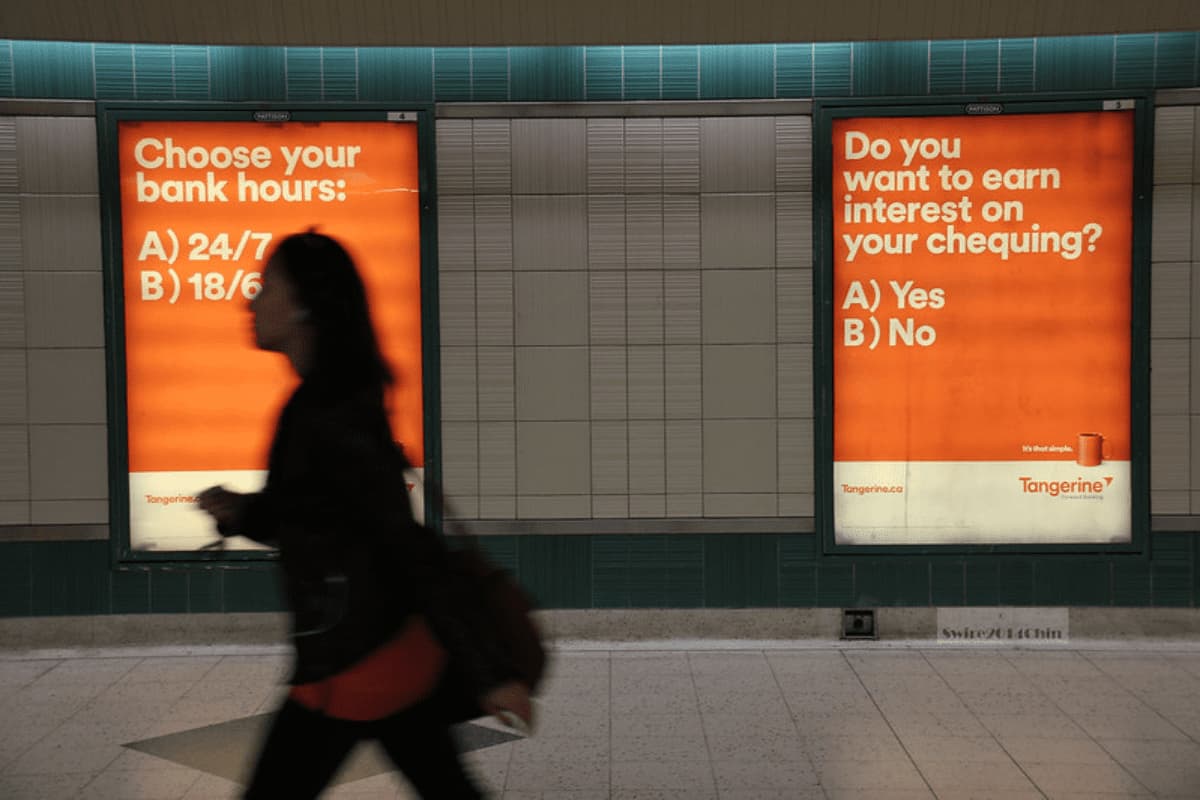

Tangerine Cash Back World Mastercard Review

By Stefani Balinsky | Published on 26 Jul 2023

The Tangerine World Mastercard is one of the best cash back credit cards in Canada for good reason. Cardholders get 2% cash back on up to 3 transaction categories and potentially unlimited money back. It also has no annual fees but all of the perks and benefits of being a Mastercard. So, should tangerine be your new favourite colour? Let’s find out.

Interest rate: 1.95% balance transfer & cash advance for the first 6 months

Welcome Offer: 15% in the first two months on up to $1,000. Must apply by January 31, 2023

Annual fee: $0

Tangerine World Mastercard Welcome Offer

This is not a points card but a cash back product. If you want cash back, you have to spend. The Tangerine World Mastercard Welcome Offer is essentially 15% back on purchases up to $1,000 made in the first 2 months. You have to apply for the card by January 31, 2023 and activate the account within 45 days. In the end, it’s $100 back to you if you spend $1000 in the first 2 months of having the card. The $100 is put on the primary cardholder’s account.

However, another Welcome Offer feature is a very low balance transfer interest rate. The balance transfer interest rate is 1.95% for the first 6 months. After that, a 19.95% interest rate applies to any unpaid balance. That is still lower than most cards on the market. There is also a one-time 1% balance transfer fee.

Is there an annual fee for the primary cardholder or authorized users?

No. The Tangerine World Mastercard does not have an annual fee. You just saved a lot of money on your annual fee and those of the optional 5 extra authorized users. The credit card does not have any fee to use any of the cards linked to the primary account holder’s card. Of course, each linked card earns cash back. However, the cash is only given to the primary cardholder.

How to earn cash back with the Tangerine World Mastercard

Cash back is great as long as it’s easy to get. The Tangerine World Mastercard credit card is actually very flexible in giving its cardholders some choice in how they earn their cash back. The first thing to know is that you need to decide where you want to see your cash back deposits.

Tangerine World Mastercard has 10 spending categories

Earning 2% cash back is actually a very good cash back rate considering that there is no annual fee on this card. Tangerine pays you back when you spend on your card and does not take any fee up front. It is certainly a unique selling point.

Another unique feature is that the Tangerine World Mastercard lets you choose among 10 spending categories for your 2% cash back. Here are the categories:

- Drug stores

- Eating places: restaurants, bars, lounges, discos, nightclub taverns, and fast food restaurants

- Entertainment: sports venues, theatres, theme parks, carnivals, circuses, tourist attractions, exhibits, movie theatres, zoos, live venues for bands, orchestras, and aquariums

- Furniture: home furnishing stores, and upholsterers

- Gas: service stations

- Hotels-motels: lodging, hotels, motels, resorts

- Public transportation and parking: automobile parking lots, parking garages, public transportation including buses, trains, and ferries, taxis, and road tolls

- Recurring bill payments: this includes a lot of monthly automatic payments or monthly bills charged to the card. Not every bill qualifies.

However, Tangerine doesn’t know you as well as you know yourself. Do you have a car that you park at the train or in a parking lot? Gas prices and inflation are making that even more expensive. If you want, you can choose the gas and the parking categories and get some of the money back. But wait, why did I only choose 2 categories? Well, we get to that next.

Earn 2% cash back in 3 categories

Do you want to earn 2% cash back in your choice of 3 categories? You need to choose to get your cash back deposited into a Tangerine savings account. You can open a Tangerine savings account very easily.

Tangerine lets you deposit your cash back directly to your Tangerine World Mastercard account. There is a change to your cash back earning categories. When you choose your credit card as the redemption destination, your choice of 2% categories goes down to 2.

Earn 0.50% on everything else

The Tangerine World Mastercard gives you 0.50% cash back on all your net spending in every other category. Once again, there is no limit to your potential earnings. If you pay $13,000 a year in groceries, you earn $65 in cash back if food is not one of your 2% categories. It is not an aggressive rate but it is money back in your pocket. If you have a clothes habit, or a teenager that just keeps growing, all those new threads can cost a lot. There is no 2% category for apparel but you can count on 0.50% back when buying clothes with the Tangerine World Mastercard.

Tangerine World Mastercard insurances

Above all, the Tangerine World Mastercard is a cash back and not a travel or points card. You are covered with purchase protection and extended warranty insurances. There is also mobile device insurance.

Even though the Tangerine World Mastercard is not a travel affinity card, it does have car rental collision/loss (CLD) damage insurance. When you pay for a rental car, you are insured so long as the duration doesn’t exceed 31 consecutive days. Alway read the fine print, though. Coverage extends to minivans for 8 people or less, cars, and sport utility vehicles. You can always buy your own or extra travel insurance elsewhere.

Mastercard network perks you get with the Tangerine World Mastercard

It pays to use your Tangerine World Mastercard. First, you get Boingo Wi-Fi access when you travel. Second, certain merchants offer Mastercard users rebates as part of the Mastercard Travel Rewards program. You simply register your card and start shopping on popular sites. Another great perk is 4 months of Apple Music free. Of course, you also benefit from Mastercard digital experiences and access to airport lounges through Dragon Pass.

Should you get the Tangerine World Mastercard?

Of course, if you want a cash back credit card, then yes, you should consider the Tangerine World Mastercard. You can use the card wherever they accept Mastercard, both in-person and online. The card has a fantastic 1.95% balance transfer rate that is good for 6 months. A lot of cards with cash back and rewards have balance transfer and cash advance rates over 19.99% all the time. Plus, Tangerine lets you decide how you want to earn your 2% and gives you the choice to deposit the money into a savings account. That $65 back in groceries I mentioned? That can go to your savings account. Of course, you have the flexibility to use your cash back toward your card balance. This is one way to plan paying off your debt: use your cash back to pay off your card balance so that you do not use your savings. Leave your savings for investing!

Since all cash back is a way to stretch your dollar further, you need a cash back credit card. If inflation is eating up your spending power, a cash back card gives it back to you. Plus, the Tangerine World Mastercard does not charge any money up front since there is no annual fee. The card is simply a good choice.

Tangerine World Mastercard Rating

|

Purchase interest rate

|

4/5 |

|

Cash advance interest rate

|

4/5 |

| Balance transfer | 4/5 |

| Annual Fee | 5/5 |

| Rewards | NA |

| Cash back | 4/5 |

| Welcome Offer | 4/5 |

|

Purchase insurance

|

3/5 |

|

Extended warranty insurance

|

3/5 |

| Travel insurance | NA |

|

Emergency medical travel insurance

|

NA |

| Other Perks | 4/5 |

| Rating | 3.9/5 |

Benefits and perks of the Tangerine World Mastercard

- 2% cash back in up to 3 categories

- 0.50% cash back on all other purchases

- 1.95% interest rate for balance transfer and cash advance in the first 6 months

- Option to get cash back added to your credit balance or to your Tangerine savings account

- Up to 5 authorized cardholders

- Access to Boingo WiFi

- Mastercard travel rewards

- Mastercard expriences

- Purchase protection insurance

- Extended warranty insurance

- Mobile device insurance