Self Storage Insurance in Canada: How to Safeguard Your Stuff

By Heidi Unrau | Published on 14 Aug 2023

Self storage insurance can protect your bottom dollar should the unexpected happen. The cost of living is on the rise, forcing people into smaller and smaller living spaces. When square footage is tight, a self storage unit is a popular way to hold onto those cherished items that you don’t have room for. But is your stuff safe?

Truth hurts: nothing is ever 100% safe. Also known as storage unit insurance, self storage insurance is essential if you don’t want to pay out of pocket to replace the items in your unit. Understanding how it works, where to find it, and how to choose the right policy can provide peace of mind and financial protection. Here’s what to know about self storage insurance in Canada.

What is self storage insurance?

Self storage insurance is a type of property insurance designed to cover the personal belongings you place in a self-storage unit. It protects against risks such as theft, fire, vandalism, water damage, and other perils that could harm your stored items.

How much does self storage insurance cost?

The average cost of self storage insurance in Canada ranges from $10 to $40 per month, depending on the coverage amount, location of the storage unit, and other factors such as the presence of security systems. This is just the cost of premiums and does not include the cost to rent a self storage unit.

How does self storage insurance work?

When we stash away our valuables in a self storage unit, it’s like sending them on a little vacation. But even on vacation, they need protection. So, how does self storage insurance play the role of that protective umbrella? It works just like the most common types of insurance you’re used to. Here’s how:

Coverage

Self storage insurance covers your belongings against specific perils detailed in the policy. Often, the contents of a self storage unit can be covered under your homeowner’s or renter’s insurance policy as personal property stored off-premises. Some policies may already include this coverage, while others may require an additional endorsement or rider.

Claim Process

In case of loss or damage, you will need to provide proof of ownership and the value of the items. The insurance company will assess the claim and, if valid, compensate you accordingly. You will also need to pay a deductible as you would with any other type of insurance claim.

Exclusions

Be aware of coverage exclusions in your self storage insurance policy, because not all risks are covered. Make sure you read the policy’s fine print to understand what is and isn’t included.

Where to get self storage insurance

Storing your prized possessions is only half the battle. The other half is ensuring they’re properly protected with the right policy. But where do you start? Here’s where to find the right self storage insurance coverage for your needs:

Homeowner’s or Renter’s Insurance

Your existing policy may already cover items in storage. Contact your provider to confirm. If self storage insurance is included in your existing policy, double-check the maximum coverage amount. It’s common to have a different coverage amount for items in a storage unit than for items in your home.

If self storage insurance is not included in your policy, you may be able to add it by contacting your current provider. If you don’t currently have homeowner’s or renter’s insurance, check out our top 3 picks:

Surex

Surex is a Canadian-based online insurance marketplace that allows you to compare quotes from various insurance providers offering homeowner’s insurance and renter’s insurance. In just a few minutes, you can find competitive rates and coverages that suit your needs.

Simply visit the Surex website, answer a few questions, then browse through a range of insurance quotes. Once you’ve found a policy that fits your needs, you can finalize the purchase directly through the Surex platform.

SquareOne

SquareOne is a Canadian insurance provider that specializes in offering tailored home insurance and tenant insurance policies that are customizable to fit your unique needs. After providing relevant details and specifying the type of coverage you want, you’ll receive a quote tailored to your requirements.

The entire process is quick and easy. Once you’ve chosen the right policy for your needs, you can complete the purchase online.

Apollo

Apollo Insurance is a Canadian digital insurance broker that harnesses technology to simplify the insurance-buying process. Offering car and home insurance products through an online platform, Apollo provides instant digital policy issuance, making coverage more accessible and straightforward.

If you need home or car insurance, visit their website, select the insurance product you need, and provide a few necessary details about yourself. Once the quote is generated and meets your requirements, you can purchase the policy online. Pro tip, you may be able to save money by bundling your home and auto insurance.

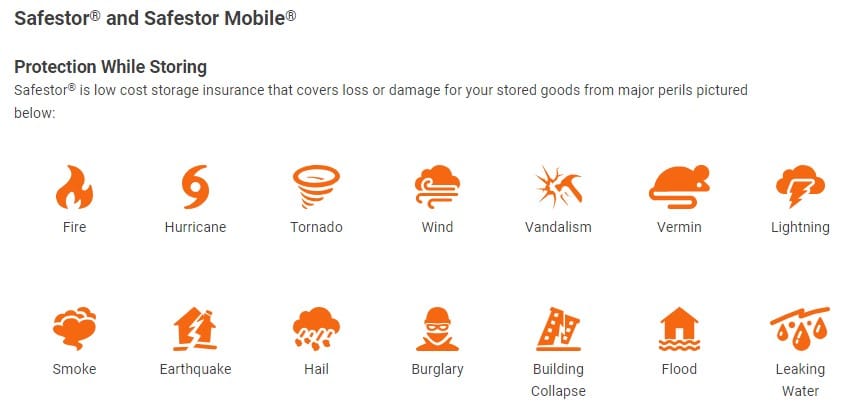

Storage Facility

Many facilities offer insurance at the point of rental. Check their coverage details and compare with other options. For example, Uhaul operates self storage facilities across North America and offers self storage insurance too. It provides coverage against a range of perils including, but not limited to, fire, theft, and natural disasters.

Specialized Insurance Providers

Some insurers specialize in storage insurance and may provide competitive rates and customized coverage. Popular providers that offer storage insurance solutions include Storage Protectors and PAL Insurance Brokers Canada Ltd.

What items does storage insurance cover?

Self storage insurance protects a wide range of personal and business items that people commonly place in storage units. However, certain items are either excluded or may require additional endorsements or specialized policies for coverage. If you have specific valuable items, consider getting them appraised and seeking additional endorsements or policies to ensure they’re fully protected while in storage.

Items most often covered by self storage insurance:

Furniture: Including sofas, chairs, tables, beds, and other household furniture.

Electronics: Such as televisions, computers, stereo systems, and more.

Household Goods: Including kitchenware, linens, clothing, and other personal items.

Tools and Equipment: Both for personal and some business use.

Books, CDs, and DVDs: Personal media collections.

Sporting Goods: Bicycles, sports equipment, camping gear, etc.

Art: Depending on the policy, some artworks might be covered, but very valuable pieces might need additional riders or separate policies.

Business Inventory: For small businesses using storage units for inventory purposes.

Items typically not covered or limited in coverage:

Cash: Money, coins, and banknotes are usually not covered.

Precious Metals and Gemstones: Gold, silver, diamonds, and other precious metals or stones may have limited or no coverage.

Jewelry: While some basic coverage might exist, there’s often a limit. High-value items might need additional endorsements.

Documents: Important papers like deeds, securities, stamps, and passports.

Collectibles: Items like stamps, cards, and rare items may require specialized insurance.

Wine Collections: Depending on their value and rarity, they might need special policies.

Antiques & Rare Items: Antique furniture, rare books, and other valuable old items.

Vehicles: Cars, boats, RVs, and motorcycles often require their own separate policies even when stored.

Perishable Goods: Items like food, plants, or anything that might rot or decay.

Illegal Items: Any item that’s stored illegally or obtained through illegal means.

Explosives and Firearms: Storage facilities often have rules against these items, and they’re typically not covered by standard policies.

What perils are typically covered by self storage insurance?

Self storage insurance policies are designed to provide protection against a range of perils that might cause damage or loss to items stored in a storage unit. While specific coverage and exclusions vary among providers, here are some of the most common perils that many self-storage insurance policies cover:

Fire or Lightning: This is a basic coverage inclusion in most self storage insurance policies, covering damages caused by fires or lightning strikes.

Theft: Coverage typically includes break-ins and theft of items from the storage unit. However, there might be requirements for evidence of forced entry.

Explosion: Damages resulting from any explosion within or around the storage facility.

Windstorm or Hail: Coverage against damages caused by severe wind events, tornadoes, or hail. However, in areas prone to hurricanes or specific windstorms, there may be separate deductibles or exclusions.

Smoke: Damages from smoke, typically from a sudden and accidental cause, are covered. This doesn’t usually include smoke from agricultural smudging or industrial operations.

Vandalism or Malicious Mischief: Damage or destruction of items due to intentional acts of damage.

Some types of Water Damage: This often covers accidental discharge or overflow of water from plumbing, heating, air conditioning, or sprinklers. However, general flooding, especially from external sources like heavy rain, is often excluded.

Riot or Civil Commotion: Damages occurring due to public disturbances or riots.

Aircraft or Vehicles: Damages caused by aircraft or vehicles impacting the storage facility.

Falling Objects: Coverage for damages from objects falling onto the storage unit, excluding items inside the unit falling onto other items.

Building Collapse: Coverage if the storage facility or unit itself collapses.

Weight of Ice, Snow, or Sleet: Damage resulting from the accumulation and weight of ice, snow, or sleet on the storage facility.

Electrical Current: This includes damage caused by electrical surges or short-circuits.

What perils are not typically covered by self storage insurance?

Like most insurance policies, self storage insurance has exclusions too. When shopping for coverage, it’s crucial to read the policy details thoroughly and discuss them with the insurance provider. That way, you can understand what is and isn’t covered and consider additional endorsements or policies if necessary to fill any coverage gaps. These are some of the most common coverage exclusions you can expect:

Flooding: While water damage from issues like broken pipes might be covered, flooding due to natural causes, such as rain or river overflow, is often excluded.

Earth Movement: This includes earthquakes, landslides, and sinkholes.

Vermin, Moths, and Pests: Damage caused by rats, mice, insects, or other pests is typically not covered.

Mold and Mildew: Unless it’s a direct result of a covered peril, like a burst water pipe, damage from mold or mildew is often not covered.

Wear and Tear: Over time, items can degrade or lose their value. This natural wear and tear is not usually covered.

Nuclear Hazard: Damage from nuclear reactions, radiation, or radioactive contamination is typically excluded.

War and Terrorism: Damage resulting from acts of war, insurrections, or terrorism is often not covered.

Chemical Contamination: Damage from chemicals or pollutants might not be covered unless it’s from a covered peril.

Mechanical Breakdown: If an item such as an appliance breaks down while in storage (but wasn’t damaged by a covered peril), it probably won’t be covered.

Intentional Acts: Damages that are the result of intentional or criminal actions taken by the policyholder will not be covered.

Items of Excessive Value: Some policies might exclude or limit coverage for extremely valuable items like jewelry, antiques, or art unless specifically itemized and added to the policy.

Improper Packing: Damage resulting from poor or inappropriate packing might be excluded.

How to Choose the best self storage insurance

Hunting for the perfect self storage insurance policy can feel a bit like hunting for the perfect pair of winter boots – you want the fit to be just right and offer maximum protection. But with so many options out there, how do you zero in on the policy that snugly fits your needs and ensures your treasures are safe from life’s unrelenting curveballs? Here’s a quick check-list:

☑️ Assess Your Needs: Determine the value of your items and the level of protection required.

☑️ Compare Policies: Shop around and look at various policies from different providers to compare coverage, exclusions, cost, and customer reviews.

☑️ Consider the Deductible: Lower deductibles may result in higher premiums but less out-of-pocket cost in the event of a claim.

☑️ Ask Questions: Speak with an insurance agent to ensure you fully understand the policy.

Can I bundle self storage insurance with my car insurance in Canada?

In Canada, self-storage insurance is typically associated with property insurance, such as homeowner’s or renter’s insurance, rather than with auto insurance. However, insurance needs and products can vary widely, and some insurance providers may offer unique bundling options or discounts for holding multiple policies with them.

Often, the contents of a storage unit can be covered under an existing homeowner’s or renter’s insurance policy as personal property stored off-premises. Some policies may already include this coverage, while others may require an additional endorsement or rider.

Insurance providers often encourage customers to bundle different types of insurance, like auto and homeowner’s insurance, by offering discounts. While bundling self-storage insurance specifically with auto insurance might not be a standard practice, you can often bundle your homeowner’s or renter’s insurance with your car insurance. It’s worth asking your provider if such an option exists or if there are discounts available for holding multiple policies.

Protect your stuff with a reputable storage facility: green & red flags to look out for

The best way to protect your stuff is to safeguard your valuables from the risk of making a claim in the first place. Choosing a reputable self storage company is crucial for the safety and protection of your belongings.

Here’s what to look for:

✅ Licenses & Accreditation: Check if the company is licensed and follows the regulations in your province or territory. Look for membership in reputable industry associations, such as the Canadian Self Storage Association (CSSA).

✅ Insurance Options: Verify what insurance options are offered, either through the facility or recommendations for third-party insurers.

✅ Security Measures: Look for strong security features such as surveillance cameras, gated access, individual alarms for units, and on-site personnel.

✅ Climate Control: If you have sensitive items, ensure that climate-controlled units are available and understand their temperature and humidity controls.

✅ Cleanliness & Maintenance: Visit the facility to assess the cleanliness and maintenance of the units and common areas.

✅ Reviews & References: Check online reviews and ask for references from current or past customers to gauge the company’s reputation.

✅ Transparent Pricing & Fair Contract: Ensure all costs, including potential extra fees, are clear and provided in writing. Review the lease agreement carefully to understand all terms and conditions, and don’t hesitate to ask questions.

✅ Accessibility & Convenience: Consider the facility’s location, access hours, and any additional features like drive-up access that may be important to you.

Red flags to watch out for:

⛔ Lack of Security: Inadequate or outdated security measures.

⛔ High Pressure Sales Tactics: Being pushed into a contract or upsold without justification.

⛔ Hidden Fees: Unclear pricing or discovering hidden fees not disclosed upfront.

⛔ Poor Maintenance: Signs of neglect, such as leaks, pests, or general disrepair.

⛔ Bad Reviews & Complaints: Multiple negative reviews or unresolved complaints with consumer protection agencies.

⛔ No Insurance Options: Lack of information or assistance with insurance for your stored items.

⛔ Vague or Incomplete Contracts: A contract that lacks detail or doesn’t clearly outline the terms and responsibilities of both parties.

⛔ Unresponsive Customer Service: Difficulty in reaching customer service or unprofessional behaviour from staff.

Tips to protect your stuff inside a self storage unit

Once you’ve chosen a reputable storage facility, the next step is to keep your keepsakes out of harm’s way and make life easier in the event of a claim. Here’s how to protect your stuff inside your storage unit:

Document Everything: Keep an inventory of stored items, including photographs and serial numbers, to assist in any future claims.

Use Quality Packing Materials: Protect fragile items and prevent damage during transport and storage.

Climate Control: Consider a climate-controlled unit if storing sensitive items like electronics,, antiques, or anything else that could be damaged by moisture and extreme temperatures.

Security Measures: Choose a facility with robust security such as cameras, alarms, and on-site staff.

Regular Checks: Visit your storage unit regularly to ensure everything is in order.