CIBC AC Conversion Visa Prepaid Card Review

By Heidi Unrau | Published on 13 Jun 2023

Every time I travel, I stress over this inevitable question: to carry cash or not to carry cash? With the CIBC AC Conversion Visa Prepaid Card, I can do both. This prepaid travel card can be loaded with up to 10 different currencies, making it a popular alternative to cash and credit cards. Not only is it safer for tourists to ditch cash, but also you ditch those expensive foreign transaction fees while locking in a special currency conversion rate.

Better yet, there’s no credit check, no interest charges to worry about, and no risk of getting caught in the dreaded debt trap. But, is it better than other top names like KOHO, Neo, and EQ Bank? We’ll find out in this CIBC AC Conversion Visa Prepaid Card review and look at what this prepaid card in Canada has to offer.

What is the CIBC AC Conversion Visa Prepaid Card?

[Offer productType=”CreditCard” api_id=”61819e0b3775394336ca7113″]The CIBC AC Conversion Visa Prepaid Card is a no-fee, multicurrency prepaid card that comes with some great perks. The card works everywhere that accepts Visa cards, at home and abroad. Plus, it can even be used to withdraw money from ATMs around the world.

Issued by CIBC in partnership with Visa and Air Canada, this card works both online and offline. You will only be limited by the amount of money that you have loaded onto the card. Because it is a prepaid card, you are spending your own money instead of borrowing. Therefore, it does not require a credit check nor does it come with the risk of going into debt, incurring interest charges, or impacting your credit score.

If you want overdraft and other credit card features, then you can compare Canadian credit cards with Hardbacon’s comparison tool.

Otherwise, this card is a good choice for people who travel a lot or shop at international stores since it can hold 10 different currencies at the same time, such as:

Costs & Penalties of The CIBC AC Conversion Visa Prepaid Card

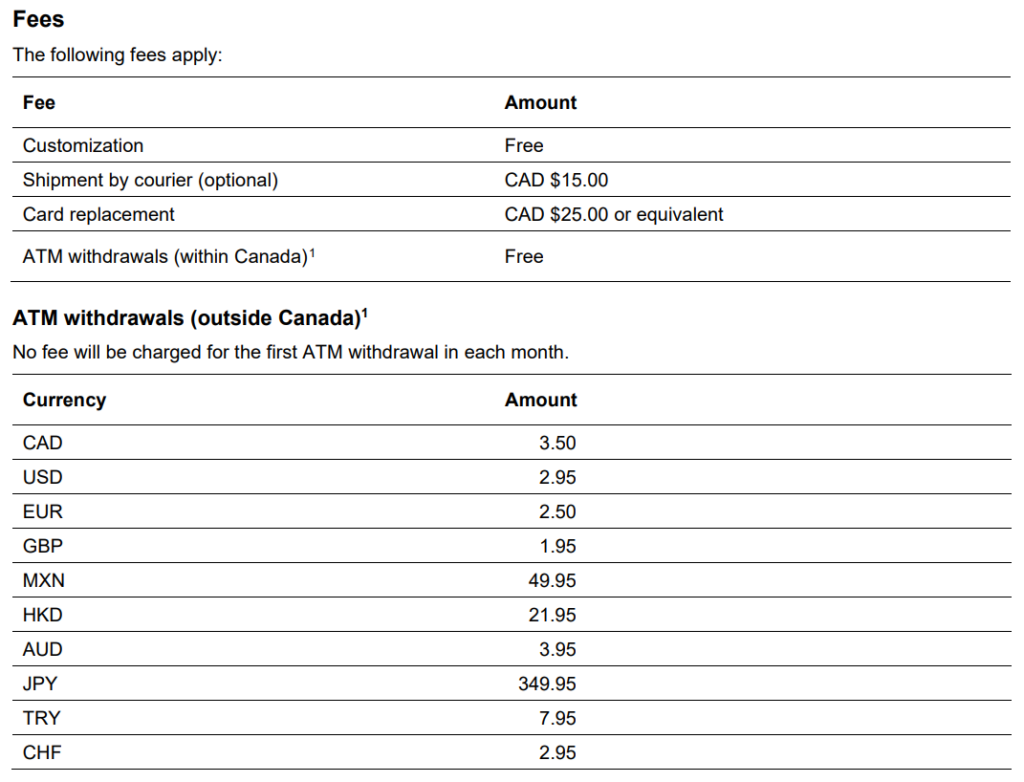

The CIBC AC Conversion Visa Prepaid Card remains true to the promise that it’s free to own. There is no cost to get one and there are no monthly fees to worry about. It’s free to withdraw from ATMs in Canada, and you get 1 free International ATM withdrawal per month. However, there are some applicable charges to be aware of, such as:

The most important of these is the foreign exchange fee that will only be charged when you pay in an unsupported currency. That means using the card to make a purchase in a currency that is not one of the 10 that can be loaded onto the card.

However, since this card supports some of the most widely used currencies in the world, you will rarely have to pay this fee. It’s fixed at 2.5% of the amount, which is the standard foreign transaction fee that most credit cards charge on top of the exchange rate.

The card works at almost all ATMs in Canada and withdrawals are free. You will enjoy one free international ATM withdrawal per month. After that, each subsequent withdrawal will cost you between $3.50 and $10 based on the country and ATM provider. Some other fees include a $25 replacement fee if you lose your card, and a $15 courier fee if you want a replacement card sent quickly.

All in all, we think this is a very affordable card. There are no inactivity charges or shortfall fees, which are charged by some providers. It might be a good idea to compare prepaid cards in Canada for a full understanding of how affordable this card really is.

To do that, visit the Hardbacon Credit Card Comparison Tool. On the left, open the ‘Card type’ filter menu and select ‘Prepaid’ at the bottom.

How does the CIBC AC Conversion Visa Prepaid Card work?

The CIBC AC Conversion Visa Prepaid Card works like any other prepaid credit card or debit card. You can use it to withdraw money from ATMs across Can ada and around the world, shop online, in-store, book hotels, pay for dinner, and more. On the downside, this card does not support recurring payments.

The card looks like a traditional credit card and will have your name, expiry date, and card number printed on it. All this information is important to be able to use the card.

It is also reloadable and CIBC offers a variety of ways to add money to it. Every time you use the card, the amount will be deducted from your balance. Because it is not a traditional credit card that works by borrowing money from the issuer when you make a purchase, you will not be able to spend more money than what you load onto it.

For this reason, there is no credit check required in order to get it. If you’re new to credit or have a bad credit score, the CIBC AC Conversion Visa Prepaid Card is easily accessible and you don’t even have to bank with CIBC.

Features & Benefits of the CIBC AC Conversion Visa Prepaid Card

The CIBC AC Conversion Visa Prepaid Card has been specifically designed to make your international transactions more convenient and secure. Here are some of the main features of this card:

Multiple currencies, one card

This is considered a travel card as it supports 10 different currencies including some of the most widely used currencies such as USD, CAD, Euro, and GBP. You will be able to deposit CAD and convert it into your desired currency without having to pay a conversion fee. Only the market exchange rate will apply.

Mobile app

The card offers great ease thanks to a mobile app that allows online deposits. Plus, you will be able to keep an eye on your balance through the app. It works on both iOS and Android devices and the interface is simple and useful.

Customer support

With this card, you will enjoy 24/7 support. You may need to get in touch with the helpline if you ever face an issue such as a misplaced card. We found the team to be professional and always available.

Security and protection

The CIBC AC Conversion Visa Prepaid Card is safe to use as it comes with a bunch of security features including Zero Liability Protection, as well as chip and personal identification number (PIN) technology. Card owners are protected against fraud and unauthorized use. Also, since the card isn’t linked to your bank account, there’s no risk of you ever losing more than what your card contains.

How can I get a CIBC AC Conversion Visa Prepaid Card?

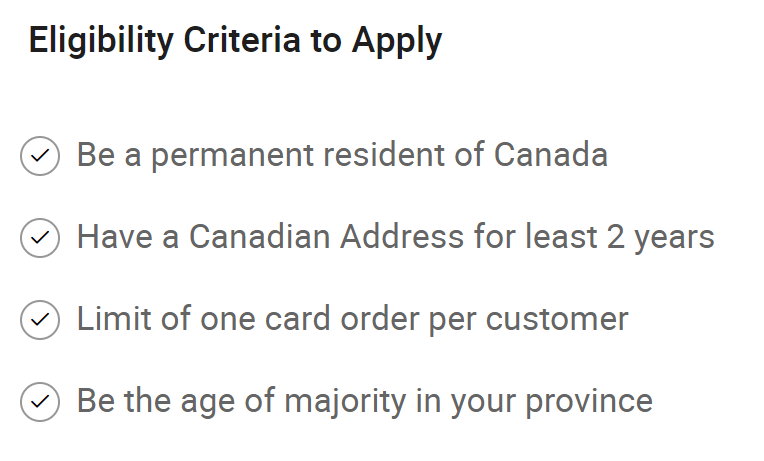

It is very easy to apply for a CIBC AC Conversion Visa Prepaid Card. There is no credit check required, which makes it a great choice for travel lovers who are new to credit or have a bad credit score. However, there are still some eligibility requirements, such as:

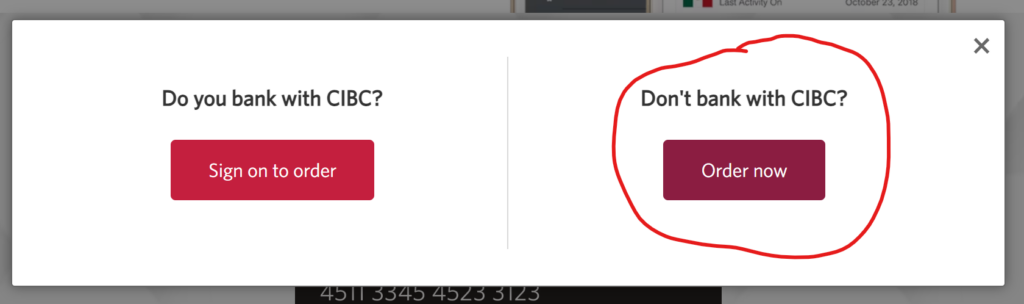

If you already bank with CIBC, you can request the card through your online banking. However, you do not have to be a CIBC customer to get it. In that case, go to the official CIBC or AC website and request a card. A box will pop up asking if you are an existing CIBC client or not. Under “Don’t bank with CIBC?’ select ‘Order now’.

The process will take a few minutes and you will be asked to provide personal information such as your name and mailing address. While CIBC won’t ask for your private financial information, you will have to verify your identity and address with a government-issued photo ID and documents with your address such as a utility bill, bank statement, credit card statement, etc.

We haven’t heard of a lot of rejections when applying for a card. If you’re rejected, it will most likely be due to incorrect or missing information. Contact the helpline if you face any issues.

When will I get my CIBC AC Conversion Visa Prepaid Card?

They will mail you the card, which can take up to 10 days to receive. Alternatively, you can visit a CIBC Bank branch to sign up for an account and you will get your card on the spot.

My card arrived, now what?

Once received, you will have to activate your card before it can be used. The card can be activated by calling 1-800-482-8347 or through the Manage My Card page by logging into your card account. The card will be activated right away and you’ll be able to use it once you add money to it.

How to Add Money to the CIBC AC Conversion Visa Prepaid Card

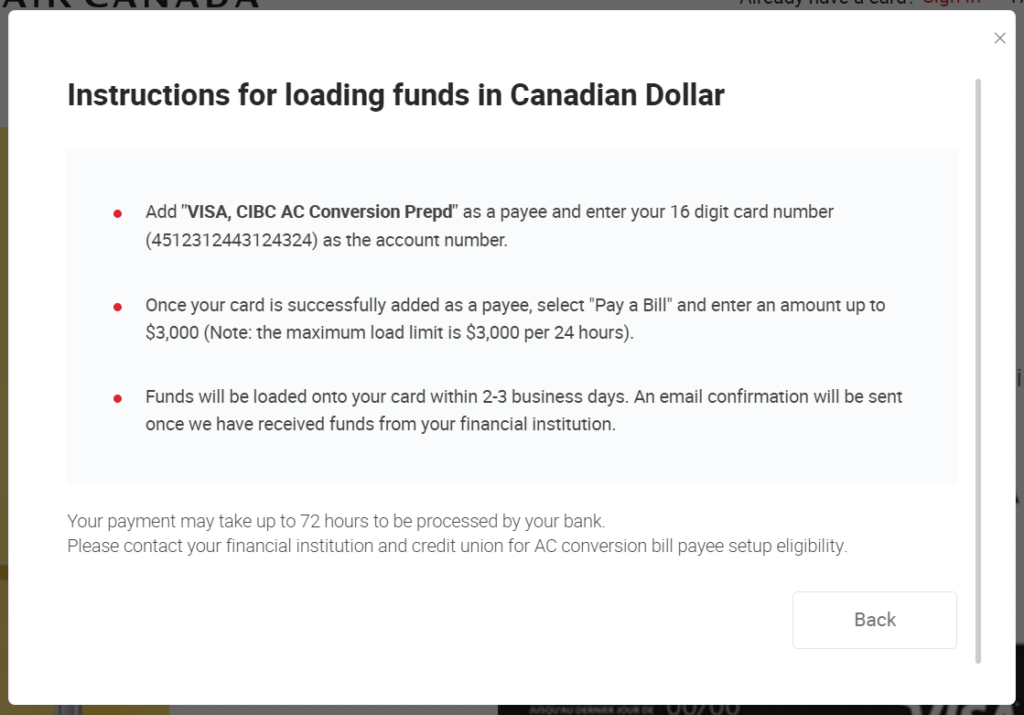

Since this is a prepaid card, you will have to add money to it before you use it. There is only one way to load Canadian dollars onto your card, but it’s super easy.

Log into your online banking account and add your CIBC AC Conversion Prepaid card as a bill payment payee. Basically, you’re going to load the card as if you are paying a credit card bill. Here’s how:

There are no deposit charges. Simply go to the dashboard or app, provide the required details, and the money will appear in your account within 2-3 business days.

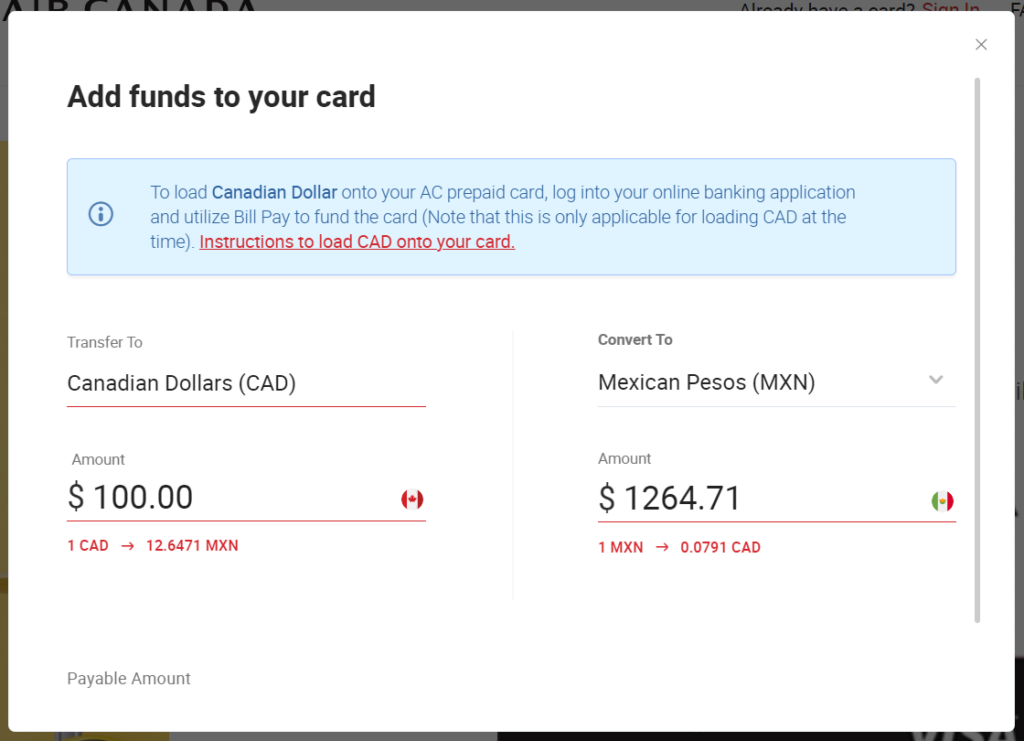

Converting your CAD balance to a support currency

Once you’ve loaded your card with Canadian dollars, you can convert some or all of your balance into a supported currency. And you can hold up to 10 different currencies on the card at once. Just sign into your CIBC AC Conversion Visa Prepaid Card account, choose your desired currency, and how much CAD you want to convert.

You’ll be able to see the exchange rate on the page so you can easily choose a suitable currency to add to your account. We found the rate to be highly competitive. It also isn’t as volatile as the international market and doesn’t change every few minutes.

Load & Balance Limits On the CIBC AC Conversion Prepaid Visa Card

CIBC has put a few restrictions on how you can use the card. The purpose of these limits is to protect your money and to ensure transactions run smoothly. While there is no minimum load amount, there are some load and balance limits to be aware of:

Maximum card balance: $20,000 CAD or equivalent

Maximum load in a 24-hour period (single transaction): $3,000 CAD or equivalent

Maximum withdrawal in 24 Hours (ATM): $2,000

Maximum spend in a 24-hour period (point of sale): $2,999 CAD or equivalent

Maximum ATM withdrawal in a 24-hour period: $2,000 CAD or equivalent

It’s important to know these limits since there is no way to increase them. The same limits apply when using other currencies. You will have to convert CAD to your desired currency. Also, since your balance cannot be more than $20,000 at any given time, this card may not be right for very large purchases.

Pros & Cons of the CIBC AC Conversion Visa Prepaid Card

Here are some of the pros and cons of owning this card. Here’s a side-by-side breakdown:

Pros:

🟢 It’s free with no monthly or annual fees

🟢 No credit check

🟢 Don’t have to bank with CIBC

🟢 You can get your new prepaid card right away 🟢 Replacement cards are easy to get

🟢 Easy load method

🟢 Can help you avoid foreign transaction fees as it supports multiple currencies

Cons:

🔴 No rewards on purchases

🔴 No interest earned on balance

🔴 Doesn’t build credit

🔴 Doesn’t offer special perks or discounts

🔴 Only one load method

🔴 Slow load time, 2-3 days

CIBC AC Conversion Visa Prepaid Card vs KOHO Prepaid Mastercard

The CIBC AC Conversion Visa Prepaid Card isn’t the only prepaid card that travellers should consider. The KOHO Prepaid Mastercard is a strong contender too. Both cards offer unique features and benefits, but how do they stack up when directly compared?

KOHO offers a free basic account with the option to subscribe to a paid plan with advanced features and premium perks. If you’re looking for travel features similar to the CIBC AC Conversion card, then you’ll need to subscribe to either the Extra Plan for $9 a month or the Everything Plan for $19 a month.

Both plans come with no foreign transaction fees and one free international ATM withdrawal per month. KOHO also offers up to 5% cash back on eligible purchases and up to 4.5% interest earned on your account balance.

The CIBC AC Conversion Visa Prepaid Card does not offer any rewards on purchases, nor does your balance earn any interest. Here’s a side-by-side comparison of the most important features:

| CIBC AC Conversion Visa Prepaid Card | KOHO Prepaid Mastercard | |

|---|---|---|

| Features |  |  |

| Annual or Monthly Fee | $0 | – Easy Plan: 0$ – Essential Plan: $4/mo – Extra Plan: $9/mo – Everything Plan: $19/mo |

| Client Requirement | No need to be a CIBC client | Must be a KOHO client |

| Supported Currencies | – Canadian Dollars – Hong Kong Dollars – US Dollars – Turkish Lira – Euros – British Pounds – Australian Dollars – Japanese Yen – Swiss Francs – Mexican Pesos | Canadian Dollars |

| Foreign Transaction Fees | All users get: – No foreign transaction fees with supported currencies (2.5% fee for unsupported currencies) – 1 free international ATM withdrawal per month | Extra & Everything Plan subscribers get: – No foreign transaction fees – 1 free international ATM withdrawal per month |

| Cash Back on Purchases | No rewards | Up to 5% cash back on eligible purchases (standard feature) |

| Interest Earned on Balance | None | Up to 4.5% interest earned on the balance |

| Additional Benefits | – Check your balance – Keep track of your spending – Transfer money from one currency to another | – 5% cash back on travel booked through Contiki – 6% cash back on travel booked through Booking.com – Check your balance – Keep track of your spending – Create budgets & Savings Goals – RoundUp feature to accelerate savings – Optional Credit Building plan – Physical and virtual card |

Alternatives to the CIBC AC Conversion Visa Prepaid Card

We think KOHO is the best alternative to the CIBC AC Conversion Visa Prepaid Card thanks to its travel-friendly perks like a high cash back rate on eligible travel bookings, no foreign transactions with the higher tier plans, and interest earned on your balance. But there are other excellent alternatives to explore that might suit you better, such as Neo, EQ Bank, and even Wealthsimple.

Neo Money Card

[Offer productType=”SavingsAccount” api_id=”60fee79313fd2f260ff90749″]Neo Financial is a fintech company offering a fantastic high-interest hybrid account that comes with a free prepaid Mastercard, called the Neo Money Card. This card is well-suited to globetrotters who want to make their travel budget stretch further. The free version of the card doesn’t come with any travel perks, but you can add a travel perks bundle for just $4.99 per month and you can cancel it anytime without penalty.

The travel bundle gives you 2% cash back on foreign transactions, 1.5x more cash back at all their hotel partners, access to over 1,300 airport lounges, several travel-related insurance protections, and more.

Plus, you earn 0.5% on almost every purchase and can earn an average cash back rate of 5% when you shop among Neo’s 10,000+ partner merchants. You can also get up to 15% cash back on each first purchase you make with a partner. And every dollar in your Neo account earns 1% interest.

EQ Bank Card

[Offer productType=”CreditCard” api_id=”63d2cb6a18196b6d2e1928c2″]EQ Bank is one of Canada’s favourite digital banks, and now their flagship Savings Plus Account comes with a free EQ Bank Card, which is a prepaid Mastercard. You load the card by moving funds from your main account to the card account. Every purchase earns 0.5% cash back and your balance earns 2.5% interest.

There are no foreign transaction fees. EQ does not charge any fees to withdraw money from ATMs at home and abroad. However, you are still subject to service charges levied by the ATM providers. But EQ will actually reimburse you any fees charged by ATM providers in Canada.

Wealthsimple Cash Card

[Offer productType=”BrokerageAccount” api_id=”5f53d2134d1911503113cafa”]Wealthsimple offers a free cash account that comes with a prepaid Mastercard. To get it, you’ll need to sign up with Wealthsimple and download the Wealthsimple Trade app. From within the app, you can open a free, high-interest account in just a few minutes and request your Wealthsimple Cash card.

It comes with no foreign transaction fees and earns 1% back in cash, stocks, or crypto – your choice. The balance in your cash account earns up to 5% interest depending on how much money you have across all your Wealthsimple accounts.

Is the CIBC AC Conversion Visa Prepaid Card Worth It?

To answer that question, it’s important to examine your own needs and goals and weigh those against the card’s pros and cons. Generally speaking, the CIBC AC Conversion Visa Prepaid Card is a great fit if you like to travel to different countries frequently. The multicurrency feature reduces the hassle of exchanging currency while abroad and almost entirely eliminates the need to carry cash.

And since it has to be preloaded with your own money from a separate bank account, it’s a fantastic hack to stay on budget and protect your main account from fraudsters. Plus, if you have limited or bad credit, the CIBC AC Conversion Visa Prepaid Card is a great payment method if you don’t qualify for a traditional credit card.

However, if you want to make every penny count, this card may not be for you. There are no rewards like cash back or points on purchases, nor are there any special travel-related perks and discounts.

If you want to make money while you spend it and save on essential travel expenses, then you’re better off choosing an alternative prepaid card with travel perks.

Still have questions about the card? Here is some information that people want to know: