The Ultimate Guide to RESP Grants in BC

By Steven Brennan | Published on 16 Aug 2023

In addition to federal education grants, British Columbia (BC) residents may also be eligible to apply for a provincial education grant. This is known as the BC Training and Education Savings Grant (BCTESG) and can provide crucial extra financial support to parents and families.

This article will detail everything you need to know about the Registered Education and Savings Plan (RESP) in BC, including how to apply for the BCTESG and more.

What is the RESP?

A Registered Education Savings Plan (RESP) is a savings and investment account available to eligible parents in Canada, designed to help save money for their children’s education. An adult can also open an RESP for themselves, if they are eligible.

The RESP allows families to access further financial benefits in the forms of grants and bonds, including the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). One of the biggest benefits of the RESP is that the money deposited is exempt from taxation until it is withdrawn, allowing you to maximize your savings.

RESPs are offered by the government of Canada through certain financial institutions and banks, with the aim of helping Canadian families manage the increasing costs of post-primary education in Canada.

What is the BCTESG?

The BC Training and Education Savings Grant (known as BCTESG) is a one off grant available to families in British Columbia, for the purposes of helping parents to save money for their children’s post-secondary education.

The BCTESG offers eligible families a financial boost to the tune of $1,200, for each child aged between 6 and 9 years old. This grant is deposited directly to a Registered Education Savings Plan (RESP) and will help parents manage education costs as their children grow.

For families with an RESP, applying for the BCTESG is an easy way to boost your savings and get a head start on building for the future. This grant is also tax-free, and it requires no matching contributions. It is also relatively easy to apply for and receive.

How to Apply for the BCTESG?

Application for the BCTESG is facilitated through any banks or financial institutions who are also RESP providers. If you’ve already opened an RESP, then you’ll apply for this education grant via the same financial institution.

Here are the eligibility requirements for applying for the BCTESG:

- The parent or guardian applying on behalf of a child must be a BC resident.

- The application must be made when the child is at least 6 years old, and before they turn 9 years old.

- The beneficiary must have an RESP account into which the grant can be deposited.

Parents or guardians can contact their chosen bank and fill out a simple application form. If you haven’t already opened an RESP, then you may want to consider your options and find an RESP provider that doesn’t require contributions to open one.

British Columbia currently lists 56 RESP partners for families to choose from.

Let’s take a look at exactly what is involved in the application form for BCTESG;

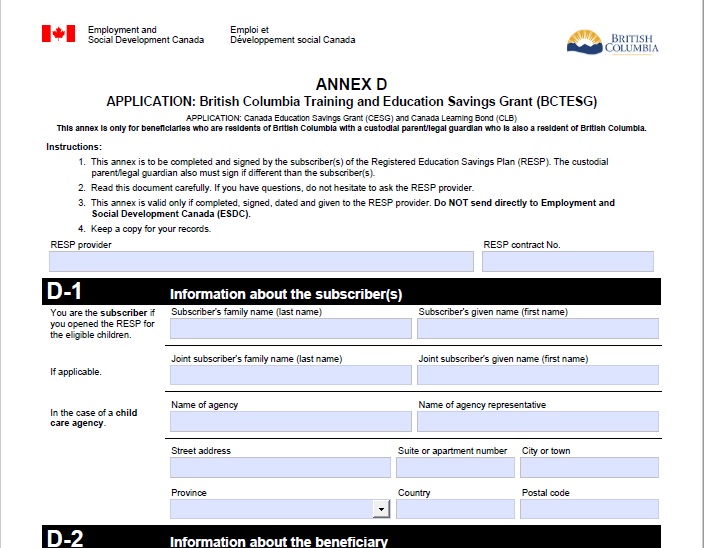

On the first page of the application form, you’ll find instructions, as well as a prompt to provide the name of your RESP provider and the relevant contract number.

The first section, D-1, requires you to share the personal information of the subscriber, i.e. the parent or guardian who is applying on behalf of a child.

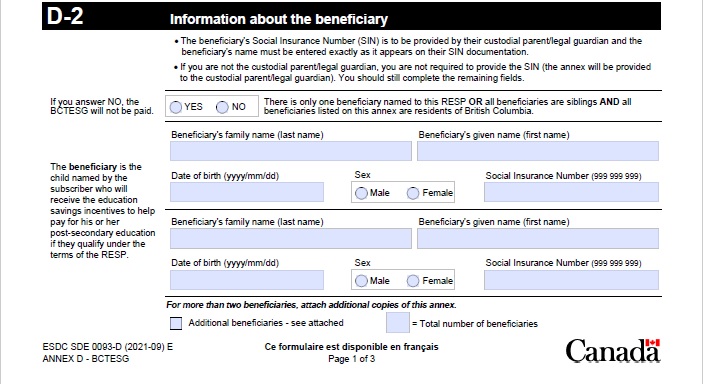

Section D-2 requires the same basic personal information, but for the beneficiary, i.e. the child who will benefit from the grant in future.

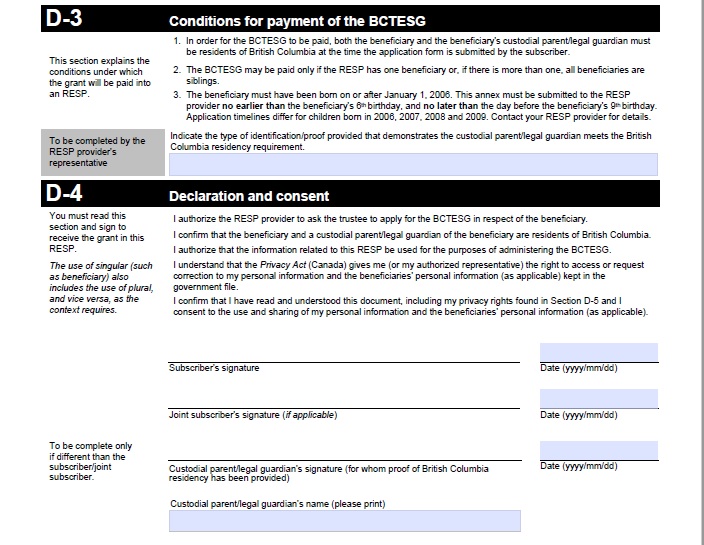

On page two, section D-3 provides information on the conditions that must be met in order to be eligible for BCTESG. There is a space here for your RESP provider to list the type of identification you will provide in order to prove your status as a resident of BC.

Still on page two, section D-4 simply requires a date and signature from the subscriber, and the joint subscriber if there is one.

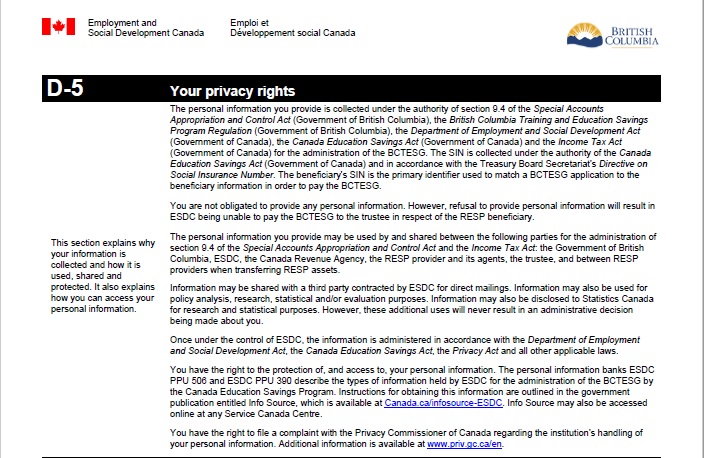

The final page of the BCTESG application form contains information relating to privacy rights and protections. Under section D-6 it also lists definitions of the key terms, provided for informational purposes.

Other RESP Grants Available in BC

Canada Education Savings Grant

This grant is based on the contributions that you make towards your RESP. The Canada Education Savings Grant is offered by the Canadian government, adding 20% to the first $2,500 of annual RESP contributions. In theory this could mean your RESP could grow an extra $500 per year.

There is a maximum limit to this grant, however, at $7,200 per beneficiary.

Additional CESG

For low and moderate income families, there is an addition to the CESG. Depending on your circumstances you could be eligible for an extra 10% or 20% on top of the standard 20% for a CESG. So you’re looking at a total of 30% or 40% on the first $500 you add to your RESP contribution each year.

To be eligible for Additional CESG during the tax year of 2023, your adjusted family income must be $106,717 or lower. The upper limit for CESG also applies here, so that your combined basic and additional CESG amounts cannot exceed $7,200 per child.

Canada Learning Bond

For modest income families there is also the Canada Learning Bond. In order to receive this additional grant the parent or guardian must also be eligible for the National Child Benefit (NCB).

The CLB offers a one-time contribution of $500 from the Government of Canada when an RESP is opened. A beneficiary can also qualify for an additional $100 every year until they turn 15 (up to a maximum of $2,000).

The Benefits of an RESP

Free Government Money

With an RESP you can set yourself up to receive money from the government, no-strings attached, that can directly benefit you and your family. Subscribers can contribute up to $50,000 over the lifetime of an RESP, and the CESG will see the government will match your contributions up to $500 per year to a maximum of $7,200.

When you also factor in the CLB and any provincial grants available to those who open an RESP, the value you stand to gain becomes even greater. For example, the CLB will contribute up to $2000 per child, which you can add to your RESP and help accrue more interest on.

There are no personal contributions required, so you are for all intents and purposes getting free money.

Tax-Sheltered Growth

The investment income that an RESP generates grows tax-free, which is a huge benefit for any investment account. You will only encounter tax on your RESP when your child eventually withdraws funds to pay for their education. These funds will be added to their income tax for that year, and typically they will see little to no taxation even then.

Investment Options & Versatility

When it comes to managing and maintaining an RESP, you’ve got lots of freedom. You can go with your traditional bank to keep things streamlined, but you might also choose a self-directed investment account, credit union or other financial institution.

It’s also worth noting that an RESP can stay open for up to 36 years, so even if your child chooses to delay tertiary education until later on in life, they will still be able to benefit from the investment made.

Minimize Student Loan Debt

Because RESP investments can grow over time, your contributions might give your child a much better chance at minimizing student loan debt. When the time comes for your child to withdraw money from their RESP, you can use Educational Assistance Payments (EAP) to help them reduce or even remove the need for large student loans.

Best Investment Accounts to Invest in Your Child’s RESP in BC

While it is possible to choose a self-directed RESP, such as those available at major banks, in most cases professionally guided investment accounts will tend to perform better.

It’s also important to note that not all Canadian brokerages are compatible with the BCTESG, so be sure to check with your financial institution before you apply for this grant.

That said, let’s take a look at two investment accounts that do facilitate the BCTESG:

Wealthsimple

Wealthsimple provides Canadians with the opportunity to open an RESP investment account with Canada’s largest robo-advisor. With a high quality app that allows you to access free financial advice, it’s easy to see why Wealthsimple has such a strong reputation among investors.

Fees at Wealthsimple are tiered depending on your portfolio, with 0.50% for portfolios below $100,000. This makes them a competitive option for an RESP.

CI Direct Investing

Opening an RESP with CI Direct Investing opens you to the benefits of top-quality robo-advisors. Opening an account here is straightforward, and you can rest assured that your RESP is in the hands of expert financial advisors.

CI’s annual management fee is up to 0.60% depending on the size of your portfolio.