EQ Bank Card Review: Is Feeless Banking Finally Here?

By Maude Gauthier | Published on 16 Jan 2024

Look out, Big 6! EQ, a charter bank, has got a brand new card. If you’re sick of hands in your pockets, it’s time to break free and get digital with Canada’s favourite online bank. The EQ Bank Card makes it easier to save more with incredible interest on deposits, and spend smarter with cash back on every purchase. Having opened my EQ Bank Savings Plus account, I also ordered my EQ card so I could spend the money in it. Here’s what to know about the EQ Bank Card.

-

Ordering the card

-

Fees

-

Cash back and Interest

At a glance

The very practical EQ prepaid card lets you spend within your budget, and helps you earn interest and cash back.

How to get the EQ Bank Card

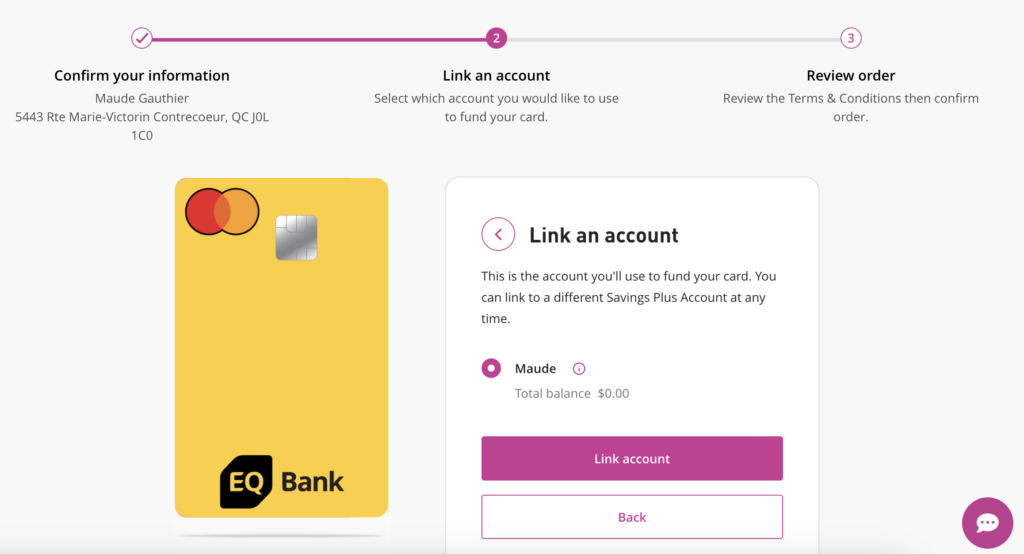

As a new customer, I had to register for an EQ Savings Plus Account and order my EQ card. Once this step is completed, you deposit funds into the Savings Plus account and from there, transfer funds to the EQ card. When you receive your card in the mail, log in to your account to activate it and set your personal identification number (PIN). Here’s a summary of the process:

- Open an EQ account – 2 to 4 business days

- Order card – 5 to 10 business days

- Activate card

- Add funds to the card from your EQ Bank Savings Plus account

You can start using the card once you’ve transferred money from your Plus Savings Account to your bank card. This may seem like an unnecessary extra step, but it’s actually a blessing in disguise. By separating the card from your main account, you don’t risk inadvertently exceeding your budget.

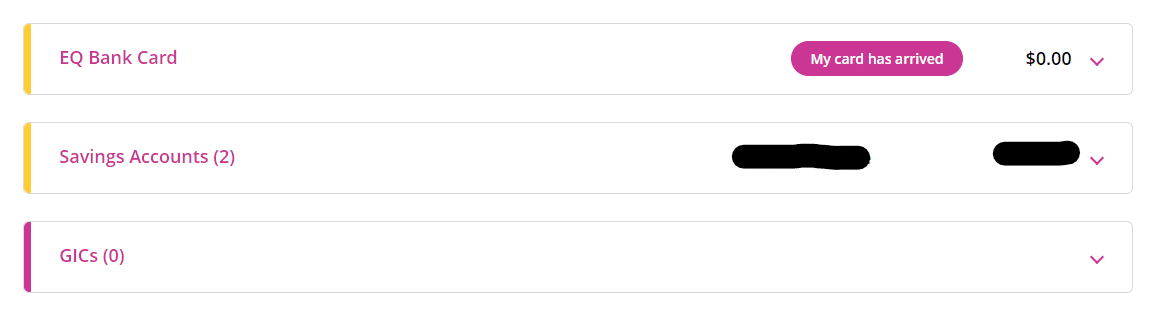

You’ll notice what looks like a new account appear on your dashboard. This is the account linked to your EQ Bank Card, which is separate from your EQ Savings Plus account.

You can instantly top up your card at any time, or transfer funds from the card to your main account.

How does it work?

The EQ Bank Card is a prepaid Mastercard that is accepted everywhere that Mastercard is accepted, which is in over 210 countries. You get the functionality of a debit card and the convenience of a credit card, but without the hassle of an application, credit check, or the risk of high-interest debt.

You simply load your EQ Bank Card with the money you already have by transferring it from your EQ Savings Plus Account to your bank card account. Since the EQ Bank Card is not linked directly to your bank account, you have even more control over your budget.

[Offer productType=”CreditCard” api_id=”63d2cb6a18196b6d2e1928c2″]What to expect from your EQ Bank Card

Having the right financial tools at your fingertips can make all the difference in managing your money effectively. With the EQ Bank Card, there are no minimum balance requirements which means you never have to worry about fees busting your budget.

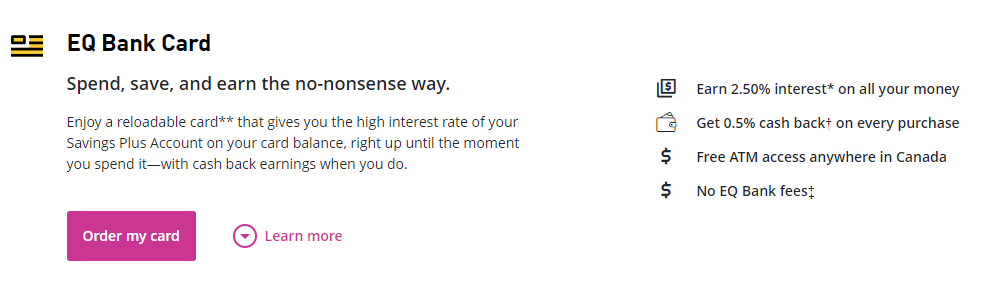

Plus, unlike most debit cards and chequing accounts out there, you can actually earn money on every dollar saved and spent. You get a high-interest rate on your deposits and cash back on all card purchases, plus free withdrawals from any ATM in Canada and freedom from surcharges.

Free ATM access

EQ Bank doesn’t charge any ATM withdrawal fees, allowing you to access your money for free at any ATM in Canada. Even better, EQ will reimburse any surcharges or out-of-network fees charged by ATM providers and you’ll see that money put back into your account within 10 business days. You won’t be reimbursed for any fees charged by ATMs outside of Canada.

Cash back on purchases

Every purchase you make with your EQ Bank Card earns 0.5% cash back and the money is deposited onto your card once a month. Now, instead of feeling like you’re losing money from every purchase, you can actually save a little extra for those things you really want. Especially since the price of everything has gotten out of hand.

You won’t earn cash back on:

- Fees charged to your card

- ATM withdrawals

- Cash advances

- Credits to your account

- Refunded card transactions

Earn interest on every dollar

Every dollar loaded onto your EQ Bank Card gets the same great interest rate that your EQ Savings Plus Account gets – which is at least 2.5% at the time of writing and up to 4.0% if you request direct payroll deposit. That means your money keeps working hard for you right up until the moment you spend it, giving you more bang for your buck – even when it’s earmarked for bills.

Interest is calculated daily and paid out to your account monthly. The interest rate is subject to change anytime without notice, so make sure you check out the EQ website for the most up-to-date information.

No more annoying fees

Besides no ATM fees (in Canada), there are a few more pesky fees you don’t have to worry about. Your EQ Bank Card comes with zero transaction fees, foreign transaction fees, monthly fees, or inactivity fees. When you make a purchase in another currency, you only pay the Mastercard Currency Conversion rate at the time of the transaction – and not the additional 2.5-3% surcharge that most other credit cards add.

Stop letting the other guys take a cut of your cash. Make purchases, pay bills and travel with peace of mind knowing you’re not lighting your hard-earned bacon on fire.

Additional Mastercard perks

Since the EQ Bank Card is a prepaid Mastercard, you get access to exclusive Mastercard perks. With Mastercard Priceless Experiences, you can book unique adventures in your city or while travelling. Get discounts, hotel upgrades and more – all you need to do is sign up and register your card on Priceless.com.

You’re also protected from unauthorized and fraudulent charges under Mastercard’s Zero Liability Protection Policy. Enjoy greater security and stay worry-free knowing you won’t be on the hook for transactions you didn’t authorize.

If your card is lost or stolen, don’t panic – just lock it! Secure your account in a few clicks through the EQ Bank mobile app, online banking, or by calling the customer service line. Get back in control of your finances at the touch of a button.