KOHO Review: A Prepaid Card With Unique Benefits!

By Maude Gauthier | Published on 04 Jan 2024

KOHO is one of the Canadian financial technology companies changing the way people access banking services. The number of users of such online solutions is growing every year. I’ve had a KOHO account for over a year, and I share its strengths and weaknesses in this article.

-

Fees

-

Cash Back and Interest

-

Tools

-

App

-

Load and Withdrawal Limits

At a glance

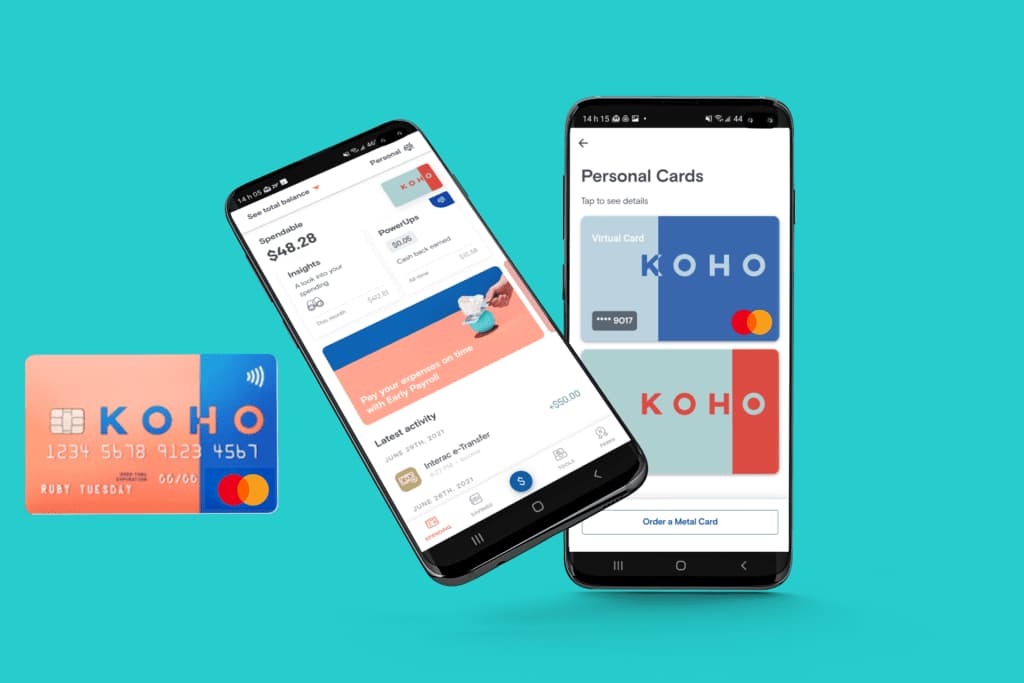

KOHO offers an all-in-one solution for people who want to spend and save better. The app is perfect for tracking your current spending and setting short-term savings goals. Its benefits are limited, however, and the app doesn’t always make things easy for users.

KOHO account: How it works

KOHO offers many services that can replace those of banks and credit unions. The People’s Trust Company is behind every KOHO account, and the funds are insured by the Canada Deposit Insurance Corporation (CDIC).

The free plan is not available anymore, but there is a workaround. The Essential plan is normally available at $4 per month. However, it can be available at $0 for new users if you set up a recurring direct deposit of your pay cheque or government benefits, or if you deposit $1,000 per month into your account.

You can deposit all or part of your pay directly into your KOHO account. The same applies to government deposits, for example if you receive child benefit. However, KOHO does not offer investment accounts, TFSAs, RRSPs or other registered investment accounts.

[Offer productType=”CreditCard” api_id=”637cf8206bbb7962c19ae225″]A significant disadvantage when opening an account is the waiting time to receive the card, which is 7 to 10 days. KOHO claims to provide a virtual card instantly, but this didn’t work in my case. When I clicked to get the virtual card, the application asked me to order the physical card. Once received, you can activate it and you’ll get its virtual version in the app. The card is compatible with Apple Wallet and Google Pay.

With the Essential plan, I earn 1% cash back on my groceries, eating, drinking and transportation purchases, and 5% interest on my balance. Cash back can rise to 50% at selected partners.

When interest rates rose in 2023, KOHO was slow to offer an attractive rate compared with its competitors. Today, I can say that it has become competitive again and is one of the best accounts for saving money.

KOHO also offers more expensive plans, which I haven’t tried personally. The cost varies from $9 to $19 per month. You still earn 5% interest on your balance and you can get up to 2% cash back on certain expenses, plus no foreign exchange fees.

Useful budgeting tools in the KOHO app

My experience with the tools provided by KOHO is mixed. I like the ability to make a budget and the way KOHO supports me. For example, I’ve been able to choose my spending categories, enter my income information and set targets by category. What’s interesting is that I’m not left to determine these amounts on my own; KOHO offers a suggestion for almost every category, as you can see from these images.

At the bottom of the budget, my savings capacity is clearly indicated, which I can use to set goals. There’s also a graph showing your actual spending on the KOHO card (but not all your spending if you have accounts elsewhere). An independent budgeting application is still the best solution if you have various bank accounts.

I was a little less charmed by the savings Goals. I tried to set a long-term goal for dental care and couldn’t do it. I started by entering the amount I wanted to save. Normally, you can also choose the deadline (when you’ll need the money), the frequency of payments, and then the amount to be paid, for example every week, adjusts automatically. But for a goal in 2027, the application had a bug that kept coming back despite my repeated attempts. I couldn’t go any further than three months ahead from now, which isn’t very practical!

KOHO also offers a Vault, ideal for those who find it difficult to control their spending. You can put extra money in there that you don’t want to spend, and it prevents you from spending it accidentally. So having all your accounts in one place, saving and spending, isn’t a disadvantage. Unlike Goals, you don’t need to set an amount or a date to add money.

Build your credit with KOHO

KOHO offers a prepaid card, which has no impact on your credit. KOHO does, however, offer ways to improve your credit score, on a subscription basis. This feature costs from $5 to $10 per month, depending on your plan.

It works by opening a line of credit in your name and choosing an amount to set aside from it each month. Payments are reported to Equifax, which helps improve your credit score (if you make the payments right). An other option, the secured line of credit, requires you to set aside funds up front (from $30 to $500). You then withdraw as much as you like, and the punctuality of each repayment helps build your credit history.

KOHO’s limitations

One of KOHO’s limitations is its velocity limits! At any time, your account balance cannot exceed $50,000. Debit card loads cannot exceed $1,500 per day, which I find relatively low for people who want to make KOHO their main savings and spending account. For direct deposits (your paycheck, for example), the limit is higher.

Withdrawals are also limited. At ATMs, for example, you can withdraw no more than $1,010 per day. The maximum number of pre-authorized payments is 20 per month. If you have a lot of subscriptions and bills (phone, internet, electricity, streaming, etc.), you risk exceeding this number. Still, it’s enough for the vast majority of people.

KOHO’s other disadvantages, in my opinion, are the modest cash back and foreign transaction fees that come with the low-cost plan. Some competitors offer free cards and accounts and are able to waive foreign transaction fees or offer cash back in more spending categories.

Is KOHO for you?

KOHO’s prepaid card is a good choice for anyone who wants to avoid carrying a credit card in their wallet. Anyone who wants to improve their spending and budget management should also try KOHO. For optimum use, however, you need to use the prepaid card for almost everything, so that your spending analysis is good.

KOHO is not ideal for saving, as my experience with long-term goals shows. You should also know that you can’t build your financial future with KOHO. There are limits on how much you can save, and for registered accounts such as the FHSA for first-time homebuyers, you have to go elsewhere!