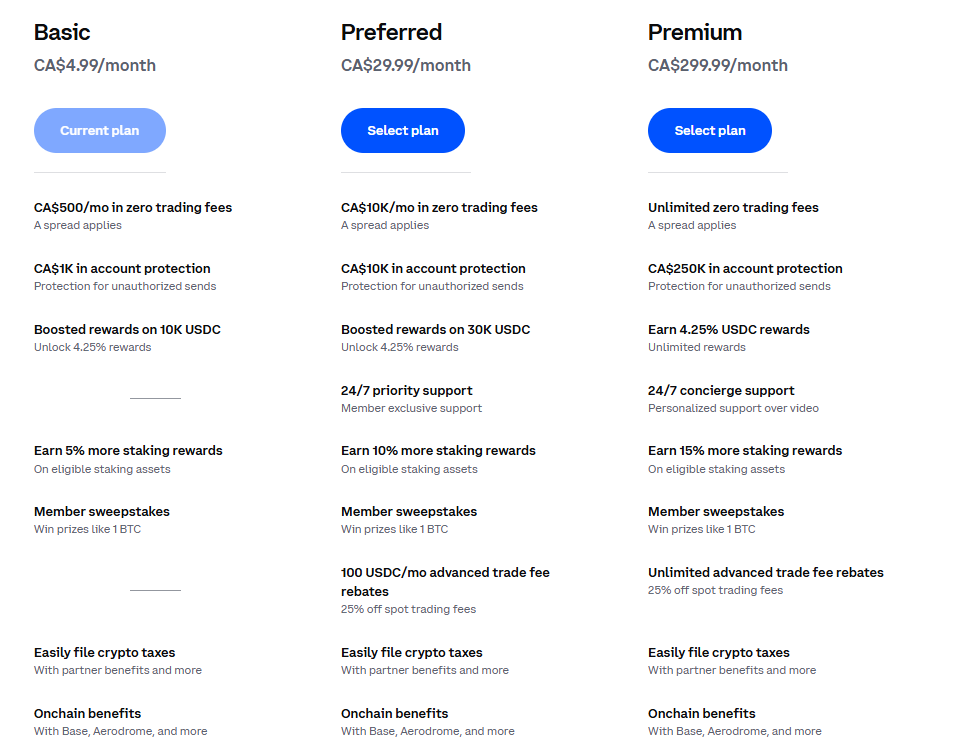

Plans and Pricing in Canada

Coinbase One is offered in three tiers:

- Basic at $4.99 per month with up to $500 in zero-fee trading volume, account protection, boosted USDC rewards, and increased staking rewards.

- Preferred at $29.99 per month with up to $10,000 in zero-fee trading and higher protection limits.

- Premium at $299.99 per month with unlimited zero-fee trading, concierge support, and the highest level of account protection.

All plans include benefits such as boosted USDC rewards, increased staking yields, crypto tax-reporting perks, and access to member sweepstakes.

Where the Real Value Comes From

The fee savings are immediate. During our testing, a single $500 purchase saved us $12 in fees on the Basic plan, which covered more than two months of the subscription cost. For Canadians who buy crypto consistently or follow a dollar cost averaging strategy, these savings add up quickly.

The value increases even more for Canadians who:

- Buy crypto consistently

- Use recurring purchases or DCA strategies

- Make several medium-sized trades per month

Once your monthly buying volume crosses a certain threshold, the subscription tends to pay for itself quickly.

Added Value from Staking and Rewards

Coinbase One also improved our staking experience significantly. Before subscribing, it was unclear which assets were eligible for rewards. After activating Coinbase One, staking options became easy to navigate and boosted APYs were clearly displayed. Holding USDC made the rewards even more visible, with the APY showing directly on our dashboard.

For long term holders, these boosted rewards can meaningfully offset the cost of the subscription. If you already plan to hold assets like USDC, Solana, or Cardano, the enhanced yields provide tangible value.

We initially subscribed to the Basic plan, but after seeing the savings and boosted rewards, we found ourselves wishing we had taken the Preferred tier to access higher zero-fee limits.

Who Should Consider Coinbase One

If you use Coinbase regularly, Coinbase One makes a noticeable difference. The subscription reduces trading costs, simplifies fee planning, and improves the overall experience through clearer rewards and enhanced features. Even moderate monthly activity can justify the cost, and in our case we quickly realized that a higher tier would have matched our usage even better.

Our Take on Coinbase One in Canada

After using it ourselves, Coinbase One feels less like an optional upgrade and more like the natural way to use Coinbase. The savings are immediate, the boosted rewards improve long term returns, and the platform becomes easier to navigate once the subscription is active. For anyone who is serious about buying or holding crypto, even at a moderate level, Coinbase One is an easy win.

Coinbase Advanced Trade Review

Coinbase Advanced Trade is designed for users who want deeper market insight and more control over their trades. We spent time using this interface to understand how well it performs for Canadian investors who rely on technical indicators, order books, or more precise execution. It ended up being one of the strongest parts of the entire platform.

Charting Tools and Indicators

The charting experience was a standout during our testing. Advanced Trade includes a range of tools that usually require third party platforms, such as:

- MACD

- RSI

- Bollinger Bands

- Multiple timeframes

- Candlestick views with clean movement

- Volume markers

- Depth charts

- Real time order book visibility

Being able to check indicators directly inside Coinbase made analysis faster and removed the need to switch between the app and external charting tools.

Order Types and Execution

Advanced Trade supports a wider range of order types than the standard interface, including:

- Market orders

- Limit orders

- Stop limit orders

Execution was instant whenever the payment method allowed the trade to proceed. Combined with the transparent fee model in this interface, it offered a smoother experience for users who want more predictable costs.

Layout and Ease of Use

Despite offering more advanced tools, the interface remains clean and easy to navigate. Information is grouped logically, and the layout feels less cluttered than what we have seen on some Canadian exchanges.

This balance of simplicity and depth is ideal for users who want stronger trading tools without needing the complexity of a full professional platform.

How It Compares to Other Canadian Platforms

In Canada, many exchanges either do not offer an advanced trading view or provide very limited charting tools. Compared to those platforms:

- Coinbase’s built in charts are significantly more capable

- The depth chart and order book display offer clearer insight into market conditions

- The overall experience feels more polished and stable

For users who already rely on technical analysis, Coinbase Advanced Trade stands out as one of the more complete options available to Canadians.

Our Take on Advanced Trade

Advanced Trade was one of the features we enjoyed most. It bridges the gap between beginner friendly design and professional grade tools, which makes Coinbase a strong fit for both new investors and more experienced traders.

Funding Methods for Canadians

Coinbase offers several funding options for Canadians, and each comes with its own strengths. Below is a general overview of what Canadians can expect when adding funds or buying crypto on the platform.

| Funding Method | Speed | Typical Limits | Best For |

| Interac e-Transfer | Fast once verified | Limits vary; name must exactly match your legal ID | Everyday deposits if you don’t mind initial verification friction |

| PayPal | Instant when approved | Starts low (~$1,000/day) but increases with account history | Small, instant purchases and convenience users |

| Visa/Mastercard | Instant | Card limits apply; fees may vary | Urgent buys or users who want one-click purchases |

| EFT / Bank Transfer | 2–5 business days | Higher limits over time | Larger deposits, recurring funding, long-term investors |

Our Take on Funding Methods

Canadians have several ways to add funds or buy crypto on Coinbase, but each method comes with trade-offs:

- Interac is the most natural choice, but name matching must be exact.

- PayPal is convenient but initially capped at $1,000 CAD per day.

- Visa and Mastercard are fast and reliable, but fees depend on the card issuer.

- EFT is slower but stable for non-urgent transfers.

Once a transaction is approved by the payment method, Coinbase processes it instantly. The funding method you choose will determine how smooth those first purchases feel.

Customer Support Review

Customer support can be an important part of the crypto experience, especially when dealing with funding issues or identity verification. To evaluate Coinbase’s support quality, we contacted the team during our testing when Interac deposits were failing. The experience highlighted both strengths and limitations that Canadians may want to be aware of.

Our Support Interaction

Our support request involved an Interac deposit that was withdrawn from our bank account but did not appear in Coinbase. The first support agent we spoke with struggled to recognize the Interac email associated with the transfer and initially suggested it might be fraudulent. The agent also seemed unfamiliar with major Canadian banking institutions and terminology. This made the early steps of troubleshooting feel slow and unclear.

After providing screenshots and requesting escalation, a specialist reviewed the issue and confirmed that the Interac email was legitimate. The final explanation was that the name on our bank account did not perfectly match the name on our Coinbase profile, which caused the transfer to be rejected.

The issue was eventually clarified, but the process took longer than expected.

How This Compares to Broader Feedback

While researching for this review, we observed a recurring theme in community discussions. Users often find Coinbase reliable during normal activity but report that support can feel limited or slow when an issue requires deeper investigation.

Our experience aligns with that pattern. The platform works very smoothly once everything is set up correctly. When something falls outside the usual flow, support quality depends heavily on the agent and the complexity of the problem.

Where Coinbase One Improves the Experience

Coinbase One includes enhanced support, especially at the higher tiers. Faster response times and access to more knowledgeable agents can be meaningful advantages for users who:

- Trade regularly

- Move larger amounts

- Prefer a predictable and faster resolution path

For users who value peace of mind, improved support may be a compelling part of the subscription.

Our Take on Customer Support

Our support experience was mixed. The initial responses were not very helpful, but the issue was eventually resolved once it reached a specialist. This is consistent with what we often see on large financial platforms, where frontline agents may have limited regional knowledge.

Support is not the strongest part of the Coinbase experience, but for many users it may not be a dealbreaker, especially if they choose to upgrade through Coinbase One.

Who Coinbase Is Best For

Coinbase appeals to a wide range of Canadian crypto users. The platform is simple enough for beginners yet powerful enough for investors who want deeper tools and more control. Based on our testing, here are the types of users who are most likely to enjoy the best experience with Coinbase.

Beginners Who Want a Simple Start

Coinbase is one of the easiest places for Canadians to buy crypto for the first time. The interface is clean, onboarding is quick, and the flow from creating an account to making your first purchase feels intuitive. Anyone who wants a smooth and low-pressure introduction to crypto will feel at home here.

Investors Who Prefer a Long-Term, Low-Effort Strategy

If your goal is to build your crypto position gradually, Coinbase works very well. Auto Buy makes dollar-cost averaging simple, and the layout helps you focus on accumulation without getting overwhelmed by advanced trading tools. Staking rewards and boosted APYs available through Coinbase One can also make long-term holding more rewarding.

More Advanced Traders Who Value Strong Charting Tools

The Advanced Trading View is one of Coinbase’s strongest features. It includes MACD, RSI, Bollinger Bands, depth charts, real-time order books, multiple order types, and a cleaner interface than many Canadian competitors. For traders who like making data-driven decisions, Coinbase offers a much richer experience than most local exchanges.

Users Who Want Predictable Fees Through Coinbase One

Anyone who buys crypto regularly will likely find Coinbase One worthwhile. The subscription helps reduce trading friction, makes fees predictable, and provides boosted rewards on assets like USDC. Even moderate monthly activity can justify the cost, and in our case, a single $500 transaction already covered more than two months of the Basic plan.

People Who Prefer a Well Established and Transparent Platform

As a publicly traded company, Coinbase provides more visibility into its operations than most crypto platforms. Canadians who value trust, oversight, and long-term platform stability may feel more comfortable choosing Coinbase over smaller or less transparent alternatives.

Final Verdict: Is Coinbase Worth It in Canada

After testing Coinbase in real Canadian conditions, our overall impression is that it is one of the strongest and most polished crypto platforms available today. The interface is clean and accessible, trade execution is fast once your payment method approves the transaction, and the Advanced Trading View surpasses what most Canadian competitors offer.

The main friction points come from external payment systems, not from Coinbase itself. Interac requires a perfect legal name match, and PayPal has a $1,000 daily limit with occasional early-use security checks. Staking was initially confusing, but once we subscribed to Coinbase One and held an eligible asset, the experience became clear and easy to use.

For Canadians who want a reliable, well-established, and user-friendly platform, Coinbase is a strong choice. Users who buy crypto regularly may find even more value by pairing the platform with Coinbase One.

If your priority is the lowest possible fees with no subscription, or if you need very advanced trading tools found only on specialized platforms, there are alternatives worth considering. But for most Canadians who value ease of use, strong charting tools, staking rewards, and a high degree of trust, Coinbase stands out as one of the best options available.

Frequently Asked Questions

Is Coinbase safe for Canadians

Yes. Coinbase is considered one of the safest crypto exchanges available to Canadians. It is a publicly traded company with audited financials, strong security practices, and a long track record in global markets. The platform uses protections such as two factor authentication, encryption, and offline storage for most assets. As with any exchange, long term holdings are safest in your own wallet, but Coinbase is a reliable place to buy and trade crypto.

Are Coinbase fees high

On the basic interface, fees can be higher than on exchanges that use pure maker taker pricing. Canadians who want lower and more predictable fees can switch to Coinbase Advanced Trade or use Coinbase One to reduce trading costs.

Does Coinbase support Interac e Transfer

Yes, but the name on your bank account and your Coinbase profile must match exactly. If they do not match perfectly, the deposit may fail.

Why did my PayPal purchase get blocked

Some PayPal transactions may be declined due to PayPal’s internal security checks, especially when a new crypto connection is first established. Once a purchase is approved by PayPal, Coinbase processes it instantly and the crypto appears in your account right away.

Is Coinbase a good app for beginners

Yes. Coinbase is one of the most beginner friendly crypto platforms in Canada. The interface is simple, onboarding is quick, and buying your first asset only takes a few steps.

Can I use advanced charting tools on Coinbase

Yes. Coinbase Advanced Trade includes tools such as MACD, RSI, Bollinger Bands, depth charts, order books, and multiple order types, making it suitable for more experienced traders.

Can I stake crypto on Coinbase in Canada

Staking is available on Coinbase, but the experience may not be intuitive at first. During testing, staking options only became clear after we subscribed to Coinbase One and held an eligible asset such as USDC, which displayed the APY directly in our dashboard.

Is Coinbase One worth it

For Canadians who buy crypto regularly, Coinbase One can be worth it. In our testing, a single $500 purchase saved us $12 in fees, which covered more than two months of the Basic plan. The subscription also provides boosted staking rewards and a smoother overall experience.

How long does Coinbase verification take

Verification is usually quick. In our case, we were able to use the platform shortly after completing the identity check.

Does Coinbase offer free crypto

Yes. Coinbase offers several ways for users to earn small amounts of crypto. Promotions vary, but they typically include learning rewards through Coinbase Earn and referral bonuses. For example, new users may receive a Bitcoin reward when they sign up through a referral link and complete their first eligible trade. Reward amounts and availability depend on the promotion period and region.