The 7 Best Virtual Credit Cards in Canada

By Louis Angot | Fact-checked by Maude Gauthier | Published on 04 Apr 2024

Thanks to virtual credit cards, gone are the days of fumbling through your wallet for that elusive plastic. A virtual credit card can be exclusively digital or have a physical counterpart. Virtual credit cards can also be used to shop in-store, as long as the payment terminal supports mobile wallet payments. Most of the virtual credit cards on our list are prepaid credit cards. We also listed some business credit cards.

1. Neo Credit – Best Virtual Credit Card Overall

[Offer productType=”CreditCard” api_id=”60fed96813fd2f260ff90748″]Neo offers a real credit card and not only a prepaid card. On average, Neo Credit holders can enjoy 5% cash back from numerous partners across the country, including Netflix, Avis and Clearly. As soon as your application is approved, you will be able to add your virtual Neo Credit card to Apple Pay or Google Pay and start using it.

Neo offers a user-friendly mobile application that allows you to check the availability of nearby partners. Plus, there’s no limit to the amount of cash back you can earn, and some online and brick-and-mortar stores offer deals of up to 25% cash back.

Neo Credit also stands out for the absence of annual fees, while offering the possibility of opting for a subscription which confers additional advantages. For example, by subscribing to the Travel perks (not available in Quebec) at $4.99 per month, you get 2% cash back on some travel transactions, a 1.5x discount at travel partner hotels, as well as access to Priority Pass airport lounges in more than 1,300 locations worldwide. Additionally, this benefit provides comprehensive travel insurance coverage, including emergency travel medical care, trip cancellation, car rental and flight delays.

2. EQ Bank Card – Best Prepaid Card

[Offer productType=”CreditCard” api_id=”63d2cb6a18196b6d2e1928c2″]The EQ Bank Card is a prepaid card that is linked to an account. It has no monthly fees, no additional foreign currency fees and free withdrawals from any ATM in Canada. This means it is a good card to shop in Canada but also online and out of the country. You can use your card everywhere Mastercard is accepted.

On top of that, you earn cash back on every purchase at a rate of 0.5%. It is not much, but there is no cap on eligible expenses. You also get up to 4% interest on your balance, right up until you spend it. In order to get your EQ Bank Card, all you have to do is set up a Personal Account from EQ Bank and then charge your card with funds.

3. KOHO Prepaid Mastercard – Best for a Customized Plan

[Offer productType=“CreditCard” api_id=“637cf8206bbb7962c19ae225″]The KOHO prepaid card offers three paid plans. You access the virtual version of the card through the KOHO mobile app. The KOHO Essential plan costs $4/month. When it comes to cash back, you get 1% on groceries, transportation, dining and drinks, plus 0.25% on all your other purchases. You also benefit from an interest rate of 5% on your entire balance.

Normally, prepaid cards do not report your spending behavior to credit bureaus. But with KOHO, if you need to build your credit, you can sign up for the credit building feature for a few dollars per month.

The KOHO Extra offers more cash back on your purchases but has fees of $9 per month, or $84 per year. You get 1.5% back on groceries, transportation, and food and beverage, including delivery and takeout. On all your other purchases, you get 0.25% back with KOHO Extra. In addition, your balance generates 5% interest. The Extra is great because it allows you to have no currency conversion fees. You also have access to the services of a financial coach.

The most expensive plan, KOHO Everything, costs $19 per month. You get 2% cash back on groceries, meals and drinks, and transportation. You also get 0.5% cash back on all other purchases and 5% interest on your entire balance, plus you benefit from real-time wire transfers. These two last plans include discounts on Credit Builder.

Don’t hesitate to sign up for a 30-day free trial to see if this card is right for you.

4. Wise Debit Card – Best Virtual Card for Travellers

[Offer productType=”CreditCard” api_id=”61a9498244ba3653baf3dd5e”]Recently launched in Canada, the Wise card is already gaining fans all over the world. This one is really made for globetrotters. With this prepaid card, you can hold a bank account in 40 different currencies. Plus, you can convert money in over 40 currencies and send them to over 160 countries. Thanks to its intelligent technology, this card automatically chooses the currency with the best conversion rate and lowest fees.

Remember that as a prepaid card, this card will not help you build your credit score. However, it will be very useful for online shopping and traveling.

Additionally, the Wise card eliminates the hassle of using ATMs abroad. Your first withdrawals of a total of $350 are free. Then you only pay very low fees on withdrawals after the first $350.

5. Wealthsimple Cash Mastercard – Best for Saving and Investing

Wealthsimple is best known as an investing platform, but it also offers cash accounts that you can access through the all-in-one mobile app. When you open a Wealthsimple Cash account, you get a prepaid Mastercard that also offers a virtual version. If your virtual card is compromised, you can instantly lock it from the app.

The Wealthsimple Cash card offers 1% cash back on all purchases. One of its notable features is its flexibility. You have the option of receiving your cash back directly into your Cash account or investing it in stocks, ETFs or cryptocurrencies. Plus, there are no foreign transaction fees when you spend online and abroad, and the cash in your account earns 4% interest. The account is free with no monthly fees and there is no minimum deposit required.

6. Float Prepaid Business Credit Card – Best for Management Tasks

[Offer productType=”CreditCard” api_id=”636d3ef84106580ea0b71d76″]Float is an innovative prepaid credit card for businesses that eliminates the most tedious and time-consuming expense management tasks. And because it’s prepaid, there’s no need for a credit check. With the free plan, you can issue unlimited virtual cards and up to 5 physical cards in either CAD or USD. For more physical cards and advanced features, you can upgrade to a paid plan.

Virtual cards can be issued for almost any need, and you can easily set and manage spending controls from your dashboard. You get an instant overview of all company spending and real-time tracking for different team members or categories. Plus, transactions integrate with leading accounting software for streamlined bookkeeping.

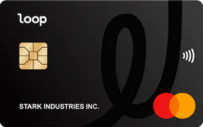

7. Loop Business Credit Card – Best for eCommerce

Loop is a business credit card uniquely designed for eCommerce businesses. It’s a multi-currency card featuring no foreign transaction fees as well as multi-currency accounts that make global transactions easier and cheaper. On the free basic plan, you get up to two physical cards and up to 20 virtual credit cards. If you need more or want to access premium expense management features, you can upgrade to one of the paid plains.

From your Loop dashboard, you can issue cards for almost any use case, set spending limits, create rules for how a card can and cannot be used, and set up transaction notifications. Expenses are automatically categorized, reported, and integrated with popular accounting software.

[Offer productType=”CreditCard” api_id=”6638ea018c0e5d5ce749e449″]What are the benefits of a virtual credit card?

Virtual credit cards offer a unique set of advantages that cater to the modern, digital-first consumer. Most virtual credit cards in Canada are actually prepaid credit cards that you load with your own money. These features can help with budgeting and prevent unauthorized or excessive purchases.

A virtual credit card is designed for online use. It offers a quick and convenient way to pay without the need for physical cards, making online shopping a breeze since it’s readily available in your on your phone in your mobile wallet. Some virtual credit cards, like prepaid ones, are available to individuals who may not qualify for traditional credit cards. This opens up the world of online shopping and other benefits to people who are typically underserved.

If your virtual card information gets into the wrong hands, you can often freeze or delete the virtual card easily. This quick action can halt fraudulent activity in its tracks.

[Offer productType=”CreditCard” api_id=”6638ea018c0e5d5ce749e449″]Are there any drawbacks to a virtual credit card?

Virtual credit cards are convenient, but in some cases, it’s wiser to use your regular card. For example, if you make a purchase that you need to pick up in person, you may need to present your physical card. The same problem can occur when you make hotel or car rental reservations.

The virtual credit card is meant to be used online, which means you can’t use it directly in the store. You have to add it to a mobile wallet to use it in person. Most major banks don’t offer virtual credit cards either, so your best option would be to add your physical card to your mobile wallet.