KOHO vs Neo Financial: Who Wins the Battle for Your Buck?

By Heidi Unrau | Fact-checked by Maude Gauthier | Published on 16 Apr 2024

Both KOHO and Neo are Canadian fintech startups that offer out-of-the-box digital banking services. These two platforms are becoming increasingly popular among millennials and younger Canadians because they provide an alternative to traditional banking with low or no fees, a personalized user experience, and access to financial tools that help people better manage their money. We think Neo financial has more to offer than KOHO. But you might think otherwise, depending on your needs. In this article, we compare KOHO vs

What is KOHO?

[Offer productType=“CreditCard” api_id=“637cf8206bbb7962c19ae225″]KOHO is a non-bank that offers an alternative to traditional banking. KOHO works in partnership with Peoples Trust, a bank that operates under federal regulations, to securely store the funds add to your KOHO account, which are also eligible for CDIC protection. KOHO provides a mobile app and Prepaid Mastercard that allow you to quickly and easily manage your money on the go while earning bank-beating interest and cash back on purchases.

What is Neo Financial?

Neo Financial is a fintech company that offers a robust alternative to traditional banking.

KOHO’s prepaid card vs Neo’s cards

KOHO provides a prepaid Mastercard while

Both KOHO and

Fortunately, there is a workaround. KOHO Essential, the basic plan, is offered at $0 for new users who deposit $1,000 per month into their account or who choose to set up the direct deposit of their paychecks.

The KOHO prepaid Mastercard offers 1% cash back on groceries, eating & drinking, and transportation plus up to 50% extra cashback from select merchants. The Neo Money card offers 1% cashback on gas and groceries as well as an average of 5% cash back when you shop with one of

Both Neo and KOHO offer tiered plans. KOHO’s Extra ($9 per month) and Everything ($19 per month) plans will give you more cash back, just like Neo’s Premium plan at $4.99 per month.

Earning interest with KOHO vs Neo Financial

With the KOHO Essential plan, every dollar in your account earns 5% interest. Neo Financial offers 2.25% interest on your deposits in a Neo Money account. Moreover, Neo offers a high interest rate account, which offers 4%. Interest is calculated daily and deposited to your account monthly.

Savings features

Both KOHO and

The KOHO app offers a suite of tools to help you budget, save, build credit, and more. Savings features include:

- The Vault: the Vault serves as a savings account separate from the regular account linked to your prepaid card. You stash money away in the Vault that you don’t want to spend, where it continues to earn interest.

- Goals: the Goals feature allows you to set savings goals but amount, date, or both. You can track your progress and adjust your timeline and contributions amount as needed. Unfortunately, you cannot set up automatic transfers to move money into the Vault for you. You’ll need to proactively do this yourself.

- RoundUPs: the RoundUps feature lets you save money every time you spend. You can choose to round up purchases to the nearest $1, $2, $5, or $10. KOHO will automatically deposit the extra change into the Vault for you.

Neo Financial does not offer comparable features to level up your savings rate. There’s no comparable RoundUp feature that lets you turn purchases into accelerated savings, for instance. However, you can open up to 10 Neo savings accounts to save money for different projects.

Budgeting features

Both KOHO and

To help you stay on budget, both the KOHO and

KOHO takes budgeting a step further by allowing you to create and customize your budget by inputting your net monthly income, fixed expenses, variable expenses, and target spending amounts for different categories. The app will track your activity and give visual cues, like a coloured-coded progress wheel, to help keep you accountable to achieve your goals.

Neo Financial does not offer this kind of budgeting tool. Rather, you can use the

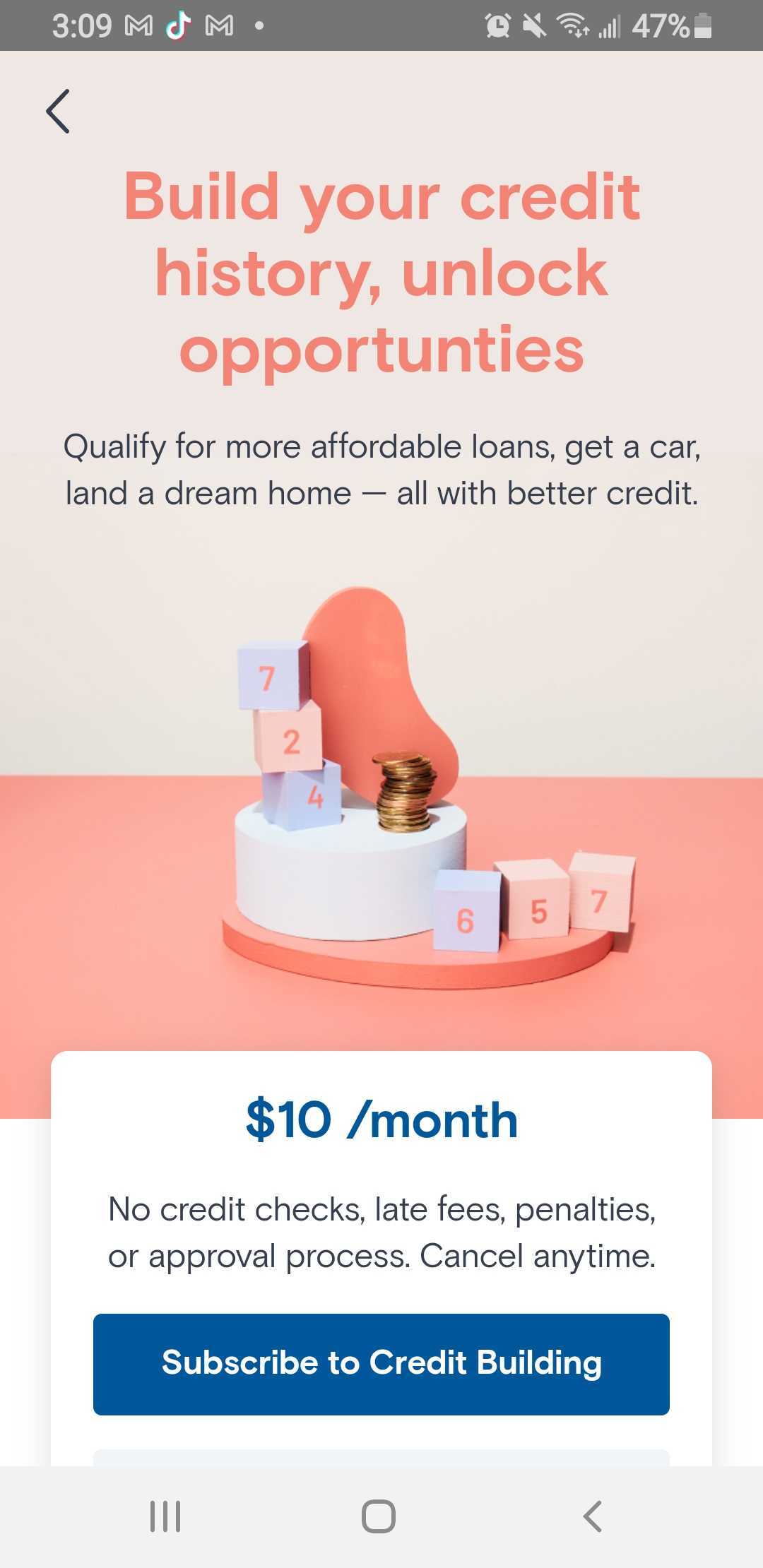

Credit building features

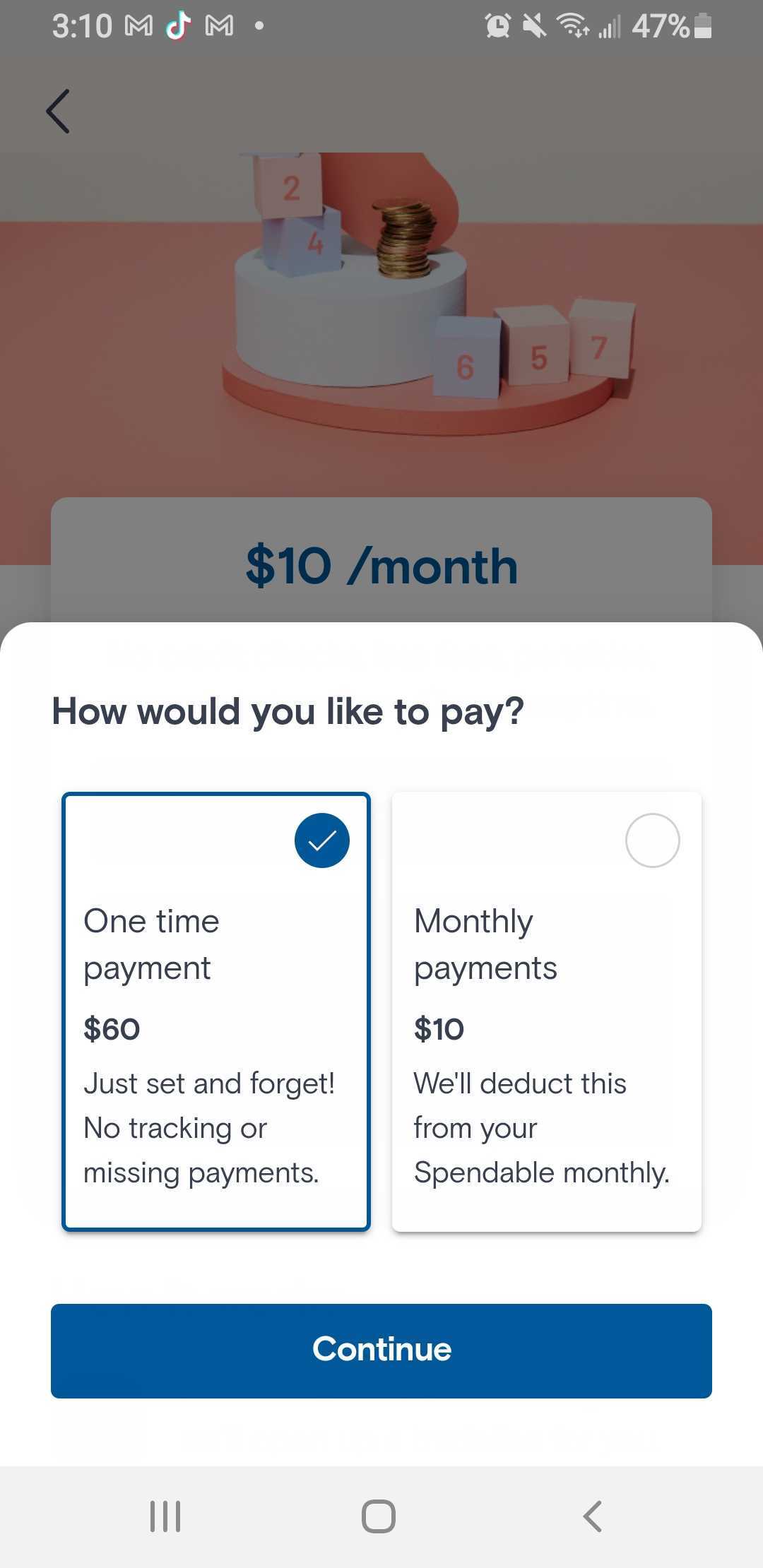

KOHO offers a unique subscription plan called Credit Building that allows you to (re)build your credit score without a credit card or borrowing money. For $10 a month, KOHO Essential will open a tradeline on your credit file and report your monthly subscription payments to the credit bureaus. You can cut down this fee by 50 % if you subscribe to the Everything plan.

The plan runs for 6 months and you can choose to re-subscribe to continue building your credit. You also have the choice between a recurring monthly payment out of your KOHO account or pay the full 6 months upfront.

Neo Financial does not offer a comparable credit-building feature. However,

The Neo Cash Back Rewards Mastercard requires you to apply and submit to a credit check. You can use the card to improve your credit score by paying the balance off in full every month before the due date. If you have bad or no credit, the Neo Secured Mastercard offers guaranteed approval with no credit check, and a low minimum security deposit of just $50. The card limit is the same amount as your security deposit. You can increase your limit at any time by depositing additional security funds.

Both

- No annual fee

- 5% cash back on average at

Neo partners - Up to 15% cash back for each first purchase at a

Neo partner - Subscription bundles to customize your rewards & perks

- Real-time spending insights from the mobile app

Additional perks

KOHO offers additional perks such as overdraft protection and expert financial advice personalized just for you. These unique benefits set KOHO apart from

What’s the verdict?

Both KOHO and