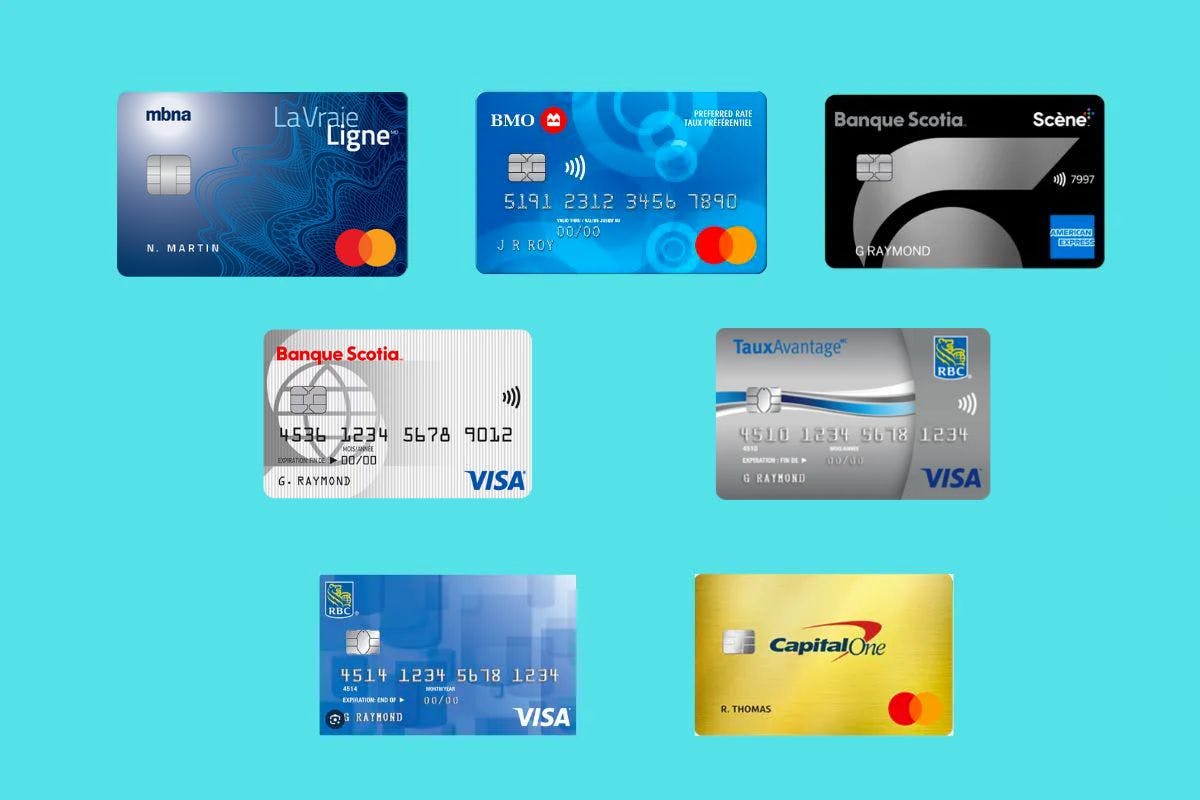

The 7 Best Low-Interest Credit Cards in Canada in 2024

Do you often find yourself unable to pay off your entire credit card balance at the end of the month? If that’s the case, you should consider getting a low-interest credit card. Indeed, credit cards with reduced interest rates typically offer an interest rate lower than 14.90%, whereas standard credit cards usually have rates of at least 19.99% and can go up to 29.99%. To avoid paying more for your purchases due to interest charges, look no further; we have compiled a list of the best low-rate cards for you.

[Offer productType=”OtherProduct” api_id=”6654b8321688eb5e5db5df1e”]1. MBNA True Line Mastercard – Best Overall

[Offer productType=”CreditCard” api_id=”5fa300347964eb6eed4655e7″]Our top choice for the best low-interest credit card is the MBNA True Line Mastercard. This card has a low rate of 12.99% on purchase interest rates and balance transfers. However, it has a fairly standard rate of 24.99% on cash advances. Plus, new cardholders who meet certain criteria will be eligible to receive 12 months of a 0% interest rate on balance transfers.

The MBNA True Line Mastercard is available for no annual fee and, on top of its low-interest rate, is a great option if you’re trying to rebuild your credit. It doesn’t have a minimum income requirement and you only need a credit score of around 660 to qualify. If you’re carrying a balance from a different card, you can save quite a bit in interest by transferring to the MBNA TrueLine Mastercard.

And if you charge a large purchase to your MNBA True Line Mastercard, you can save even more on interest with an MBNA Payment Plan, which lets you pay off high charges in installments rather than be charged interest.

| Eligibility Requirements | MBNA TrueLine Mastercard |

| Credit Score (estimate) | 660 |

| Annual Income | N/A |

| Additional | Resident of Canada Provincial Age of Majority |

2. BMO Preferred Rate Mastercard – Best for Balance Transfers

[Offer productType=”CreditCard” api_id=”5f2ac25068c746304bee125a”]The BMO Preferred Rate Mastercard offers an interest rate of 13.99% on purchases and 15.99% on cash advances and balance transfers. However, it offers a reduced welcome rate on balance transfers of 0.99% for the first 9 months after opening the account. Each transfer must be for a minimum of $100 and a 2% transfer fee applies.

With the BMO Preferred Rate Mastercard, you benefit from a free extended warranty and purchase insurance. It protects you against theft and damage to the items purchased with the card for 90 days, up to a lifetime maximum of $60,000.

| Eligibility Requirements | BNO Preferred Rate Mastercard |

| Credit Score (estimate) | 660 |

| Annual Income | N/A |

| Additional | Resident of Canada Provincial Age of Majority |

3. Scotiabank Value Visa Card – Best For Larger Purchases

[Offer productType=”CreditCard” api_id=”5f32dd5563ae8636997fa6ab”]The Scotiabank Value Visa credit card is popular for a very good reason. The interest rate on purchases, cash advances and balance transfers on the Scotiabank Value Visa card is 12.99%.

No insurance is included with this credit card, but you can enroll in one of two optional coverages: “Basic Protection” or “Comprehensive Protection”. The first offers death, critical illness and hospitalization coverage. The second offers the same coverage plus one for disability, job loss and strike or lockout.

Recently, Scotia SelectPay became available. It’s a monthly instalment plan that lets you pay for your purchases in bite-sized chunks. Purchases of $100 or more are converted into fixed monthly payments, with no interest and low fees ($8.00/month).

Road trip enthusiasts will be pleased to know that when you rent a car with the Scotiabank Value Visa at participating Avis and Budget locations in Canada and the United States, you are entitled to a discount of up to 25%.

| Eligibility Requirements | Scotiabank Value Visa Card |

| Credit Score (estimate) | 660 |

| Annual Income | $12,000 |

| Additional | Resident of Canada Provincial Age of Majority Minimum card limit of $500 |

4. Scotiabank Platinum American Express Card – Best For Travel

[Offer productType=”CreditCard” api_id=”62c4512c8e710d4f783b951c”]Sure, at $399 a year, the Scotiabank Platinum American Express credit card isn’t cheap! But you get what you pay for. Its interest rate is among the lowest, at 9.99%. If you like to travel, you’re in for a treat. You will pay no foreign transaction fees, whether you shop online or in a store outside Canada. Only the exchange rate applies. You will also enjoy 10 free airport lounge visits per year. It’s actually one of the best cards for airport lounges. Plus, you earn 2 Scene+ points on all your purchases.

If you use Scene+ Travel, you’ll even earn 3 Scene+ points for every dollar you charge to your Scotiabank Platinum American Express card on hotel and car rental reservations. Your points can be redeemed for airfare, car rentals and hotel reservations. If you’re not travelling this year, it’s easy to redeem them for merchandise, dining and entertainment.

| Eligibility Requirements | Scotiabank Platinum American Express Card |

| Credit Score (estimate) | 700 |

| Annual Income | Not specified |

| Additional | Resident of Canada Provincial Age of Majority Minimum credit limit of $10,000 |

5. RBC Visa Classic Low Rate Option – Best for Vehicle Owners

[Offer productType=“CreditCard” api_id=“5f3558577096af4588b011e1″]As the name implies, the RBC Visa Classic Low Rate Option is like the standard Visa card but with a flat 12.99% interest rate for all transactions. The fee is $20 for the primary cardholder and 0$ for all authorized users.

This card has gas rewards too. Use your card at Petro Canada stations and you can save 3¢ per litre on fuel. If you have a Petro Points card, your RBC Visa Classic Low Rate Option gets you 20% more Petro Points. This credit card also gives you a free 3-month subscription to DashPass, which entitles you to unlimited free deliveries on orders of $15 or more.

Furthermore, you get purchase protection and extended warranty insurance with this card. You have the option to add on extras. Travel insurance, identity theft protections, RBC road assistance service, and balance protection features are available when you apply.

| Eligibility Requirements | RBC Classic Low-Rate Option |

| Credit Score (estimate) | 630 |

| Annual Income | N/A |

| Additional | Resident of Canada Provincial Age of Majority |

6. RBC RateAdvantage Visa – Best for Variable Rates

[Offer productType=“CreditCard” api_id=“5f3572317096af4588b011e5″]The RBC RateAdvantage Visa Card uses a variable prime rate, determined by RBC, which is 7.20% since July 2023 but very much subject to change. An additional 4.99% to 8.99% is added, depending on your application information, including your credit score. The higher your credit score, the less interest you should pay. It is, therefore, in your best interest to pay all your balances on time to take advantage of the lowest possible rate.

Like all RBC cards, this one offers an instant discount of 3¢ per litre at Petro-Canada. This discount is valid on all types of gasoline (including diesel) at any station. When you use your card at Petro-Canada, you also earn 20% more Petro-Points on all eligible purchases. The RBC Rate Advantage also comes with purchase insurance and an extended warranty.

| Eligibility Requirements | RBC Rate Advantage Visa |

| Credit Score (estimate) | 630 |

| Annual Income | N/A |

| Additional | Resident of Canada Provincial Age of Majority |

7. MBNA True Line Gold Mastercard – Best Rates on Purchases

[Offer productType=”CreditCard” api_id=”5f452a294726ce7207266a6d”]The MBNA True Line Gold Mastercard offers a low interest rate on purchases and balance transfers, but fairly standard rates on cash advances. With this card, you benefit from purchase protection covering loss, damage or theft of your items for 90 days after the date of purchase. The manufacturer’s warranty is doubled for up to one year. You also have access to assistance and legal aid services, particularly in the event of lost luggage or for the replacement of lost documents and tickets.

If you rent a car, you’ll get at least a 10% discount at Avis and Budget in Canada and the United States. Internationally, the discount is at least 5%. The MBNA True Line Gold card allows you to have up to 9 additional cards at no charge.

| Eligibility Requirements | MBNA True Line Gold Mastercard |

| Credit Score (estimate) | 680 |

| Annual Income | N/A |

| Additional | Resident of Canada Provincial Age of Majority |