The Ultimate Guide to Holding Companies in Canada

By Brett Surbey | Published on 14 May 2023

Growth in business is almost never linear. You started out with an idea and four walls and now you might own a company and manage 10-20 employees. Reaching specific entrepreneurial milestones can bring a sense of deep accomplishment, but also ambition for future plans.

If you’re in a position of growth and are wondering how to strategically use your assets to continue on a positive trajectory, this post is right up your alley. Holding companies in Canada offer corporation owners more opportunities to make the most of their assets in an economically tumultuous period.

What is a holding company?

A holding company or “holdco” is a registered corporation created for the purpose of holding assets or other investments–typically shares in another company known as a subsidiary. Holding companies may or may not be operating companies, meaning they generate income through manufacturing or product/service sales.

Though there are various ways to use holdcos, their primary function is to hold the shares of an operating company (i.e. the corporation generating business income) to allow for tax and liability mitigation benefits. Holding companies can also be used for investing in passive income sources (e.g. bonds, investments, interest on accounts, real estate).

Types of holding companies

Though a holding company’s central use is to hold the majority of shares in an operating company to realize various benefits, there is more than one way to accomplish this. In fact, there are at least types of holding companies for use in Canada.

Non-operating holding companies are corporations created to simply hold most or all of the shares of an operating company and do not generate any income whatsoever, though they may hold other investments such as bonds. Typically, these types of companies are traditional holdcos.

Operating holding companies in contrast, are corporations that hold all or the majority of shares in an operating company while still generating income through active means. Generally speaking, these are less common than standard holdings companies.

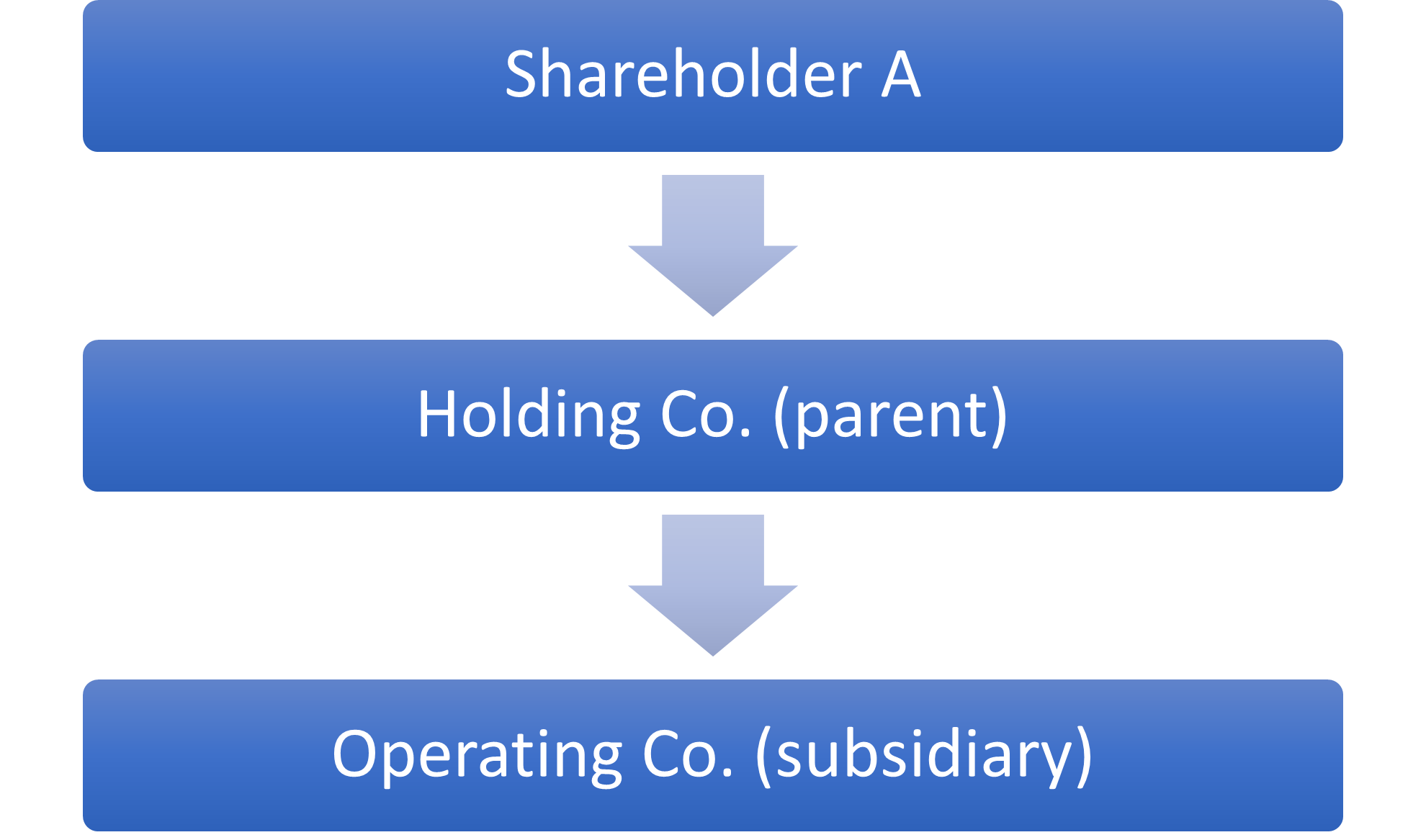

Note that using a operating or non-operating holding company does not change the general corporate structure used, as per the below diagram.

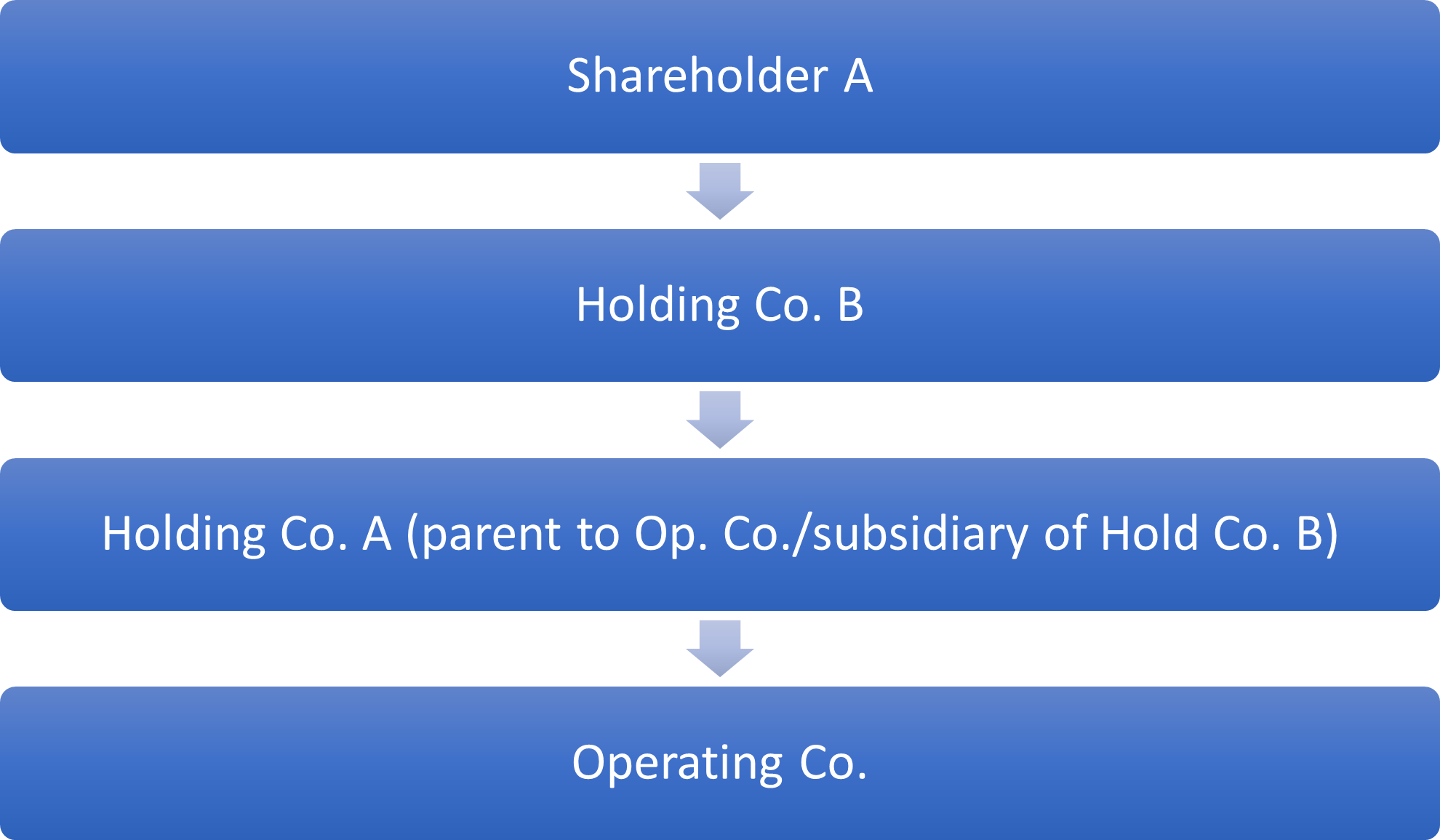

Subsidiary (multi-level) holding companies are holding companies that are owned by other holding companies. Though they are considered a “parent company” in relation to the operating company, they are considered the subsidiary or “daughter company” to the companies that own all of its shares. Keep in mind that these types of corporate structures are highly complex and are not always applicable to small or medium businesses. Below is a diagram illustrating this structure.

What are holdings companies used for?

Holding companies are used for a myriad of tax/business planning and liability reduction strategies for business owners. Here’s a breakdown of common uses of holding corporations in Canada.

Corporate tax planning

Note that while these corporate tax ideas may seem applicable to your business at first glance, it is highly recommended you seek professional accounting and legal advice prior to proceeding.

Tax deferral and reinvestment opportunities

In cases where corporate profits are given to individual shareholders rather than another corporation, the profits will be taxed as soon as the shareholders receive them. In the case of a holding company receiving the dividend, the outcome is much different.

So long as the following conditions are met, any dividends paid from the operating company to the holdings company (also called intercompany dividends) will flow tax-free:

- The holding company owns 10% of the shares of the company issuing the dividend.

- The holding company owns 10% of all the voting shares issued in the operating company.

- The dividend is taxable.

- The company receiving the dividend is able to deduct the received amount from its income for the year it was received.

Having the ability to transfer profits from an operational company to a holding company gives major benefits to the business owner. For one, this allows reinvestment of the profits from the operational company into the holding company with no tax. These funds can be used as the owner sees fit, such as investing them into the stock market, investing in new business ideas, or saving them in a business bank account.

Secondly, the shareholders within the holding company now have substantial flexibility when it comes to choosing when to receive their dividends. This allows for a type of tax deferral as the shareholders can decide how much of the profits they want, and when they want them–rather than having to take them out all at once. If a shareholder already received a large salary for the year and does not want to increase their tax bracket for the year, for instance, they can wait and receive the dividend during a lower income period.

Lifetime capital gains exemption

A major boon for Canadian corporate owners is the lifetime capital gains exemption (LCGE). In sum, it allows Canadian-controlled private corporations (CCPC)–most small businesses in Canada –to receive up to $971,190 in capital gain completely untaxed. Note that this amount does depend on the type of property sold. If you sold shares of your business, for example, you could only claim half of the full LCGE amount ($485, 595), as per the CRA’s guidelines.

Capital gains are when a capital property (e.g. home, shares, bonds) is sold for more than what it was worth when it was acquired–including the expenses to sell the property. The most common example of a capital gain is selling a home.

Say you purchased a property for $200,000 and went on to sell it for $300,000. The costs of the sale amounted to $15,000 in total. By taking the increase in value of the home ($100,000) and subtracting the cost of the ($15,000) you are left with a capital gain of $85,000.

If your business is doing quite well and someone approaches you to purchase it, you could be eligible to claim the capital gains of the sale under the LCGE–as long as you meet the following requirements:

- 90% of the business’ assets must be used in active business activities (i.e. non-passive investments) at the time of sale.

- 50% of the corporation’s assets must be in active business use 24 months prior to the sale.

- The owner of the business under consideration must have owned its shares for at least two years.

Holding companies come into play to reduce or “purify” the assets of the operating company so they can meet the 90% active asset requirement. If the operating company holds real estate but runs a bookkeeping business, then this asset could disqualify it from the LCGE benefit. Moving it into the holdco, well before the owner decides to sell, will help prepare the business for receiving tax benefits that come with a sale.

Note that only an individual can receive the LCGE amount, not a corporation. Because of this, accounting advice becomes a necessity in order to ensure your business is properly structured to receive the benefit.

Planning for the future

Increasing the salability of the business

By choosing to keep substantial assets (e.g.real estate, investments, equipment) in the holding company rather than the operational corporation, can make a business much more attractive to potential buyers. Typically, purchasers of a business prefer to purchase only the assets of the operation, rather than the shares as well, as buying the corporation itself means they also take on its liability.

Having or most of the business’ assets in a holdco, allows potential buyers to purchase the assets of a business, and potentially the shares of a holdco, with possibly less liability involved for the buyer.

Succession planning

Holding companies are one of the best corporate devices to transfer your business to the next generation. One of the most common transactions used to do so is estate freezes.

Let’s say your electrician business, All Wound Up Ltd., was incorporated with common shares issued with a value of $100. After 20 years in the business, your shares are now worth $2 million, yet you want your son or daughter to take over the business. But, selling your shares outright is nearly impossible.

With a newly-created holding company, you can have the holdco purchase your shares for their fair market value and issue preferred shares in the holdco worth $2 million. Because the value of the holdco is reflected in the issued preferred shares, the new owners seeking to enter into the business can purchase common voting shares for a nominal value (e.g. $100).

Because common shares track with the fair market value of the corporation, the next-generation owners will be able to benefit from future growth of the business, while the primary owner can slowly redeem their shares as they phase out.

Keep in mind that there are a myriad of options when it comes to transferring a business to your children via holdcos; this is just one method of many. The best approach is to discuss your specific situation with a corporate tax specialist.

Protecting business assets

Given that assets can be moved tax-free (assuming requirements are met) holding companies also offer additional creditor protection for business owners. Consider the following scenario.

A welding company, ABC Metals Inc., has earned $500,000 in profits over the last three years. Rather than use a holding company, the owner has chosen to keep the profits in the company and reinvest them through the purchase of a new company vehicle. The following year ABC Metals gets sued for improperly installing their metal frames on a recently constructed shop, resulting in damages to their client’s equipment. Because of this, it is being sued for $1,000,000. If ABC’s client is awarded a judgment in their favour, they might be able to seize these newly purchased vehicles to cover the damages they incurred.

In contrast, if ABC Metals had instead invested these profits into a holding company years prior, it would have had significantly more creditor protection in place. The lawsuit would be coming against the operating company (the business that did the work), not the holding company. That effectively distances the holding company from the lawsuit.

What are the disadvantages of a holding company?

Though holding companies come with many benefits, they are a more bespoke option for business owners, as they come with a number of potential disadvantages if they are not used properly.

Increased cost

Creating a new company, especially one for tax planning purposes, means incurring more costs. You’ll have to consider the cost of incorporating a business in Canada (anywhere from $600 to $2,000) as well as annual maintenance fees for annual compliance and corporate income returns. In total, you could be looking at around $3,000 per year in maintenance fees alone–not including bookkeeping or other administrative tasks.

Greater complexity

Holding companies are complex in and of themselves, but they also increase the complexity of your business operations on the whole. Rather than having to track assets in one company, you’ll have to pay attention to two different corporate banking structures. You’ll also need to track the investments to ensure everything is in its proper place, especially the more passive investments.

Higher margin for error

Although the tax benefits for holding companies are numerous and well worth the effort if they match your situation, the margin for error increases. With two companies in place (or more), making an improper transfer, purchase, or investment could be costly and set off any benefits you could have incurred in the first place. Holding companies are complex structures that require financial precision to manage well.

Difficult to reverse

Creating a corporation is a decision that is not simple to reverse, especially a holding company that you have moved large amounts of assets into. Disposing of the holding company in a tax-prudent manner, such as amalgamating it with the operating company, is expensive and time-consuming. Making sure a holding company is the right decision for your business is paramount.

How to make sure a holding company is the right decision for you

Holding companies are complex. Deciding to create one for tax, future, or liability planning purposes means you could be creating more work for yourself and your business partners. In brief, one efficient method to decide if a holdco is an appropriate decision is to perform a cost-benefit analysis. Take stock of the potential tax breaks you could receive, among the other non-monetary benefits (e.g. successfully preparing the sale of your business), and subtract the general cost of a holdco discussed above. If the benefits outweigh the costs, you know your next steps.

Another way to examine whether a holdco is prudent is to ask specific questions regarding your business endeavors such as:

- Does my current company have a mixture of passive and active investments? If so, what’s the ratio between the two?

- Am I hoping to sell my business in the next 5-10 years?

- Am I planning to pass my business along to my children in the near future?

- Do I operate in a high-risk industry where extra liability protection would be an asset?

- Do I max out my TFSA and RRSP annual contribution limits on a regular basis?

Answering in the affirmative to most of the above may indicate the need for another corporation.

Finally, arguably the best course of action is to discuss the matter with your accountant or other tax professional. They likely have deep insight into when holdcos are the most beneficial and will be able to tell if your situation warrants a corporate structure change.