Koinly Review : A Crypto Tax Software for Canadians

By Arthur Dubois | Published on 26 Jul 2023

Canadians who have started to invest in cryptocurrency for the first time may be in for a shock when tax time rolls around. Many believe that they can invest in crypto without having to pay taxes, but that isn’t the case in Canada. Canadians are expected to pay taxes when it comes to their crypto transactions, but how exactly would one go about calculating what they owe?

If you’re struggling with trying to pay your crypto taxes in Canada for 2022, you’re in the right place. We’re going to go through how crypto is being taxed in Canada, as well as what you can do to ensure that you’re filing things properly using a crypto tax software called Koinly. There are plenty of tools available online to compare exchange fees and such, but it never hurts to learn more about how you’re being taxed on your crypto investments and how to file your tax return as a crypto investor.

How crypto taxes work in Canada

Understanding what records to keep and how to apply taxes properly with crypto is tough for a beginner. Canadians are supposed to pay taxes on any gains they’ve made through cryptocurrency and the CRA (Canadian Revenue Agency) treats these assets as a commodity in regards to taxes. Commodities that are already often traded publicly would be oil, silver, or even gold – if you’ve ever invested in any of these areas, you already know how things work.

Any profits that are made through your cryptocurrency investments will be considered business income or capital gains when the time comes to file your taxes. As of 2022, 50% of the value of any capital gains you’ve made will be taxable.

For example:

- You purchase 1 BTC @ $45,500

- By the end of 2022, the price has soared to $91,000 (increasing by $45,500)

- You would be given a capital gains tax of 50% of $45,500 ($22,750)

- As a result, you would pay your marginal tax rate on $22,750

Which transactions are taxable?

Any sort of sale or transfer of cryptocurrency that takes place is what we call a “disposition”, and they are taxable events. The list of dispositions includes:

- Selling your crypto assets for fiat

- Swapping one crypto asset for another (ex. BTC > ETH)

- Using crypto to pay for any goods/services

- Giving away crypto as a gift

Although some of these transactions could be a common occurrence for you, it stresses how important using a service like Koinly can be to keep things organized come tax time.

Selling your crypto assets for Fiat

Whether you’ve generated a profit or a loss, selling your crypto is going to be a taxable event. This is why most people purchase their crypto and hold it for years since you don’t have to report it to the CRA. Once you finally sell, whether it’s at a loss or for profit, you’ll have to report it on your next tax return. You will pay a capital gains tax or report it as business income if you’ve made a profit, but you can also claim losses to help lower how much you owe.

Swapping one crypto asset for another

Comparing the abundance of exchanges and finding the one that offers the best deal can be a hassle, but it’s important when it comes to swapping crypto assets for each other. Many people think that this isn’t a taxable transaction because they didn’t sell for fiat, but that isn’t the case.

Swapping BTC to CRO is still considered a disposition, and even if you’re purchasing a coin at ICO (Initial Coin Offering) with crypto, the same rule applies. The best exchanges make this process an easy one, but they don’t always make it clear that it’s a taxable transaction.

Using crypto to pay for any goods or services

Purchasing goods and services using crypto has become a common theme these days, but Canada does not consider crypto as an official “currency” just yet. It’s still considered a commodity and will be treated like such in any transaction, including the purchase of goods/services. It’s the equivalent of making a “barter transaction”, which is when you and another party agree on the exchange of goods or services without using legal tender (such as the Canadian dollar).

Whoever is receiving the crypto will report it as a business income and the party sending the crypto will likely have to pay tax on capital gains if they’ve made any profits since purchasing the asset. For example:

- You purchase $100 of BTC (0.001735 @ $45,100 each)

- The next day you use that BTC to purchase something after the price increases $10 (now $110)

- Since you used your BTC to make the purchase, it’s a “sale of commodity”

- The extra $10 you made would be a capital gain and need to be reported to the CRA

- However, if the BTC value went down $10, you would generate a capital loss

Giving away crypto as a gift

Even just giving away crypto to your friends and family can be considered a taxable event, as it’s still a disposition of property. The person receiving the crypto doesn’t have to pay any taxes, but the party sending it out may have to. If the value of the crypto you’re sending increased at all in between the time you purchased it and gifted it to someone else, it would be a capital gain. Much like making a purchase, if the asset loses value before you’ve sent it, you would have accrued a capital loss.

Business vs. personal income

Deciding whether you need to file your crypto taxes as business or personal income can be tricky, but that’s only if you have no clue where to start. If you’re operating a business and using crypto in a taxable manner, you would be reporting business losses or income. Those who are filing it as personal income will be reporting either capital gains or losses; that’s it!

Let’s just say you purchased BTC at $55,000 and decided to sell when it dropped down to $47,000. This loss would be either a business loss or capital loss. Either can be used to lower the amount you pay on business income or capital gains tax.

Should I report my crypto profits as business income or capital gains?

If you’re one of the lucky people who made a profit throughout the year with crypto, you’ll have to report it correctly to the CRA by using the right forms. Using the T2125 Form is applicable if you’re reporting these transactions as business income, and this only applies if you:

- Run a commercial company that involves the use of cryptocurrency (ex., an exchange or Bitcoin ATM)

- Regularly trade crypto assets (ex., a day trader)

- Purchase crypto with the intent to make short-term profits

- Approach your crypto projects and portfolio with a business mindset (you seek out investors, have a business plan, etc.)

If you’re somebody who simply mines their crypto and “HODLS” it forever, you don’t have to worry about filing your crypto taxes until you’ve sold. If you eventually sell for a massive profit, this will be considered a capital gain and get taxed at 50%. When you’re mining crypto and selling it at a profit consistently throughout the year, it’s hard to argue that it isn’t business income.

Those who are not actively investing in the crypto space (such as long-term holders and DCA specialists) you’ll likely file any profit made as a capital gain. The CRA hasn’t expanded on how they treat the staking of cryptocurrency, although it’s often looked at like any other interest or dividend payments accrued from stocks. When you pull your assets out from staking and sell at a profit, the capital gains tax would still apply.

How GST/HST is calculated on cryptocurrency taxes in Canada

If you are a business owner or self-employed and generate over $30,000 annually from your goods/services, you are required to file GST/HST during tax time. If you’ve been getting paid in crypto for your goods/services, you’ll have to calculate the GST using the average market value at the time your assets were exchanged. GST records must remain organized for anyone who is running a business or happens to be self-employed, even when dealing in crypto.

Are there tax-free investment options for crypto in Canada?

If you don’t want to take on the risk of investing in true cryptocurrencies or want to avoid paying taxes whenever possible, you can always take advantage of your TFSA (Tax-Free Savings Account). While you can’t purchase BTC or ETH using your TFSA, you can gain exposure to the crypto markets by purchasing one of the many BTC or ETH ETFs that have recently risen in popularity.

There’s no need to worry about creating a wallet and learning blockchain technology if you choose to go down this route! With that being said, your profits may be limited in comparison to those who own the coins.

Some of the most popular crypto ETFs available on the Toronto Stock Exchange (that are priced in CAD) would be:

- BTCC (Purpose Bitcoin ETF)

- ETHH (Purpose Ether ETF)

- BTCX (CI Galaxy Bitcoin ETF)

- ETHR (Evolve Ether ETF)

Properly calculating your crypto taxes as a Canadian

This is arguably the hardest part about investing in the cryptocurrency space because people don’t want to deal with all of the number-crunching that comes with it. Purchasing one asset and selling it for a profit seems like a simple process, but there’s a lot that comes with that! Being taxed at 50% for capital gains can seem unfair at first, but that doesn’t mean you owe them half of what you’ve made in the past year.

Finding the adjusted cost basis

Your portfolio and all of the assets that you still hold don’t apply when tax season rolls around, as you still own them and haven’t sold at a profit yet. When you’re trying to calculate how much of a profit you’ve made, you always need to account for the adjusted cost basis. What does this mean, exactly?

If you’ve made multiple purchases throughout the year on one specific asset (BTC, for example) but the price has fluctuated throughout the year, you’ll have to figure out what your average cost was. Only then will you be able to figure out whether you’ve generated a profit or a loss! If you’ve been mining the crypto and selling it, your cost basis is automatically (and obviously) zero.

Koinly makes things simple!

Crypto taxes have become a confusing and daunting process for investors all over Canada, and that’s because crypto can be applied in so many different ways. Whether you’re entering the crypto industry for investing, using it as an alternative currency, or even running a business based on it, the tax people will always want their cut. While it used to be a struggle to keep everything organized in the past, Koinly is a tool that made it incredibly easy to file your crypto taxes in Canada.

Why should you use Koinly?

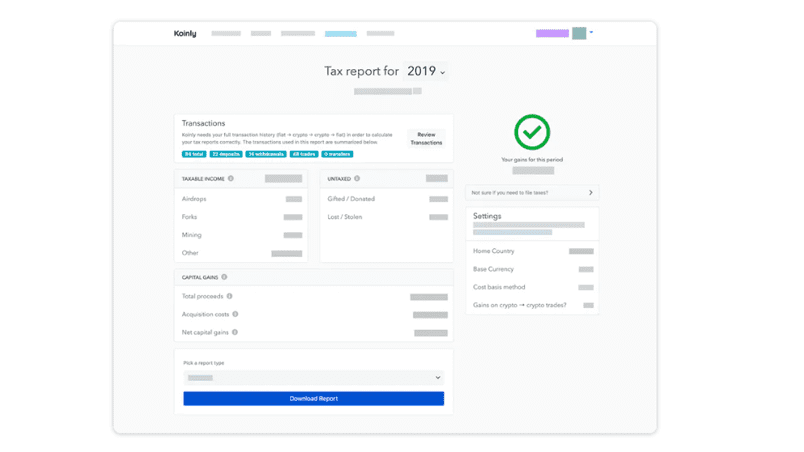

Koinly is a straightforward service that lets you import all of your exchange trades using CSV files, crypto exchange APIs, or even the public keys of your crypto wallet. All of the transactions that take place on the blockchain are stored in the ledger, and Koinly merely taps into this power to help fuel an easy-to-use crypto tax return service.

Benefits of Using Koinly

- Multiple cost-basis methods available (FIFO, LIFO, HIFO, Average Cost, etc)

- Universal or Wallet-based cost tracking (connect your wallets for easy access)

- Smart transfer matching to ensure your original costs are always stored properly

- An automated tool that makes filing crypto taxes a breeze!

They support well over 17,000 cryptocurrencies, 50+ wallets, 350+ exchanges (including the most popular exchanges available in Canada!), 50+ blockchains, and 11 additional services to handle DeFi (staking/farming). All of your transactions can be found in one spot with Koinly, and you can see exactly how much you’ve spent and profited over the year.

Koinly also does an amazing job of pointing out your tax liabilities to keep users in the loop at all times. Certified and in regulation with the Canadian laws that come with buying crypto, Koinly has everything you need to successfully report your crypto taxes with ease.

Canadian crypto taxes don’t have to be hard!

To keep things simple, you only have to worry about reporting your crypto taxes if you’re doing more than just buying and holding the assets. Keeping track of your transactions can be a hassle, but thankfully, there are services like Koinly out there to do it for you. Some of the things you’ll want to keep on record yourself would be:

- Transaction dates

- CAD value of assets during a transaction

- Purchase/transfer receipts

- Crypto wallet addresses

- Legal/accounting costs

- Mining expenses (hardware/service costs)

In other words, if you aren’t someone who is professionally trained and certified to be handling crypto taxes, you’d be better off using a tool like Koinly to keep your life stress-free!