The Top Betterment Alternatives in Canada

By Arthur Dubois | Published on 28 Mar 2023

Are you on the hunt for Betterment alternatives for Canadians? Robo-advisors like Betterment, which uses computer algorithms to give personalized advice and help manage your investment portfolio, are numerous in Canada. Many investors find this option to be stress-free, and they end up saving money from the high fees they would typically see with a traditional investment brokerage. Betterment is one of today’s leading robot technology investment platforms in the US, but it’s not available in Canada.

What are Betterment key features?

Other than being an all-in-one robo-advisor and a zero-work investment platform, Betterment has additional features worth considering.

Investments

Betterment uses modern portfolio theory, which suggests diversifying investments will end in better long-term success. This investment platform uses its robots to make smart decisions for its users. However, if you want more control, you can use the “flexible portfolio” tool to adjust the percentage of your investment in any ETF (Exchange Traded Fund).

On top of being able to choose the type of account you like (we covered this above), investors can also choose from various kinds of portfolio options:

- Smart Beta: a portfolio that seeks higher-than-average returns by embracing systematic risks.

- Income portfolio: a portfolio made solely of bonds.

- Socially responsible portfolio: a portfolio that uses ETFs companies whose business aligns with certain social causes.

All in all, Betterment’s investment options are very flexible for all types of investors.

Financial planning packages

If you wish for a little more hand-holding, Betterment offers advice packages. The first is a “getting started” package, which costs $199. You get 45 minutes to help you set up your account, learn about Betterment’s tools and features, and make your first investments.

The other 4 packages each cost $299 for 60 minutes of phone time, with advice tailored to your situation like marriage, family planning, retirement, college planning, and general financial guidance.

With all packages, you’ll speak with a certified financial advisor.

High yield savings

Betterment also offers a savings account called Everyday. It has an interest rate of 1.37%, but you won’t pay a fee on your balance. Your savings will get up to $1 million in FDIC insurance coverage. You can stash as much money as you wish in your Everyday account, or as little. There’s no minimum balance.

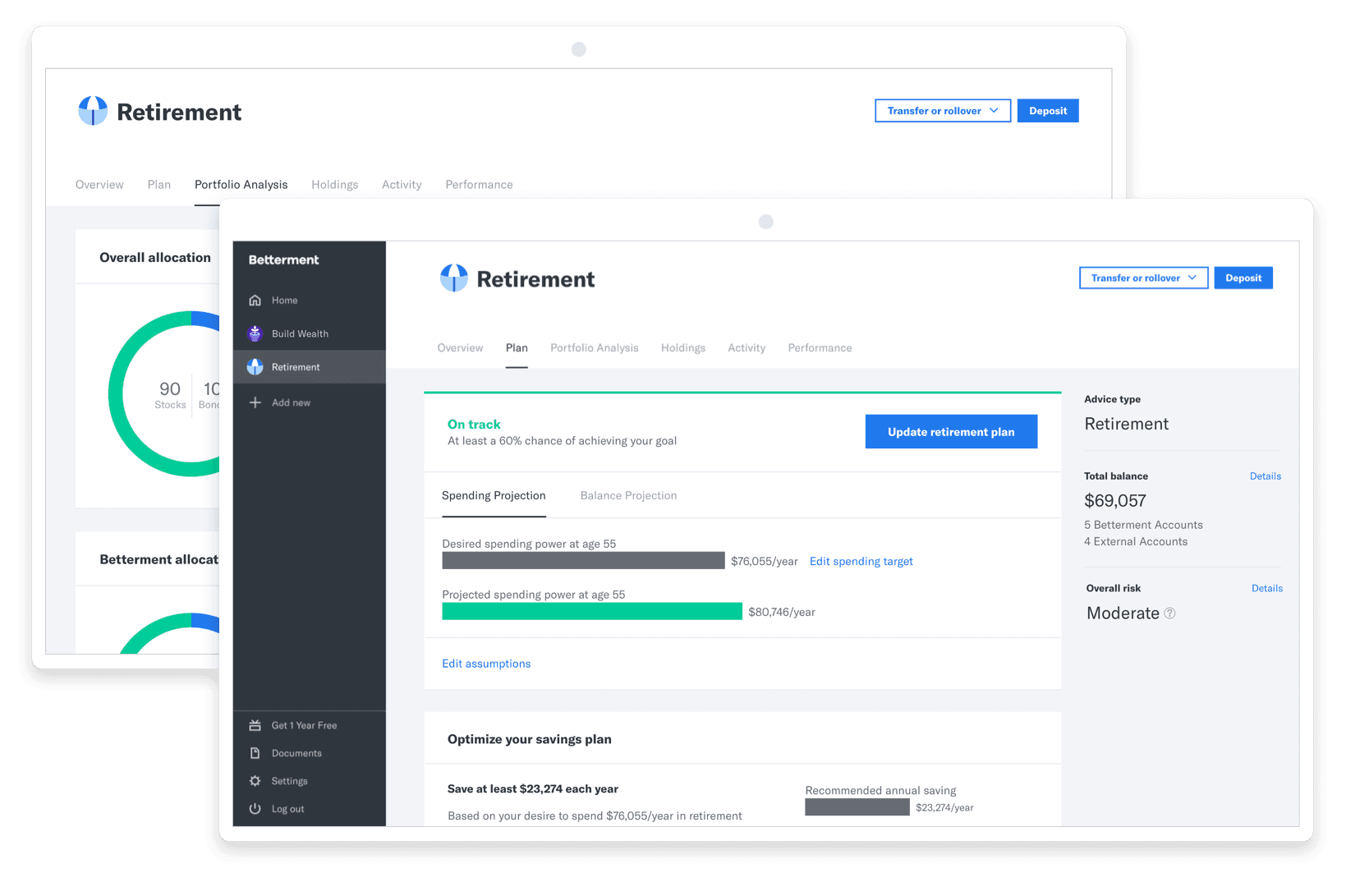

RetireGuide

With RetireGuide, you can link external accounts, including 401(k)s, giving a full picture of your savings and investment accounts. With this information, the robot can provide comprehensive retirement financial planning advice.

Top Betterment Alternatives for Canadians

Despite its appeal, Betterment is not currently available to Canadian investors. Fortunately, there are several Canadian alternatives that offer similar portfolio management features and can help you improve your investment strategy. Here are some of the best Betterment alternatives for Canadians to consider, each one appeared on our list of Canadian robo advisors.

Wealthsimple Invest

This investment robo-advisor is a great alternative to Betterment for Canadians and offers a free comprehensive portfolio review that includes accounts that are not with the platform. If you transfer investments greater than $5,000 to Wealthsimple Invest, you’re eligible for a transfer fee reimbursement by completing an online application.

You’ll receive an analysis of your portfolio allocation, account fees, and tax efficiency, and have access to a free tax-loss recovery feature that can offset your investment losses by reducing your taxes on investment gains. Additionally, you can request financial advice and receive a personalized financial report from a team of experts that is tailored to your specific goals. The robo-advisor builds your portfolio by selecting assets based on your risk tolerance, which means that even a $100 portfolio can enjoy the same diversification as a $100,000 portfolio.

Investors can choose the Socially Responsible Investment (SRI) option to create portfolios that include companies with a positive human rights record, low-carbon companies, and clean tech innovators, as well as AAA-rated Canadian federal bonds. Wealthsimple also offers Halal Investing, which is an investment portfolio designed for investors who comply with Islamic law.

Plus, this robo-advisor provides a wide range of technological features, including Overflow, a tool that lets users transfer excess funds from their chequing accounts, and Roundup, which rounds up debit and credit card purchases to boost investments.

CI Direct Investment

CI Direct Investing is another Betterment alternative for Canadians, offering clients financial planning services and access to private investments that can enhance their portfolio diversification. This platform also offers access to high-end investments that all clients can enjoy, and even provide transfer fee refunds up to $150 when transferring an investment portfolio worth $25,000 or more from another financial institution. You can also enjoy risk-free trial use without paying transfer fees.

CI Direct Investing provides a special feature for harvesting tax losses during market events, ensuring you get tax benefits by offsetting gains with losses. It also shares the same opportunities for socially responsible investment (SRI) and provides investment options such as Cleantech, which focuses on clean energy innovations.

You also get access to automatic rebalancing, which will keep your portfolio asset allocation balanced even when the market changes. Rebalancing happens after each dividend payment and every quarter.

Questwealth Portfolios

Questwealth Portfolios through Questrade is another great Betterment alternative for Canadians that is provided by Questrade. With management fees ranging from just 0.2% to 0.25% depending on your investment amount, and management expense ratios (MERs) for Questwealth Portfolio ETFs ranging from 0.11% to 0.23%, your total portfolio fee could be as low as 0.31%.

But that’s not all. If you have taxable accounts or are investing money outside of RRSPs and TFSAs, you can take advantage of tax loss harvesting to reduce your taxes on investment gains. Questwealth also offers actively managed portfolios with no additional cost, meaning a team of experts will monitor the market and adjust your portfolio as necessary. Your investments will also be automatically rebalanced and dividends will be reinvested.

If you need assistance, Questwealth provides excellent customer service through phone, chat, or email, as well as an automatic assistance feature. Additionally, when you transfer your assets to Questwealth, they may reimburse up to $150 per account in transfer fees from your institution. So why not consider Questwealth Portfolios for your investment needs?

Final Thoughts

Without question, Betterment is a great starting point for beginner investors. However, it is NOT available to Canadian investors. Some of the best alternatives for Betterment in Canada include Wealthsimple Invest, CI Direct Investing, and Questwealth Portfolios, which are among the most popular investment platforms in Canada offering comparable features and benefits.