How to Register a Business in BC

By Arthur Dubois | Published on 05 Jun 2023

British Columbia (BC) is a great place to register a business in Canada. The province offers many opportunities for businesses, including a variety of tax incentives and a pro-business regulatory environment. The province has a strong economy, a well-educated workforce, and a variety of business opportunities that make it an attractive destination for businesses.

In BC, you can register your business online through the OneStop Business Registry. The process is fast and convenient, and you will only need to provide some basic information about your business and pay fees with your personal or a business credit card.

Choosing a business legal structure to register a business in BC

After you have identified your business model and before you register a business in BC, you will need to select the legal structure for your business.

Each business structure has different tax implications, advantages, and disadvantages, so it’s important to choose the right one for your business. You can speak to a business lawyer or accountant to get advice on which business structure is right for you.

Sole proprietorship

A sole proprietorship is the most widespread and simplest structure of a business. This is the most suitable legal business structure for most small businesses as it is easy to set up and run.

The sole proprietor has complete control over the business and gets to keep all the profits. However, they are also personally liable for all potential debts and losses incurred by the business.

In other words, while you are in full control of the developments of your business and all business processes, you will also be solely responsible for business debts.

Partnership

A partnership is a more complex business legal structure, and it is usually only suitable for businesses with more than one owner. Partners are individuals who have agreed to cooperate to advance their mutual interests.

The partnership agreement sets out the roles, responsibilities, and rights of each partner. This contributes to the diversification of risks and allows for sharing of profits and losses. Like a sole proprietorship, each partner in a general partnership is personally liable for the debts of the business.

If limited partnership status is registered, then there will be at least one general partner who has unlimited liability and at least one limited partner whose liability is limited to their investment in the business.

Corporation

This is the most complex business structure, and it is the most suitable for businesses that are large and/or have many shareholders. Corporations are created as legal entities that are separate and distinct from their shareholders.

This means that the liability of shareholders is usually limited to their investment in the business. However, there are some exceptions to this rule. For example, if a shareholder personally guarantees a debt of the corporation, they may be held liable for that debt.

Choosing a business name in BC

Applying for a business name is the first step to register a business in BC. This will be the name under which your customers will know and remember your business.

There are some rules that you need to follow when choosing a business name:

The name cannot be the same as or too similar to another registered business name

If you are using your personal name, you don’t need to register it as a business name. If you register your business as a sole proprietorship or partnership, your business name is not protected. For corporations, cooperatives, and societies, the names are registered and protected.

The name cannot be misleading

You cannot register a business in BC with a business name that is misleading about the nature of your business or its products and services. For example, you can’t register a business name that implies that your business is a government organization if it’s not.

The name cannot be offensive

Do not register a business name that is offensive or considered obscene. This includes names that are racially or ethnically offensive, as well as profanity.

You can not use well-known names or trademarks

You cannot register a business name that is the same as or too similar to a well-known name or trademark. This could create confusion for your customers and damage the reputation of the well-known name or trademark. BC Business Registry won’t approve such a name.

Registering a business name in BC

There are several ways to register your business name in BC. The easiest and fastest way to register your business name is online. You can do this by submitting your name request online through BC Business Registry.

You will also have to pay a $31.50 fee with your credit card. Another way to register your BC business name by filling out the Name Request form and dropping it off or sending it via mail to the Service BC location.

In this case, you will have to pay a $30 fee. You can also use a priority service and register your business name in 1 to 2 business days for a $100 fee.

Remember to submit 3 different business names in order of your preference, as the first name on your list may already be taken or may be inappropriate. If this is the case, BC Business Registry will register other names on your list.

After your business name is registered, it is reserved for 56 days. You have to register your business within this timeframe or pay the additional fee.

OneStop BC business registry

After you have selected the business legal structure and registered your business, you can register your business in BC through the online OneStop Business Registry or through BC Corporate Online if you are incorporating your business. These services are provided by the BC Government, and it is the most convenient way to register your business in the province. You can also register your business offline in the Service BC Office or at OneStop service counters.

Unfortunately, online registration may not be available on certain days, so you may require to fill out the form offline.

Another way to register your business

Ownr is an all-in-one platform designed to help entrepreneurs and business owners quickly launch and manage their enterprises. Create a personalized Canadian business entity, from sole proprietorships to corporations within 10 short minutes. Access the resources you need such as bank accounts, Business Number registrations, licenses, permits, contracts and tax guidance from experienced professionals – all with Ownr.

Registering a sole proprietorship in BC

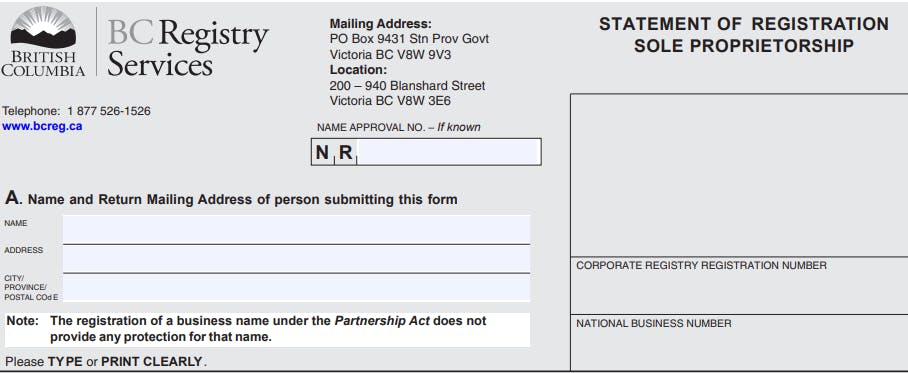

If online registration is not available, you should fill out a Statement of Registration Sole Proprietorship. This form is available online or at any Service BC location.

If your name is already approved, you should provide your business name approval number. Fill out your name, address, city, province, and postal code. Please make sure you type clearly and provide accurate information, as you may be subjected to fines for not doing so.

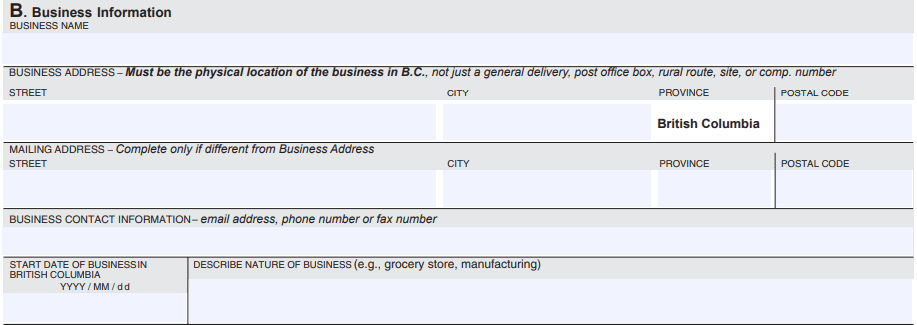

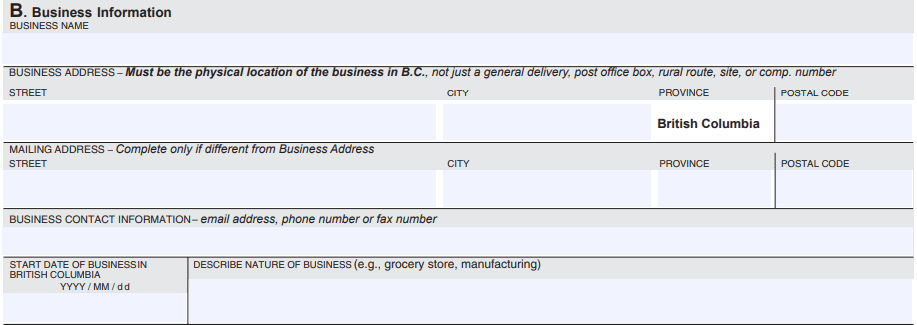

Proceed to the next section and provide your business information. In the business information section, you will have to provide:

- Your business address

- The mailing address

- Any business contact information

- The start date of business in BC

- The nature of your business.

Your business address is the physical address of where you are planning to conduct business in BC. Only fill the mailing address if it is different from your business address. Your start day of business can be either past, present, or future. The nature of business refers to what your business does. T

In the last section, state your corporate or individual name. If you are registering sole proprietorship as an individual, enter your residential address and your full name, including last name, first name, and middle initial.

Once you have filled out everything, you can submit a Statement of Registration Sole Proprietorship to the Service BC location. After that, you will have to pay a $40 fee to the Minister of Finance. You can submit both your application and cheque here:

BC Registry Services

PO Box 9431 Stn Prov Govt

Victoria, BC V8W 9V3

Registering a general partnership in BC

The process of registering a general partnership in BC is similar to the registration of a sole proprietorship. You just need to fill out the Statement of Registration General Partnership and submit it to the Service BC location.

Provide your name approval number if you already have it, as well as your name, address, city, province, and postal code. All correspondence and documents are sent to this address.

Again, you need to fill out:

- Fill out the business name of your partnership

- The business address

- The mailing address if it is different from your business address

- Any contact information of your business,

- The start date of your partnership

- What is the nature of business. Try to make your business description short; one or two words is enough.

Section C requires you to fill out the credentials of all your partners. If you have more than 3 partners, you should attach an additional statement with their credentials. If partners are individuals, they must provide their residential addresses.

Finally, you have to pay a $40 fee to the Minister of Finance. Submit the cheque and general partnership registration application to the Minister of Finance at:

BC Registry Services

PO Box 9431 Stn Prov Govt

Victoria, BC V8W 9V3

Registering a corporation in BC

Before filing an Incorporation Application, you should request business name approval and reservation, establish your company’s articles and prepare an incorporation agreement. Once all these steps are completed, you can file an Incorporation Application. You can do it on the CorporateOnline website.

Fill out the Company’s name by providing the name reservation number. You can use a number name. In this case business name reservation is not required.

Select your incorporation effective date. If your effective date is in the future, you will be required to pay a $100 fee. Pay attention that your incorporation effective date can’t be more than 10 days in the future.

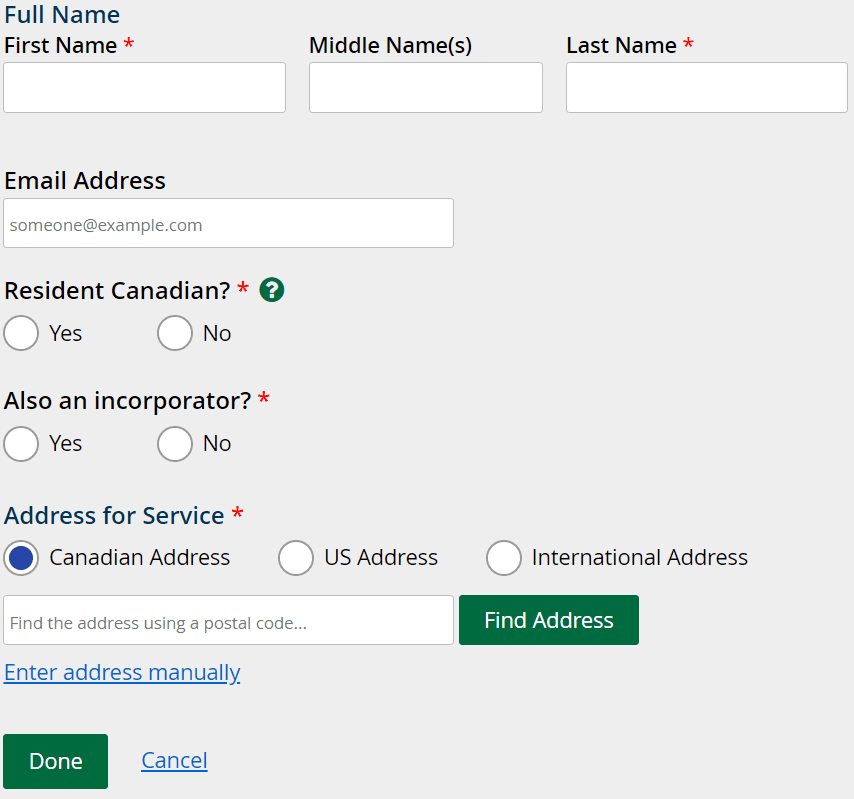

Fill out the incorporator’s name. The incorporator is an individual or organization that files the incorporation application on behalf of the company. The incorporator may be an officer, director, or shareholder of the company.

Provide the mailing address of your corporation. This address will receive all the documents associated with your corporation.

If you have more than one incorporator, you should add them during the next step. Provide credentials and address of each incorporator to proceed.

During the next step, you should provide the credentials and the mailing address of the completing party. The completing party is the individual who fills out the forms.

If your corporation has the translation of its name to use outside Canada, you should note it in the next step. Just click the “next” button if it does not.

Corporate director information

Further, provide the company’s director(s) information. The corporation director is the individual who oversees the day-to-day operations of the corporation. This person is responsible for ensuring that the corporation is meeting its goals and objectives and that it is compliant with all applicable laws and regulations.

Provide the registered office mailing address of your corporation. Make sure to use a valid mailing address as this is where your corporation will receive important legal documents.

Add information about the number of shares as well as about each share class. The company’s board of directors determines the number of shares of each class.

Indicate the value of your shares, as well as special rights or restrictions associated with each share class. Each class has different privileges. For example, Class A shareholders may have voting rights while Class B shareholders may not.

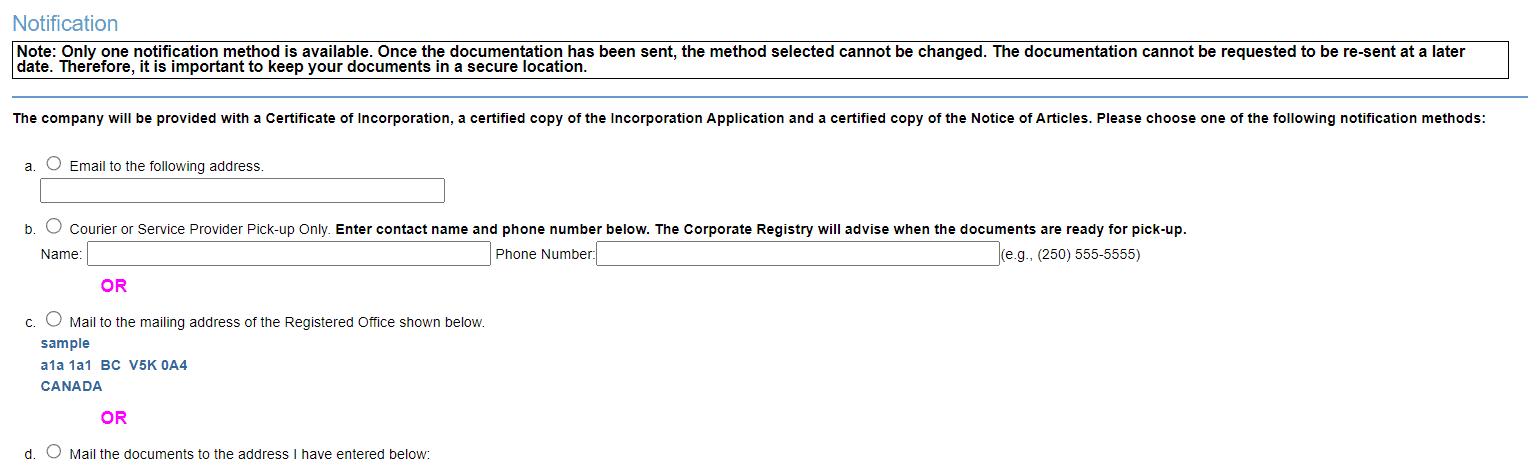

During the last step, you should choose how the Certificate of Incorporation will be delivered to you. The Corporate Registry will deliver it to your email or physical address.

Check all the information you filled out, and pay the $351.50 registration fee. You can pay the fee with Visa, MasterCard, and American Express credit cards.

Once you have paid the fee, you should wait for your application to be confirmed. The registration process may take up to 14 working days.

The Best Canadian Credit Cards for Your BC Business

Business Platinum Amex Card

The American Express Corporate Platinum is a business credit card for business owners and executives who want to earn rewards on their business expenses. The card comes with a number of benefits, including a generous welcome bonus worth up to $1,200 and points on virtually every purchase.

This is not just a credit card but a full-fledged business tool that can help you manage your expenses and earn rewards on business purchases (1.25x point for every $1 spent). You can earn up to 120,000 reward points as a welcome bonus if you charge at least $15,000 in net purchases during the first three months of membership and make a purchase between months 14-17 of card membership.

Business EdgeTM Amex Card

American Express Business Edge Business/Enterprise card is one of the most popular credit cards in Canada. Enjoy special offers to earn more points you can spend on various expenses.

Earn 3x points on selected categories, including food and drinks, rides and gas, and office supplies and electronics. The card comes with a 20.99% preferred rate for purchases and 21.99% for funds advancements. 24/7 customer service and fraud protection guarantee are also available for Business Edge card holders.

Business Gold Rewards Amex Card

The American Express® Business Gold Rewards is a card that offers a flexible rewards program for small businesses. Earn a quarterly purchase bonus of up to 10,000 bonus Membership Rewards® points when you charge $20,000 in net purchases.

You will also earn 1x points on eligible categories. There is no pre-set spending limit on purchases, which provides you with financial flexibility.

Disclaimer: American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link.