Affinity Credit Union Sample Cheque: Everything You Need to Know to Find and Understand it

By Arthur Dubois | Published on 02 Mar 2022

From pre-authorizing payments to getting paid, sample cheques still come in handy… even though cheques are rarely used in Canada. The main reason you need an Affinity Bank sample cheque is to share your banking information with someone else.

Understanding your Affinity Credit Union sample cheque

If you know what the numbers at the bottom of your Affinity sample cheque mean, you can probably just share them… without having to go looking for a sample cheque in your banking portal every time someone asks for one.

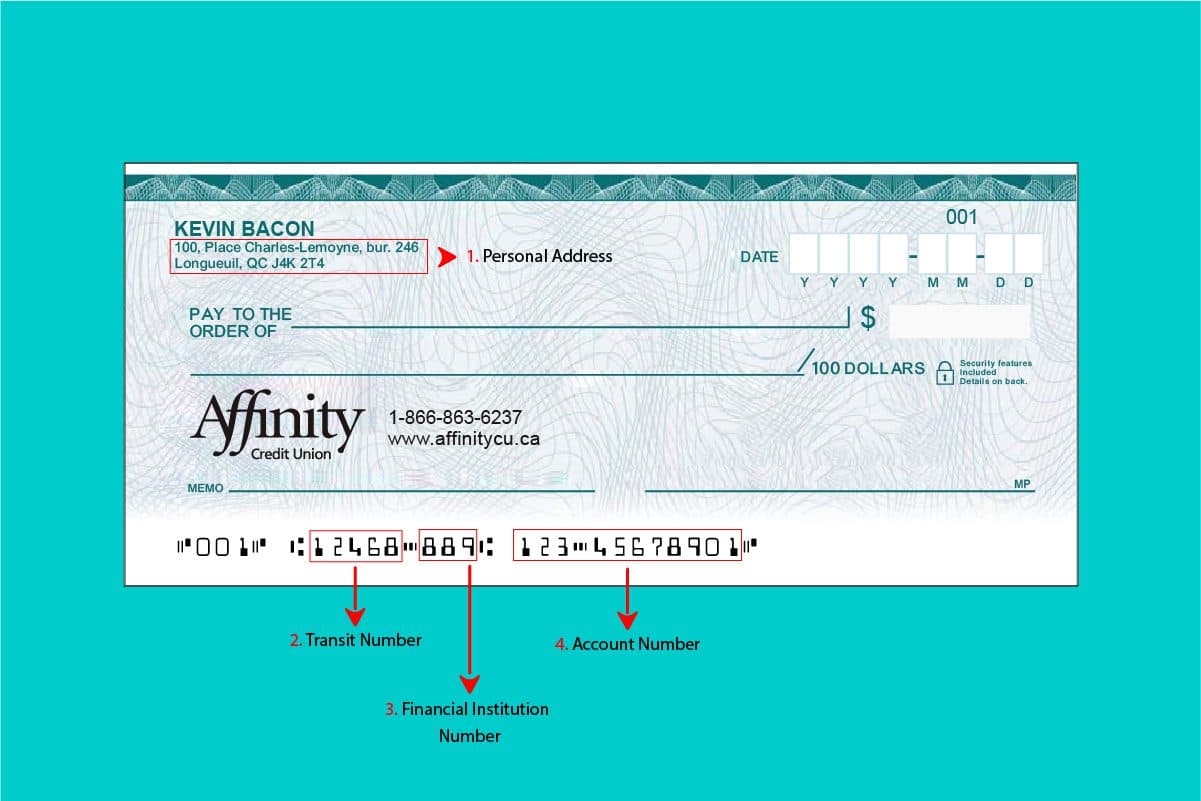

So, here are the important features of a cheque in Canada that you should be able to recognize by looking at one :

1. Your home address

This is the information you don’t need to look at a sample cheque to know. However, it is often needed by those who ask you for a sample cheque.

2. Your branch address

This is the address of your Affinity branch. Note that some Affinity branches have more than one point of service.

3. Your branch transit number

This is a 5-digit number that identifies the Affinity branch to which your bank account is associated.

4. Your bank Institution Number

The institution number is a three-digit number that identifies the financial institution you are dealing with, regardless of the branch you have chosen. Affinity’s institution number is 889

5. Your account number (or folio number)

The account (or folio) number is the identifier for your bank account. Without the transit number and institution number, it cannot be used to transfer money. As a result, it is the most sensitive information you will find on your sample cheque, as it is the number that is associated with your bank account. This number varies in length depending on the financial institution but generally ranges from 7 to 12 digits.

How to find your sample cheque on the Affinity Credit Union online portal

Before the Internet, a sample cheque was a paper cheque with “SAMPLE” or “VOID” written on it to ensure that the cheque could not be used. If you have a chequebook, you can still do this. In fact, a sample cheque is a document that contains all the information displayed on a cheque, so you can still do it that way.

If you don’t have a chequebook, there is a simple alternative. Unlike some financial institutions, which allow a sample cheque to be downloaded from their client portal, Affinity invites its clients to download a document with the same function, a direct deposit form. In fact, it contains all the information available on a cheque and anyone who asks you for a sample cheque will accept it. Here are the steps to download Affinity’s direct deposit form through their website:

- Log into your Affinity Credit Union account using the following link: https://personal.affinitycu.ca/;

- In the left-hand menu, click on “Direct Deposit and Pre-authorized Debit Form”;

- Choose the account you need

- A form that includes the necessary information for direct deposit will appear. All you have to do is save it as a PDF or print it.

Now you know all it takes to find your account information as an Affinity Credit Union customer! Furthermore, you should now be able to write a cheque.