The Ultimate Guide to Bookkeeping for Canadians in 2022

By Emma Martin | Published on 19 Jul 2023

Business owners know the critical importance of having their company’s financial books up-to-date and accurate. It is impossible to make an informed business decision if a business owner doesn’t have a handle on their business finances:

- How much cash are they generating

- What are the gross and net profit margins

- How much did it cost in business expenses to generate revenu

- Are there notable trends of success or concern

- Sales tax and income tax payable to the provincial and federal governments

- And the list goes on.

Accurate and timely books also allow businesses to compare and analyze trends by comparing their financial transactions and results to the previous year.

Even with the well-known critical importance of maintaining a company’s books, many businesses fail to proactively stay on top of their accounts. With precious time each day to complete all the tasks required to manage their business activities, business owners will justify kicking their bookkeeping tasks down the road because they need to put out critical business fires.

However, there will always be business fires to put out, and once business owners normalize this reason to put-off other tasks important to the business, it doesn’t take long for the business’s ‘bookkeeping can’ to be kicked a month, a quarter, or years down the road.

When business owners invest time in creating bookkeeping systems and bookkeeping automation, maintaining their books can become a simple administrative task they can do themselves or assign to one of their employees. This ultimate guide will walk you through the different bookkeeping basics,

Difference between bookkeeping and accounting

Bookkeeping and accounting are often used synonymously, but they are different in a few fundamental ways.

Bookkeeping is when a bookkeeper records the financial transactions of a business either manually or with cloud-based bookkeeping software. They are also responsible for:

- Creating invoices

- Receiving and recording payments

- Chasing down and collecting accounts receivables

- Calculating and managing payroll

- Preparing basic financial statements.

Bookkeeping tasks require someone who is organized and knows how to accurately record a business’s financial transactions; however, these tasks are largely administrative.

Bookkeepers are not required to have any specialized education or certification and can learn on the job. However, bookkeepers will often have some form of bookkeeping or accounting training. The hourly rate bookkeepers charge for their services is anywhere from minimum wage to $50 an hour.

Chartered accountants, now known as Charted Professional Accountants (CPAs), must have a degree with required accounting classes, two years of professional experience, and successfully pass both the CPA professional program and a common final exam.

To earn a CPA in the shortest possible time, it would take six years to complete. Once a person receives their CPA, they are required to stay up-to-date with the profession by taking and then affirming they have received a certain number of training hours each year.

CPAs will provide adjusting entries to both fix incorrect journal entries and record any accrued revenue and expenses not accounted for. They will review the business’s financial statements for completeness and will provide the business with their opinion of the company’s financial position.

This will include notable financial trends and where there are opportunities to improve the financial performance and direction of the company. CPAs will also complete the business’s corporate income tax return and can prepare for the business one of the three types of financial statements.

CPAs and three types of financial statements

The first type of financial statements a CPA can prepare for a company are Notice-to-Reader statements (NTRs). NTRs are simply financial statements prepared by a CPA with the information they have from the business.

When preparing NTRs, CPAs will not run any accounting tests or offer assurances or opinions relating to the quality of the financial information; they simply prepare the financial statements with the information they have at hand.

The second type of financial statements are Accountant-reviewed financial statements, where a CPA will run some accounting tests to determine if the information in the financial statements is plausible.

The third and most expensive type of financial statements are audited financial statements. The accountant will run a series of accounting tests to provide an opinion to the reader that the financial statements represent the financial position of the company.

Businesses are not required to have one of these three noted financial statements; however, if they are preparing to sell the company, looking for investors, or business loans, they will need to have at least Notice to Reader Financial Statements prepared.

Bookkeeping basics

Bookkeeping is essentially capturing cashflow: when cash came into the business, when cash went out of the business, and putting each transaction into an appropriate account. Each transaction is recorded as a journal entry, and bookkeeping accounts are either debited or credited.

Debits and credits

Each bookkeeping account will either be debited or credited depending if the transaction either increased or decreased the value of the bookkeeping account. Whether a debit or credit increases or decreases a bookkeeping accounting will depend on the type of bookkeeping account and what financial statement they are shown on.

Below is a high-level summary of common bookkeeping accounts, what financial statement they are shown on, and whether a debit or a credit will increase or decrease the account.

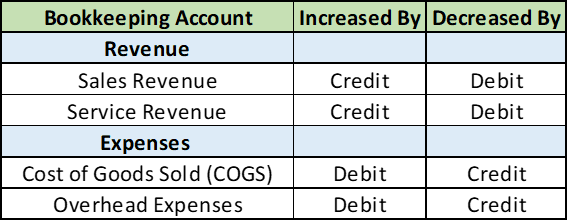

Income Statement Bookkeeping Accounts

When a product or service is sold, and revenue increases, the Sales Revenue or Service Revenue bookkeeping account is increased through a credit. When expenses are incurred to earn revenue, an Expense Account such as Cost of Goods Sold (COGS) or Overhead Expenses is increased through a debit.

Balance Sheet Bookkeeping Accounts

Current Asset and Capital Asset bookkeeping accounts are debited when increased and credited when deceased. The opposite is true for Current Liabilities and Long-term Liabilities, which will be credited when increased and debited when decreased.

Journal entries

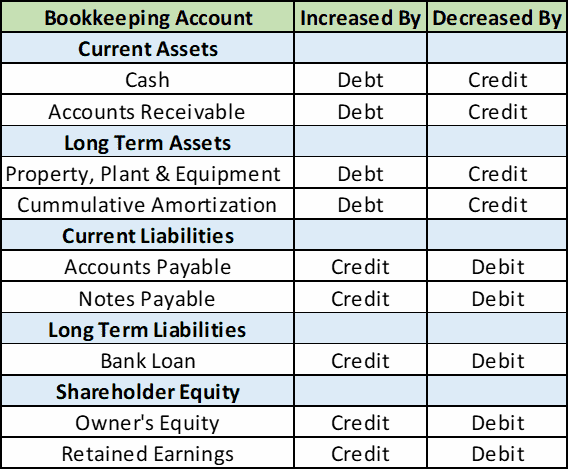

One of the bookkeeping accounts described above goes up, and one goes down when a business makes a purchase. The transactions are recorded in journal entries such as the journal entry examples shown below.

For example, in Journal Entry #1 shown below, a business that made a sale of $1,000 on Sept. 25th will debit Accounts Receivable for $1,000 and credited Sales Revenue by $1,000. When the customer pays their outstanding balance on Sept. 30th, the business will debit Cash and credit Accounts Receivable, as shown in Journal Entry #2.

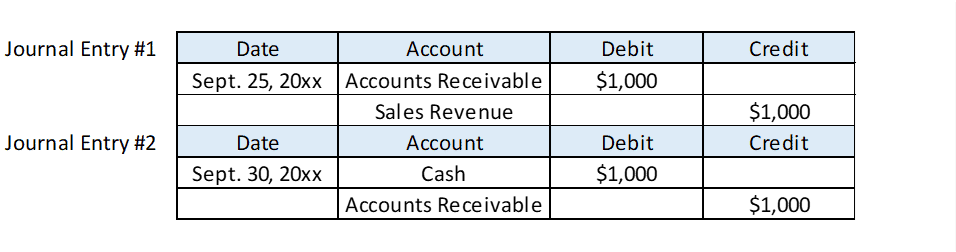

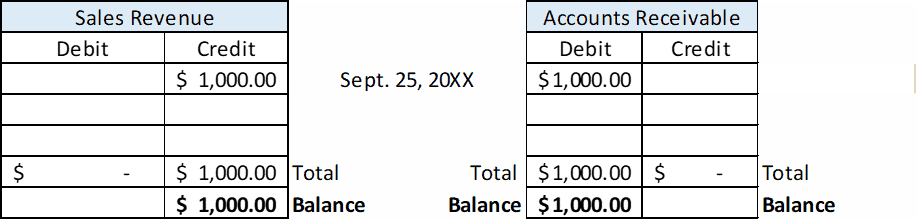

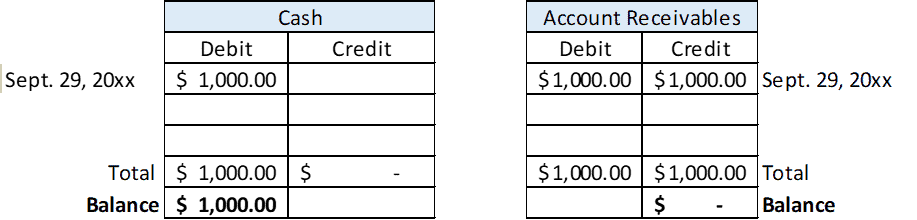

T Accounts

T Accounts are an essential part of bookkeeping, and they get their name from resembling a ‘T’ in their most basic form. Each bookkeeping account will have a corresponding T Account to help keep track of when accounts are increased or decreased through journal entries.

The first set of T Accounts below show increases in the Sales Revenue and Accounts Receivable from Journal Entry #1. The second set of T Accounts show an increase in Cash and a decrease in Accounts Receivable from Journal Entry #2.

A business with 500 financial transactions and 500 corresponding journal entries will also have 500 debit and 500 credits shown in T Accounts. T Accounts provide a valuable quality check as the cumulative value of the debits and credits in the T Accounts must equal $0. If they don’t equal $0, it will flag for the bookkeeper to find and correct the error.

Pro-tip

if you’re using cloud-based bookkeeping software, there is no need to manually maintain T Accounting as the software will automatically create corresponding T Account entries for each journal entry posted.

Journal Entry #1

Journal Entry #2

Trial Balance

A Trial Balance is a summary of each bookkeeping account’s credit and debit balances. If bookkeeping is managed manually without the aid of cloud-based accounting software, it is easy to create a Trial Balance by simply taking the balance of each T-Account. Trial balances also provide another bookkeeping quality check, as the cumulative debt and credit total must be equal.

A Trial Balance will automatically be prepared and available to review if bookkeeping is being managed with cloud-based accounting software.

Chart of Accounts

When a business first sets up its bookkeeping, it will create a basic list of bookkeeping accounts to manage its financial transactions, collectively known as the Chart of Accounts. Below are common bookkeeping accounts in a company’s Chart of Accounts.

Pro-tip

cloud-based accounting software will provide you with a basic Chart of Accounts, and you can easily create new bookkeeping accounts when required.

Assets

Cash

Cash is the most liquid asset a business will have and is listed first on the Balance Sheet under Current Assets. It is commonly received digitally through debit cards, business credit cards, personal credit cards, electronic transfers, and physical cash in either bills or coins.

Petty Cash

Petty Cash is a specific fund for small and incidental expenses. Maintaining a Petty Cash fund provides a convenient way for businesses to pay for small expenses and avoid having to write cheques.

Accounts Receivable

Accounts Receivables are generated when a sale is made, or revenue is earned, and the buyer did not pay the business at the time of purchasing a product or service. When the buyer pays the business the amount owing, the business will debit Cash and credit Accounts Receivable.

As companies can’t pay their employees and expenses with Accounts Receivables, they must proactively manage current and aging accounts receivables.

Inventory

Inventory can be the value of the products you purchase for resale or the value of manufactured goods recorded at cost.

Pro-tip

If your business regularly purchases and sells inventory, using accounting software with a point of sales system will make it easier to manage inventory.

Prepaid Insurance

Insurance premiums are commonly paid 12 months in advance. A prepaid current asset account such as Prepaid Insurance will be created and drawn down each month when the insurance expense is recorded.

Vehicles

Vehicles are considered long-term or capital assets. When a business purchases a vehicle, a bookkeeper debits a vehicle asset account and credit the account used to pay for the vehicle, such as bank loans, lines of credit, or cash.

Businesses receive the value of long-term assets over a period of time known as the amortization period. At the end of the accounting period, a bookkeeper would debit a Vehicle Amortization expense account and will credit the corresponding Accumulated Amortization account.

Buildings

Buildings are other long-term assets that will provide value to the business owner over its useful life. When the building is purchased, the bookkeeper debits a building account and credits the method used to pay for the building, such as a Bank Loan account.

The bookkeeper will decide on an appropriate way to amortize the building and will debit the Building Amortization expense account and credit a Building Accumulative Amortization account.

Pro-tip

When disposing of a capital asset, there can be complicated tax considerations, and it is recommended to consult with an accountant.

Liabilities

Accounts Payable

When a business has not paid for products or services they have received, they have generated a liability. The bookkeeper will credit the Accounts Payable account when they debit an expense or asset account.

For example, if a pub receives a $500 food order and will not pay for 30-days, the bookkeeper will record an Inventory account and credit Accounts Payable. When the outstanding balance is paid at the end of 30-days, the bookkeeper will debit the Accounts Payable account and credit the Cash account.

Lines of credit

Business lines of credit are a popular and widely used form of credit as businesses can use it when they need to and pay it down when they don’t. Lines of credit also provide operational flexibility when there is a delay in receiving cash from customers, and they need readily available cash to pay for expenses.

Pro-tip

Working Capital is the amount of cash a business needs to meet its obligations and is often underestimated by companies. If a business has a 30-day collection period on Accounts Receivables, it will need to have the Working Capital on hand to pay its obligations until they collect.

Bank loan

Bank loans are common long-term liabilities. Businesses will take out business loans for various reasons, such as purchasing the company, funding the acquisition of a capital asset like a piece of heavy equipment, and the list goes on.

Shareholders’ Payable

When a company’s owner(s), the shareholder(s) use their personal funds to pay for business expenses or investments, they will debit an expense or asset account and credit Shareholders’ Payable. Then, as the business can reimburse the shareholders(s), they will debit the Shareholders’ Payable and credit the Cash bookkeeping account.

Pro-tip

The personal funds’ shareholder(s) use for business expenses are net of tax. As the shareholder(s) have already paid tax on the personal funds, reimbursements are not subject to tax.

Shareholders’ Equity

Common Stock

Small corporations will often only have Common Stock owned by their Shareholder(s). The book value of the Common Stock will be what the Shareholder(s) have paid or invested in the corporation.

Preferred Stock

Preferred Stock is issued to raise cash for a business. This stock commonly offers a regular dividend payment, and owners will receive their dividends before Common Stockholders.

Retained Earnings

Retained Earnings is the income the business keeps in the business. It is not distributed to the Shareholders. The Retained Earning bookkeeping account will be credited with the net income for the reporting period and debited for dividends provided to Shareholders.

Bookkeeping tools and software

The bookkeeping industry has many high-quality options for cloud-based bookkeeping software. The options range from limited functionality perfect for small businesses with limited requirements on the one end to complete suites of bookkeeping functions on the other.

Google Sheets and Microsoft Excel

Even with cloud-based bookkeeping software being affordable and easy to use, it can make sense for small businesses to use other tools if they don’t need many bells or whistles. If a company has under 20 monthly financial transactions, Google Sheets and Microsoft Excel will be enough to keep your financial transactions organized for government compliance and tax time.

However, it may cost the company more for an accountant to prepare the corporate income tax return as they will need to complete the bookkeeping for the reporting year.

Wave Accounting

Wave Accounting is a free cloud-based bookkeeper software that offers paid options like payroll and credit card processing. With Wave Accounting, smaller businesses can manage all their bookkeeping, issue professional-looking invoices, and will automatically record financial transactions by connecting directly to a business’s bank account and, or business credit card. Wave Accounting is a good choice if the business is small and needs to conserve money. However, while free and highly useful, Wave Accounting has a few notable drawbacks.

If a business has aspirations of growing its revenue, employee numbers, or business scope, Wave Accounting is not an ideal long-term bookkeeping solution as it has limited ability to scale. Another drawback is the lack of inventory management for businesses selling retail products.

Quickbooks and Xero

QuickBooks and Xero are both highly functional and industry-leading bookkeeping applications. Since its launch in 1992. Quickbooks has become the most widely used bookkeeping software in the United States.

It offers both cloud-based and desktop bookkeeping applications for businesses to use. Quickbooks is recommended if a company operates in the United States, given its popularity and industry-leading position, as well as advanced features at a low price point.

Xero is a relatively new bookkeeping software launched in 2006 in New Zealand and is popular with small businesses, startups, and businesses outside the United States. Xero is recommended if a business is a start-up, is located outside the United States, and is looking for a bookkeeping application that can scale with its business.

Pro-tip

If you have a Chartered Professional Accountant (CPA), you can check with them on their software preference. If the accountant is familiar with specific bookkeeping software, not only will they be able to help the business use all the valuable software tools, but they will save time and save the business money reviewing their books.

Pro-tip

Keep your business and personnal expenses completely separate.

The easiest way to do this is by paying your business expenses with a business credit card or a business bank account. It can get very messy and complicated if personal, and business expenses are mixed. Not only will it take time to organize, but it increases the chances of either expensing a personal charge as a business expense or forgetting to reimburse the business owner for business expenses they paid.

Taxes and compliance

Businesses need to stay in compliance with government sales and income tax requirements. The cost of not staying in compliance, such as a penalty and the stress of government audits and demands, is substantial. It is much easier for a business to stay on top of its tax obligations if its bookkeeping is up to date and accurate.

Sales taxes

Businesses operating in Canada must pay sale taxes in the province and territories they operate in and to the federal government. Each province and territories have different sales tax rates, and types businesses must collect and remit to the different levels of government.

New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island have a Harmonized Sales Tax (HST). This contains both the provincial and federal sales tax and is managed by the Canada Revenue Agency (CRA). British Columbia, Manitoba, Saskatchewan, and Quebec each have a Provincial Sales Tax (PST), called the Quebec Sales Tax (QST) in Quebec, and the federal government’s Goods and Services Tax (GST).

Lastly, Alberta, Northwest Territories, Nunavut, and the Yukon do not have provincial or territorial sales taxes. Businesses are only required to collect and remit GST to the Federal Government.

Sole proprietorship – filling income tax returns and paying income taxes

It is important to note that as a sole proprietorship, there is no legal separation between an individual and their business. This type of business structure creates greater risks to the owners operating their businesses.

However, it is a much simpler form of business to manage. Businesses that operate as sole proprietorships will record their business income as personal income when completing their personal income tax returns, also known as a T1. As such, the personal income tax return is due at the end of April each year.;

Corporations – filling income tax returns and paying income taxes

A business can complete and submit its corporate income tax return to the CRA electronically or manually. A corporation must submit its corporate income tax return electronically if it generates more than $1 million a year in revenue. Corporations must submit their corporate income taxes, also known as a T2, within six months after the corporation’s year-end.

The CRA requires corporations to make their income tax payments in monthly installments.However, new corporations are not required to make corporate income tax installments until their second year of operation.

A corporation must make federal, provincial, or territorial corporate income tax installment payments if the amount of corporate income tax payable is greater than $3,000.

Employment taxes

Business owners must pay employment taxes for both themselves and their employees, whether the business is a corporation, partnership, or sole proprietorship. The business and employees will pay Employment Insurance (EI), Canada Pension Plan (CPP), and income tax. The business must collect and remit all required taxes to the CRA within 15-days after month-end.

For Canadian Pension Plan (CPP) premiums, the business and employee will each pay 5.7% in 2022 up to a maximum yearly payment of $3,499.80. For EI, the employee will pay 1.58% up to an annual maximum premium of $952.74. Businesses will pay 1.4 times the employee EI rate of 1.58% up to an annual maximum employee premium of $1,333.84.

Workers’ Compensation

Workers’ compensation isn’t a tax; however, businesses must have Workers’ Compensation Insurance for their employees. Each province and territories have different Workers’ Compensation Board (WCB) rates, and requirements businesses must meet.

The WCB rate per $100 in earnings by province and territory is: Alberta $1.17; British Columbia $1.55; Manitoba $0.95; New Brunswick $1.69; Newfoundland and Labrador $1.69; Northwest Territories and Nunavut $2.40; Nova Scotia $2.65; Ontario $1.30; Prince Edward Island $1.43; Quebec $1.67; Saskatchewan $1.23; and, Yukon $2.00.

Business expense deductions

Businesses only pay income tax on their net income; however, understanding what expenses they are allowed to deduct from their gross business revenue is complicated. At a high-level, companies are able to reduce their taxable business income by the costs they incur while earning business income.

While that seems fairly straightforward, there are endless tax rules and nuances that either hurt or help a business. Tax compliance and strategies can have material impacts on businesses, and tax advisory services have grown to meet this need, with the global tax management market size expected to reach $33.9 billion dollars by 2027

Operating expenses

Operating expenses are the most common business expenses and are defined as items being consumed or providing value in a single accounting period. These expenses make up the majority of a business’s expenses, can be deducted from revenue, and businesses will not pay income tax on the expense amount. However, there are some Canada Revenue Agency (CRA) exceptions to this rule that are walked through below.

Meals and entertainment

A business can only claim up to 50% of expenses related to meals and entertainment. If a business expenses 100% of meals and entertainment receipts throughout the year, their bookkeeper or accountant must add 50% back to net income for tax purposes. This rule discourages business owners from expensing endless meals and entertainment as they can only claim half of the incurred expenses.

Office expenses

If a business owner has a home office, they can reasonably expense a portion of their home expenses as home office expenses. An example of calculating a reasonable portion is by taking the square feet of the office and dividing it by the total square feet of the home to derive a reasonable percentage to expense home expenses. The business owner would then use this percentage when calculating the business amount of their home expenses.

Vehicles

Business owners can expense the cost of a vehicle if they use it for business purposes. When a vehicle is used for business and personal use, the business will need to determine what percentage of the vehicle expenses were for the business. This can be taking the mileage for business activities and dividing it by the total mileage for the reporting period to derive a percentage used for business. The business would then use this business percentage to calculate the business portion of vehicle expenses they incur.

Capital assets and expenses

Businesses will derive value from capital assets such as buildings and equipment over multiple years. As a result, the Canada Revenue Agency (CRA) only allows companies to expense a percentage of the value of the capital assets each accounting period. This is Capital Cost Allowance.

It is difficult for businesses to ensure they are only claiming eligible business expenses according to both accounting and Canada Revenue Agency rules, as well as ensuring they are not missing any expense claims they could have made to reduce their taxable income. The ultimate test to determine if an expense is appropriate is whether it was reasonably incurred while operating the business and generating revenue.

Should you hire an accounting firm?

Hiring an accounting firm or CPA, has clear advantages and disadvantages. Unless there is internal expertise within the business and a history of successfully filing the business’s income tax return, it is highly recommended to hire an accountant to complete the business’s income tax return.

An experienced bookkeeper will have no trouble managing tasks for government compliance, such as remitting sales, employment, and corporate income taxes. However, when a bsuiness hires an accountant to complete the business’s income tax return, the CPA will review the bookkeeping and government remittances for quality. They also do recommended corrections to journal entries for any identified issues.

Hiring an accounting firm can be costly; however, they provide business owners peace of mind knowing their accounting is complete and accurate. They will also provide advice and strategies to reduce the business’s tax obligations, which can lead to savings far greater than the fees the business paid to the accounting firm.