Compare Canadian Robo-Advisors

Compare dozens of Canadian robo-advisors and find the one that best suits your needs.

Qtrade Guided Portfolios

Qtrade Guided PortfoliosNext $400,000,

Nest $500,000,

Above $1 million

Wealthsimple Invest

Wealthsimple InvestDeposit from $ 100,000 and more : 0.4 % + MER,

More than $ 500,000: 0.4 % + MER

Justwealth

JustwealthOver: 0.40 % + MER

Questwealth Portfolios

Questwealth PortfoliosWith a balance of $ 100,000 : 0.20 % + MER

Nest Wealth

Nest WealthBetween $75,000 and $149,999 : $50 a month,

Between $150,000 and $324,999 : $100 a month,

$325,000 and above : $150 a month

RBC InvestEase

RBC InvestEase

SmartFolio

SmartFolioNext $150,000 : 0.6% + MER,

Next $250,000 : 0.5% + MER,

More than $500,000 : 0.4% + MER

CI Direct Investing

CI Direct InvestingNext $ 350,000 : 0.4 % + MER,

More than $ 500,000 : 0.35 % + MER

ModernAdvisor

ModernAdvisor$ 10,000 to $ 100,000 : 0.50 % + MER,

$ 100,000 to $ 500,000 : 0.40 % + MERV,

$ 500,000 and over : 0.35 % + MER

Frequently asked questions about Canadian Robo-Advisors

HOW TO COMPARE ROBO-ADVISORS WITH HARDBACON?

The main Canadian robo-advisors are very similar when it comes to offering services and even portfolios. The most important question is therefore the management fees. To compare the different advisors on this criterion, enter the amount you wish to invest through a robo-advisor in the left sidebar, and the estimated annual fees for each robo-advisor will appear in the comparison tool. Finally, several robo-advisors offer socially responsible portfolios that will appeal to the investor who wishes to invest in this type of investment value. To choose the ones that offer such type of investment, select this type of portfolio in the left sidebar.

WHAT IS A ROBO-ADVISOR?

WHY CHOSE A ROBO-ADVISOR INSTEAD OF A TRADITIONAL FINANCIAL ADVISOR?

WHAT TYPES OF INVESTMENTS ARE AVAILABLE WITH ROBO-ADVISORS?

WHAT ARE THE FEES ASSOCIATED WITH AN INVESTMENT VIA A ROBO-ADVISOR?

WHY DON’T YOU COMPARE BETTERMENT, WEALTHFRONT OR PERSONAL CAPITAL?

DO ROBO-ADVISORS BEAT THE MARKET?

HOW DO ROBO-ADVISORS MAKE MONEY?

WHAT IS THE BEST ROBO-ADVISOR IN CANADA?

HOW MUCH MONEY CAN YOU MAKE WITH A ROBO-ADVISOR?

Read more on robo-advisors in Canada

Investing

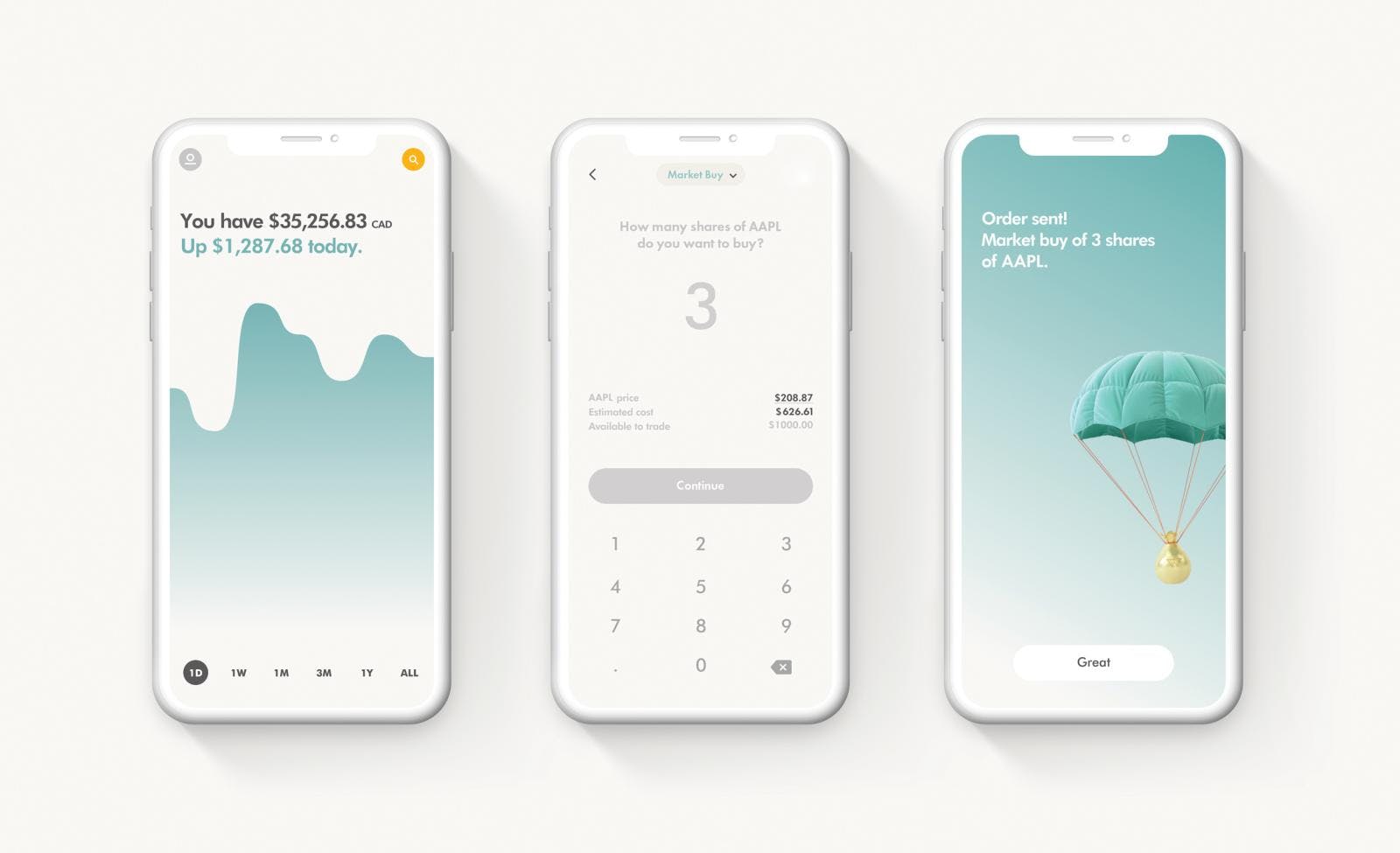

A review of Wealthsimple

Wealthsimple is an online investing service founded by Michael Katchen in 2014 in Toronto. Today the company has over $70 billion in assets under administration. Wealthsimple stood out from the start by offering smart and simple investing without the high fees and account minimums associated with traditional investment management. The investment is made in a […]

Investing

Questrade VS Wealthsimple: Which Online Broker Should You Choose?

Online brokerage has grown in popularity in recent years, driving down trading costs between fiercely competitive platforms. There are now a wide variety of online brokers on the Canadian market, with different prices, features and tools. With the arrival of new players and an expanding user base, it can be difficult for you to find […]

Investing

Investing in Fractional Shares in Canada: What You Need to Know

The annualized average return of the S&P 500 index is around 10%. Some stocks that make up the S&P 500 are worth hundreds or thousands of dollars, which means they may be out of reach for the average online investor, bringing the need for fractional shares into focus. In recent years, bull runs have built […]