Understanding the new iteration of Hardbacon

By Mathieu Tousignant | Published on 16 Apr 2021

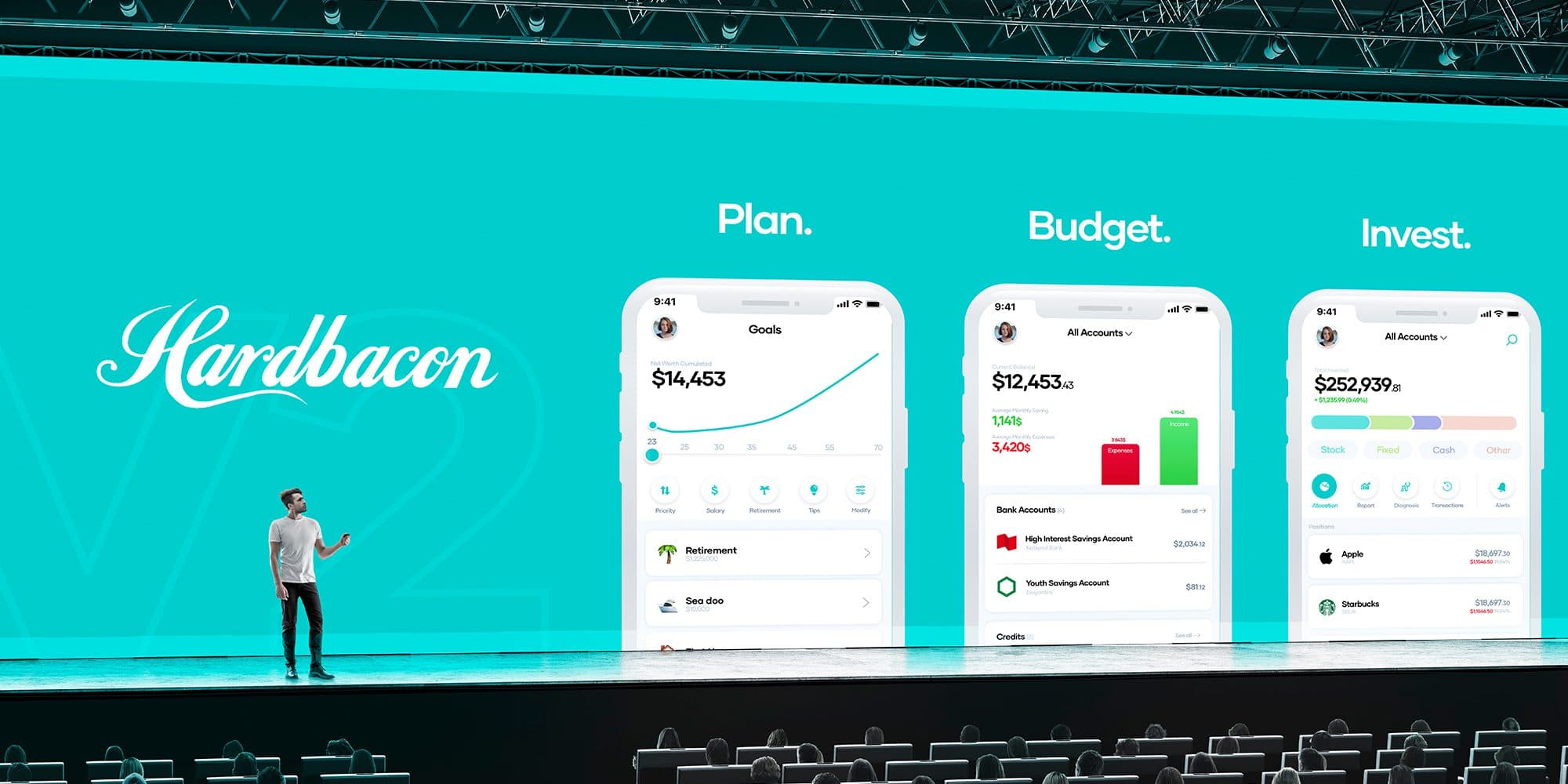

The new version of the Hardbacon app is now available in the App Store and Google Play! Up until now, Hardbacon has managed to create a special place in the hearts of independent investors and those who closely monitor their investments on the stock market in general. Today, with the addition of goal-planning and the banking module, the application becomes an indispensable tool for every Canadian.

An app to help people become wealthier

When I joined Hardbacon in August 2019 as Product Manager, I was given a clear mandate: to add functionality to the app to help people become wealthier.

The first version of Hardbacon appealed to investors, giving them a global portrait of all their investment accounts, and providing them with a diagnosis of their portfolio in real-time. And that’s not to mention access to stock alerts, financial data and practice accounts.

However, Hardbacon wanted to venture further and become a useful tool for more Canadians. After interviewing hundreds of users, I decided to add two modules to the application: Banking and Objectives/Goals. With these additions, Hardbacon truly becomes a financial coach, supporting and helping people to better plan, budget and invest.

Hardbacon helps you plan

Putting an effort into tightening your belt is good, but it is important to keep in mind why you are doing it, whether for a new house, a boat, a nice retirement, etc. With the new module for planning by financial objectives, you will see if you are on the right track to reach your life’s goals. It’s easier to adjust your financial habits and optimize your investments when you do it to achieve goals that matter to you. What’s more, it’s easier to stick to a plan when you can see its progress in real time. Here are the features included in the “Objectives” module:

See your net worth’s evolution over time

Get a quick overview of what your net worth will look like in 1 year, 5 years and even 40 years, depending on your income, your returns, your debts and your future goals.

Add goals/objectives

We have included several types of objectives to guide you in your financial decision-making. We started with buying a car, buying a house and retiring. By answering the questions related to each objective, we will help you make choices. For example, we will help you determine the optimal amount of a downpayment on a house, or if it is more advantageous to buy or lease your next vehicle. If your goals are not compatible with your financial situation, we let you know, but you are free to do what you want…after all, it’s your money.

Know if you’re on track to reach your goals

Each financial goal you add to the app will have an impact on your retirement and other goals. Thanks to our planning module, you will be able to visualize this impact and see if you are on the right track to achieve your objectives or not.

Hardbacon helps you budget

If you ask your loved ones where their money goes, other than for accommodation and food, few of them will have much to say. However, the first step to take control of your finances is to know where your money is going, because no matter what your income level, you will not get rich or reach your goals if your expenses are equal to your income.

Hardbacon now enables you to track your daily spending, but above all, it helps you reduce it by making a budget and cutting unnecessary spending. Here are the features included in the “Banking” module.

Income and expenses

Before you can begin to get rich, especially through investing, the first step is to have more income than expenses. By connecting your bank accounts to Hardbacon, we can tell you exactly how much money has flowed in and out over the past 30 days.

Categorization

Are you curious about where you spend the most? See how much you are spending by category and what proportions they represent within your expenses. You can also change the category of one or more of your transactions manually, to ensure that you have an accurate picture of your financial situation.

Budget

Once you know how much you spend in each category, you can assign a monthly budget to each one. For example, you might decide that you don’t want to spend more than $100 a month on entertainment. If you exceed this budget, you will receive an alert to inform you.

Predictive alerts

Since Hardbacon is connected to your accounts, our algorithms analyze your spending and follow your consumption behaviour, in order to warn you in advance if there’s a strong likelihood that you will not respect your budget. At Hardbacon, our goal is not to make you feel guilty about your finances, but to help you reach your goals.

Recurring payments

Subscription billing has become commonplace. Unfortunately, these are fixed expenses that we pay every month, sometimes without realizing it. Hardbacon automatically generates a list of your recurring payments so that you are aware of them, in order to help you cut your expenses.

Your frequent expenses

While doing user research, we noticed that one of the most harmful behaviours for our users’ personal finances was related to frivolous spending. Did you know that a $2 coffee every morning represents $520 per year and that ordering out every night represents more than $2,500 per year? To help you optimize your budget, we have developed a feature that enables you to take note of all these small purchases that sometimes make a big difference in your budget.

Hardbacon helps you invest

The “Investment” module has been available for a long time, but we took the opportunity to blend it into a brand-new interface and improve its performance. Since we were adding two new modules to the application, we had to redo the navigation. Those who have already downloaded the application will find that the old menu is now located in the “Investment” screen submenu. We have thus brought together all the functionalities necessary to better manage and understand your investments on the same screen.

Asset allocation

Quickly access your portfolio’s asset allocation. You can view your investments according to the asset class to which they belong. This functionality is particularly essential to rebalance your stock portfolio!

Reports

Generate performance reports based on the time period and accounts of your choice. The reports generated by the Hardbacon app are real gold mines. They provide an overview of your portfolio’s market performance. Quickly access key figures and view the value of your investments on a graph. Also, Hardbacon reports help you get your portfolio score. This score, which is based on the portfolio’s risk-adjusted return, helps you assess your portfolio’s quality. You can also compare your portfolio to those of other investors thanks to the Hardbacon portfolio score.

Diagnostic

To be able to manage your investments, you must know all the facets of your stock market portfolio, its strengths and weaknesses. Discover your portfolio’s weaknesses at a glance. Our analysis criteria include fees, diversification, asset allocation and portfolio beta. In short, everything is there so that your portfolio hides no more secrets and so you can improve it.

Transactions

View all the transactions made in your investment accounts, whether they are deposits, dividend payments, or purchases or sales of financial securities. Never miss the activity on any of your investment accounts.

Explore

Lastly, we could not talk about the “Investment” module without talking about the “Explore” section, which our users can access by pressing the magnifying glass located at the top of the “Investment” module. It is in “Explore” where you can search by a stock name or symbol to find any fund or stock traded in North America. For each security, we present a multitude of financial data and ratios, such as analysts’ consensus or earnings per share, for example. This section also provides lists of stocks, ETFs, and portfolio templates for inspiration.

You can now navigate from one module to another from the application menu. What do you think? Is this now the best application for managing your finances? Email me at mathieu@hardbacon.com and we can discuss your ideas! Until then…enjoy this new version!