FIRE Calculator

Find out how soon you could reach financial independance and retire early with our FIRE Calculaor. Our calculator will tell you at what age you could retire, and how much money you need to invest per month to do so.

Table of Contents

The Financial Independence Retire Early (FIRE) movement is a personal finance philosophy that advocates people living a frugal lifestyle and investing rigorously in order to retire early and live off of the investments made. While the term was initially coined in the 1992 book “Your Money Or Your Life” by Vicky Robin and Joe Dominguez, it has regained popularity in recent times as people seek to regain control of their time.

If the FIRE lifestyle appeals to you, but you aren’t sure how to go about preparing for an early retirement, we are here to help! Our FIRE calculator is curated specifically for people to understand how much they need to save and invest each month to live the lifestyle they want to live in retirement. It also enables users to test multiple scenarios of returns on their investment portfolio to see how a change in the markets impacts your financial goals.

How to use the Hardbacon FIRE Calculator

The FIRE calculator is designed to be user-friendly and easily understandable for people with varying degrees of personal finance knowledge. As a user, all you have to do is enter the numbers applicable to your own personal situation into the right cells, and the calculator will take over after. All cells that need a data entry are labelled for reference.

Before you start though, you should have the following numbers on hand with you. If you need to search for any of the information listed below, we have provided an indication of where you would be able to find it if required. These are the most important numbers to be entered into the FIRE calculator.

- Your current age: If you don’t already know it, it can be found on a passport or other such government-issued ID.

- Your annual income (use after-tax income for most accurate results): This can be found on your paystubs that you receive from your employer or by checking your monthly bank statements.

- Annual expenses: This can likely be found on your monthly bank statements as well. You may want to take an average over 2-3 years to ensure accuracy.

- Current net worth: The total value of your assets (cash in the bank, house value, car value, etc.) minus your liabilities (any debt you hold like credit cards, personal loans, student loans, etc.).

- Asset allocation: This is a personal decision based on your own risk appetite and financial goals that may be taken in conjunction with a financial advisor.

- Expected rate of return: Your financial advisor will be able to provide an indication of what type of returns you can expect to earn on each of your stock portfolio, bond portfolio, and cash portfolio.

Understanding the results of the FIRE calculator

Once you have entered the required numbers on the left, look over to the right and your FIRE goals will be right in front of you! There are several numbers here, so we will go through each of them below to ensure that you know what they mean, and more importantly, that you know what to do to make progress on your way to Financial Independence Early Retirement.

- You can achieve financial independence in: This is possibly the number that will get the most attention. Essentially, this figure tells you how many more years you need to work at your current income and investment assumptions to be able to afford your projected annual expenses that you input on the left side.

- Annual Savings: This figure is simply your Annual Income minus your Annual Expenses to show you how much you are projected to save each year.

- Savings Rate: The Savings Rate number expresses your total Annual Savings (described above) as a percentage of your Annual Income to demonstrate how much of each dollar you earn goes towards your expenses and how much is being saved. For example, a 40% Savings Rate implies that for every $100 you earn, $60 is spent on expenses and the remaining $40 is saved.

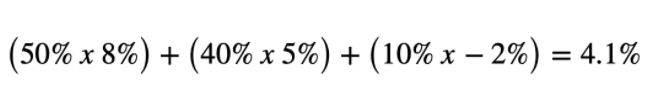

- Average Return: This represents the weighted average of the returns that you have assumed per your asset allocation. For example, if a user assumed a portfolio comprised of 50% equity, 40% fixed income, and 10% cash where equity earned 8%, fixed income earned 5%, and cash earned -2%, then the formula for Average Return would look like the below:

- Year of Retirement: Assuming that you have made the right investment and savings assumptions on the left, the Year of Retirement is the year where you can expect to hang up your boots permanently to start living the FIRE life!

- Monthly Deposits Needed: The calculator assumes that the excess amount you have left after fulfilling your required expenditures each month is fully deployed into the investments as per your allocation. A simple way to calculate this is to take the Annual Savings amount from above and divide it by 12 to see how much you need to deposit into your investments on a monthly basis.

Learn more about the FIRE Calculator Inputs

At first glance, the numbers required to be entered into the FIRE calculator may seem daunting. Given that the FIRE movement emphasizes both aggressive saving and investment, there are several variables that the calculator tracks to provide you with the best possible answer for your financial goals. Below is a detailed description of each input:

Age: In short, the younger you start saving and investing towards your goals, the earlier you can retire based on the FIRE methodology.

Annual income: Ideally, you want to use your after-tax income for this amount to reflect the exact amount of disposable income you receive each year into your bank account. You also want to ensure that you are capturing all of your income streams here. For example, if you own stock that pays you quarterly dividends or have a property where you receive monthly rent, earnings from those sources should be added to your income. If you are a business owner, then a good way to estimate annual income is to take a historical average over 3 to 5 years if you do not have visibility over how much you will earn each year.

Annual expenses: Your annual expenses are a bit of a flexible number depending on what type of lifestyle you live and plan on living. There are 3 types of retirement expenses you can plan for:

- You can assume that you will have the same level of expenses in retirement as you do currently. This is the ‘Coast FIRE’ approach (explained below).

- You can assume that you will spend more each year in retirement than you do currently. This is the ‘Fat FIRE’ approach (explained below).

- You can assume that you will spend less each year in retirement than you do currently. This is the ‘Lean FIRE’ approach (explained below).

Current net worth: Your current net worth is determined as the value of all your assets minus the value of your liabilities. Assets may include cash you have in the bank, properties, cars, and even watches if you are a collector! Take the market price of these belongings to understand the total asset value. Next, subtract all the debts you owe (mortgage, car loan, student loan, etc.).

Asset allocation: Your asset allocation is likely tied to what stage of life you are currently in and your appetite to take on investment risk for the possibility of higher returns. When you are young, you can likely afford to take on more risks because even if things don’t turn out well, you still have a long time to make it up again. However, as you get older, your risk appetite diminishes in most cases. As such, you might find a higher weighting of equities in the investment portfolios of young people while older demographics will start to have equal or greater weightings of fixed income over equities. This is because stocks (equities) are considered to be riskier than bonds (fixed income), which pay out regular interest to bondholders.

Expected rate of return: The expected rate of return is the anticipated return you get on your investment each year. Typically, stocks have greater returns than bonds. However, this greater return comes at a higher risk too as discussed above. On the other hand, holding cash can cause a negative return because cash loses some value to inflation each year (typically 2%). To understand the rate of return for equities and fixed income, you should look at the historical performance of stock or bond indices, or talk to your financial advisor. Here are definitions of the three main asset classes our calculator ask you to provide an expected rate of return for :

- Equities (stocks) are shares of companies that you can buy on a stock exchange such as the Toronto Stock Exchange or the NYSE. Typically, you can expect equities to return between 6% to 10% or even higher depending on the type of equities you select.

- Fixed income (bonds) are securities issued by companies or governments that offer regular interest payments at predefined rates to their investors. You can earn anywhere from 1% to 6% or even higher depending on the type of bonds you purchase.

- Cash is also an asset class. This comprises the cash that you keep in your bank account for any purposes like paying your daily bills or just holding for emergencies. Because cash doesn’t generate any return annually, it actually declines in value based on inflation. Historically, a good measure of inflation has been around the 2-3% range.

Coast FIRE vs. Lean FIRE vs. Fat FIRE

While the calculator can provide you with the monthly deposits you need to be making into your investments to meet your financial goals, you may be wondering if there is a single number that we can calculate where you can retire from your day job with full peace of mind that you do not have to make any further contributions to your retirement fund. However, this depends on what type of lifestyle you want in retirement.

As we briefly discussed above, there are different types of lifestyles that you can plan for in retirement.

- The Coast FIRE number is the figure in your retirement accounts that will cover all your planned retirement spending at the rate of your current expenses. This is done through the power of compounding. By saving and investing heavily in your early career, you will eventually reach a number where your investments will grow into the amount you need to cover your retirement expenses, thereby enabling you to ‘coast’ towards retirement once that number is reached.

- The Lean FIRE number assumes that you spend less in retirement than what you are currently spending. Perhaps you won’t have to worry about childcare expenses in retirement that you are currently paying for. Or perhaps you imagine yourself living in another country with lower living expenses. In this case, the Lean FIRE approach will provide you with a smaller number to hit to be able to cover your retirement expenses.

- The Fat FIRE number is the opposite of Lean FIRE where you envision spending more in retirement than you do currently. If you are looking forward to taking exotic vacations or living at a higher standard, then the Fat FIRE approach is best to show you what number you need to hit.

As you can see, the only difference between these diverse approaches to financial planning for retirement is the volume of expenses that you plan to have each year. But how exactly do you calculate how much you need to retire early? At what point have you earned enough to not work any more and not have to make any further contributions to retirement?

To start, you need to know a few things:

- Your current age

- Your planned retirement age

- Your withdrawal rate: This is the percentage of your total retirement nest egg that you will be withdrawing each year in retirement. A good proxy that many people use is 4%. This gives you 25 years of withdrawals (i.e., 100%/4%). We will see later why this Rule of 25 is significant.

- Investment growth rate: You can take the Average Return you calculated using the Hardbacon FIRE Calculator to gain a weighted average growth rate that you expect your investments to earn each year.

- Annual Expenses: Enter the expected level of annual expenses. If you are planning for Coast FIRE, use your current level of expenses. If you are planning for Lean or Fat FIRE, know the amount you expect to spend each year

Once you have all of the above, the next few steps are relatively simple:

- To calculate your Financial Independence number, multiply your Annual Expenses by the number of years that you plan to be retired. A common rule of thumb is the Rule of 25 that says a person retiring at the regular retirement age of 65 should have 25 years of annual expenses saved up. For example, if your Coast FIRE number is $60,000, you will need $3,000,000.

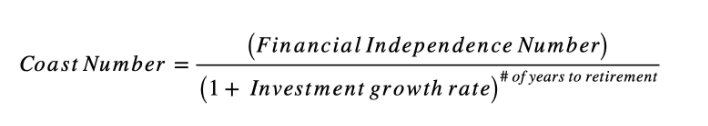

- To calculate your Coast FIRE number (i.e., the amount you need to have invested at which your money will grow into your target Financial Independence number at your assumed investment growth rate), you need to use the following:

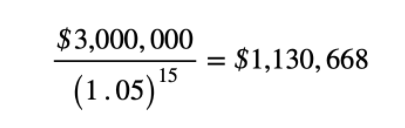

If that looks confusing, let’s use an example. Say that the Financial Independence number is the same as what we calculated above ($3,000,000). For the purposes of this calculation, we will assume that the person can earn an average investment growth rate of 5% and will retire in 20 years. The calculation would then be:

Ultimately, this implies that a person who has set a Financial Independence number of $3 million and plans to retire in 15 years would need $1,130,668 invested to be able to ‘coast’ towards their retirement without making any additional contributions.

Frenquently Asked Questions

What is the FIRE movement?

Short for Financial Independence Retire Early, the FIRE movement is a personal finance approach that states that with a combination of frugal living and aggressive investing, people can retire as early as their 40s or even 30s. Ultimately, the movement is founded on the premise that through smart financial decisions early on in a person’s life, they can choose to not have to work a full-time job until the traditional retirement age of their 60s if they wanted to.