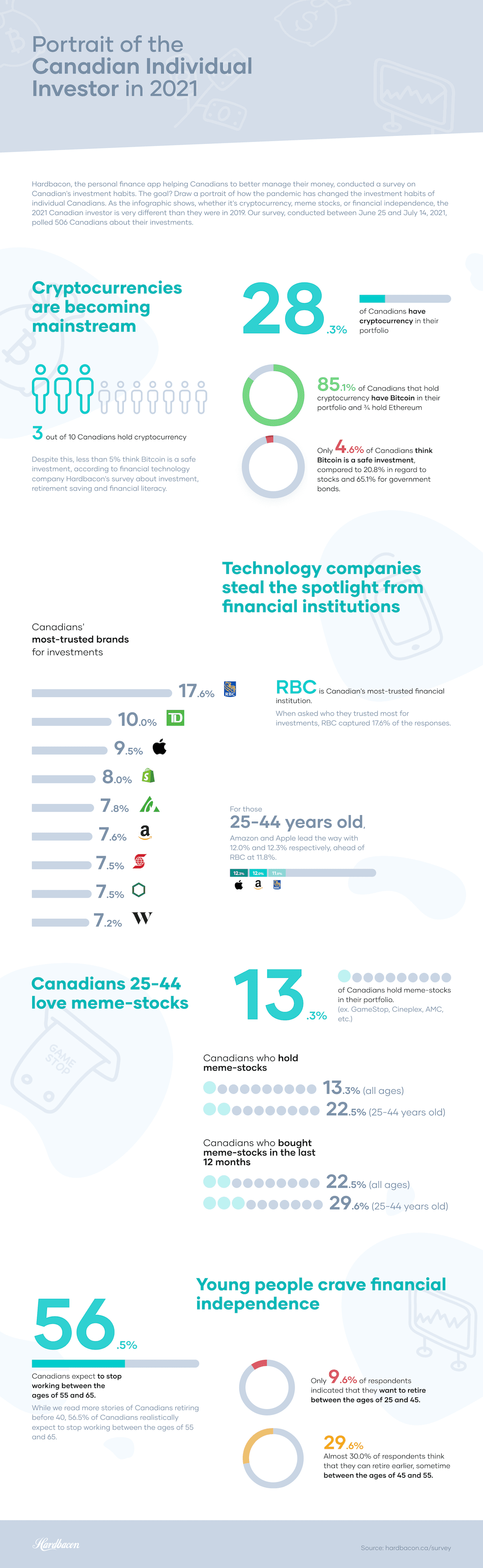

Hardbacon Canadian Investor Survey 2021 Results

By Arthur Dubois | Published on 26 Jul 2023

3 out of 10 Canadians own cryptocurrencies. Surprised? Hold on to your tuques because we live in a country of young investors who are risk takers! At least that’s one of the surprising facts that emerged from a survey of investment habits conducted among Hardbacon users between June 25 and July 14, 2021. However, the investors surveyed are a savvy group: despite the popularity of Bitcoin, less than 5% of Canadians believe it to be a safe investment.

A Survey with Timely and Relevant Information

Confined and with more time on their hands than ever before, the growing number of do-it-yourself investors has taken online brokerage platforms by storm in 2020 and 2021. This investment craze has benefited our app, which, in addition to its planning and budgeting features, allows users to track their investments.

We have had a front row seat to the transformation of the North American stock market, where retail investors have disrupted the established order of Wall Street and Bay Street. Indeed, these new investors have shown that they can induce movements by drastically changing the price of certain stocks. Our investing, retirement savings and financial-literacy survey reached out to Canadian investors to get a sense of this diverse crowd.

The survey was conducted among Hardbacon users between June 25 and July 14, 2021. A total of 506 Canadians responded to our questions. The data was weighted by language to properly represent the proportion of French and English speakers in the country.

Cryptocurrency Isn’t on the Investment Sidelines Anymore!

We’re hearing more and more about it, especially when Elon Musk decides to tweet about it: crypto is here to stay. Our survey reveals that 28.3% of Canadians have cryptocurrencies in their wallet. As for Quebecers, we’re talking about 25.6%. That’s huge! Has it become mainstream? Few companies accept payments in Bitcoin, so … not yet!

On the other hand, 85.1% of Canadians who invest in crypto hold Bitcoin and 75% have Ethereum. A little more cautious than others, 79.6% of Quebecers surveyed own Bitcoins, while 69.4% have acquired Ethereum.

Even though only 1% of Quebecers and 4.6% of Canadians believe that Bitcoin is safe, that doesn’t stop them from buying in! By comparison, 12% of Quebecers and 20.8% of Canadians surveyed believe that stocks are the safest investment. Not surprisingly, these percentages rise to 85.5% and 65.1% respectively for government bonds.

Meme Stocks Gain Value

Once a risk-taker, always a risk-taker! Have you heard of GameStop? Probably, since the company made headlines in the winter of 2021. A high-profile case of the meme-stock phenomenon, it suddenly became very popular thanks to the story going viral on the web. Young investors who are very active on various online groups have drastically increased the value of its stock. Other examples include Cineplex and AMC.

Are you as surprised as we are to learn that 13.3% of Canadians own this type of stock in their portfolio, given its volatility? This percentage increases to 21.2% among those who own cryptocurrency. As for Quebecers, we are talking about 8.9% (and 11.2% among crypto holders). Nearly 20% of Canadians and 15% of Quebecers have purchased this type of stock in the past 12 months. For those who own crypto-currencies, the figures rise to 33% of Canadians and 22.4% of Quebecers. This means that a significant portion of our respondents share an appetite for risk and speculation!

Is the picture similar for young people? Among 25 to 44 year-olds, 29.6% of Canadians and 17.2% of Quebecers have bought equities in the past 12 months. In addition, 22.5% of Canadians and 11.8% of Quebecers still own them.

Where Is Investor Confidence Headed?

Quebecers love Desjardins, a relationship that has been going strong for decades. The financial cooperative is favoured by 20.3% of them. But less traditional players are making significant inroads. When asked which brand they trust the most when it comes to investing, 15.5% choose Wealthsimple. Wealthsimple is even more popular than Desjardins among Quebecers aged 25 to 44.

In contrast, Canadians see Royal Bank of Canada (RBC) as the winner, with 17.6 percent of respondents saying they are most confident in RBC. Among younger Canadians, when asked who they trust when it comes to investing in large technology companies and financial institutions, Amazon and Apple stand out. They are more trusted than the big banks, at 12.0% and 12.3% respectively, followed by RBC at 11.8%.

What do Canadians and Quebecers base their investment decisions on? You might want to sit down for this: only 15% to 22% identify social and environmental impact as important factors. Wow.

Corporate growth is more of a concern for investors, and that’s normal. Three quarters of Quebecers and two thirds of Canadians have identified this as a factor. For half of Canadians, the company’s past performance is also an element that guides their investment decisions.

Are Quebecers and Canadians really different?

A few other findings emerge from the data. Where Quebecers and Canadians differ the most is in their perception of risk. This is true for both crypto-currencies and meme-stocks: Quebecers are more cautious about the risks associated with them. Even among young people, who are more enthusiastic about crypto and meme-stocks, the gap between Quebecers and Canadians persists. What explains this caution? Maybe Quebecers pay attention to the experts when they warn about the risks of speculation.

Another major difference between Quebecers and Canadians is that there is a greater consensus around certain brands. While Canadians divide their trust among various companies, Desjardins and Wealthsimple stand out in Quebec. The former is a Quebec icon, and Quebecers are very loyal to it. It seems that the data breach has not shaken user confidence too much! But nearly 21% of young people prefer Wealthsimple. Why are young people turning to this platform? Possible explanations include its name brand and its French media campaign in the Quebec market.

FIRE Is Gaining in Popularity, Slowly

Although there are many stories of Canadians and Quebecers retiring before the age of 40, the majority of those surveyed actually plan to stop working between the ages of 55 and 65. We are talking about 56.5% of Canadians and 54.6% of Quebecers. Another point on which we agree! About 10% of respondents still indicated that they want to retire between the ages of 25 and 45. Will crypto and meme-stocks help them get there?