Wealthsimple Crypto Review : What You Need to Know

By Heidi Unrau | Published on 26 Jul 2023

Wealthsimple Crypto is helping to bring cryptocurrency out of the shadows and into the wallets of Canadians like you. Over the past 10 years, Bitcoin has outperformed every other asset class on the market. If you haven’t been watching the news, then you’ve probably heard about Bitcoin over the water cooler at work. And I guarantee someone you know has already claimed their stake in the crypto market. So why haven’t you?

For one thing, it’s super risky. But also, it’s the techiest investment out there. Cryptocurrency is a pretty intimidating space for an inexperienced investor, especially if cutting-edge financial technology isn’t your schtick. Don’t despair, Wealthsimple Crypto is on a mission to deconstruct complicated crypto mechanisms so you can add a little digital currency to your investment portfolio too. Let’s take a look at everything Wealthsimple Crypto has to offer, and what it doesn’t.

What is Wealthsimple?

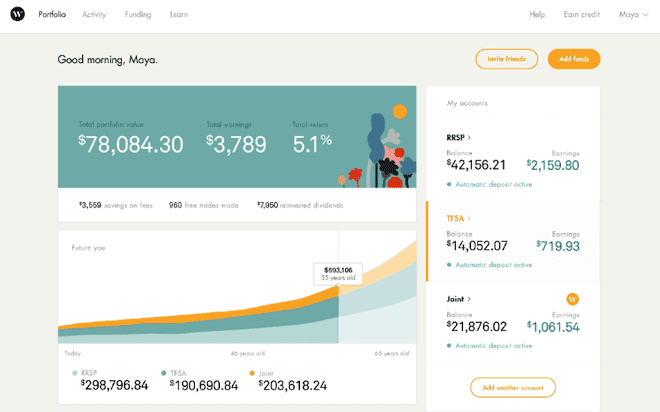

Wealthsimple is an online investment and trading platform. If you know about Robinhood in the U.S., think of Wealthsimple as the Canadian version. They’ve marketed themselves as “the smarter way to invest,” by removing the financial barriers that have prevented everyday, hard-working Canadians from being able to grow their wealth. Wealthsimple offers low-cost, user-friendly access to globally diversified index funds with their award-winning financial technology services.

But they didn’t stop there. Wealthsimple currently has 1.5M investors using their platform. You don’t earn that kind of street cred from retail investors without keeping your finger on the pulse of major market trends. Their flagship feature started with low-cost passive investing through an automated robo-advisor. But they have since grown to include stock trading, cash deposit services, and even tax filing services. It should come as no surprise that Wealthsimple recently launched Canada’s first regulated crypto trading platform in the summer of 2020.

What is Wealthsimple Crypto?

Wealthsimple Crypto is a new trading service nestled inside the Wealthsimple Trade app. If you’re already familiar with their traditional stock trading platform, crypto is simply the newest digital asset the app has to offer. In the app, just tap on your list of investment accounts, which is located under your account icon on the top left corner of your app, then tap on “Crypto.” Voilà. Once you’ve selected the crypto feature you can add funds to your crypto account and start trading.

If you’re brand new to Wealthsimple, you’ll need to create a login account and verify your identity. This is standard practice for all financial service providers. The process is quite simple and easy to navigate. You should be up and running in about 5 to 10 minutes. If you’ve never invested before then Wealthsimple Trade is perfect for you. The user interface is elegant and intuitive. The step-by-step process is foolproof and all your account features and functions are straightforward and easy to find.

Wealthsimple Crypto: how to get started

Wealthsimple is a Canadian online investing and trading platform, so you’ll need some Canadian documentation to get started. Before you open your account, make sure you meet the following eligibility requirements first:

- You’re a Canadian citizen, permanent resident, or hold a valid Canadian Visa

- You’re 18 years of age or older

- You have a Canadian residential address (no PO Boxes)

If you meet the eligibility criteria then you can open your Wealthsimple Trade account. The process is fairly straightforward and requires the following:

- Social Insurance Number

- Valid Government Issued Photo Identification

- Personal contact info

- Date of birth

- Email address

Now that you’re all set up, let’s take a look at everything Wealthsimple Crypto has to offer; the good stuff and the not-so-good stuff.

Wealthsimple Crypto: the good stuff

No account minimums

To get started with Wealthsimple Crypto, you don’t need to worry about high minimum deposits. You can get started with as little as $1. On top of that, there are no fees for funding your account or withdrawing from it. You simply transfer money from a Canadian bank account to your Wealthsimple Trade app through an Electronic Funds Transfer (ETF). That sounds overly technical but it’s actually very easy, just follow the prompts. If you’re already a Wealthsimple user, you can buy crypto using the funds from one of your Wealthsimple accounts.

Inexpensive transactions

Unlike traditional stock purchases, Wealthsimple doesn’t charge a commission on trades. You will, however, pay an operations fee when you buy or sell crypto. This fee will fluctuate from trade to trade because it depends on the size of your transaction (the total Canadian dollar value) as well as the spread. The spread is the difference between the quoted price of that coin at the time you initiate your buy and the price you end up paying once the transaction settles.

Crypto is volatile and the price is in constant flux. That means you might want to buy $100 CAD worth of Bitcoin but end up with only $97.50 CAD worth of Bitcoin. The spread is normal market activity and should be expected with every transaction. Then you pay Wealthsimple an operations fee of 1.5-2%, which is added to the price of the cryptocurrency you are buying or selling. After the spread and operations fee, you could net about $95.55 worth of Bitcoin. If you’ve ever bought or sold stock through a brokerage, then you know this fee pales in comparison to the commission you pay on traditional stock market trades.

Perfect crypto trading for beginners

If you’re new to crypto, investing, or both, Wealthsimple Crypto was tailor-made for you. The user interface is not only visually stunning as far as financial apps go, but it’s also incredibly easy to navigate. The layout is intuitive and well organized. I was brand new to investing when I opened my very first investment account with Wealthsimple and I have had no issues with navigation or functionality.

You can link your Canadian bank account or use funds from another Wealthsimple account you already have. The crypto coin selection is modest, offering just 24 coins. But that’s perfect for beginners wanting to get their feet wet without falling down the cryptocurrency rabbit hole. If you want to realize your crypto profits or decide this space just isn’t for you, you can cash out the value of your holdings to Canadian funds and transfer the money back to your bank account.

A variety of popular crypto coins to choose from

When Wealthsimple Crypto first launched back in 2020, it only offered Bitcoin and Ethereum. Since then, they’ve added to their crypto lineup and now offer 24 popular cryptocurrencies to choose from. Wealthsimple Crypto plans to add even more currencies in the future which will make it even more attractive to crypto enthusiasts. At the time this article was written, Wealthsimple Crypto offered the following cryptocurrencies:

1inch (1INCH)

Aave (AAVE)

Balancer (BAL)

Basic Attention Token (BAT)

Bitcoin (BTC)

Bitcoin Cash (BCH)

Chainlink (LINK)

Compound (COMP)

Curve (CRV)

Decentraland (MANA)

Dogecoin (DOGE)

Ethereum (ETH)

Fantom (FTM)

Filecoin (FIL)

Kyber Network (KNC)

Litecoin (LTC)

Maker (MKR)

Ox (ZRX)

Polygon (MATIC)

SushiSwap (SUSHI)

Synthetix (SNX)

Uma (UMA)

Uniswap (UNI)

Yearn.Finance (YFI)

Coins held in third-party custody for you

If you’re brand new to the crypto space, the wisest course of action is to buy and HODL. No, I didn’t misspell the word “Hold.” In the crypto world, HODL means “Hold On for Dear Life.” There’s a lot of information and very strong opinions out there. It can be a minefield for someone who doesn’t fully understand what they’re investing in. The good news? Wealthsimple has partnered with Gemini Trust Company LLC to hold your coins safely for you offline, away from the sticky fingers of tech savvy computer hackers.

According to Wealthsimple, “Our Custodian, Gemini Inc, maintains a commercial criminal insurance policy in an aggregate amount of up to $200,000,000. Their policy insures against the theft of Cryptocurrency that results from a security breach or hack, employee theft or fraudulent transfer.” As a crypto rookie, you don’t have to worry about leaving your coins exposed on a sketchy unregulated platform, or worrying about which hardware wallet to buy and how to transfer your coins without losing them. You can focus on learning as much about crypto as possible.

Wealthsimple Crypto: the drawbacks

Tax implications

While the cryptocurrency market lacks the same regulatory framework as traditional asset classes, one thing is for sure: you will pay taxes. It’s true, Wealthsimple has no control over federal tax law. But you cannot slap the Fed’s hand away from your pocket on a regulated platform that is legally required to submit records of your investment accounts. If you like to live dangerously and want to break federal tax law, you’ll need to do that somewhere else (seriously though, don’t be cringey. Pay your taxes).

Currently, cryptocurrency is a prohibited investment which means it cannot be held inside a registered investment account like your Registered Retirement Savings Plan (RRSP) or your Tax-Free Savings Account (TFSA). According to Wealthsimple, “Crypto accounts are non-registered personal accounts and are subject to any capital gains or losses incurred from buying and selling cryptocurrencies.” The Government of Canada is very clear about how the tax law applies to cryptocurrencies: if you use it as a commodity expect to pay capital gains tax. You can also expect tax implications anytime you sell your cryptocurrency back into traitional money, use it to purchase goods or services, trade it for other cryptocurrencies, or even gift it to someone.

Can’t move your coins

As you learn more about crypto you’ll want to take on more control of your holdings. If you want to move your cryptocurrency off the Wealthsimple platform, you’re going to have a hard time. Once you make a purchase on Wealthsimple Crypto, your coins are immediately moved to a third-party custodian for storage. You do not have the option to move your cryptocurrency to your own software or hardware wallet.

While your crypto is stored with Gemini, a third-party qualified custodian regulated by the New York State Department, and highly trusted by the greater financial industry, you are still exposed to risk. Wealthsimple discloses the risk of third-party custody right on their website, “you may be exposed to insolvency risk (credit risk), fraud risk or proficiency risk on the part of WDA.” Basically, if Wealthsimple Digital Assets (WDA) goes bankrupt or their employees commit fraud, for example, you are straight out of luck. Kiss that crypto goodbye.

Expensive compared to other platforms

Compared to trades of traditional assets on traditional brokerages, Wealthsimple Crypto fees might seem like virtually free trading, at first glance. But if you compare their operational fee to trading fees on other cryptocurrency trading platforms, Wealthsimple is one of the most expensive out there. It’s also inconsistent since your fee ranges between 1.5-2% in addition to the spread from normal market activity. The dollar value of the operations fee will always be different.

If you plan to buy and hold, then Wealthsimple Crypto fees are not really an issue. But if you plan to be more active in the crypto market, you’ll want to consider a less expensive platform like Bitbuy, NDAX, or VirgoCX. As you progress with your crypto education and become a more confident trader, I would recommend Binance for more advanced trading between cryptocurrencies.

Final thoughts

As a crypto enthusiast, I believe that cryptocurrency is the financial market disruption Canadians have been waiting for. Despite my enthusiasm, and that of the global crypto community at large, this digital asset remains unregulated, volatile and highly speculative. The risks associated with putting your hard-earned money into this asset class cannot be ignored. That’s exactly why I love Wealthsimple Crypto. If you’re brand new to crypto, their trading app is the perfect platform to wet your wistle. It’s easy to set up with an uncomplicated interface and your crypto is automatically stored for you. There are no fees to transfer Canadian dollars into your crypto trading account and the list of available cryptocurrencies continues to grow. If you’re ready to grab your piece of the crypto pie, Wealthsimple Crypto is the perfect place to start; for beginners.