How to Make a Budget With Hardbacon

By Heidi Unrau | Published on 07 Jun 2022

You wouldn’t drive from Vancouver to Halifax without a map, would you? Money is like a car that takes you from where you are to where you want to be, and a budget is a map with the best way to get there. But how do you make a budget, and how do you know you’re making the most of your hard-earned bacon? The Hardbacon budgeting app can get you to a better financial place quicker than you could on your own. It’s not just a map for your money, it’s GPS navigation built into your car’s dashboard. I took the newly released Hardbacon web-based budgeting app for a test drive on my desktop, and now I’m a convert. Here’s how to make a budget with Hardbacon.

Why I love my Hardbacon budget

The web version of the Hardbacon budgeting app is a game-changer for a very important reason. Like a lot of people, I already struggle with budgeting to begin with. My experience with the competition left a lot to be desired, in fact, it triggered an actual anxiety attack. Why?

I’m neuro-divergent. I have a condition that makes certain things incredibly difficult for me that are second nature for most people. Anything that requires a lot of steps and attention to detail feels like a karate-chop to my brain. It can even trigger my fight-or-flight reflex – aka anxiety! It sucks, but I’m a rockstar at a lot of other things.

Three years before I ever heard of the Harbacon app, I tried a well-known competitor app. A few minutes in, brain chaos ensued, words were thrown, and so was my phone. The web-based version of their app wasn’t any better. It completely turned me off budgeting software and I lost three years of financial progress. I was stuck with my inefficient, time-consuming spreadsheets that can’t point out bad habits or money-saving opportunities.

Enter the Hardbacon budgeting app and the web-based feature. Everything I need to budget my bacon is easily accessible on my computer and organized the way I like it on my desktop. The Hardbacon Budget web interface is clean, crisp, and easy to navigate. The layout is organized in a way that makes sense to me. And best of all, I get to choose how to create my budget based on my unique needs. I’m not forced into a specific budgeting method that, by its very design, is an affront to the executive function part of my brain. The graphics and visual aids give me the information I need without having to comb through a lot of text or numbers, which is something else I struggle with that many others don’t. And now that I am getting older, I can zoom in and out on the screen to see better, not hunched and squinting over my phone.

If a budgeting app ever left you feeling like WTF (what the fintech), give the web version (or the mobile version, if you prefer) of the Hardbacon budgeting app a whirl. In my experience, the functionality is more accessible to diverse people with unique needs. Whether your brain broke the mold, you’re visually impaired, or less smartphone savvy than the youngbloods, you can still make the most of your bacon. It’s also great for parents if little ones keep snatching the phone out of your hand the second they see it! If you know, you know. Now let’s get started!

How to make a budget with Hardbacon: getting ready

At its foundation, a budget keeps track of how much money comes in, how much goes out, and where it goes. Before you can make a budget, you need to gather all your essential financial information. Make sure you have the following ready to go:

Income (after tax): include all sources such as your salary from employment, pensions, side hustles, government benefits, etc. Have income statements on hand like your pay stubs and bank statements that indicate how much you receive, when, and how often.

Expenses: include all essential expenses and payment obligations such as your rent or mortgage, utilities, childcare, car payment, debt/loan payments, insurances, groceries, gas, etc. Have statements like bills with payment amounts and due dates.

Now that you have the numbers on hand, you need to have access to your various financial accounts. Make sure you have your login information ready to go for things like your:

- Chequing & savings accounts

- Credit cards

- Loans

Your mobile phone and email inbox

You will also need to have your mobile phone with you, and access to the email accounts connected to your various financial accounts. Why is that important? Hardbacon needs to access account information in order to track your spending and optimize your financial situation. You will need to give authorization by entering security codes that your financial service providers will either text to your phone or send to your email, depending on your security preferences for each account.

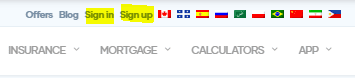

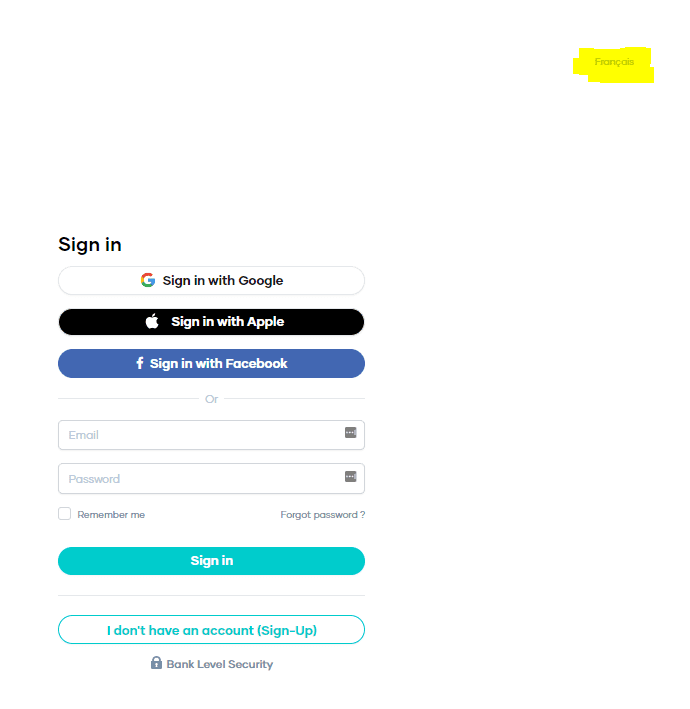

Sign in to your Hardbacon account

Visit the Hardbacon Homepage and select “sign in” from the top-right menu. Enter the same email address and password you use to log into the mobile app. If you don’t already have a Hardbacon account, sign up now to get started.

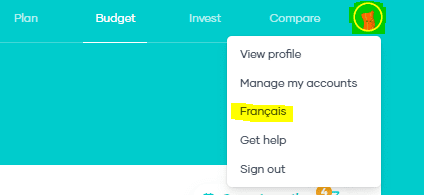

Before you sign in, you may need to change the default language to your preferred language. On the top right of the sign-in page, select either English or French. You can also change the language setting after you sign in. On the top right of your Hardbacon dashboard, select the profile icon, then select your preferred language from the drop-down menu.

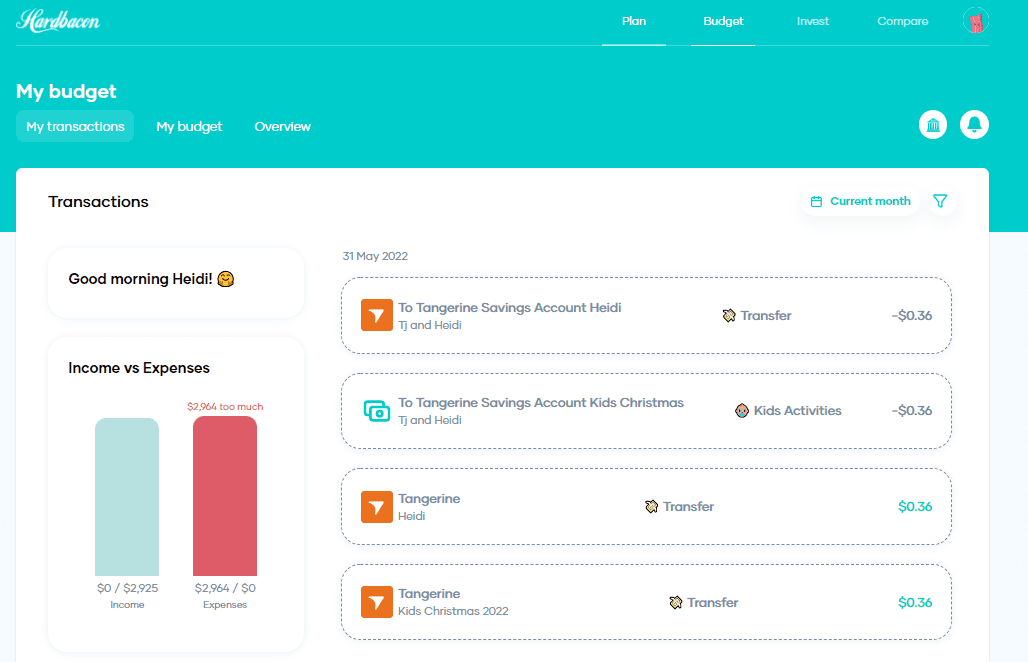

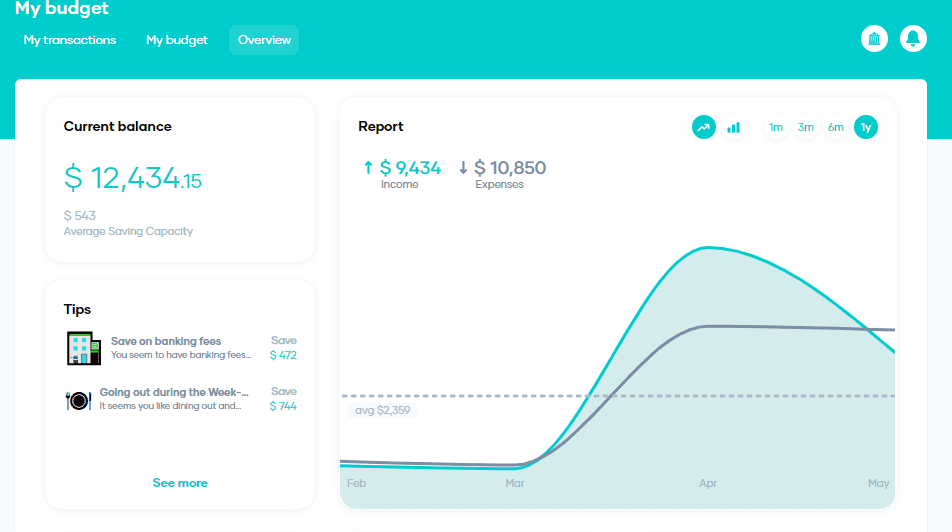

Your Hardbacon budget dashboard

Welcome to your Hardbacon Budget Dashboard where you’ll see a snapshot of your current financial situation. From here, you can access the functions you need to take total control of your money. There are 3 main tabs:

- My Transactions

- My Budget

- Overview

My Transactions: your recent activity

The dashboard defaults to the “My Transactions” tab. To the left, a bar graph gives you a quick visual aide that shows:

Projected income vs. actual income: how much you expect to receive and how much you have actually received so far, based on the information you have provided and your transaction history.

Projected expenses vs. actual expenses: how much you expect to spend and how much you have actually spent so far, based on the information you have provided and your transaction history.

Why is that important? At a quick glance, you can see if you are spending less than you’re making, breaking even, or way off track. Then you can take the appropriate action based on your current situation.

To the right, you will see your most recent transactions from specific accounts, how much you spent, and where you spent it. It will also show the deposits you have received, the amount, and the account it went into.

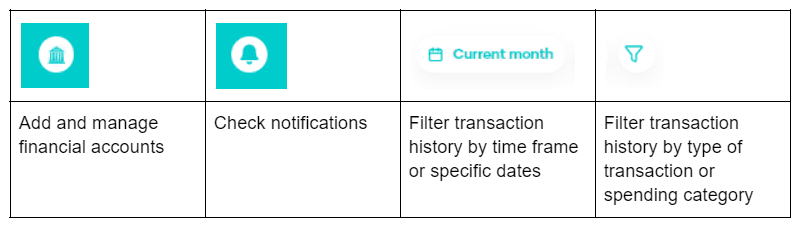

To the top right of your dashboard, you can also:

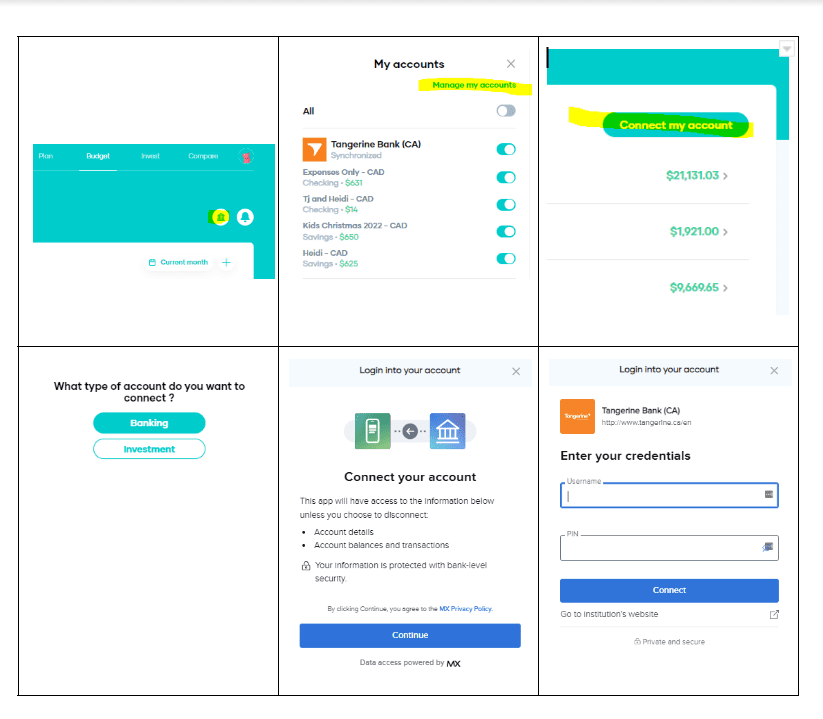

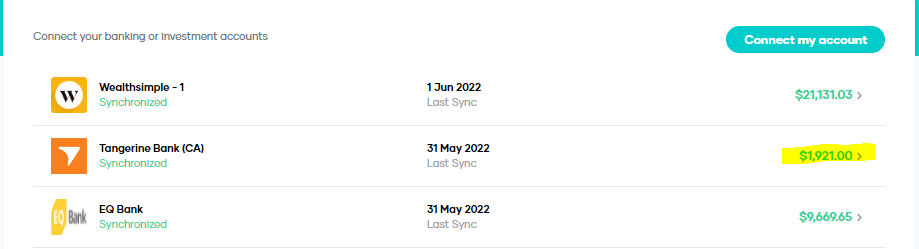

How to add your financial accounts

To add and manage your accounts, select the Bank icon to the top right of the transaction history. Select the type of account you would like to add such as a chequing, savings, or credit card account from a bank, or an account from an investment provider.

Select your financial institution from the available icons, or use the search bar. Click on your financial institution, click on “continue” and enter your sign-in credentials for that account. The financial institution will send a security code to either your mobile phone or your email. Enter the code to connect the account.

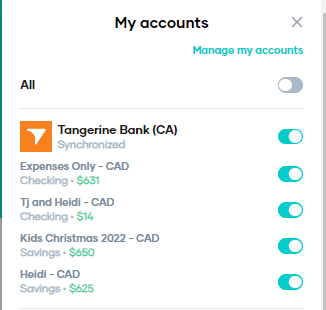

Once your accounts are added, you can also select which ones Hardbacon should track and include in calculations, and which ones it should ignore. You can change these settings any time you want based on what information you want to see and when.

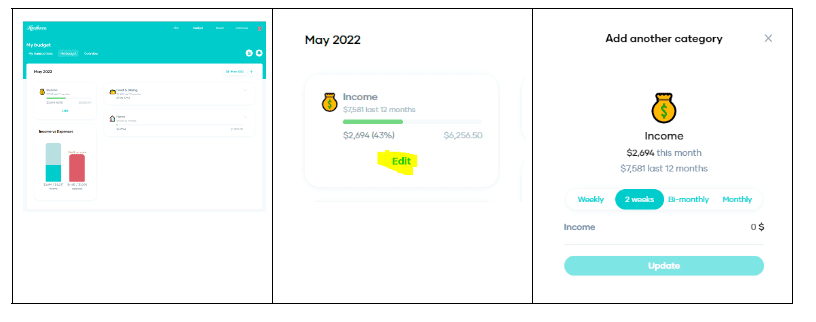

My Budget: how to make your budget

This is where the magic happens! To create your budget, click on the “My Budget” tab. Begin by entering your income. To the left of the My Budget screen, you will see a block labelled “Income.” To add your income, click on “edit.” A menu will appear to the left of the screen. Enter the after-tax amount you make with each paycheque, along with how often you get paid:

- Weekly: every 7 days

- Bi-weekly: every 14 days

- Semi-monthly: twice a month

- Monthly: once a month

If you have multiple income streams, add them together to find the total amount of money coming in, enter it as monthly income, and click “Update.” The income block will keep track of your projected income, which is how much you expect to receive versus how much you have actually received so far based on the transaction history from your connected accounts. It will also track your year-to-date income from the time you connect the account, forward.

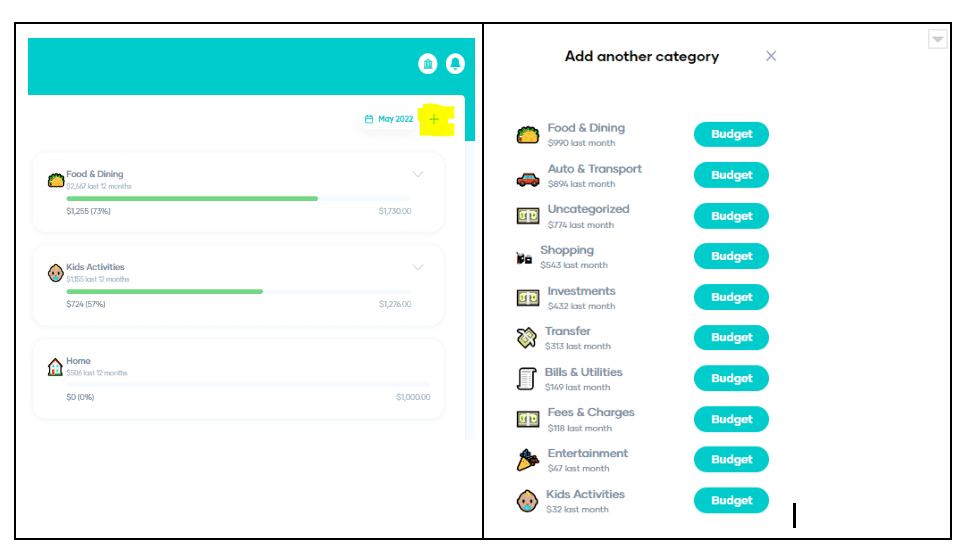

Next, add your expenses in each applicable category. As you add budgeted categories, they will appear to the right of your My Budget screen. Start adding the essentials like Housing, Bills & Utilities, Food & Dining, Auto & Transportation, etc. Click on the plus sign at the top right of the budget section, then select the spending category that relates to the expense you want to add.

Here, you can keep things as simple or as detailed as you want. You have the freedom to set spending limits based on your needs, habits, and personality, so go HAMM (hard as a money manager). There are two ways you can set up a budgeted category:

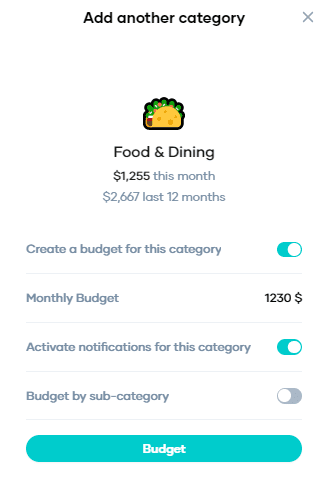

Monthly Budget: enter one total spending limit for a primary category. For example, enter the total budgeted amount for all food-related expenses under “Food & Dining.” You can spend as much or as little as you want of the total budgeted amount on specific things like groceries, restaurants, coffee, etc. Hardbacon will only notify you if you go over your total food budget. This method is best for more traditional budgeting or those who prefer a simpler way to spend.

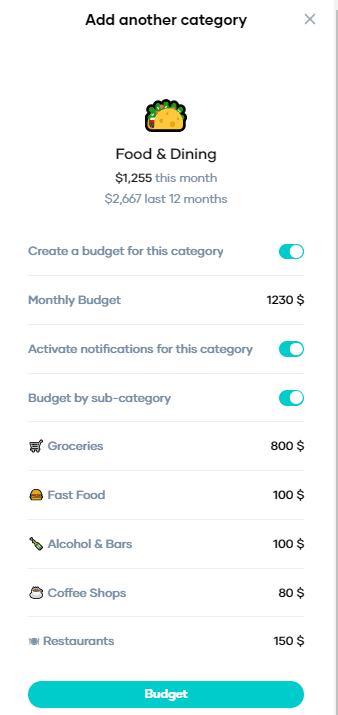

Budget by sub-category: within a primary category, select “Budget by sub-category” and enter specific spending limits for each item. For example, within the “Food & Dining” category, enter an individual spending limit for each: groceries, coffee, restaurants, fast food, etc.

Add all the individual spending limits together and enter the sum total in the “Monthly Budget” field. Hardbacon will keep track and notify you when you have gone over budget in a given sub-category. This method is great for those who love zero-based budgeting, want more control over where their money goes, or want to break a bad habit like a designer coffee addiction.

Monthly Budget

Budget by sub-category

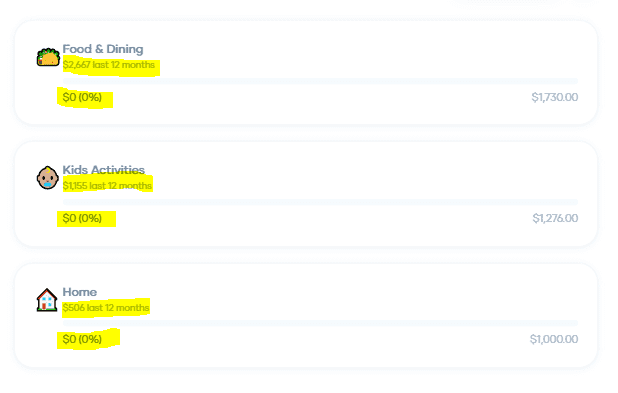

Under the name of each budget category you create, you will see two data sets:

- $0.00 in the last 12 months

- $0.00 (0%)

Hardbacon will track your monthly spending as well as your year-to-date spending in that category. Your current monthly spending is expressed as both a dollar amount, as well as a percentage of the monthly budgeted amount. At a glance, you can quickly see exactly how much you have spent so far and how quickly you are approaching your limit. This information is a great way to see how insidiously small expenses can add up over time, and how much you could save by cutting back or eliminating certain purchases.

Overview: what does it all mean?

Have you ever wondered what your life would look like as a bar graph? No way, me too! The Overview section turns your money behaviour into graphs! Here, you get a clear visual representation of your current financial situation, and your past income and expenses. What a beautiful way to see where you’ve been so you can change where you’re going.

Current balance

This number reflects the net amount of money you have right now combined across your connected accounts like chequing, savings, credit cards, loans, etc. It adds together your positive balances and subtracts what you owe. You can control which accounts you want reflected in this total, and which accounts you want to omit. For example, you might choose to omit your emergency fund from this total to avoid the temptation to spend it. Personally, I omit my emergency fund balance so I don’t buy a one-way ticket to Mexico when my kids are melting down.

The report

The report is a graph that shows you the history of your income and expenses over time. You can see how things fluctuate month over month, and there’s an average line of expenses to identify when you deviated from your normal spending pattern. Choose a line graph or a bar graph, depending on your personal preference. You can also look at your history over 4 different time periods: 1 month, 3 months, 6 months, and 1 year. When you select “1 M” you can see your income and expenses week-by-week for the previous month.

Tips

This is where Hardbacon provides tips to optimize your finances based on your linked accounts and financial behaviour. Hardbacon told me I spend too much money on take-out on the weekends. Did I feel attacked? Yes. Was I aware that weekends were a food money-pit for me? Nope! Now that I know, I can do better. Specifically from Friday to Sunday.

Below the graph, you will see a breakdown of your most common spending habits. There are 3 categories that reveal where you spend the most frequently, and where you spend the most amount of money:

Recurring payments: this section is designed to make you aware of recurring expenses to promote mindful spending. Repetitive little purchases are easily unnoticed but they really add up; like my husband’s energy drink addiction from the convenience store next door.

Where you spend the most: this section shows you where you spend the most amount of money by merchant/retailer. The places where you spend the most are listed top-down by highest total amount spent. For me, I spend the most amount of money on eTransfers because that’s how I pay rent, daycare fees, and fund my high interest savings account.

Most frequent transactions: this section lists where you spend the most frequently. If you shop with a merchant or make a certain transaction 3 times in the last 30 days, it will show up here. The list is ordered by highest frequency and works its way down. My top 3 most frequented merchants are a certain convenience store, our neighbourhood grocery store, and my favourite coffee shop. Looks like someone could cut back on their energy drinks, and I might consider cutting back on lattes.

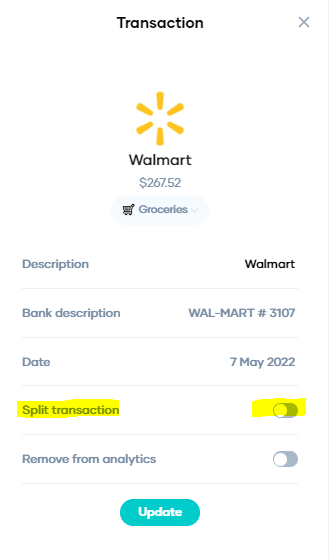

Unique features for unique transactions

Not every transaction is straightforward, that’s why Hardbacon developed cool features to give you even more control. For those unique situations where a simple purchase isn’t so simple, you can modify transactions to fit your needs. Let’s take a look:

Split transaction

This feature allows you to modify transactions that don’t accurately reflect the context or the true impact on your budget. You can split a single transaction between people or between spending categories. Why is this a key feature? Here’s an example:

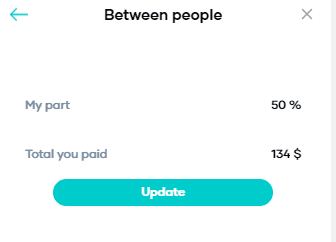

Split by person

You and a few friends want to go to the Spice Girls reunion tour and obviously want to sit together. So you buy all the tickets in a single transaction and your friends pay you back in cash. No problem, you can modify this transaction to reflect what you actually paid. You can enter either the exact dollar amount of your portion of the purchase or by percentage if that’s easier.

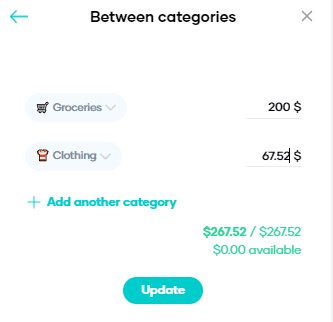

Split by category

Or maybe you went grocery shopping at Walmart and needed to grab some new summer clothes and sandals for the kids while you were there. But if you pay for it all in one transaction it throws off both your food budget and child-related expenses. Fear not, you can modify this transaction to reflect what you actually spent in each category.

From the My Transactions tab, hover your mouse over the transaction you want to modify. Click on the pencil icon to the left, then activate “Split transaction.” Select “Split by person” or “Split by category.” Enter the info and satisfy your inner control-freak. Hardbacon will update the analytics to reflect what you actually spent, and where.

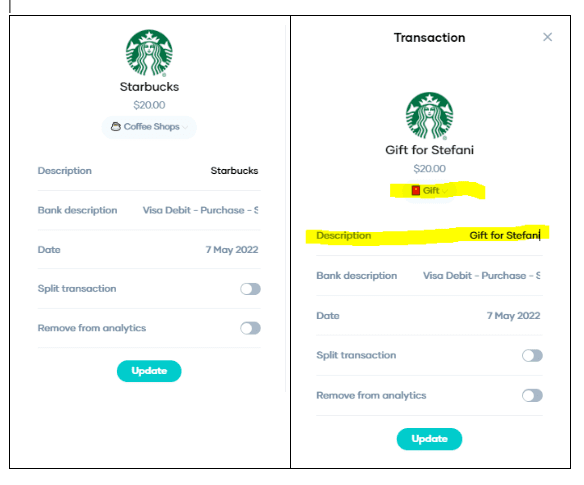

Edit transaction

You can also edit other information about a transaction such as the spending category and description. Why would you do that? Perhaps you bought a gift for a friend that debited the obvious spending category, but since you didn’t buy it for yourself, you’d like to deduct the purchase from your “Gifts” budget, and also give it a label so you know exactly what it’s for. Hover over the transaction, click the pencil icon to the left, and change the details. You can also remove a transaction from analytics if you don’t want it calculated or analyzed.

Manage my accounts

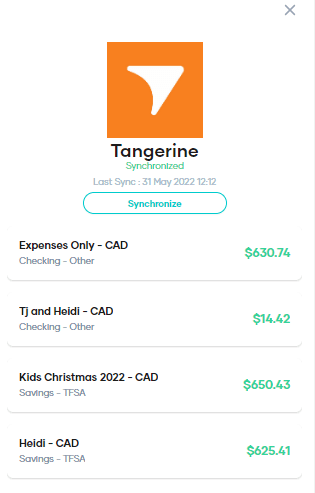

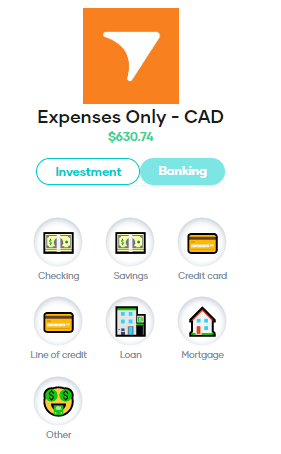

Here, you can add, remove and modify your connected accounts. That lets you control which financial accounts you would like Hardbacon to analyze and/or include in transactions. You can also label multiple accounts from the same institution as either chequing, savings, credit card, loan, etc. This helps Hardbacon accurately analyze your financial situation and make appropriate recommendations. Also, labelling your accounts within an institution is important because Hardbacon analyzes by account type rather than by type of financial provider.

Categorize each account

To categorize accounts, click on your profile icon then select “Manage my accounts.” Select the desired institution and click on the arrow to the far right. Select the desired account, then choose how you would like to categorize it. You can also access “Manage my accounts” by clicking on the Bank icon next to the notification Bell icon, then select “Manage my accounts” from the top right of the menu. Properly categorizing accounts ensures you are getting the right current net balance, accurate analytics, and relevant recommendations.

Track or omit account activity

To manage which accounts are included in calculations and/or analytics, click on the Bank icon next to the notification Bell icon. Beside each connected account, you can turn tracking on or off. If you turn tracking off, transactions will not appear in your transaction history, activity will not be analyzed, nor will it be included in your net current balance. Keep in mind that if you omit an account from analytics you won’t get personalized product recommendations that could benefit you.

What’s the best budgeting method to use with Hardbacon?

The one you actually stick with. The best part of a Hardbacon budget is the power to build it your way. But what is your way? What budgeting method will you actually stick with? Don’t worry, we have you covered there too. Here are some of the most popular budgeting methods you can use with the Hardbacon app.

- Traditional budgeting is a simple and easy way to track money coming in and money going out. It’s a non-complicated way to measure how much discretionary money you have left to spend on whatever you want after all the essentials are paid for. If this is your style, you can stick to a spending limit for a primary category and ignore the “Budget by sub-category” feature.

- Zero-based budgeting goes much further than traditional budgeting. It is designed to eliminate mindless spending by giving every single dollar a purpose. It’s a great way to uncover expensive habits, find money-saving opportunities, and hold you accountable for each transaction.

If this is your style, you can set individual spending limits for the sub-categories within a primary category. You can also edit each transaction in your transaction history to ensure it is tracked properly in the appropriate sub-category. Hardbacon will notify you if you overspend on a sub-category, like too many lattes on the way to work.

- The 50/30/20 budgeting method is used to assign a certain percentage of your income to 3 primary categories: essentials, debt and savings, and fun money. This is a great place to start if you’re not too sure how much money is appropriate to spend on certain things based on how much you make. You can use this method to help you calculate spending limits for your budgeted categories.

Hardbacon will analyze your financial behaviour to give you tips and insight to manage your money better. Use that information to adjust your budget, niche down, and gain more control. Whatever method you start with, you can always change it later as needed.

- Tracking instead of budgeting is more for people who already have a handle on their finances, but want to keep track for the sake of accountability and uncovering opportunities. This might include paying yourself first, then bills/essentials, followed by guilt-free spending.

You can do this by not creating any budgeted categories at all, and simply keeping track of your balance, where you spend the most often, and how much. Or by creating a budgeted category with your desired spending target, but turn off notifications if overspending in that category isn’t actually a big deal. You’ll still get all the same great Hardbacon analytics, insights, and tips. Not to mention, the Hardbacon app is a powerful hub to see your complete financial picture in one spot.

How to stay motivated: find your “why”

A budget is a plan for your money, context for your goals, and accountability for your choices. Most importantly, it breaks the paycheque-to-paycheque cycle to create financial stability. But no matter what budgeting method you use, there will be hiccups along the way and times you want to give up. Stay the course, Rome wasn’t built in a day. Here are the top 25 reasons to make a budget with Hardbacon, and stick to it even when you don’t want to:

- See where your money is going

- Control spending

- Pay down debt

- Achieve your goals

- Reduce risk of financial trauma

- Save for emergencies

- Prioritize needs over wants

- Discover ways to cut costs

- Set realistic goals and track progress

- Discover opportunities to save more

- To have control over your money

- Break unhealthy habits

- Spend with intention

- Achieve financial independence

- To afford what’s important to you

- Plan for retirement

- Afford more time with loved ones and personal interests

- Plan for major life milestones

- Avoid taking on debt

- Invest what you save to get rich, slowly

- Challenge yourself

- Manage the unexpected

- Supports self-care and wellness

- Discover better financial products and services

- Get money-smart and build confidence