The Ultimate Guide To Improve Your Credit Score In Canada

By Heidi Unrau | Published on 20 Jul 2019

Want to hear a crazy statistic about debt? One in three Canadians admit they are on the verge of bankruptcy.

In fact, most Canadians say they would not be able to pay a $200 surprise expense or shortfall in their budget. One unpaid sick day could be a recipe for disaster.

And while there is a lot of shame and embarrassment surrounding financial insecurity and the bad credit that often goes with it, there really shouldn’t be. Many Canadians are struggling to keep up. You are definitely not alone.

We know that bad things happen to good people all the time. So if you’ve found yourself in some financial hot water and need to repair your credit and regain control of your finances, you have plenty of options available to you.

Table of Contents

What Is A Credit Score And How Is It Calculated?

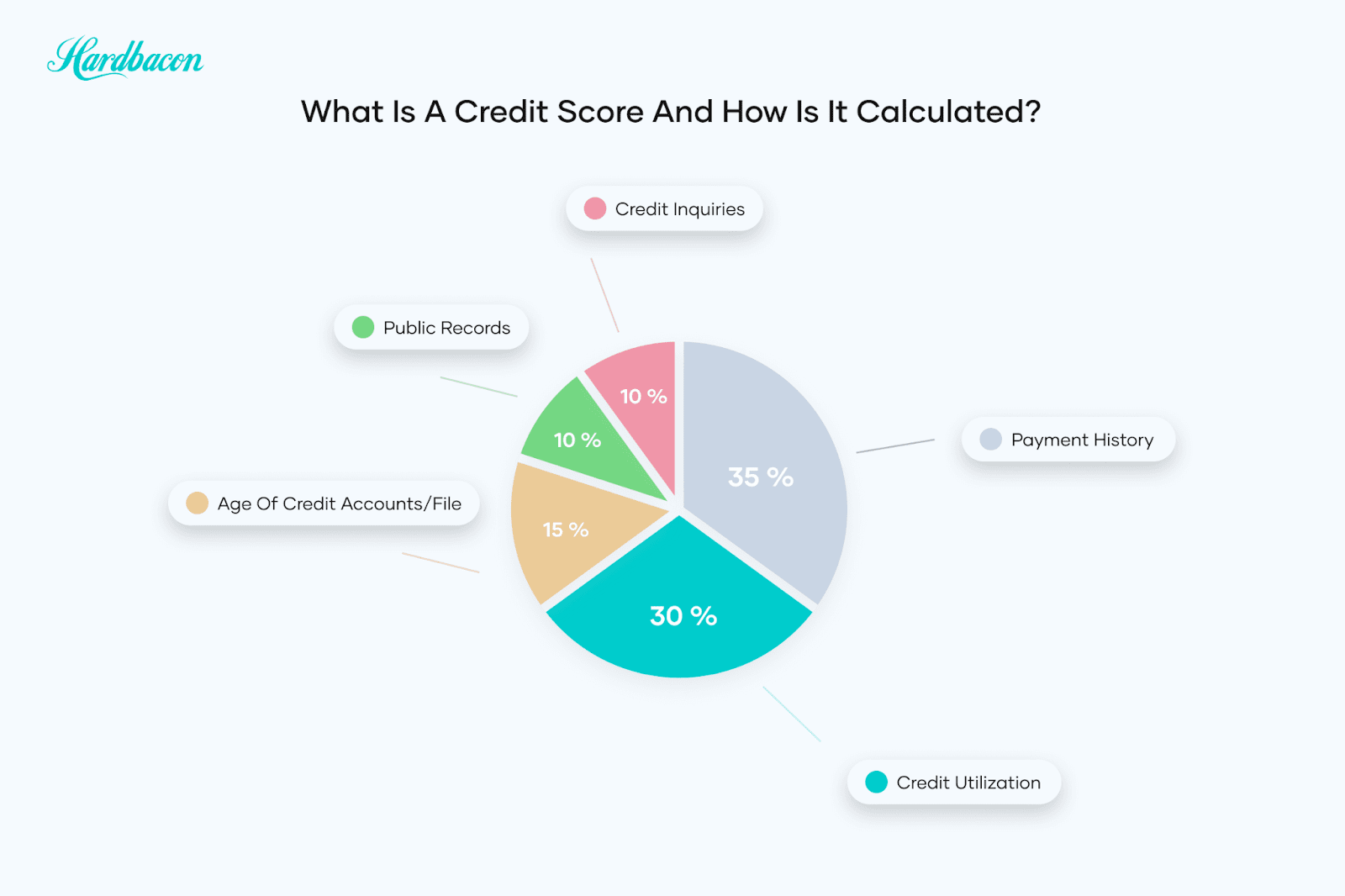

When you apply for a loan, you are asking for someone else’s money on the promise you will pay it back each month for a specific period of time. Since lenders don’t know anything about you personally, like how trustworthy you are, your credit file is like a report card on your ability to handle money that doesn’t belong to you. And your credit score is the specific grade evaluating how good you are at keeping your financial promises. The majority of your credit score is based on your payment history. If making your payments on time every month were an exam, it would make up 35% of your final grade. If you mess this part up, it has a serious impact on your score. One late payment could cost you 150 points and it stays in your file for 7 years.

The second most important part of your score is how much available credit you are using, known as your credit-utilization ratio, and it accounts for 30%. Imagine your credit card and lines of credit limits are a pie. Every time you charge something to your credit card or withdraw money from a line of credit it’s like eating more and more of that pie. The more you eat, the more it hurts your score.

Next is the age of your credit file which makes up 15% of your score. Those new to credit will have a much lower credit score because it’s almost impossible to tell how well they can handle and pay back their debt. Those with older files, and credit accounts that have been open for many years, often have a higher score because potential lenders can see how they have handled those debts over time.

Finally, public records and inquiries contribute 10% each to your score. Public records are things like collections and legal judgements like bankruptcy or a consumer proposal. Inquiries are every time a lender accesses your credit file when you apply for credit. Obviously, collections and judgements hurt you the most. But too many credit inquiries in a short amount of time can hurt you too.

How Can I Rebuild My Credit Score In A Hurry?

The best way to build credit is to use it. But what if traditional lenders say no? If your credit score is in the basement because life happened, there are tools available to help you get back on your feet even when the banks won’t help.

A Secured Credit Card

Hands down the easiest way to repair your credit score is to use a credit card. But that’s frustrating advice if you can’t get one, or the ones you already have are maxed out. Refresh Financial offers a secured credit card specifically designed to help you get to where you need to be. As long as you can provide a deposit, your approval is guaranteed.

Once you receive your card and start using it, it’s the same as using a regular credit card. You still need to make your monthly payments on time but doing so improves your credit score month over month. And Refresh Financial reports those payments to both TransUnion and Equifax.

A Credit Builder Loan

Refresh Financial also offers a credit builder loan which is a cross between a savings account and an installment loan. This product is a fairly new concept but it’s a total game changer. Like an installment loan, you’ll make regular monthly payments and those payments are reported to both credit reporting agencies.

But like a savings account, those payments are set aside into a trust account for you. When you’ve finished paying off the loan, your payments will be returned to you, minus interest and applicable fees. You can tailor this loan specific to your needs based on how much you want to borrow, how long you need it, and the monthly payment you can afford. You can even cash out early if you’ve reached your credit score goal before the end of the term.

Building And Maintaining A Good Credit Score

Rebuilding your credit score is only half the battle. And while tools like a secured credit card or a credit builder loan make it easier than ever, you need to maintain a good score in order to access credit in the future. How can you do that?

Check Your Credit File For Errors

Humans submit information about your borrowing behaviour to credit bureaus, and humans make mistakes. Monitor your credit regularly for inaccuracies and errors. There could be something on your file tanking your score that isn’t actually your fault at all.

Collection agencies are particularly notorious for not updating the credit bureaus once a collection item has been paid in full or settled. You can access your credit file for free from Borrowell and check it as often as you want without hurting your score.

Make Your Payments On Time

We hate to point out the obvious, but you need to make all your monthly payments ontime no matter what. There really is no wiggle room here, especially if you’re trying to repair a damaged credit score. Keep track of your due dates and make sure you are submitting online payments at least 3 to 5 business days before the due date to ensure your lender receives it in time.

Pay Down Your Debt

You already know that part of your score is based on how much credit you have used on things like credit cards and lines of credit. But did you know that being over the limit hurts your score almost as much as a missed payment?

Generally, any balance above 30% of your limit starts to negatively impact you. That means a credit card with a $1000 limit shouldn’t carry a monthly balance over $300. Going over the limit is like punching your credit score in the stomach.

On top of that, your lender will likely hike your interest rate and charge you an over limit fee. That basically renders your minimum monthly payment useless as far as reducing your balance, since it’s all going to interest and fees.

If your credit cards are at or near their max limits, you need to work on paying them down as quickly as possible. There are two strategies that can help you do this – The Snowball method or The Avalanche method.

The Snowball Method focuses on paying off the smallest debt balance first. So list all your debts owing in order from smallest balance to highest. Of course you make your minimum monthly payment to each of them. But you’ll aggressively pay down the smallest balance first by paying as much money over the minimum payment as possible. Once you have eliminated that debt, you’ll move on to the next smallest balance, so on and so forth.

The Avalanche Method focuses on paying off the debt with the highest interest rate first, usually a credit card. But if you have any subprime loans from a private lender, they can have rates much higher than credit cards. List all your debts owing from the highest rate to lowest.

Then, just like the snowball method but in reverse, put as much extra cash as possible above the minimum monthly payment on to your highest interest debt. Just don’t forget to keep making your minimum monthly payments to your other debts too, obviously. Once it’s paid off, do the same with the next one on the list.

Diversify Your Debt

Just like a healthy investment portfolio needs diversification, so does your credit file. Don’t put all your eggs in one credit basket, like having tons of credit cards or installment loans. Different types of credit show lenders you are capable of handling different kinds of credit products which come with different repayment requirements. A well rounded credit file makes you less of a lending risk

Don’t Close Old Accounts

Don’t close old credit cards or lines of credit just because you don’t use them anymore. As long as their balances are at or near zero, the longer those accounts remain open the better. It gives creditors a longer history to look at when assessing your creditworthiness. However, if you can’t help yourself from using them and raking up balances, then you should definitely close them.

Stop Applying For Credit

While credit inquiries make up a small percentage of your score, too many can tank it really fast. A hard inquiry will cost anywhere from 5 to 10 points off your score. The lower your score was to begin with, the more it will hurt you. While a few checks a year are normal and expected, many inquiries in a short period of time can drop your score low enough to fail basic qualification requirements. It also makes lenders think you are desperate for credit which makes you a higher lending risk in their eyes. If you’re trying to rebuild a damaged credit score, you should hold off on applying for any new credit unless absolutely necessary.

The Takeaway

If you’re reading this, you’ve probably been turned down for credit. Or maybe you’re struggling to manage your debt and don’t know what to do. Rest assured, no matter how badly you might be feeling, you are not alone. Most people take on debt with the best of intentions to pay it back as agreed.

But then life happens, and when it rains it pours. Bad credit doesn’t mean you’re a bad person, it means you’re human. There are tons of resources to help you take control of your debt and rebuild your credit. Understanding how your credit score works and making a few simple changes means you’re on your way to better days.