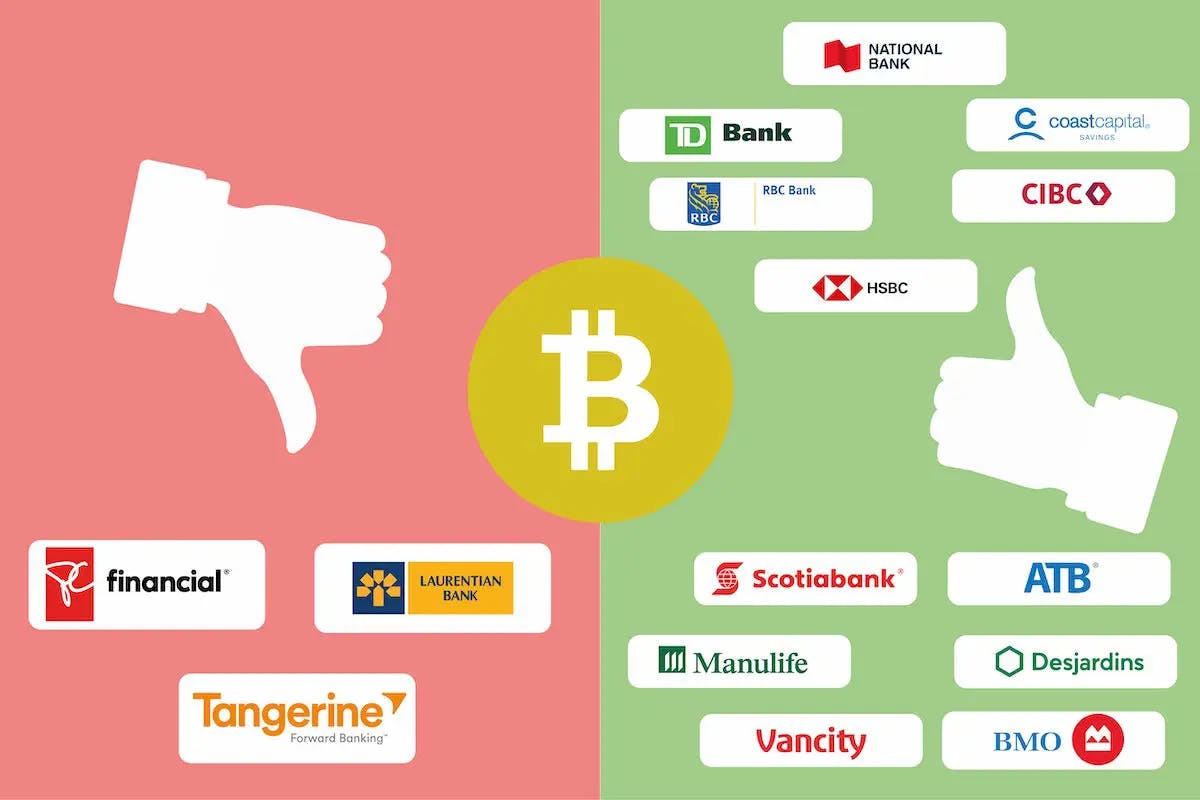

The 11 Best Crypto-Friendly Banks in Canada (and Some of the Worst)

By Arthur Dubois | Published on 26 Jul 2023

Finding a reliable bank to work with when it comes to your cryptocurrency investments is important. As a Canadian, you’ve got to know which banks are going to make it a seamless process, and which ones will make it a hassle. Actively avoiding the lacklustre options should be relatively easy once you’ve read through this article though, so let’s get started!

Comparing chequing accounts can be daunting as you’ll have to look at the many different fees and perks associated with them; this is why using a guide like this will always be ideal, especially for beginners.

Why Would I Need a “Crypto-Friendly” Bank?

When you want to invest in the cryptocurrency space and need to get your money onto the exchanges, banks aren’t always going to be your best friend. They want you to stick around and invest with them using traditional stocks and such, so some of them will limit or block crypto transactions entirely.

By working with a bank that is known to be friendly towards crypto investors, you’ll never have to worry about your deposits being rejected by the bank. Some of them have a strict “no cryptocurrency” policy, while others are more flexible and lenient. Using this guide will take you a long way, especially if this is your first time looking into purchasing Bitcoin, Ethereum, or anything else!

The 11 Best Crypto-Friendly Banks in Canada

Take a look at the list below and learn more about 11 of the most crypto-friendly banks in Canada. Most of them will allow you to purchase cryptocurrency using wire transfer, eTransfer, and even debit; while a few will even let you to fund your crypto exchange account using a credit card.

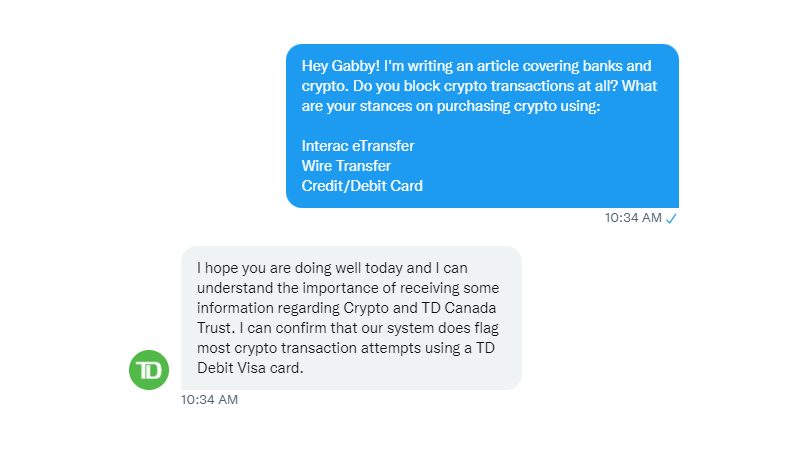

1. Toronto-Dominion (TD)

Arguably the most crypto-friendly, Toronto Dominion (otherwise known as TD Canada Trust) allows account holders to purchase crypto using eTransfer, credit/debit, and wire transfers. They’ve stated that they are regularly overlooking their policies to ensure maximum protection for their customers and TD, and while credit purchases for crypto have been enabled, they will be approved after manual review.

Cheapest Chequing Account: TD Minimum Chequing Account ($3.95/month + additional fees)

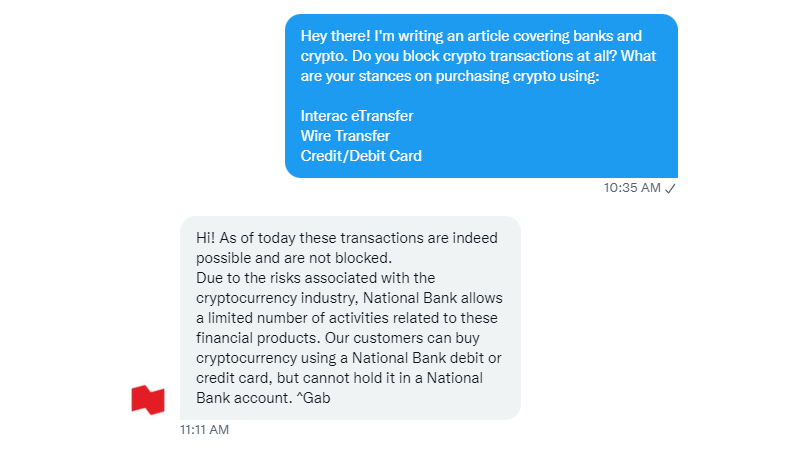

2. National Bank of Canada

National Bank of Canada is welcoming the cryptocurrency revolution with open arms, as they are actively allowing customers to invest in crypto using any of their financial services/products. This means that you can fund your account on exchanges using eTransfer, wire transfer, and credit/debit without the worry of any blocks happening.

National Bank is a financial institution that has covered crypto extensively over the past few years, and it seems as if they are looking to be one of the front-runners when it comes to innovation in the financial services industry.

Cheapest Chequing Account: The Minimalist ($3.95/month + additional fees)

3. Coast Capital

Coast Capital allows customers to comfortably invest in cryptocurrencies and doesn’t block any transactions; you can purchase it through eTransfer, wire transfer, credit, or debit card. Not only that, but they’ve also shown that they are willing to innovate and work with new technology, as they’ve recently announced the addition of enhanced digital services through the nCino platform. Their commitment to remaining flexible and adjusting to customer needs is astounding, and means that they could be a powerhouse to watch out for in the near future!

Cheapest Chequing Account: Personal Chequing Account ($0/month)

4. Canadian Imperial Bank of Commerce (CIBC)

Using your debit card is always possible for cryptocurrency transactions, but I was told that eTransfer and wire transfer are two options that could be up for review. Some transactions will be blocked, while others will go through after being verified by an official party – you cannot use a credit to purchase any crypto assets at CIBC (as usual).

Cheapest Chequing Account: Everyday Chequing Account ($4.00/month + additional fees)

5. RBC

RBC (Royal Bank of Canada) allows you to purchase cryptocurrency using eTransfers and Debit, but that’s all you’ve got to work with. They’ve recently stated that they do not allow wire transfers to crypto exchanges, and also don’t allow customers to use credit cards to fund their crypto investments. Most banks believe that using a credit card to fund investments in such a volatile market can be dangerous for customers, and RBC is following suit here.

Cheapest Chequing Account: The Essentials ($4.00/month + additional fees)

6. Scotiabank

The Bank of Nova Scotia (Scotiabank) allows people to purchase cryptocurrency using Debit, eTransfer, and wire transfer if certain pre-requisites have been met. If you’re trying to send money through wire transfer to an exchange that isn’t Canadian-based, odds are it’s going to be blocked – but there are plenty of amazing Canadian crypto exchanges to choose from nowadays.

Cheapest Chequing Account: Basic Bank Account ($3.95/month + additional fees)

7. ATB

ATB has been in support of cryptocurrency since at least 2019, and while they are trying to inform their customers of the risks associated with cryptocurrency, they are still allowing them to transfer funds to exchanges and make purchases. They offer international wire transfers for $5.00 if the amount is less than $999.99 (everything $1,000+ is free!), as well as a Visa-enabled ATB debit card. You can also purchase cryptocurrency through eTransfer as an ATB customer.

Cheapest Chequing Account: Pay As You Go Chequing ($0/month)

8. Desjardins

Desjardins has many customers and some of them have said that they’ve purchased cryptocurrency using a Desjarding account without any issues. This means you can expect to be capable of purchasing crypto through wire transfer, eTransfer, or debit card, but not a credit card. Canadian banks aren’t too keen on letting people use metaphorically borrowed money to invest in such a high-risk asset, as per usual.

Cheapest Chequing Account: DBank Virtual Chequing Account ($0/month)

9. Manulife Bank

Manulife in itself has been in support of blockchain technology since 2016, but how does Manulife Bank handle transactions? Manulife allows customers to send wire transfers to cryptocurrency exchanges, but it requires them to submit exchange information beforehand. This is likely so that they can verify the legitimacy of the exchange, keeping both their customers and themselves safe in the process. The support worker seemed to think I wanted to purchase crypto directly from them, but it’s safe to assume that you can also use debit and eTransfer to make purchases.

Cheapest Chequing Account: Advantage Chequing Account ($0/month)

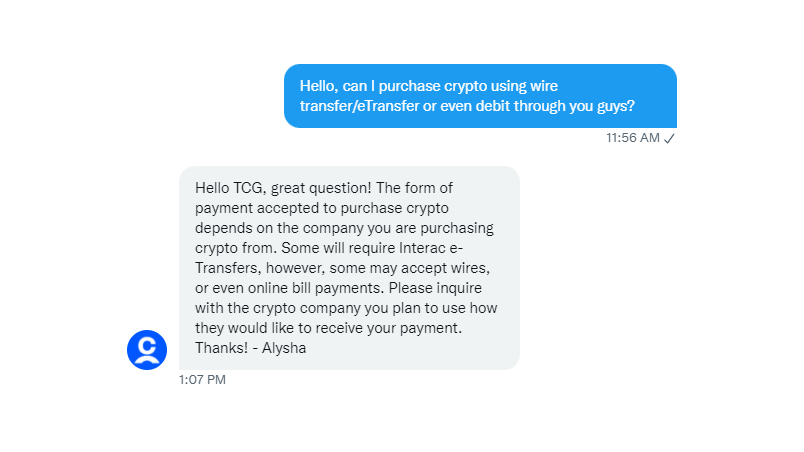

10. Vancity

Vancity also seems to be down with the cryptocurrency movement, although I feel like the customer support worker may have been a bit confused. They do offer both wire transfer and eTransfers and it sounds like they aren’t going to block any transactions – as long as the exchange offers these options as a method of deposit, you’re good to go!

Cheapest Chequing Account: Pay As You Go Chequing ($0/month)

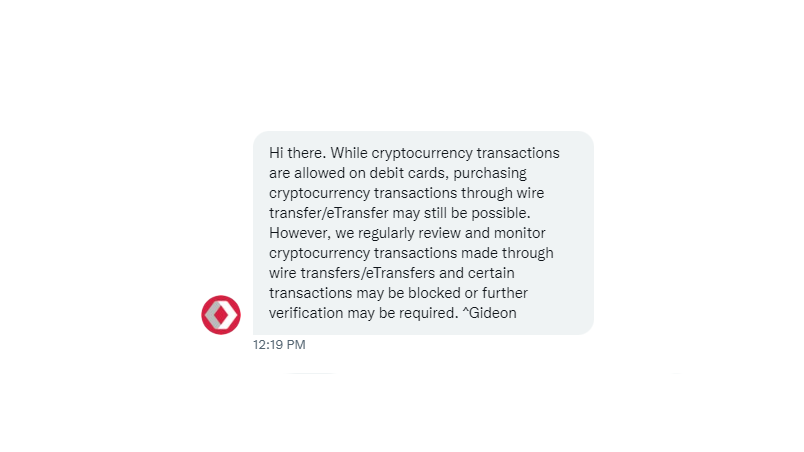

11. BMO

One thing to keep in mind is that most Canadian banks won’t allow you to purchase cryptocurrency using credit cards. BMO allows you to purchase crypto using Debit or eTransfer, and even wire transfer – they have stated that they will look at some orders on a “case-by-case” basis though. You cannot purchase crypto using a BMO credit card, and there have even been reports of BMO blocking debit cards after identifying a cryptocurrency transaction.

This means that larger orders may be rejected unless you’ve called the bank ahead of time, and even then they still may refuse your request. In that case, you may be better off purchasing smaller amounts to start.

Cheapest Chequing Account: Practical Chequing Account ($4.00/month + additional fees)

Canadian Banks That Block Cryptocurrency Transactions

Not all banks are willing when it comes to completing cryptocurrency transactions, as some either lack the required services (like wire transfers or eTransfers) or simply don’t support purchasing crypto in general. It’s a high-risk asset but it’s becoming one of the more commonly used investment options as time progresses. If you want to innovate alongside financial technology and don’t want any bumps in the road, here are a few banks you should actively avoid.

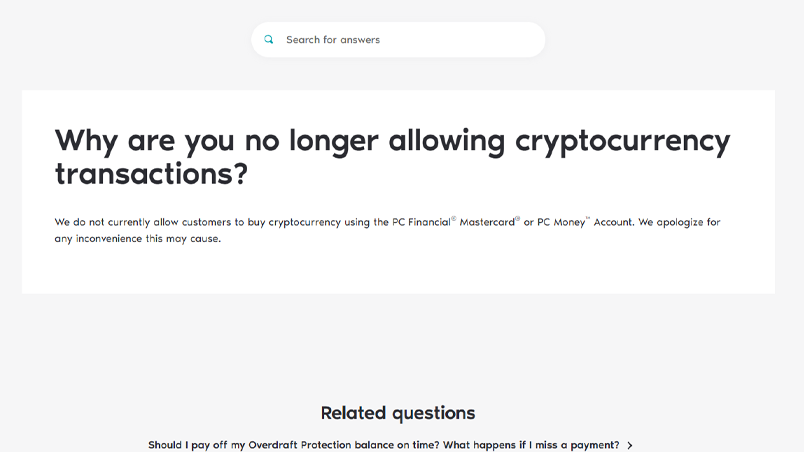

President’s Choice Bank

President’s Choice Bank is a viable option for people who just want a chequing account that offers no monthly fees, but the transaction number is capped at 12 (with each additional transaction costing $1.99). Not only that, but they have actively stated that they are blocking all cryptocurrency-related transactions when it comes to PC Bank accounts.

Cheapest Chequing Account: PC Money Account ($0/month)

Laurentian Bank

Laurentian Bank made it tough to figure out, but apparently, they will block most transactions associated with cryptocurrency. Trying to purchase through Shakepay triggered an automatic lock on the accounts of users who tried to purchase crypto in the past, and they haven’t said anything about updating their stance on the matter.

If you don’t want to worry about having your transactions automatically flagged and your account locked, it may be wise to stray away from using Laurentian Bank for cryptocurrency transactions.

Cheapest Chequing Account: Minimal Chequing Account ($4.00/month + additional fees)

Tangerine

Offers up to 0.10% interest on every dollar held in your account, which is a nice touch for a traditional no-fee chequing account. With that being said, Tangerine doesn’t offer wire transfers and doesn’t permit the use of eTransfer, credit, or debit cards for cryptocurrency purchases. As such, you should avoid Tangerine at all costs if you’re looking to invest in any crypto assets.

Cheapest Chequing Account: No-Fee Daily Chequing Account ($0/month)