Budget

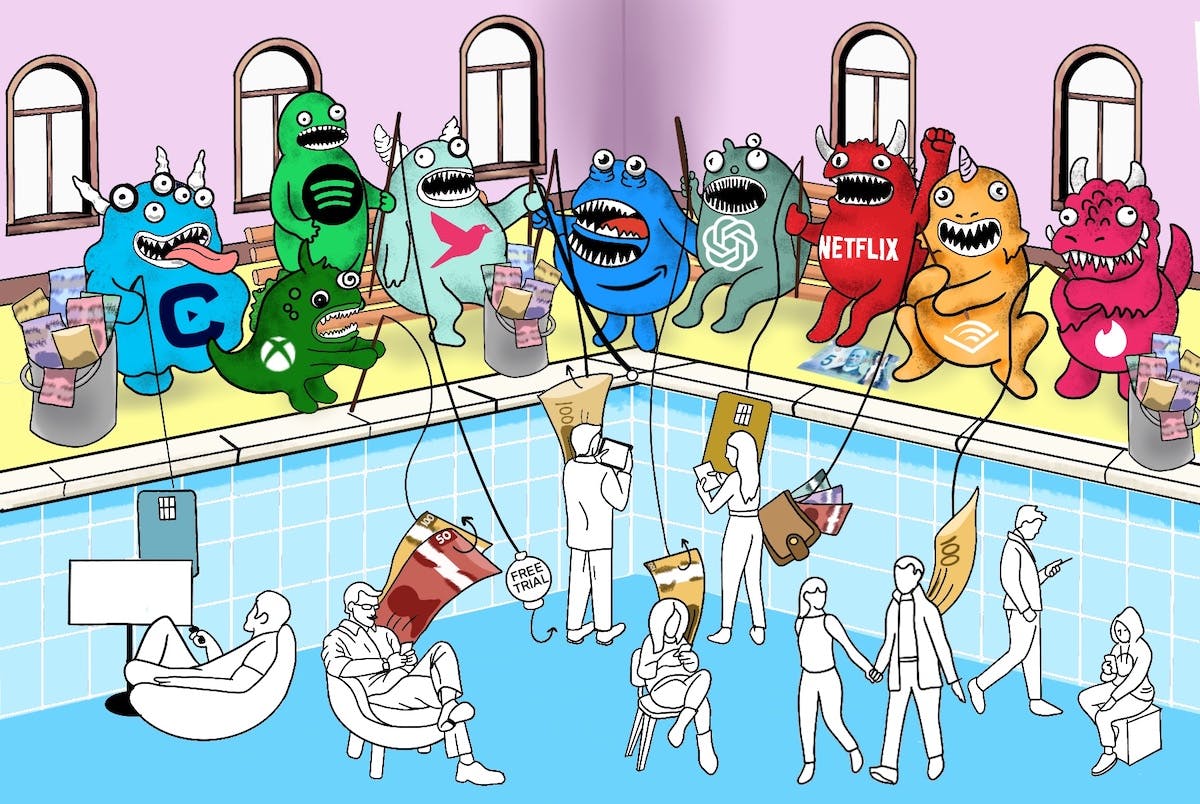

If you want to learn how to make a budget, retake control of your spending, and save money, then you’ve come to the right place.

Popular articles about budget

Free Stuff on Your Birthday? The 56 Best Birthday Freebies in Canada

Michael Wight - 19 May 2023

Costco Vs. Walmart: Which one is best for Canadian shoppers?

Yuri Sychov - 31 Jul 2023

10 Package Forwarding Services to Shop From the U.S. to Canada

Michael Wight - 22 Aug 2023

Why a Costco Canada Membership is Worth Your Money

Michael Wight - 25 Jan 2024

The 20 Best Cash Back Apps in Canada

Heidi Unrau - 10 Nov 2023

90 Ways to Save Money in Canada

Khadija Jouini - 19 Apr 2023

Amazon Prime Review: Is It Worth It In 2023?

Heidi Unrau - 11 Oct 2023

The 15 Best Grocery Delivery Services in Canada for [year]

Arthur Dubois - 09 Aug 2023

Frequently asked questions about budget

Why do I need a budget?

The key benefit of creating a budget is that it adds stability to your finances by allowing you to anticipate expenditures as they come and develop suitable financial plans to ensure that you are progressing towards your long-term savings targets and financial goals. Another benefit of a budget includes being able to work towards large expenditures that you are planning to make such as a car, a vacation, etc. By assessing your monthly expenses, you can determine exactly how much you need to save and when you can go out and make that big purchase.