How to Choose a Credit Card in Canada

By Émilie J.Talbot | Fact-checked by Maude Gauthier | Published on 30 Nov 2023

Are you looking for a new credit card or your first credit card? Before using Hardbacon’s credit card comparator to pick the best card, consider these points so that you choose the one that best meets your needs.

Credit card interest

There are several things to consider during your search, but the most important question is: do you pay your balance in full at the end of each month? If you don’t, like 9% to 20% of canadian households who only make the minimum payment, you will start paying interest.

If you pay off your balance in full each month, you will not have to pay interest. In this case, it would be wise to choose a card with benefits that match your consumption profile. We will return to these advantages a little later.

If, on the other hand, you are unable to pay off your card balance in full, the biggest attribute you look for should be a low interest rate. While the interest rate on a typical credit card in Canada is around 20% to 22%, low interest credit cards charge between 8% and 15%. Here is an example for comparison.

| Balance owed | Interest rate | Interest paid | Total cost | |

| Standard credit card | $4,000 | 21% | $472 | $4,472 |

| Low-interest credit card | $4,000 | 9% | $199 | $4,199 |

Grace period

The grace period is the time you have to pay off the balance you owe each month. Once it expires, you pay interest. In most cases, the grace period begins on the billing date and ends a certain number of days later. It may be worth choosing a card that offers a grace period a little longer than the usual 21 days.

Is it worth having a credit card with an annual fee?

Generally, credit cards with annual fees offer better rewards programs. In this case, a calculation is required. Let’s compare two cards with different attributes.

| Card | Minimum Income | Annual Fee | % Cash Back | Total Cash Back on $12,000 annual spendings |

| BMO CashBack World Elite Mastercard | $80,000 | $120 | 1%-5% depending on spending categories | Up to $458 in cash back including the welcome bonus (of $188) |

| Tangerine Money-Back Mastercard | $0 | $0 | 2% on 2-3 categories of your choice | Up to $240 if you spend entirely in those 2-3 categories |

In this case, even though the Tangerine card has a lower rewards rate, it is very competitive! If we don’t take into account the welcome bonus of the BMO card, the two cards are almost equivalent.

About 93% of Canadians have at least one credit card, and many have more. You have to be careful about credit cards with attractive bonuses. If you don’t really need one, don’t apply for a card just for the welcome bonus, or you risk damaging your credit score. These cards often require a minimum individual or household income to obtain them. In addition, enhanced rewards rates often have limits, for example 5% on the first $500 of groceries then 1% thereafter so the card may be less profitable than expected.

Fees for additional cards

Some credit cards charge a fee for an additional card, while others offer them for free. For example, if you want your spouse to use your account to earn rewards faster, a second card is very useful. On the other hand, if it costs you $50/year or more, it may become counterproductive!

How to choose a credit card rewards program

The majority of cards offer cash back or points programs which are usually a percentage of eligible spend or expenses. These amounts are awarded in the form of cash back or in the form of points to be exchanged for travel, items on the rewards program’s online store or other things.

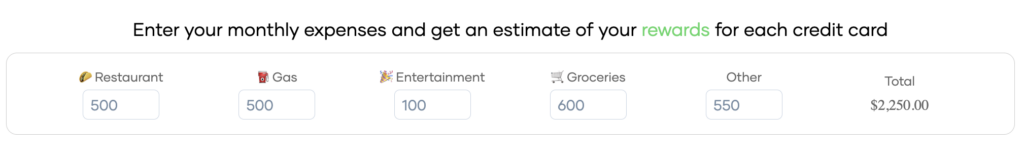

Rewards credit cards and cash back credit cards offer a host of benefits to savvy consumers, making them a popular choice for those looking to maximize their spending. One of the main benefits is the ability to earn reward points or discounts. These rewards can be redeemed for various benefits, including discounts on travel, merchandise, statement credits, and more. Here’s an image that shows how our credit card comparison tool helps you find the best Canadian credit card based on your spending.

Additionally, many cards come with enticing sign-up bonuses, which significantly increase the initial rewards balance. Frequent travelers can especially benefit from travel rewards credit cards, enjoying perks like airline miles, hotel discounts, and airport lounge access.

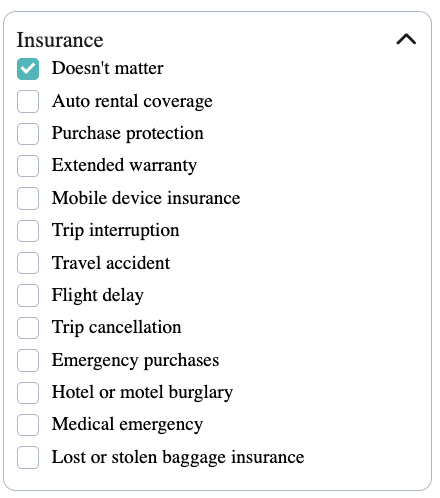

But consider the following before you get excited about a rewards program. Will you really get the benefits? How much time and money will you have to spend before you benefit? The calculation can sometimes be laborious because the points value is not always clearly displayed, but it is worth doing. Do you already have access to this benefit in another way? Mobile device insurance is useless if you already have one. What restrictions apply? For example, a travel rewards program that requires you to use one carrier over another may not be ideal if you travel little or, on the contrary, travel all over the globe.

Here is an example of two cards, one with a rewards program and the other with a cash back program. Let’s assume my monthly expenses are these, for a total of $1,700 per month:

- Groceries: $300

- Gas station: $150

- Public transportation: $150

- Pharmacy: $45

- Periodic payments and expenditures: $225

- Other: $630

Rewards credit card

The MBNA World Elite Rewards card offers 5 points per dollar spent on eligible dining or grocery purchases, digital media, subscriptions and household utilities, up to $50,000 spent annually in applicable category, then 1 point per dollar spent on any other eligible purchase. I would get around 4,600 points per month. With this card, 120 points are worth $1, so I would have an average reward of $38 per month.

Cash back credit card

[Offer productType=”CreditCard” api_id=”5f32a25c92ec22115033b2cf”]The Scotia Momentum Visa Infinite card offers 4% back on groceries and recurring payments, 2% back on gas and public transportation, then 1% back on other purchases. With the same spending, I would therefore obtain $38.75 in cash back. The difference is sometimes minimal (here, $0.75), but with cash back, the calculations are simplified.

The choice of a rewards program therefore depends on your spending habits. If’d go out dining a little more, the MBNA card might be more interesting. The value of a card differs from one individual to another. Take the time to calculate which card gives you the most bang for your buck.

What are the best perks for you?

As mentioned earlier, credit cards provide a variety of perks. Depending on your consumer profile, these can have significant value. For example, if you were going to purchase a warranty on your mobile device and you make your monthly cell phone plan payments on your credit card, you don’t need to pay an additional amount to be covered. You’ve already saved a lot. Our credit card comparison tool allows you to select the insurance benefits you are looking for.

To choose your credit card according to the advantages it offers, calculate all the expenses avoided thanks to it, in order to concretely see your savings. For example, if it offers rental car insurance, it could save you more than $50 every time you rent a car. You still need to rent a car from time to time!

Do you really need a credit card?

Remember that a credit card can lead to debt if misused. If you know you’ll have a hard time saying no to overspending with a credit card, or if you’re struggling to pay off your entire card balance each month, a credit card might not be a valuable tool for you. If so, the best credit card for you is probably no credit card.

If you want a credit card just because they make it easier to shop online or use apps like Uber, you should probably turn to prepaid credit cards like those from KOHO or Wealthsimple. KOHO offers an account in the form of a reloadable prepaid Mastercard. You have to deposit funds in order to use it – in fact, it works more like a debit card than a traditional credit card. Unlike a debit card, on the other hand, you get cash back on some of your purchases and can use your KOHO card anywhere Mastercard is accepted (online or in stores, worldwide). In addition, the basic plan has no monthly fee! They also offer a subscription to build credit.

[Offer productType=”CreditCard” api_id=”637cf8206bbb7962c19ae225″]Applying for a credit card

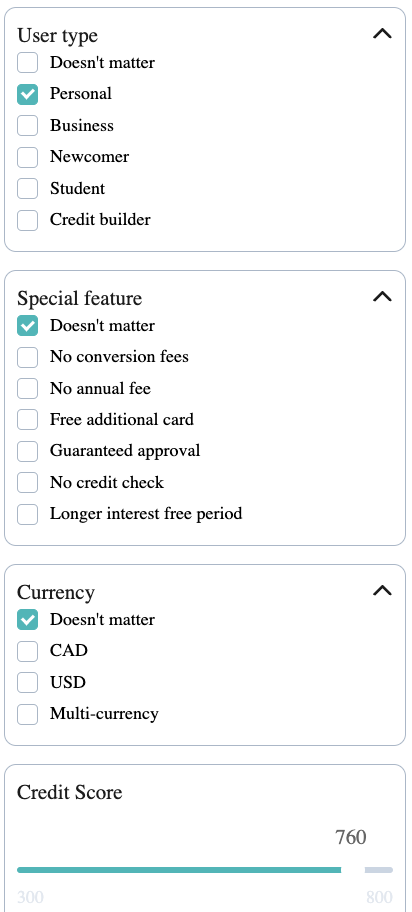

If you have recently arrived in Canada or are 18 years old and want to build your credit, some cards are more suitable for you. Check if you have a Canadian credit score for free to get started. Our credit card comparison tool allows you to choose filters for newcomers, for example, and your credit score, in addition to other relevant features like additional free cards or a longer interest-free period.

Then use this information to choose your credit card. A low score (below 660) will close many doors for you, so don’t waste time applying for high-end cards. If this is your first credit card, make sure you choose a reasonable credit limit so that you are able to repay the balance and thus build a good credit score.

Secured credit cards

An interesting option for people with bad credit and beginners? Secured credit cards are ideal, like the Neo Secured, which also offers cash back. You must provide a security deposit before you can use it, but it will help you build your credit.

[Offer productType=”CreditCard” api_id=”6209e06d9c5f4c05c0de0111″]Choosing the right credit card

Choosing a credit card is a process to be taken seriously and should not be underestimated. You are not required to take out a credit card with your financial institution. With hundreds of card choices across Canada, you’ll find what you’re looking for. In order to choose your credit card, use a credit card comparison tool, carefully read the legal terms and you will certainly find a card that will help you keep the most money in your pocket.