How to Buy Gift Cards With a Credit Card to Unlock More Rewards in Canada

By Athanasia Nikolakakis | Fact-checked by Maude Gauthier | Published on 13 Feb 2024

Credit cards can be a great way to earn some extra cash back or rewards points on your everyday purchases. However, depending on how you use your cards, you may be leaving a lot of rewards on the table. Gift cards are key to taking full advantage of credit card perks. When you strategically buy a gift card with a credit card, you can enjoy better rewards rates at a wider variety of stores. Gift cards can also help you to qualify for new credit cards’ welcome bonuses.

Take advantage of credit cards’ bonus rates when buying gift cards

Many credit cards offer higher rewards rates on grocery purchases in an effort to better fit cardholders’ lives. After all, we all need to eat. But what if you could earn bonus rewards rates at some of your favourite stores, too? Enter the gift card.

Cash back bonus rates are applied based on where you shop, rather than what the contents of your bill include. This means that a gift card purchased at a grocery store will be counted as a grocery purchase — and will qualify for any bonus grocery rewards. If your credit card offers a better earning rate for grocery purchases, you just have to purchase a few gift cards at your local grocery store in order to enjoy higher rewards at nearly any major store. This bonus rate can even be combined with earnings from cash back apps to truly save as much money as possible.

That being said, it is important to note how credit card merchant categories work. Generally, credit cards make a distinction between grocery stores (which primarily sell groceries) versus supermarkets (which sell a greater variety of goods, often including houseware and electronics). Supermarkets usually are not eligible for bonus grocery earning rates. Each credit card network (e.g. Visa, Mastercard, American Express) decides which category a store is classified under, so you may want to double-check how your credit card classifies local shops before you purchase any gift cards.

Unfortunately, most credit cards that offer bonus grocery rewards have a spending limit for the category. Once you reach that limit, any additional purchases will be subject to the same earning rates as non-grocery purchases. To get around this, you can either shop with a credit card that does not have a spending cap or open up an additional credit card that heavily rewards grocery purchases.

Sometimes, credit cards are a better deal than gift cards

Once you realize just how quickly gift cards can allow you to rack up credit card rewards, it can be tempting to turn to them for most purchases. However, there are still plenty of situations where it may not be wise to pay with a gift card — no matter how appealing the extra rewards may seem.

It might be tempting to stock up on gift cards at the grocery store, then use them to fund your next electronic purchase. After all, if you earn an extra 1% in cash back at grocery stores and your purchase will be several hundred dollars, the gift cards could earn you a small but noticeable amount of money. However, many credit cards come with purchase insurance that extends the manufacturer’s warranty (usually providing up to one extra year). If the item happens to break shortly after the initial manufacturer’s warranty expires and you do not have insurance coverage, you will need to pay several hundred dollars out of pocket to replace it. The few extra dollars you would have earned in credit card points are hardly worth the trouble.

Of course, there are plenty of other credit card perks that can save you money in the long run, too. To ensure that you always get the best deal possible, make sure that you understand which perks your credit card offers. Then, carefully consider whether or not they are likely to be useful for a particular purchase. For example, a credit card’s built-in insurance for lost goods is far more helpful when purchasing a forgetful child’s new lunchbox than it is when buying a frozen pizza.

Is buying a gift card the same as a cash advance?

Pay attention to the purchase of gift cards in certain situations. All major banks record the purchase of gift cards as cash-like transactions, which are treated like a cash advance. Cash advances are usually excluded from promotional offers and do not benefit from the interest-free grace period of more or less 21 days. You may end up paying too much for your gift card.

Banks know you bought a gift card when the merchant’s name reveals the type of purchase. This does not necessarily happen often. A good example is Starbucks gift cards. Starbucks uses CashStar (look for CASHSTAR STARBUCKS GFT on your statement), so banks like CIBC know it’s a gift card and attribute it to a cash advance. This won’t happen if you buy your gift cards while shopping for groceries and they are part of the same bill!

Gift cards can help you earn credit card welcome bonuses

It can be incredibly satisfying to use gift cards to earn higher cash back rates at non-grocery store retailers. However, if you want to earn as many credit card rewards as possible, you might want to consider purchasing gift cards to meet new credit cards’ welcome bonuses.

Some credit card welcome offers can be extremely generous. However, issuers have caught on to the fact that credit card churners sign up for new cards just to enjoy the welcome perks. In response, many now require cardholders to spend a certain amount of money on their new credit card before they qualify for the welcome bonus. Cardholders generally have to meet this minimum spend requirement by a specific deadline, too. Depending on an individual’s spending habits, they may not qualify for the signup rewards. Likewise, credit card churning becomes far less profitable. Fortunately, gift cards can save the day once again.

Buy gift cards with a credit card to extend your welcome offer window

Sometimes, a cardholder might be close to meeting their new card’s minimum spend, but do not need to purchase anything else before the deadline. They could make a needless purchase to meet the threshold, but that would be a waste of money. Instead, it is better to purchase gift cards for stores or restaurants that they frequently visit. That way, future purchases can count towards the minimum spend requirement — even if they do not occur until long after the welcome offer’s deadline.

Resell gift cards to meet credit card churning requirements

As we mentioned above, minimum spend requirements make it difficult to churn credit cards. After all, most people simply do not spend enough money to simultaneously reach several minimum spend requirements. However, you can purchase and then resell gift cards to artificially increase the amount of money that you spend (and thereby qualify for extra welcome bonuses).

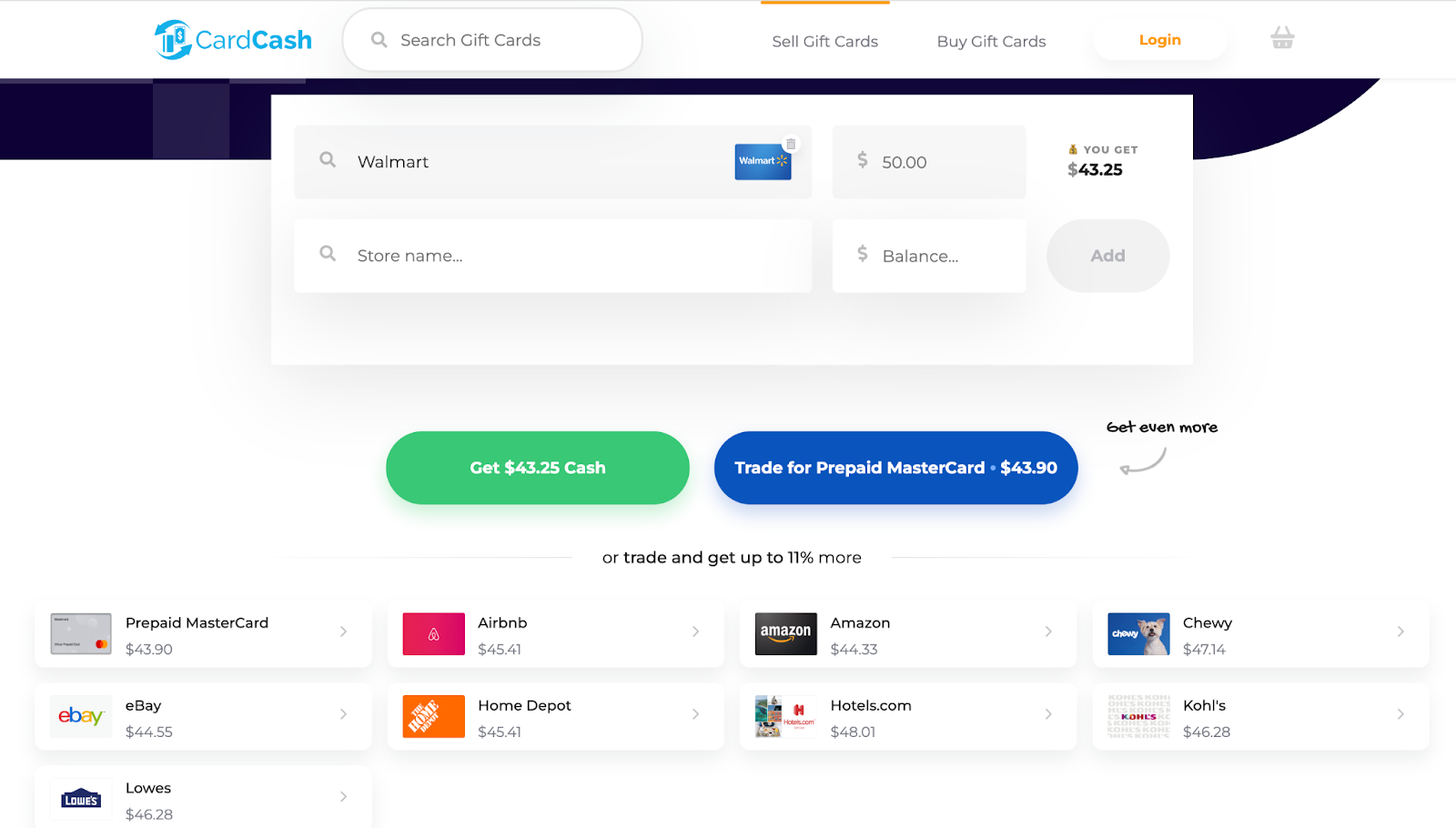

There are plenty of online companies and marketplaces that allow users to resell unused or partially used gift cards. Generally, the gift cards are sold at a slight loss (otherwise, buyers would simply purchase the gift card from a store). You can expect to recover about 85-90% of a gift card’s face value if you use a reputable reselling site with competitive fees. For example, CardCash (pictured above) claims to provide up to 92% of each gift card’s value.

Before purchasing any gift cards, be sure to check which stores are in high demand on resale sites. The more popular that a particular gift card is, the more money that you save. Similarly, since there are so many different companies that allow users to resell gift cards, it is a good idea to shop around for the best resale rate possible. Just be sure to only sell your gift cards to reputable companies — it is relatively easy for scammers to set up fraudulent gift card resale sites.

Of course, it is important to highlight that this strategy requires some money out of pocket. Before you open up a credit card for the sake of its welcome offer, be sure to calculate the cash value of the welcome offer and how much money you would spend if you resold enough gift cards to meet the minimum spend. Some credit cards may still be a great deal, but you might lose money on others. By checking beforehand, you can eliminate unpleasant surprises.