Wealthfront Alternatives for Canadians

By Arthur Dubois | Published on 28 Mar 2023

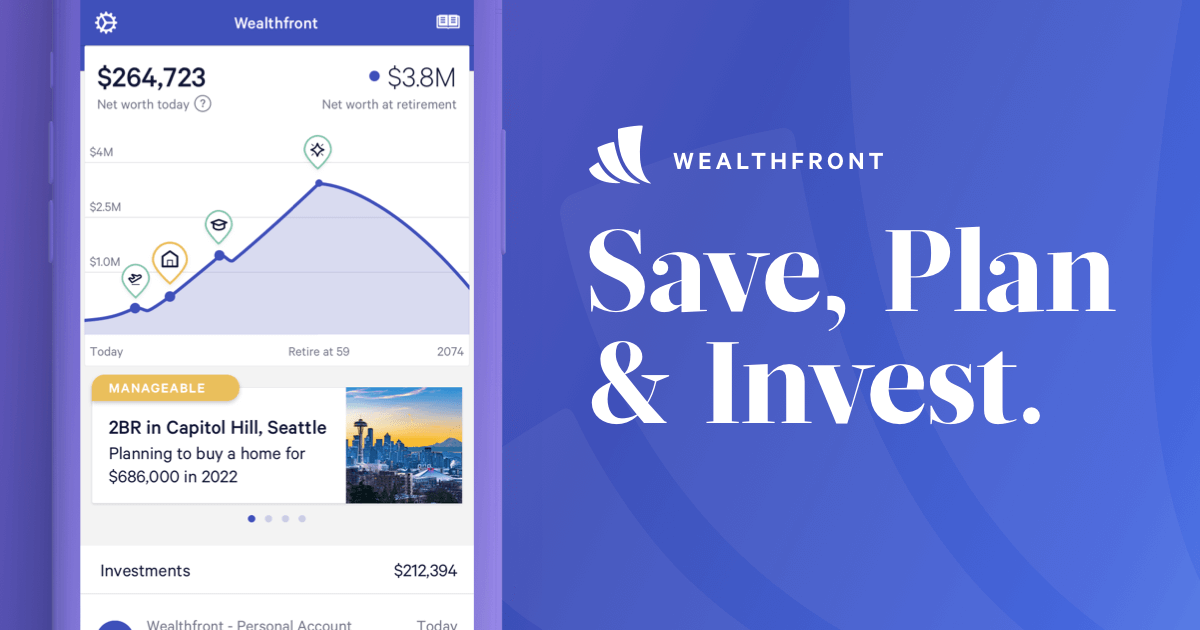

The rise of machine-enhanced financial advisors – or “Robo-Advisors” – lead to the spawn of many different investment products. Wealthfront is one of the most popular, offering automated investing plans alongside financial advice. The platform calls itself “financial planning, redefined,” but is it right for everyone? Here’s our take on Wealthfront, who it works best for, and the best Wealthfront alternatives for Canadians.

Is Wealthfront available in Canada?

No, currently Wealthfront is NOT available to Canadians. However, Canadians have very similar platforms they can use as an alternative such as Wealthsimple Invest, CI Direct Investing, and Questwealth Portfolios from Questrade – which all made it on our list of Top 10 Best Robo-Adviors in Canada.

What is Wealthfront?

Wealthfront is a completely online investment platform powered by a robo-advisor. With a minimum investment of $500, you can get started using both their investment service, as well as a suite of planning tools. Their guidance programs include homeownership, early retirement, travel goals, college savings, and more.

The self-guided financial planning work comes from the company’s 2019 acquisition of Grove, a financial planning startup which helped users set goals and develop strategies to achieve them. Each path is supported by the platform’s three core options: Invest, Save and Borrow.

Working together, the three tools allow users to see how much money they have on hand, a projection of where their investments are going, and how much they can afford to borrow.

Although Wealthfront can’t, and doesn’t, take the place of a traditional bank, their roadmap foresees a future where consumers could use the app as a regular banking space, instead of a tool to manage money and plan for future growth. Potential additions the company wants to add include bill payments, emergency fund savings and investment portfolio contributions.

How does Wealthfront Investing work?

Once a user opens their account and makes the $500 minimum investment into their account, they are asked a series of questions about how they want to invest. This includes their attitudes towards market risk and when they want to access their money.

From there, a portfolio of exchange-traded funds (ETFs) is presented to align with the risks and target access date. Each investment plan comes from a mix of 11 asset classes including U.S. stocks, foreign stocks, emerging markets, and Treasury inflation-protected securities. In most portfolios, the robo-advisor will only select between six to eight options.

Customization

Although the portfolio is tailored to the individual, users cannot customize it to choose the funds or stocks they want. However, when the user gets to over $100,000 in investments, they can convert to a stock-based portfolio, and restrict the robo-advisor from choosing certain stocks.

Fees

One of the biggest appeals to Wealthfront is its low account management fees. Regardless of portfolio size, the platform only charges a 0.25% account management fee, which is significantly lower than both human advisors and other robo-advisor platforms.

Registered accounts

Another unique option is in the range of accounts users can open within Wealthfront. The account types include the traditional IRA, Roth IRAs, Self-employed IRAs and 401(k) rollovers. Users can even open a 529 education savings account, although it comes with a higher fee structure than the other investment accounts.

How does Wealthfront Banking work?

Wealthfront also offers a high-yield cash savings account called Wealthfront Cash. It’s FDIC insured up to $1 million, offers unlimited free transfers, has no fees, and only requires a minimum deposit of $1 to open an account. The best use case for Wealthfront Cash is for short-term savings accounts and for emergency funds.

Although Wealthfront offers many different investment vehicles and options, it shouldn’t be considered an alternative to traditional banking products quite yet. Many of their road-mapped features have not been implemented into the platform, and cash not invested is treated as de-facto savings.

Those who are planning to use Wealthfront should go into it as an advising platform with the goal of saving money and growing wealth. Until bill payment and emergency savings are added, this should be considered primarily for investments, and secondary for finding and closing loans.

Where Wealthfront excels

As a whole, Wealthfront is arguably one of the best robo-advisors available in the marketplace. With a low advisor fee, smart portfolios based on a complete market view, and easy accessibility, Wealthfront is a great platform for new investors to set goals and understand how their exposure to risk can drive future returns.

Additionally, this platform excels for all types of investors – not just beginners or those who want a “set and forget” style of investing. With the option of converting to a stock portfolio with $100,000 in assets, even high-wealth investors can benefit from this unique approach to robo-investing.

For both types of investors, this platform is equally impressive for its ability to discover tax savings. The robo-advisor works daily to complete tax-loss harvests, which identifies opportunities to sell investments at a loss.

This lets investors offset their gains from profitable investments, while still growing their wealth. Tax information can import directly into TurboTax each year, making it easy for investors to incorporate that information into their tax returns.

Where Wealthfront lacks

Although there’s a lot of upside to Wealthfront, there’s also some downside as well. First, none of the portfolio options allow for partial user direction, meaning individuals can’t pick their own stocks or ETFs. While there is an option to tell the robo-advisor which stocks not to invest in, it doesn’t grant complete control. This can frustrate some users as they try to create a portfolio with their personal gains in mind.

Additionally, while the technology in and of itself works great, it does not provide any human interaction or help. While many different robo-advisor platforms require users to meet with a real financial advisor at least once, Wealthfront is completely automated. This can frustrate users who run into snags or want to get a little more help and insight into their investment strategies. However, it’s a tradeoff since this is what allows them to offer such a great platform for low/zero fees.

Who gets the most from Wealthfront?

At the end of the day, new investors who are looking for the right opportunity to start growing their wealth would benefit most from Wealthfront. With an easy-to-understand platform that takes minutes to start, Wealthfront offers young investors the opportunity to start saving early, invest in portfolios that reflect their goals and strategies, and allows them to learn how to invest by watching the robot. Combined with a low management fee, Wealthfront is the right place to start your investing journey and let wealth grow to actualize real results.

Wealthfront Alternatives for Canadians

Wealthfront is a US-based company and is not available to Canadians. The best alternatives to Wealthfront for Canadians include Wealthsimple Invest, CI Direct Investing, and Questwealth Portfolios through Questrade. All three platforms are among the Top 10 Best Robo Advisors in Canada.

Wealthsimple Invest is one of the best Wealthfront alternatives for Canadians. By transferring your investment of $5,000 or more to Wealthsimple, you can receive reimbursement of the transfer fee by filling out a simple online application.

Wealthsimple Invest provides a free portfolio analysis, including detailed information on portfolio allocation, account fees, and tax efficiency for both Wealthsimple and non-Wealthsimple accounts. Tax-loss recovery is another excellent wealth management feature provided by Wealthsimple. This strategy helps you offset your investment losses and reduces your taxes on investment gains.

The portfolio is built by selecting assets based on your risk tolerance, which makes your diversification level independent of your investment amount. Even a $100 investment can enjoy the same risk trading strategies as a $100,000 investment. Wealthsimple also offers innovative investment portfolios for socially responsible investors who want to keep a positive human rights record or who comply with Islamic law.

Lastly, Wealthsimple offers a range of features that use technology to make investments easier. For example, Overflow lets users transfer excess funds from their chequing accounts, and Roundup automatically rounds up debit and credit card purchases to boost investments.

CI Direct Investing

CI Direct Investing is another top Wealthfront alternative for Canadians that provides clients with comprehensive financial planning services, allowing investors to access private investments that will enhance their diversification strategies. This platform also provides clients with investment access that is typically afforded to high-end investors.

You can even receive a transfer fee reimbursement of up to $150 when switching from another financial institution with a minimum investment portfolio of $25,000. Enjoy a risk-free trial with no transfer fees.

Tax loss harvesting during market events is a great feature of CI Direct Investing because it provides tax benefits by offsetting gains with losses. Investing in socially responsible investments (SRI) is also available on this platform, including investment options such as Cleantech, which focuses on clean energy innovations.

CI Direct Investing offers automatic rebalancing of assets, which ensures that your portfolio’s asset allocation remains balanced even when the market experiences significant changes. Rebalancing occurs automatically after every dividend payment and every quarter.

Questwealth Portfolios

For Canadians seeking a reliable investment platform that is an alternative to Wealthfront, Questwealth Portfolios via Questrade is an excellent choice. If you transfer your assets to Questwealth, they may even reimburse up to $150 per account in transfer fees from your institution.

With management fees ranging from 0.2% to 0.25% based on your investment amount, and Questwealth Portfolio ETFs with MERs ranging from 0.11% to 0.23%, your potential total portfolio fee may only be 0.31%.

In addition, Questwealth Portfolios has features that allow you to harvest tax loss to reduce investment gains taxes when you invest in a taxable account or outside of RRSPs and TFSAs. Actively managed portfolios, monitored by experts and adjusted as necessary, come at no extra cost, and automatic portfolio rebalancing and dividend reinvestment are also included.

Questwealth Portfolios prides itself in offering excellent customer service and provides support through phone, email, chat, and an automatic assistance feature. Experience the benefits of Questwealth Portfolios today for your investment needs.