Parachute Debt Consolidation: Sink or Swim Out of Bad Debt?

By Heidi Unrau | Published on 18 Aug 2023

You’re drowning, aren’t you? I can feel it, the financial anxiety is palpable. So I was taken aback when I first learned about a Parachute debt consolidation. It’s not just another lender, it’s a lifeline designed explicitly for people like you – teetering on the edge of financial trauma. Here’s what’s so refreshing about Parachute: they get it.

This new lender provides ethical debt consolidation loans combined with a tailored program to help you break free and breathe again. Developed by experts in credit and behavioural science, Parachute wants to empower, educate, and support you on your journey back to financial dryland. Parachute is not a consumer proposal or bankruptcy program; their purpose is debt consolidation only. Here’s why you should consider a Parachute debt consolidation loan.

What is Parachute?

Launched in 2022, Parachute is a Canadian alternative lending solution that genuinely understands your struggle with unmanageable debt – and the emotional torment that goes with it. Available to residents of BC, AB, MB, ON, PEI, NL, NS, SK and NB, Parachute is on a mission to save Canadians like you from the clutches of predatory lenders by offering financial relief, guidance, and a big dose of compassion.

How do they do this? By offering debt consolidation loans at lower rates than other private lenders. But it’s not your typical consolidation loan. It comes with an evidence-based strategy to change your financial behaviour for the better, and for good!

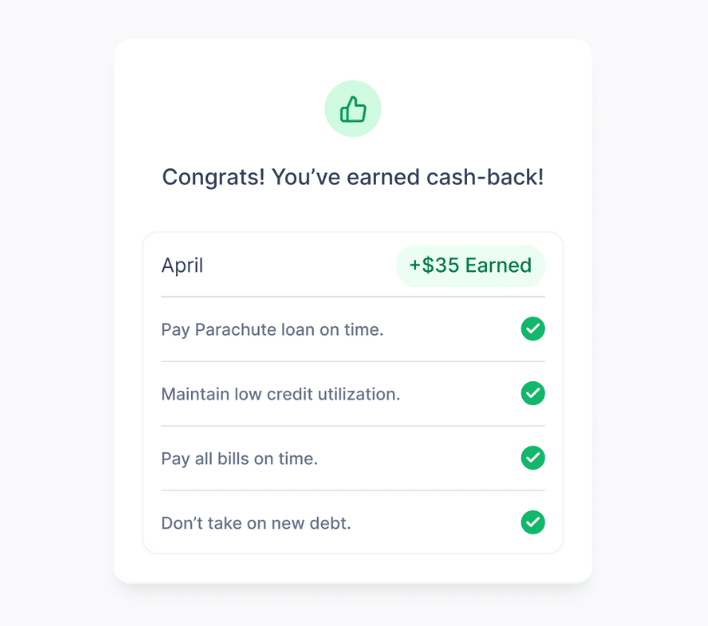

Better yet: Thanks to a first-of-it’s-kind rewards program, a Parachute debt consolidation is the only loan on the market that gives you cash back, which lowers your cost of borrowing even more! A loan that pays YOU? This is one of the reasons Parachute stopped me dead in my tracks.

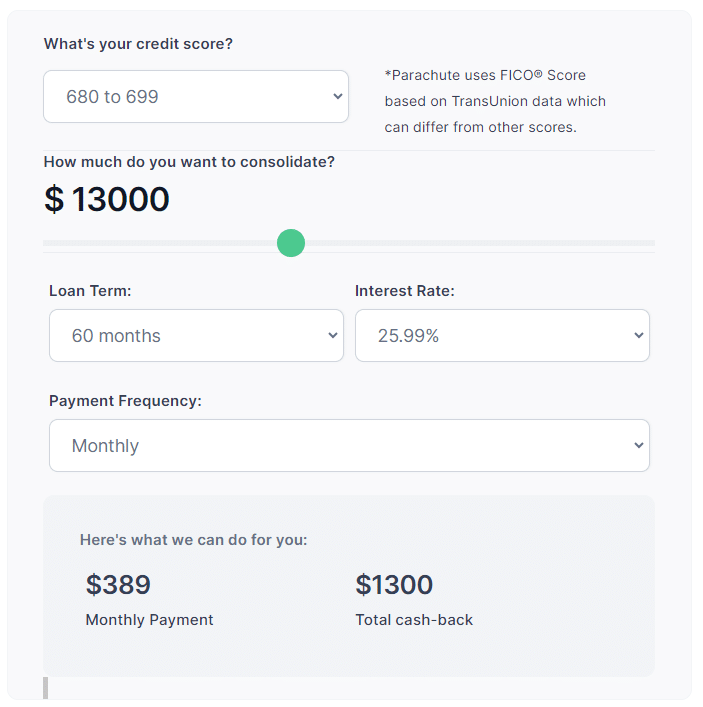

Take a look at the cash back you could earn on a $13,000 loan:

How does a Parachute debt consolidation work?

Picture all your high-interest debts. Those sticky credit card balances, predatory payday loans, and cringe personal loans get bundled into one tidy package. That’s what a Parachute debt consolidation loan is.

It takes the stress and confusion out of managing multiple debts and rolls them into one, easy-to-handle loan with a lower interest rate. It’s like decluttering your bad-debt Marie Kondo style, giving you just one payment to manage.

And in many cases, it gives you a whole lot more breathing room in your budget. No more treading water with ankle weights on!

What are the interest rates, terms, and loan amounts?

You can borrow anywhere from $5,000 to $25,000. Loan terms range from 2.5-5 years with no penalty or hidden fees to pay your loan off early. And Parachute’s interest rates range from 24.99% to 29.99%, which is significantly cheaper than the rates from Canada’s leading private lenders, which range from 32-47%!

Parachute’s rates are so high, how does that even help me?!

When you’re drowning in high-interest debt, it’s easy to focus solely on the numbers. And yes, at first glance, Parachute’s interest rates look no different than your average credit card (higher, even!). So how can they claim to be in your corner, let alone “ethical”?

Because there’s more to the story than just percentages. It’s not only about the rate but also about how the interest is calculated, which is exactly why they can save you up to $1,000 per month despite a double-digit rate. I know what you’re thinking right now…

“WTF (what the finance)?!”

Compounding vs. simple interest: the difference between sink or swim

Credit cards use something called compounding interest. It’s a fancy way of saying that not only do you pay interest on your principal (the amount you owe), but also on the interest that has already been added to your balance. That’s right, you’re paying interest on interest!

It’s like a snowball rolling down a hill, getting bigger and bigger as it goes. If you only make the minimum payments on your credit card, you’ll find that it takes a long time to pay off your balance, sometimes decades! And you’ll end up paying a lot more than you initially borrowed. With credit card debt, it’s not uncommon to pay interest totalling 200-300% more than what you originally borrowed!

On the other hand, a Parachute debt consolidation uses simple interest on the loan. This means you only pay interest on the principal amount owing. There’s no interest on interest here.

Plus, their loans are installment loans, meaning you have a fixed payment every month that goes towards both the principal and the interest. Over time, your principal decreases and so does the interest you pay. It’s a straightforward, transparent, and more productive way to borrow.

Parachute’s unique approach to lending

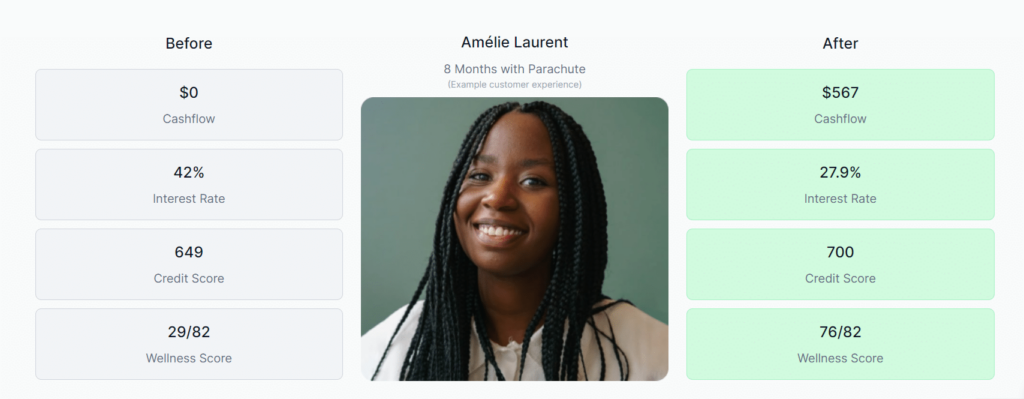

Your Parachute debt consolidation comes with a three-step dance to financial freedom. It’s what really caught my attention about this lender. They’re your partner on the journey to financial health, providing guidance, support, and rewards for sticking to your goals. Here’s how:

Step One

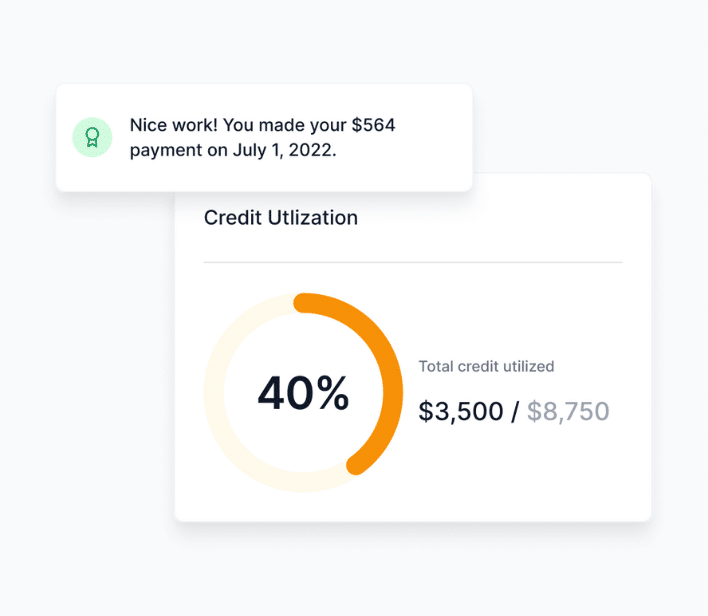

First, there’s the Reset. A Parachute debt consolidation helps you save anywhere from $200 to $1,000 a month by consolidating most, if not all, of your high-interest debt into one lower-interest loan. Then you make one payment per month that’s automatically debited from your bank account so you don’t have to worry about forgetting to pay. Or you can make smaller payments more often by choosing a semi-monthly or bi-weekly schedule.

Step Two

Next, they Motivate you with a personalized path to meaningful change. Instead of generic advice, they provide you with a targeted, actionable plan that actually works. Stick to it, and you’re well on your way.

Step Three

Saving the best for last, they Reinforce good behaviour with the mother of all incentives – cold hard cash. If you stay true to your goals, you’ll get up to 10% of the principal amount you borrowed back at the end of the term. It’s as simple as that. No, I couldn’t believe it either (insert mindblown emoji here!).

Who is eligible for a Parachute debt consolidation?

If you’re a Canadian citizen or permanent resident, the age of majority in the province where you live, have at least a 600 credit score, and regular income of at least $30,000 per year, you’re eligible!

That’s right, even if you don’t have a stellar credit score, Parachute believes financial freedom is a human right. They’re here to help you break free from the paycheque-to-paycheque cycle and work towards a happier, healthier future.

However, if you already have a bankruptcy or consumer proposal on your credit file or any legal judgements – you won’t be able to borrow from Parachute. And unfortunately, Parachute is not available in Quebec or the Northwest Territories. But sit tight, they’re working on expanding to serve all Canadians.

Will a Parachute debt consolidation affect my credit score?

Parachute does not run a hard credit check on your credit report. This is good news, because hard credit checks can cause a temporary dip in your credit score.

In the long run, a debt consolidation loan can help improve your credit score. By paying down your debt and sticking to your financial goals, you’ll build a positive credit history which has a direct impact on your score. So, think of it as a small step back for a giant leap forward – assuming you manage the loan appropriately and stick to the plan.

Speaking of credit scores, this is a big deal!

Parachute is now the first organization in Canada to give people access to FICO Score 10 through the FICO Score Open Access program. Why is that a big deal? Because FICO is the leading credit score model used by 90% of Canada’s top lenders to help make their credit decisions.

This means that Parachute is providing regular people like us with the same credit-scoring insights that were exclusively available to industry insiders. Essentially, it demystifies how lending decisions are made which gives us a new level of autonomy over our financial outcomes. When you know better, you do better.

And to bust out my fancy Economics jargon, this moves the needle closer to “information symmetry,” which is crucial for anyone who wants financial independence. But what does that mean?

Information symmetry refers to a situation where all parties involved in a transaction have equal access to relevant information. When it comes to personal finance, information symmetry is essential because without it you cannot make an informed decision about your money.

In Canada, credit score information is notoriously asymmetrical and that imbalance is skewed in favour of lenders. Knowledge is power, so the Parachute-FICO partnership is an important step toward giving power back to the people.

This new access to insider-only information enables you to take control of your financial future and reduce the risk of exploitation by predatory lenders. It empowers you to make choices that better align with your best interests. I’ll drink to that!

Is Parachute safe to use?

Borrowing from Parachute is as safe as borrowing from any other reputable lender. They use 256-bit encryption to protect your data, and they never store your banking usernames or passwords.

Plus, they have a steadfast policy against selling your information. If you have questions or need assistance, their professional team is ready to help, whether you prefer to chat online or give them a call.

Also, Parachute is subject to the specific provincial laws in which it offers and funds loans. On a federal level, Parachute’s lending operations are subject to specific statutes enforced by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), as well as other federal agencies.

How to apply for a Parachute debt consolidation

It only takes a few minutes to apply online, and the process is super simple. Before you get started, gather the following documents:

Proof of Income: Have at least two of your most recent pay stubs on hand. This helps Parachute assess your ability to repay the loan.

Statements of Debts to be Consolidated: Provide your most recent statements for the debts you want to consolidate. This gives Parachute a clear picture of your current debt situation.

Bank Account Information: Be ready to provide your bank account details. This is where your loan payments will be automatically withdrawn from.

Government-Issued ID: Have two pieces of government-issued identification. One must be a Driver’s License or Provincial ID with a photo. For the second piece, you can use a Passport, SIN card, PR card, or Birth Certificate.

Once you have these documents ready, visit Parachute’s website and follow the instructions to complete the online application form. After submitting your application, a Parachute representative will review your information and reach out to discuss the next steps.

What are the pros & cons to consider?

As impressed as I am with Parachute, there is nothing perfect under the sun. Here are some of the pros and cons to consider before getting a Parachute debt consolidation:

Pros:

Debt Relief: Parachute loans can be used to consolidate high-interest debts, which can reduce your overall interest burden and simplify your finances with a single, more manageable monthly payment.

Lower Interest Rates: Compared to many private and payday lenders, Parachute offers lower interest rates, which can lead to significant savings over time.

Supports Financial Well-being: Parachute is committed to helping its customers achieve financial wellness by offering a data-driven platform that guides user behaviour and a shared value rebate system to reward targeted outcomes.

Unique Cash Back Incentive: Borrowers who stick to their goals can receive 10% cash back, further incentivizing good financial behaviour.

Secure & Encrypted: Parachute uses 256-bit encryption to protect your information, and they don’t store your banking usernames or passwords or sell your data.

Customer Support: Parachute offers accessible customer support through chat or phone, ensuring you have the assistance you need when navigating the borrowing process.

Cons:

Higher Interest Rates Than Traditional Banks: While Parachute’s rates are lower than most predatory lenders, they are higher than those typically offered by traditional banks and credit unions.

Not For Everyone: Parachute loans are designed for individuals with fair credit history and a regular income, so they may not be available to everyone – especially if you have very bad credit or a gross annual income under $30,000.

Potential for Over-Borrowing: As with any loan, borrowing more than you can afford to repay can lead to financial strain. Depending on your financial situation, the monthly payment might be higher than the total debt payments you’re making now. It’s essential to borrow responsibly and within your means.

Limited Accessibility: Parachute does not currently operate in Saskatchewan, Quebec, or the Northwest Territories. That leaves many Canadians unable to access a Parachute consolidation loan.

Who is a Parachute debt consolidation best suited for?

Parachute is ideal for people who are drowning in high-interest debt. If you’re feeling trapped, losing sleep, or constantly worrying about your financial future, Parachute could be the solution you’ve been waiting for. It’s designed specifically to help people stay out of a consumer proposal or bankruptcy.

My personal opinion about a Parachute debt consolidation

I know what it’s like to struggle with the weight of the world on your shoulders, paralyzed by the fear of tomorrow. So I want you to know that you’re not alone. I’ve been in your shoes. Yes, really!

It’s ironic (and humbling) that with my 10 years of experience in retail banking, credit, and lending, I was thrown against a wall – just like you. Sometimes, you can do everything right and sh*t still goes wrong.

But there’s hope. There’s always hope because it literally cannot rain forever. And sometimes, that hope comes in the form of a solution we’ve never considered.

If high-interest debt is destroying your quality of life and your mental health, take a moment to find out if a Parachute debt consolidation is right for you.