Income properties that $1M can get you in these 11 Canadian cities

By Clément Deffrenne | Published on 24 Apr 2022

Investing in real estate is often seen as a simple way to increase income and diversify assets. However, making the right investment decisions and properly managing your property assets is not an easy thing. Just to show you, we had fun comparing income properties in various cities across Canada.

For the purposes of our comparison, we established a fictitious budget of $1M and we selected dwellings that best represent their geographic area. In order to compare them effectively, we used the “Gross Income Multiplier” (GIM), which is calculated by dividing the property’s purchase price by its annual gross income. It’s not the most accurate ratio, but it’s the easiest one to use. Don’t base your decision to invest in a building based solely on this ratio. Also note that this represents potential income, as the assumption is made that the building is always rented, which may not be the case.

Montreal

We begin our quest in Montreal. This pretty building, constructed in 1960, is located in the Plateau-Mont-Royal (East). On the market for $960,000, this fourplex has 2 three-bedroom units with a large terrace, and 2 loft-style units with a backyard. The city of Montreal is currently experiencing its real estate boom and the Canada Mortgage and Housing Corporation (CMHC) forecasts an annual sale price increase of more than 5%.

Number of units: 4

Living space: 1775 sq. ft.

Potential Gross Income: $50,100

Potential GIM: 19.16

Sherbrooke

Moving across the province, we make a stop in Sherbrooke. This large brick property, built in 2005, is slightly above our budget, and can be yours for $1,075,000. It is located in the Jacques-Cartier neighbourhood and has six units, including one 1-bedroom apartment, two 3-bedroom apartments and three 5-bedroom apartments, and 4 garages.

Number of units: 6

Living space: 11 862 sq. ft.

Potential Gross Income: $73 740

Potential GIM: 14,58

Quebec City

It would be difficult to compare income properties in Quebec without taking a look at Quebec City…This property is located in the Old Port, and has four residential units and two commercial premises. At $995,000, this 1930s building offers breathtaking views of the Bassin Louise.

Number of units: 6

Living space: 2 150 sq. ft.

Potential Gross Income: $79 476

Potential GIM: 12,51

Trois-Rivières

Renowned for having the most accessible real estate market in Canada, this article wouldn’t be complete without Trois-Rivières. So we unpack our suitcases in this 15-unit building. Located in the heart of the city, this property is priced at $1,085,000. In Trois-Rivières you get 15 units for this price, but that’s not all: the real estate agency feels obliged to highlight its “remarkable” maintenance.

Number of units: 15

Living space: 13 538 sq. ft.

Potential Gross Income: $114 252

Potential GIM: 9,5

Ottawa

Heading southeast to the province of Ontario, we begin with the country’s capital, Ottawa. In recent years, strong demand in the Ottawa market has driven up the price of homes for sale. Fortunately, we still managed to find a multi-family property that fits within our budget, or almost: $1,100,000 for this five-unit building, which is located in the artistic district of Hintonburg. The lot includes a brick building with four apartments as well as a detached home.

Number of units: 5

Living space: 6 017 sq. ft.

Potential Gross Income: $51 000

Potential GIM: 21,57

Kingston

Nicknamed “The City of Limestone” for its large 19th century buildings, we were unable to find a property close to our budget, but we were able to save money. This two-unit property is listed for $749,000 and is located in the popular district of Williamsville.

Number of units: 5

Living space: 6 017 sq. ft.

Potential Gross Income: $51 000

Potential GIM: 21,57

Toronto

With one of the highest costs of living in the country, can we find a suitable income property in Toronto within our budget? To my surprise, the answer was yes, but we had to settle with a duplex. This spacious property, located in Dundas, is completely renovated. Each unit has three bedrooms, a laundry room, an outdoor space and a parking space…all for the tidy sum of $979,000.

Number of units: 2

Living space: 1 315 sq. ft.

Potential Gross Income: $69 122

Potential GIM: 14,16

Vancouver

Speaking of an expensive city, we might as well tackle Vancouver. This beautiful city on the west coast is in a category by itself as the most expensive location for housing in Canada, by far, with a median property price estimated at $1.24 million in 2019. We were unable to find an income property within our $1M budget, but we could acquire a luxury apartment. Located in the city centre, this little condo has only one bedroom. Fortunately, a 24-hour concierge service and a parking space is included in this price.

Number of units: 1

Living space: 877 sq. ft.

Potential Gross Income: $36 000

Potential GIM: 27,8

Halifax

This beautiful, completely renovated 19th century building has charm. Its beautiful blue colour made us forget the asking price: $1,145,000. This four-story triplex is located in the heart of Halifax’s south end and offers magnificent views of the harbour and the Atlantic Ocean.

Number of units: 3

Living space: 2260 sq. ft.

Potential Gross Income: $64 560

Potential GIM: 17,74

Edmonton

Since 2014, Alberta’s capital has experienced an abrupt and significant drop in its market value. We therefore easily found an income property within our budget. This 1965 building is contains nine fully-rented apartments, and the agency even tells us that it is an “excellent investment” because it is “easy to manage”. It’s in a great location and is listed for $849,900.

Number of units: 9

Living space: 9060 sq. ft.

Potential Gross Income: $98 325

Potential GIM: 8,64

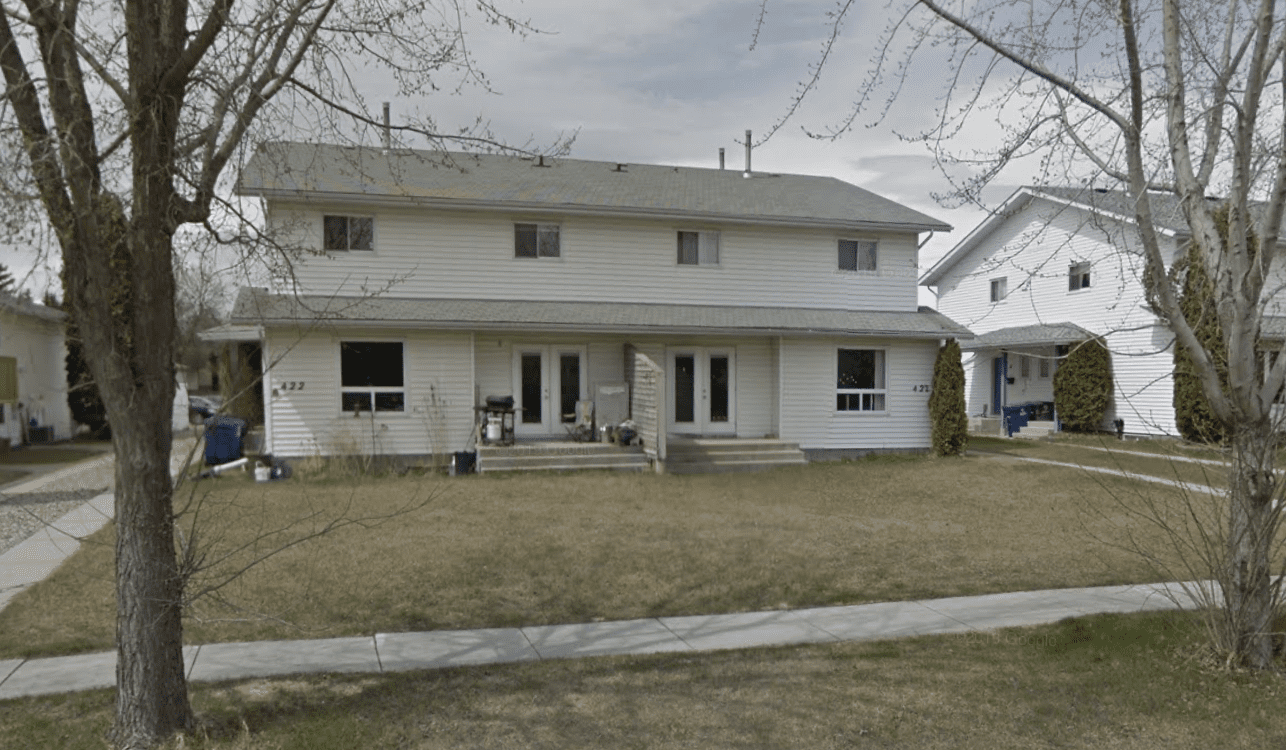

Saskatoon

The real estate market is slowing in Saskatoon due in part to changes to federal mortgage rules. This property, available for $774,900, has four apartments, two of which have a private courtyard.

Number of units: 4

Living space: 6700 sq. ft.

Potential Gross Income: $98 325

Potential GIM: 8,64

The Big Winner

As you may have noticed, the Gross Income Multiplier (GIM) varies significantly from one city to another, but this list gives you a little overview of the real estate market in Canada. Edmonton and Trois-Rivières are our big winners, shoulder to shoulder with potential GIMs of 8.64.

Having said that, is a 1965 building in Alberta really worth more than a new apartment in Toronto? This is difficult to say, because so many variables other than the purchase price and potential income must be considered when investing in an income property.

Remember, demographics drive supply and demand, and without a tenant, your investment can quickly turn into a nightmare. Add to that renovations, the time or costs necessary for management, etc., and at the end of the day, there are sometimes unpleasant surprises. If you’d prefer to invest in real estate without getting your hands dirty, Real Estate Investment Trusts (REITs) might be a more suitable solution.

If you liked this article, you’ll like the Hardbacon application even more. It links to your investment accounts, analyzes your portfolio and helps you make better financial decisions. As a loyal reader of our blog, get a 10% discount off a Hardbacon subscription. To take advantage of this promotion, use the promo code BLOG10 when subscribing through our website.