Why women may need to save more for retirement

By Joseph Czikk | Published on 20 Jul 2023

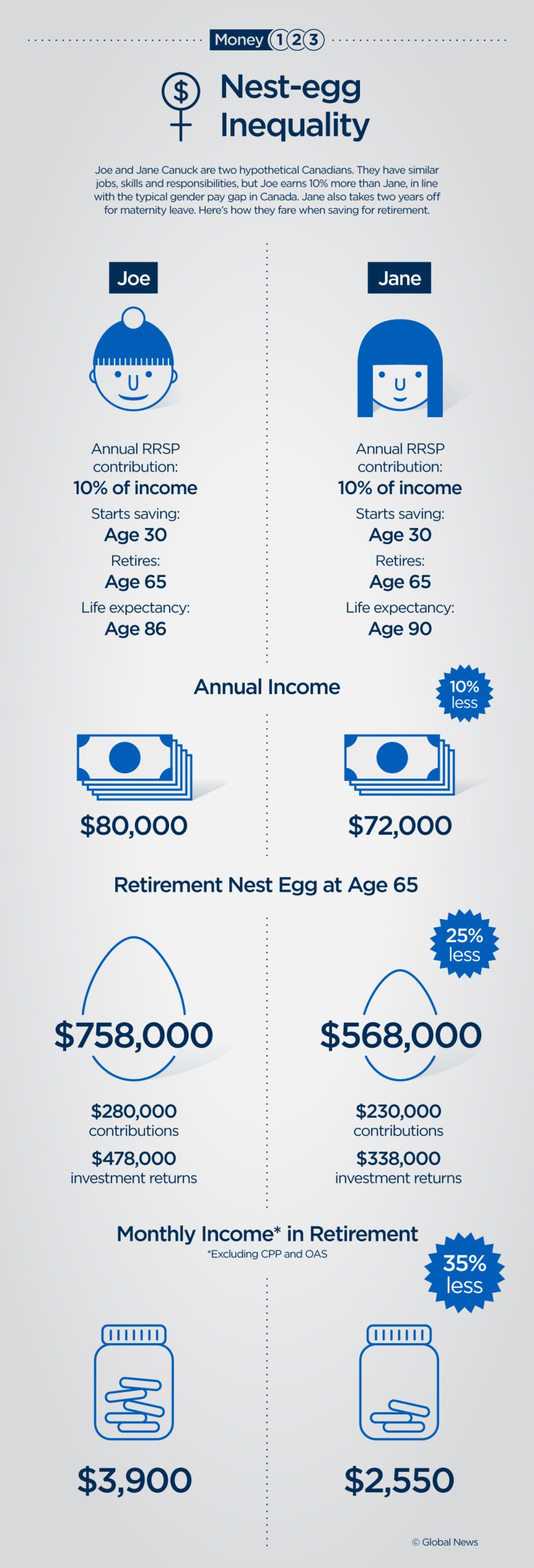

Concepts like the glass ceiling and wage gaps between the sexes remain frustrating reminders that things are not always equal between men and women in the workplace. But there’s another potential setback that may come as a surprise: women are likely required to save more for their retirement than men.

Why might women need to save more than men?

Biological and societal factors can influence how men and women may need to plan for retirement differently.

“The dirty secret is that women need more for retirement because they live longer and yet they earn less,” said Cindy Hounsell, the president of the Women’s Institute for a Secure Retirement.

Having a longer average lifespan means women need to put more in the piggy bank than their male counterparts.

And in Canada, the pay gap has been hovering around 88 cents earned by women for every $1 earned by men. Earning a lower income means an individual has less money for saving and investing in retirement.

Few would argue that it rests solely on women’s shoulders to correct the gap, nor should it. Progress in fair pay between sexes will only come with buy-in from society as a whole.

As well, women are more likely to take time out from the workforce to care for their children or aging parents. That can make it difficult to recoup lost earnings.

To help illustrate the issue, let’s take a look at two ordinary Canadians, “Joe and Jane Canuck.” (Graphic: Global News).

So what can I do?

It’s not all doom and gloom. There are several things women can do to try to close that expected retirement savings gap.

1. Continue self-educating, consider working gigs

Cindy Hounsell says those who lost their jobs during the pandemic should avoid taking on further debt while saving as much as possible. As well, they should learn as much as possible so that they’ll be well-positioned to land a better job when the economy does improve.

You can take advantage of countless classes to expand professional skills on modern online learning platforms like Coursera, Udemy, EdX, Linkedin Learning and many more.

If you’re not working full time, you can also develop skills and generate income by working in the gig economy. The gig economy includes short-term contracts or freelance work as opposed to permanent jobs, such as driving for Uber or Lyft.

In fact, more women than ever before in the US have joined the gig economy after the pandemic, says Hounsell.

2. Cut back on unnecessary spending

One of the most effective ways to ramp up on retirement savings is to examine your budget and identify ways to cut corners. The more cash you free up on a monthly basis, the more you’ll have available to contribute to a retirement plan.

This could mean downsizing your living space and renting a cheaper apartment, giving up a convenient but not needed car, or cutting back on leisure.

Ultimately your savings for retirement will have a lot more to do with the type of work you do, the retirement benefits your employer offers and your own financial decisions throughout your most crucial earning years.

3. Plan smart: consider a spousal RRSP

A smart way to plan for retirement for couples in which the other spouse earns more income is a spousal RRSP (Registered Retirement Savings Plan). A spousal RRSP is a retirement savings account that a married or common-law couple can use to save for retirement and lower their taxes. It lets couples split their income after they retire, which reduces the overall tax load.

For example, Joe could save $8,000 a year in his RSSP, then put $200 into a spousal RRSP for Jane. That, on top of the $7,000 Jane contributes to her RRSP, brings her retirement savings to $7,200.

You wouldn’t aim to contribute the exact same amounts because if Joe dies earlier, Jane would inherit any funds left in his retirement account. This could increase the size of Jane’s monthly withdrawals and possibly result in higher taxes.

4. Consider investing in riskier assets like stocks

Individuals can plan for lower-than-expected retirement savings by investing more aggressively in assets like stocks rather than lower-risk bonds or GICs (Guaranteed Investment Certificates).

One way is to open an account with a roboadvisor, which is a passive index fund investment platform. You deposit the money and the platform invests it for you based on your risk tolerance.

The more aggressive portfolios will invest more of your money in equities (like stocks) rather than safer bonds.

Investing in riskier assets like stocks is generally a smarter move at younger ages, like in your 20s and 30s. You can shift your investment strategy towards safer assets when you get closer to retirement.

Don’t get down on yourself!

If you haven’t started saving for retirement and don’t know where to start, know that you can offset these risks. There’s no better time to start than now.

Hounsell reminds us that a great first step is to work yourself out of debt and learn as much as you can about retirement savings and accounts, like the Tax-free Savings Account (TFSA) and RRSPs in Canada.

Starting an emergency fund would also be a great move, especially after the lessons the pandemic taught us.

“Just don’t beat yourself up,” said Hounsel. “You can only do as much as you can. Learn everything you can… so that you’re able to help people in your family like your parents as they age.”