Hardbacon Funding Round Now Live on the FrontFundr Portal

By Julien Brault | Published on 16 Apr 2021

As of noon, December 8, 2020, you can now invest in Hardbacon’s round of financing through the FrontFundr web portal. At one time reserved only for accredited investors, this type of financing round has become more democratic thanks to equity crowdfunding, which allows companies like Hardbacon to obtain financing from the general public without going through an IPO.

In an environment in which venture capital funding is scarce during this pandemic, Hardbacon’s decision to opt for this type of funding from the beginning seems more far-sighted than ever. In fact, we are fortunate to be able to count on several hundred shareholders spread across Canada, who do not have the same constraints as venture capital funds. In fact, the latter must preserve their capital to better support their portfolio of current start-ups.

For those investors who will participate in our round on FrontFundr, the advantage of participating in such a round is that they will be able to gain exposure to an asset that is not connected to the stock market. It is risky to invest in a start-up, but the potential is enormous.

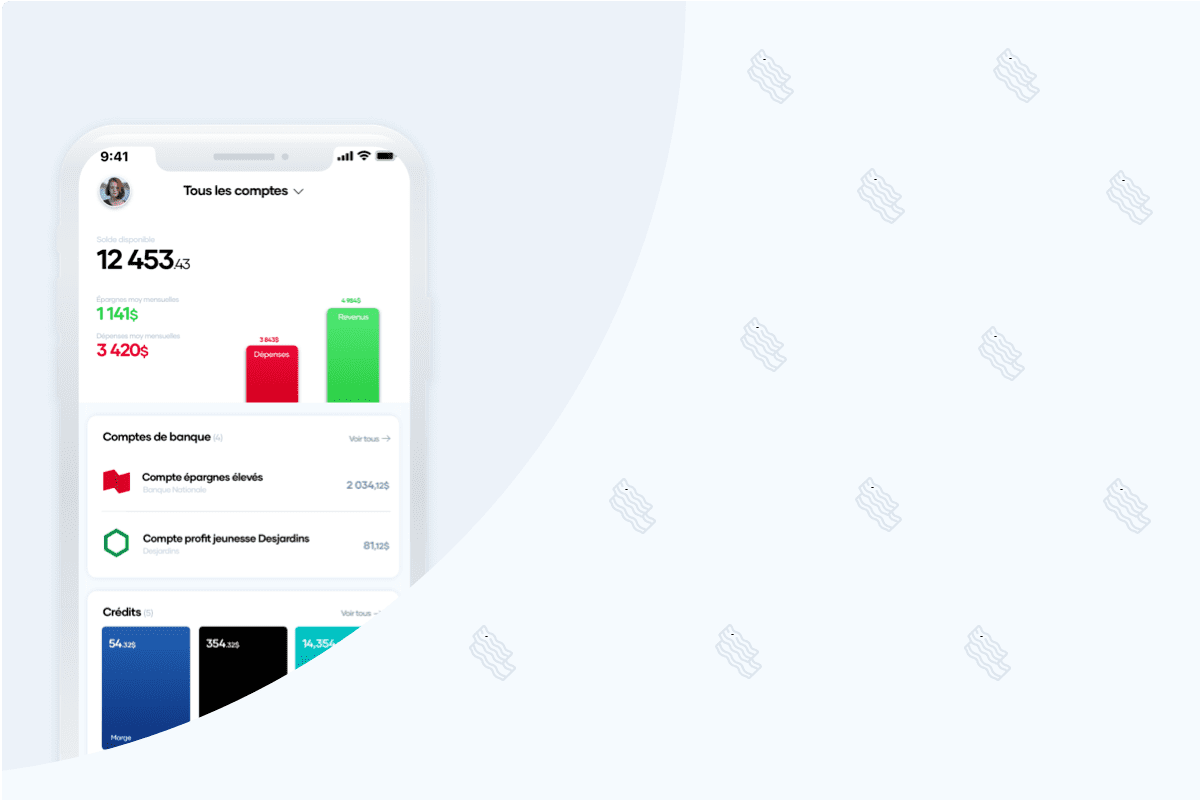

In fact, economic crises tend to foster innovation in the financial services sector. In March 2020, we saw our number of downloads skyrocket. We then accelerated our transformation from an app for retail investors to an app that helps all Canadians regain control of their finances. We made this transition by making the app free and launching planning and budgeting features, as well as financial product comparison tools.

The comparison of financial products enables us to make free users profitable. In fact, this segment helps us generate income every time one of our users opens a bank account, a brokerage account or applies for a new credit card.

This strategic pivot has served us well, as we now have over 20,000 registered users and our website generates over 30,000 pageviews per month. It’s no coincidence that the price comparison site NerdWallet (now valued at $520 million) and robo-advisor Personal Capital (recently acquired at a price of $1 billion) were both launched in the United States in 2009, at the height of the last financial crisis. Mint, a budgeting app launched in 2007, experienced its strongest growth during the crisis, and was acquired in 2009 for $150 million.

This round is all the more special to me, as it has symbolic value. After being told “no” on national television by the dragons of Dragons’ Den, Canadians will have the opportunity to say “yes” or “no” to us, and they will vote with their money. If you want to join Hardbacon, or simply familiarize yourself with crowdfunding, I invite you to visit our page on FrontFundr.