Social Insurance Number in Canada: Everything You Need to Know

By Josiane Stratis | Published on 04 Dec 2022

“My precious” is kind of the nickname you should give to your Social Insurance Number (SIN) and you’ll find out why in this article. You’ll see what a SIN is, who issues it, what it’s for, who can ask for it, where you can manage the loss of your SIN and whether you can find it online. It’s enough to make you go through all ranges of emotions!

What Is a Social Insurance Number?

The Social Insurance Number is a nine-digit number that identifies you to the Canadian government and your province of residence. The SIN appeared in 1964 as a client account number for pension plans. In 1967, what would become the Canada Revenue Agency took the SIN as an identification number for tax purposes. Eventually, it became the national identification number issued by the government.

Who can apply for a Social Insurance Number?

Anyone who is a Canadian citizen, temporary resident or permanent resident needs a SIN to work and receive services from government programs. It is one of the most important elements in establishing your financial life in Canada. You should protect you SIN at all costs.

Who issues a SIN?

The SIN is issued by the Government of Canada and more specifically, by Service Canada. There are three ways to have a SIN issued: at a Service Canada Centre, by mail or online. To apply for yourself or a child under 12 years old for whom you are the legal guardian, you must have your birth certificate, proof of address and government-issued secondary identification. Online or by mail, you must also complete a form.

You can request to update your gender identity, with X being available now. You can also change your name if it changes, such as a marriage or divorce. You can find the required documents on the Service Canada website.

Why do I need a Social Insurance Number?

The Social Insurance Number keeps your personal information in the Social Insurance Register. It is the basic information that identifies you to the government. It is primarily for government purposes that you need a SIN. It also tells your employer that you can work.

It is a personal identification number that will follow you for the rest of your life and that allows you to file your taxes and to receive assistance in case of emergency, as was the case during the pandemic with the CERB and the CRB.

Many Canadian benefits require the SIN. This is the case with:

- Canada Pension Plan;

- Quebec Pension Plan;

- Old Age Security pension;

- Employment Insurance;

- Registered Education Savings Plan (RESP)

- Registered Disability Savings Plan (RDSP);

- Canada Child Allowance (CCA);

- QST and GST tax refunds;

- Social assistance;

- Veterans’ benefits and programs;

- Worker’s compensation benefits;

- Child support payments.

Who has the right to ask for our SIN?

As you may have guessed, there are few people who can ask you for your SIN. There is the Government of Canada, your employer, if you are dealing with a financial institution that pays you interest, Hydro-Quebec, the Customs Agency, and some exceptions for tax purposes.

It is therefore not necessary, and not even recommended, to provide your SIN to apply for or negotiate a lease, apply for a job, confirm your identity other than for government programs, apply for a credit card, apply for a mortgage or loan, fill out a medical form, rent a car, subscribe to a telephone or internet service or to register for university and college.

If a company or individual asks for your SIN in an unnecessary context, you can file a complaint with the Office of the Privacy Commissioner of Canada. Often, just bringing up a possible complaint allows you to keep your personal information and present another less sensitive form of proof of identity.

Keep in mind that the SIN is the most sensitive piece of identification of all. Keep it in a safe place, never leave it in your wallet and destroy all documents that carry it. Never put a document with the SIN in the recycling.

Which websites have the right information to obtain, renew or report a loss or problem with your SIN?

If you want to apply for a SIN, you must go to the Service Canada office or apply on the Service Canada website. This is the only place to apply.

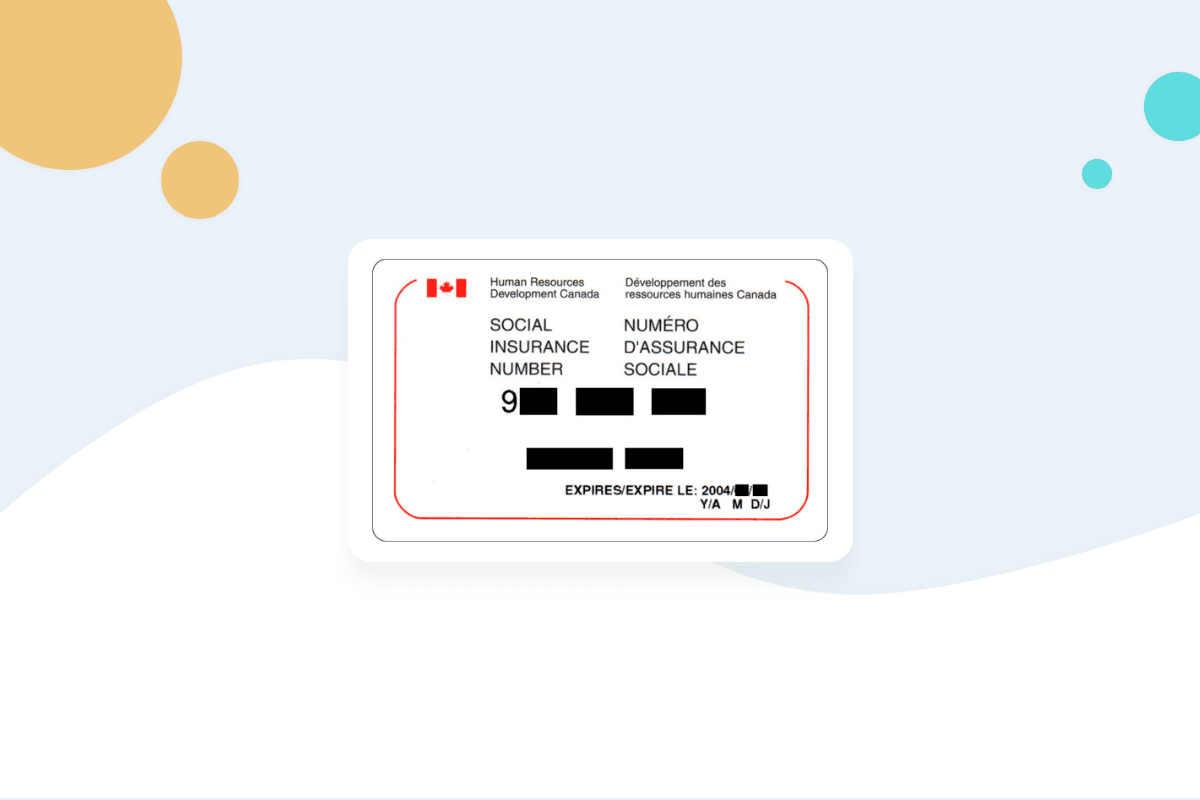

If your SIN starts with the number 9, it is a temporary SIN. This means that it has an expiry date. You can apply for a renewal with Service Canada to renew it when it expires. You must update your file so that the expiry date is always the same as the date on the document issued to you by Immigration, Refugees and Citizenship Canada that authorizes you to work in Canada.

If you suspect fraud, you must act quickly. The first step is to report it to the police to get an event number containing at least the last three digits of your SIN. Then report the fraud to the Canadian Anti-Fraud Centre via the web or by phone. Then you need to check your credit report with Equifax Canada or TransUnion Canada. You can set up a fraud alert notification to let your creditors know about possible fraud. You should keep an eye on your credit report to close any open accounts for which you are not the applicant. Then you can notify Canada Post if you have mail problems.

Once you have proof that your SIN has been used by someone else, along with the police report and a valid identity document, you can get a new SIN. This is in the rare case where there is proof of fraudulent use of the number. In the case of fraud, you will also need to provide a clear photo of yourself to verify with your last employers whether or not you worked with them along with a list of your past jobs and addresses for the last 10 years. Also, you must have a list of credit applications made in your name with a letter from the creditor proving that you did not apply.

The social insurance number is a very serious matter. That is why it is not changed if there is a data leak at a service provider. A new social insurance number does not protect you from fraud. What does protect you is keeping your personal information secure and destroying all documents with that information.