Steinbach Credit Union Void cheque: Everything you need to know to find and understand it

By Arthur Dubois | Published on 02 Mar 2022

From pre-authorized payments to getting paid, sample cheques still come in handy even though cheques are rarely used in Canada. The main reason you need a Steinbach Credit Union sample cheque is to share your banking information with someone else.

Understanding Your Steinbach Credit Union Confirmation Letter

However, Steinbach Credit Union does not offer sample cheques or direct deposit forms through your online banking portal. Instead, they provide you with a confirmation letter that includes all the same information found on a sample cheque or direct deposit form. If you have a Steinbach Credit Union chequebook and know what the numbers at the bottom of your cheques mean, you can probably just share them without having to get a confirmation letter every time someone asks for one.

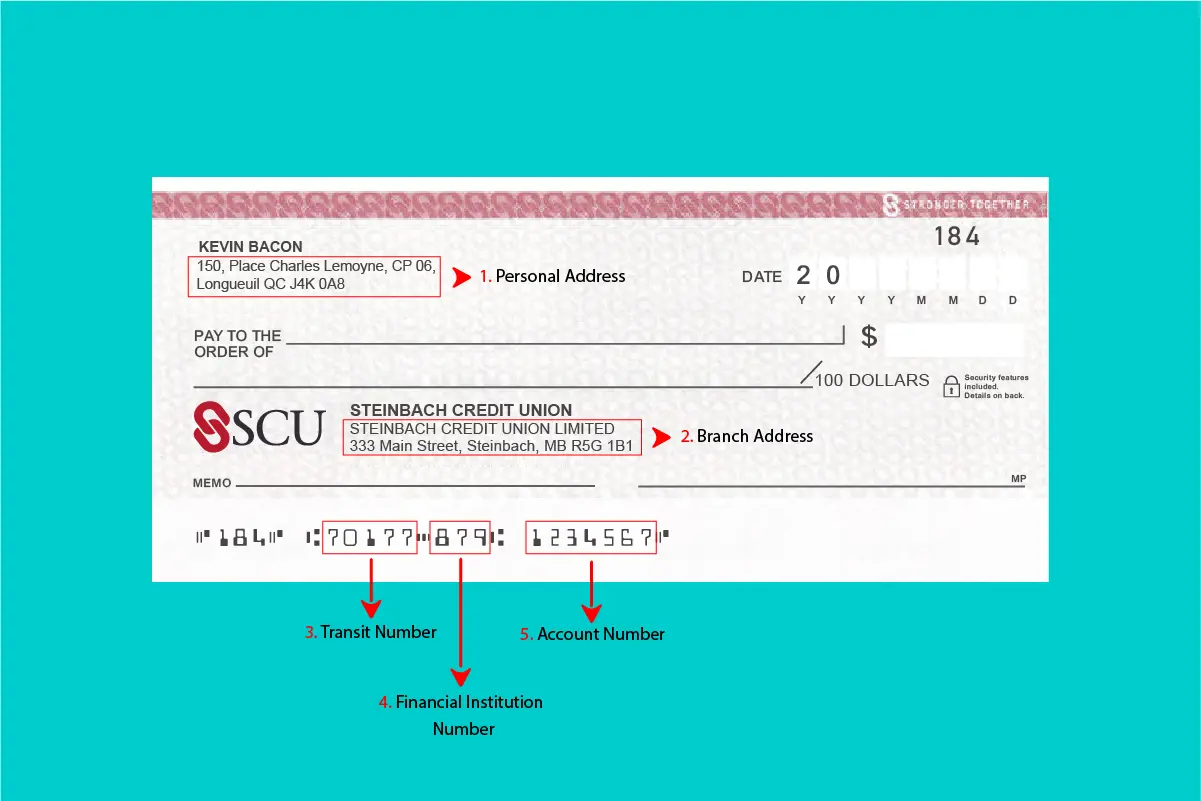

So, here are the important features of a cheque in Canada that you should be able to recognize by looking at one :

1. Your home address

This is the information you don’t need to look at a sample cheque to know. However, it is often needed by those who ask you for a sample cheque.

2. Your branch address

This is the address of your Steinbach Credit Union branch. Note that some Steinbach Credit Union branches have more than one point of service.

3. Your branch transit number

This is a 5-digit number that identifies the specific Steinbach Credit Union branch to which your bank account is associated.

4. Your bank Institution Number

The institution number is a three-digit number that identifies the financial institution you are dealing with, regardless of the branch you have chosen. Steinbach Credit Union’s institution number is 879.

5. Your account number (or folio number)

The account (or folio) number is the identifier for your bank account. Without the transit number and institution number, it cannot be used to transfer money. As a result, it is the most sensitive information you will find on your sample cheque, as it is the number that is associated with your bank account. This number varies in length depending on the financial institution but generally ranges from 7 to 12 digits.

How to get your confirmation letter

Before the Internet, a sample cheque was a paper cheque with “SAMPLE” or “VOID” written on it to ensure that the cheque could not be used. If you have a chequebook, you can still do this. In fact, a sample cheque is a document that contains all the information displayed on a cheque, so you can still do it that way.

For those who don’t have a chequebook, it is possible to obtain a confirmation letter by calling Steinach Credit Union and speaking with an agent, or by visiting your branch in person. Here are the steps to get a Steinbach Credit Union confirmation letter by phone:

- Call Steinbach Credit Union at the following number, based on where you are:

Steinbach area: 204 – 326 – 3495

Winnipeg: 204 – 222 – 2100

Toll-free North America: 1 – 800 – 728 – 6440 - Press 4 or remain on the line to speak with a Member Service Representative

- Once you have been connected with a representative, ask for a bank account confirmation letter

- The representative will verify your identity, then ask if you would like the confirmation letter emailed or faxed to you

Alternatively, you can get a confirmation letter in person by visiting any Steinbach Credit Union branch.

Now you know everything you need to know about getting your Steinbach Credit Union confirmation letter, and how to interpret the different elements on it. Furthermore, you should now be able to write a cheque.