How to Register a Business in Ontario

By Emma Martin | Published on 05 Jun 2023

Starting a business is an exciting time, but there are a few things you need to do to get your company started. Business registration is one of those things. In Ontario, businesses are incorporated under the Business Corporations Act (OBCA). Depending on your business model and goals, you can choose from three legal business structures in Ontario: sole proprietorship, partnership, or corporation.

Registering your business in Ontario is important for many reasons. For one, it ensures that your business is legal and compliant with all provincial regulations. It also allows you to open a business bank account, apply for loans and other financial assistance, and register for GST/HST. Additionally, registering your business allows you to hire employees and enter into contracts. Overall, registering your business in Ontario gives you the foundation you need to operate a successful and legal business.

What legal form of business do you need?

The first step in registering your business is to decide on the legal structure of your business. You can choose between three legal business structures in Ontario: sole proprietorships, partnerships, and corporations.

Sole proprietorship

A sole proprietorship is a legal business structure owned and operated by one individual. This legal business structure is the most widespread. Sole proprietorships are not legally separate from their owners, which means that the owner is personally liable for all debts and obligations of the business.

Partnership

A partnership is an arrangement between two or more people to carry on a business together. Partnerships are usually created by an agreement, which sets out the roles and responsibilities of each partner, as well as how profits and losses will be shared. There are two major partnership types: general partnership and limited liability partnership.

General partnership

A general partnership is a legal entity formed by two or more co-owners who carry on a business together with the intention of making a profit. The partners share in the profits and losses of the business, and each partner has full management and control over its operations.

Limited partnership

A limited partnership is a business arrangement in which one or more partners (the general partners) manage the business and assume all liability for its debts, while one or more other partners (the limited partners) contribute capital but do not participate in the management and cannot be held personally liable for the debts of the business.

Corporations

Corporations are businesses that shareholders own. They are legally separate from their owners, which means that the shareholders are not personally liable for the debts and obligations of the business.

Deciding on the right business structure is an important decision. You should speak with a lawyer or accountant to make sure you choose the best option for your business.

Registering your business name in Ontario

Business name registration is an important part of running a sole proprietorship, partnership, or corporation in Ontario. If you decide to use your own name as your business name, you don’t have to register it. But suppose you want to use a different name for your business. In that case, you must register it with the Ontario Business Registry. In certain scenarios, you may be required to register your business name even if you are using your own personal name.

You may want to create a trade name if your personal name is difficult to pronounce or spell or if you feel that it would be advantageous for marketing purposes to have a different name associated with your business. For example, suppose your personal name is John Smith, and you own accounting business. In that case, you may want to operate under the name “Smith and Associates” or “John Smith Accounting”.

What to keep in mind when choosing your business’s name

If you want to operate under a business name in Ontario, you must register it with the province. There are a few things to keep in mind when choosing and registering your business name:

Your business name cannot be misleading. It cannot be confusingly similar to another business name or trademark. Use the Ontario Business Registry to check if your business name is already taken. You cannot use restricted words or expressions in your business name unless you get permission from the government agency that controls them. For example, you need permission from the Canadian Intellectual Property Office (CIPO) to use the word “bank” in your business name.

You may need permission from another government agency to use certain restricted words or expressions in your business name. For example, you need permission from the Ontario Securities Commission to use the word “investment” in your business name.

Business names and suffixes

Depending on your business legal form, you can choose from a different assortment of business names. For instance, if your business operates as a corporation, you will have to include suffixes such as “Corporation”, “Incorporated”, “Incorporée”, “Company”, “Limited”, or “Limitée” at the end of your corporate business name. This is required by Canada Business Corporations Act. You can also use abbreviations such as “Corp.” “Ltée.”, “Ltd.”, “Inc.”, or “S.A.R.F.”. Other restrictions apply, and you should consult an incorporation specialist or a business lawyer to ensure your desired name is available and complies with naming regulations.

You must do a trademark search to make sure it’s available if you want to register a trademark as part of your business name. You can apply for a Business Name Registration online through the ServiceOntario website. The registration fee is $60. You need to renew your business name every five years. Make sure to renew your business name within 60 days before the expiration date.

Obtaining a NUANS name report in Ontario

NUANS stands for Newly Upgraded Automated Name Search. It is a computerized system that searches for similar or identical business names. The NUANS name report is used by businesses in Ontario to help them choose a unique name for their company. NUANS report is not required for partnerships, sole proprietorships, and number-named businesses. However, if you are registering Business Corporation in Ontario, you will need to obtain a NUANS report.

The first step in the process is to find a NUANS member in Ontario. You can search them on Google, or you can search for NUANS members in the nuans.com database.

There is a fee for each NUANS name report. The fee is based on the number of names that are searched. Businesses can expect to pay around $15-$50 for a single-name search, depending on how fast it will be delivered.

Obtaining a NUANS name report is the first step in incorporating a business in Ontario. Once a business has chosen a unique name, you can then proceed with the incorporation process.

Read more about the best business credit cards in Canada

Registering your business in Ontario

To register a business in Ontario, you must have a valid email address and a business debit or credit card. You will use these to set up your account, access government services online, and pay the registration fee. If you are

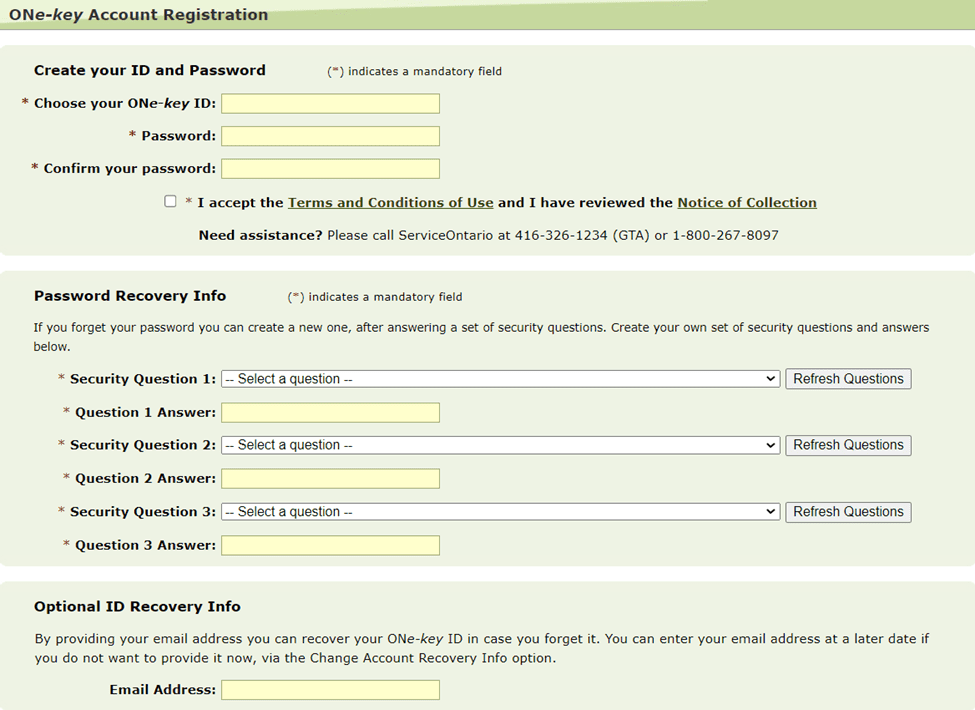

The first thing you need to do is to create a ONe-key account to obtain your ONe-key ID. ONe-key account Canada is a secure online account that allows you to access and manage your government benefits and services in one place.

Choose your ONe ONe-key ID based on your personal preferences. Create and confirm the password, and choose 3 security questions as well as answers to them. It is also recommended to provide your email, so you can recover access to your account if you forget your password.

Use your One-key ID to sign in to your ServiceOntario account.

You should fill in the form on the ServiceOntario website to register a business in Ontario.

How to fill out your business registration

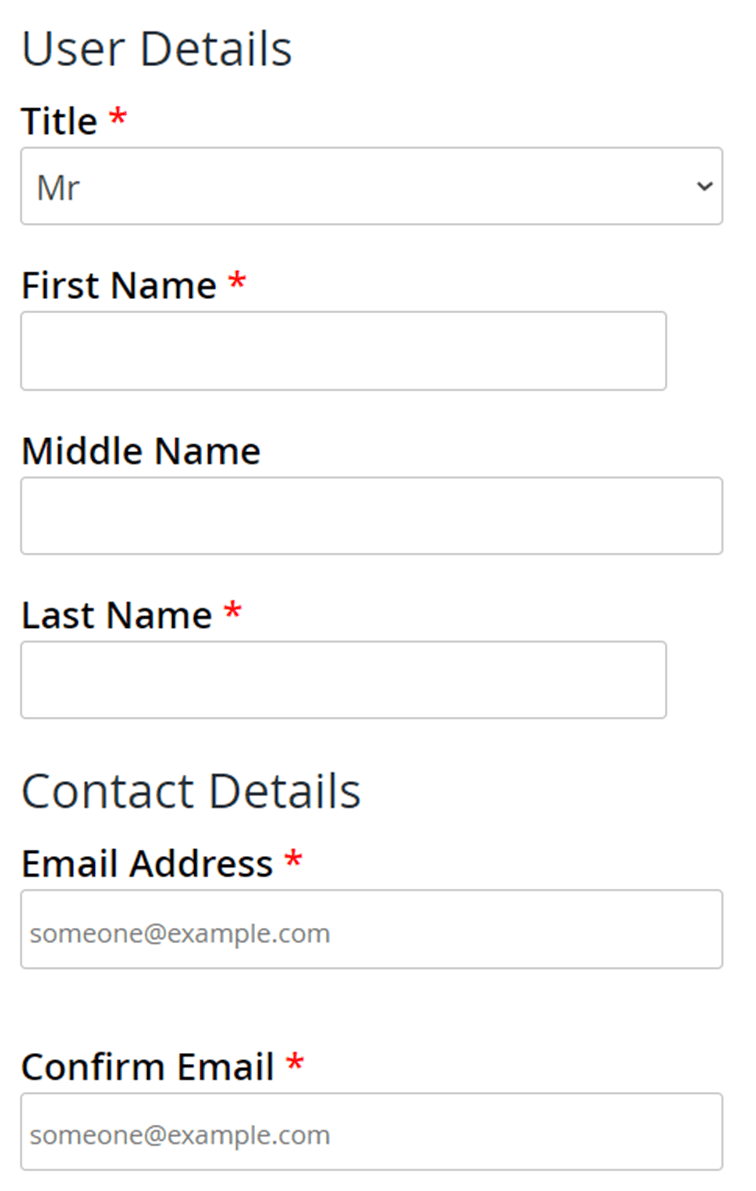

There are a lot of steps, but none of them are very hard. First, provide your credentials as well as your email.

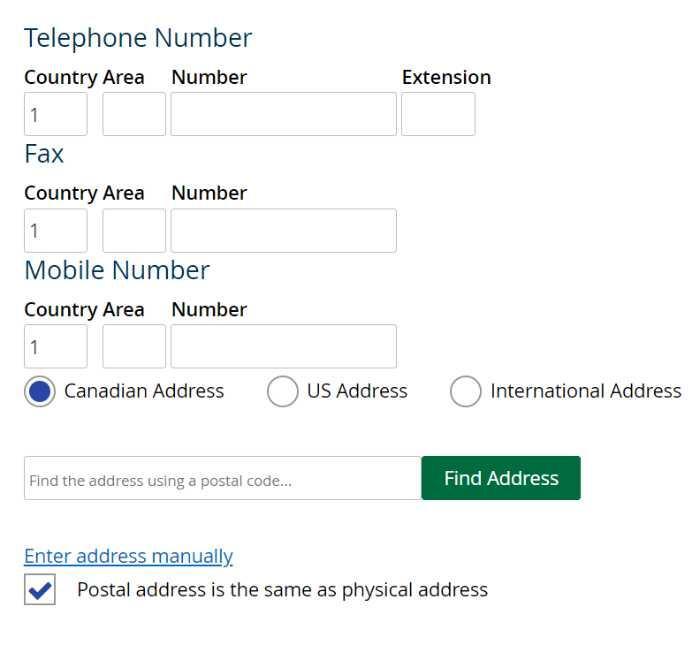

Next, add your phone number and address.

Once you have created your profile, you can register a business in Ontario as a sole proprietorship, partnership, or corporation.

Registering sole proprietorship in Ontario

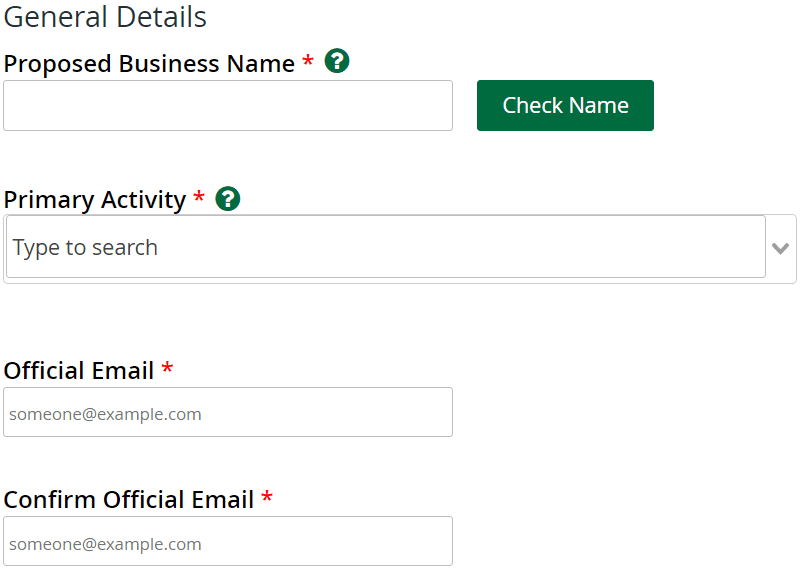

The registration of sole proprietorship is a straightforward process with several steps. First, you have to provide general details about your business. Enter your business name and check if another legal entity already uses it. Business codes are assigned according to the North American Industry Classification System (NAICS). You can start entering your activity name into the field and select the one aligning with your business, or you can use the StatCan website to find your business activity code.

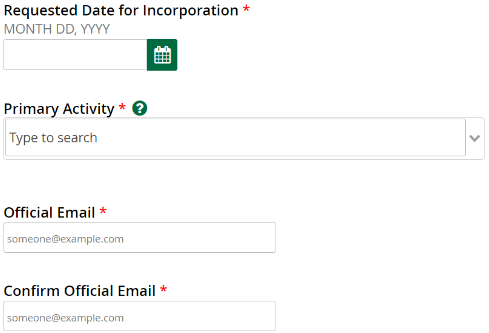

Select your primary activity and provide your business email address. Make sure your business email address is different from your profile email address.

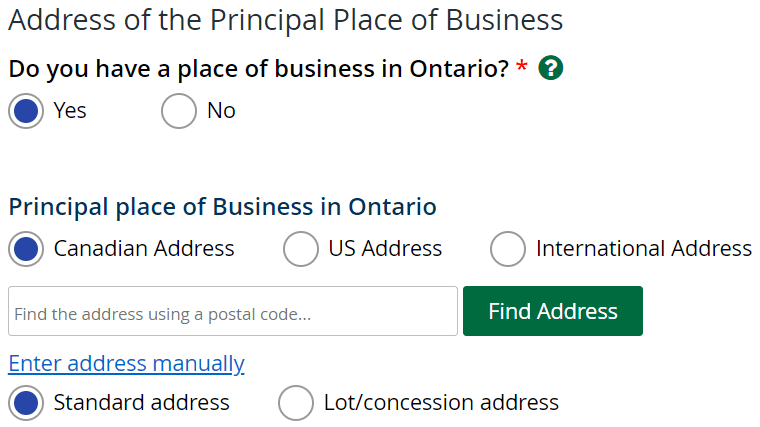

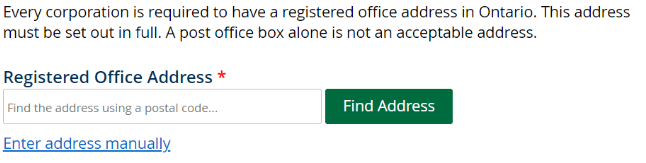

During the next step, you should provide your business address in Ontario, or if you don’t have a place of business in Ontario, you can provide the address in another country.

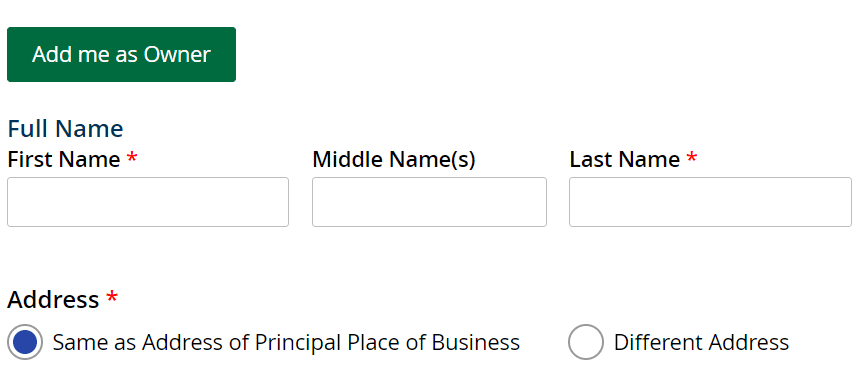

Step 3 requires you to enter the business owner’s credentials and address. If you are registering as a business owner, just press the “add me as owner” button, and your profile contact information will be duplicated to the form.

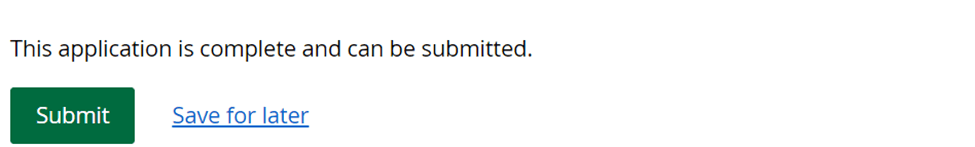

After you fill out all the forms, you can send your business registration application to Ontario Business Registry.

Incorporating a business corporation in Ontario

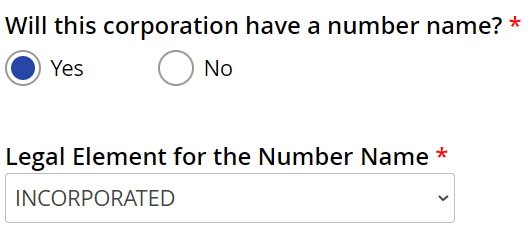

You can incorporate a business corporation in Ontario online. The first step is to select your corporate name. For a non-number name, you must obtain a NUANS report; however, if you want a number name, it can be automatically generated on the website. Most corporations avoid using a number name because of potential branding and marketing issues.

Next, provide general details, such as the requested date for incorporation, primary activity, and official email.

After all the general information is provided, submit your registered office address. Every corporation in Ontario is required to have a registered office address in the province.

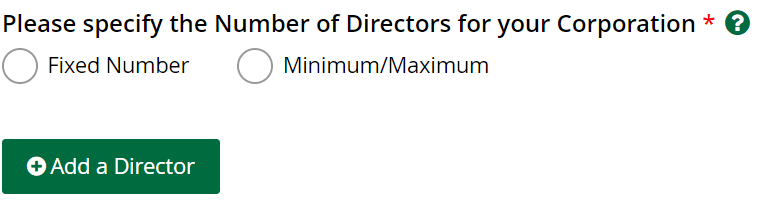

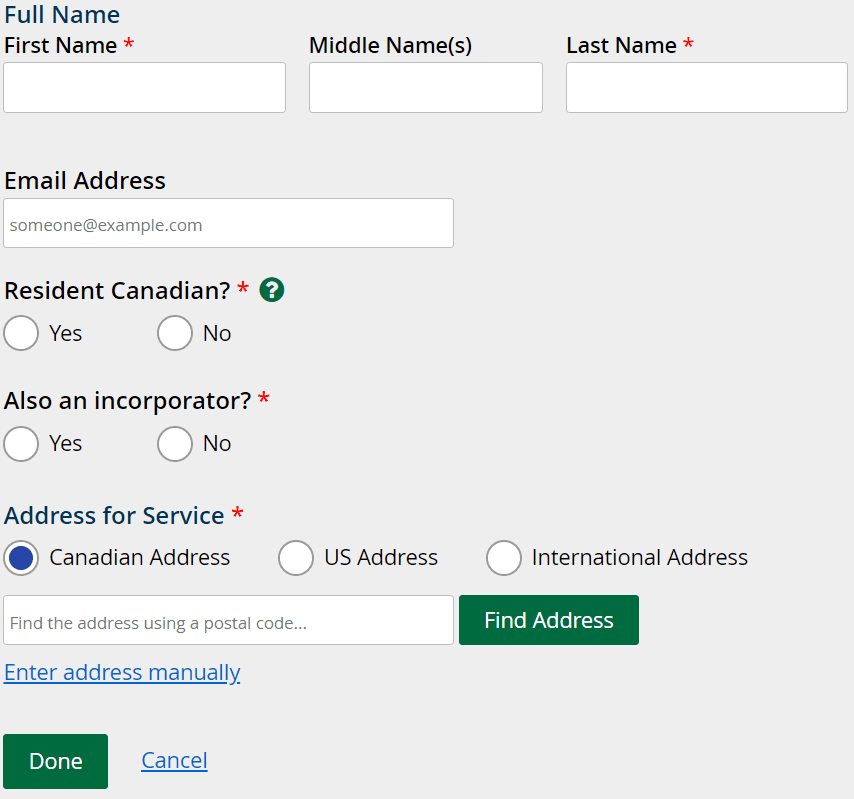

Further, enter the number of your directors. You can choose between a fixed number or a minimum/maximum number. A director in a corporation is an individual who is responsible for making decisions about the company’s operations. The decisions made by the director can have a significant impact on the company’s bottom line. Directors are often elected by the shareholders of a corporation. They may also be appointed by the board of directors.

Provide information about each director of your corporation.

Your company’s legal structure

During the next step, you should provide information about the legal structure of your corporation. There are different classes of shares for corporations, which are determined by the rights and privileges that come with them. The most common class is Class A, which gives the holder voting rights and a proportionate share in the company’s profits. Class B shares may offer more financial benefits but have limited voting rights. Class C shares offer more tax advantages but have no voting rights.

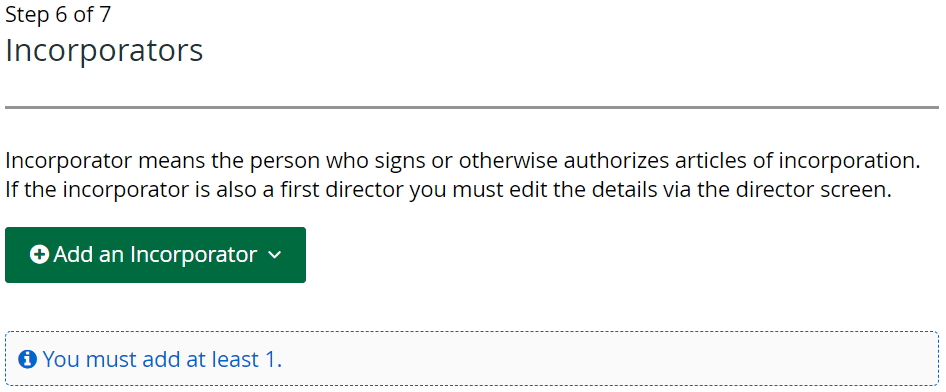

After filling out the shares & provisions form, you should provide information about incorporators. An incorporator is an individual or corporation that incorporates a new business. The incorporator may be responsible for filing the required paperwork, paying the necessary fees, and ensuring that the business meets all incorporation requirements. Once the business is incorporated, the incorporator may also play a role in its governance.

Once all forms are filled out, you should review all the information and submit your incorporation application.

What are business registration fees in Ontario?

The government fee should be paid for registering your business in Ontario. You can check the fees on the ServiceOntario website. As of July 2022, the following fees are applicable for business registration in Ontario:

| Sole Proprietorship | $60 |

| General Partnership | $60 |

| Ontario Limited Liability Partnership | $60 |

| Extra-Provincial Limited Liability Partnership | $60 |

| Ontario Limited Partnership | $60 |

| Business Corporation | $300 |

A quick & easy business hack

Ownr is an online platform that helps you register your business in Canada on the cheap. Whether you’re starting from scratch or incorporating an existing business, Ownr simplifies the process and provides all the necessary resources you need to succeed.

You can choose your business type, like a sole proprietorship or corporation. Then, Ownr guides you through the steps of registering it with the government and even helps with creating legal documents, like partnership agreements. Plus, Ownr has some awesome tools to help you manage your business, like finding the perfect business name and address.

Should you open a business bank account for your Ontario business?

Opening a business bank account is beneficial for your business. There are a few key reasons you might want to register a business bank account for your Ontario business. First, it can help to keep your personal and business finances separate. This can be important for tax purposes and also helps to give you a clearer picture of your business’s financial health. You will also qualify for a business credit card as a business account holder. Having a dedicated business bank account can also make it easier to apply for business credit in the future.

Corporate Platinum Credit Card By American Express

This credit card is designed to help businesses grow by providing valuable perks, including a welcome bonus, the ability to earn Membership Rewards points, and access to Amex Offers. Plus, you’ll enjoy perks like complimentary airport lounge access and no foreign transaction fees. So whether you’re registering a new business or running an established one, the American Express Business Platinum Card can help you get the most out of your business spending.

Business Edge Card By American Express

The Business Edge Card by American Express is a great credit card for business owners who want to earn rewards on their business expenses. With this card, you can earn up to 10х points for each $1 spent on eligible business expenses like office supplies, gas, and travel.

Plus, you’ll get access to exclusive business benefits, such as $1000 insurance for eligible items purchased with this card and a 24/7 customer service line. The Business Edge Card is a great card for business owners who want to earn rewards on their business expenses and save money on interest.

Business Gold Rewards Card By American Express

The Business Gold Rewards Card by American Express is a great choice for businesses. It offers a variety of benefits, including cash back, points toward travel, and more.

You can pay a portion of your debt over time with interest with a Flexible Payment Option (FPO). You will just pay interest on charges you opt to pay overtime at a normal yearly rate of 19.99%. Plus, you can earn 1x points on select business categories.

Disclaimer: American Express is not responsible for maintaining or monitoring the accuracy of information on this website. For full details and current product information, click the Apply Now link.