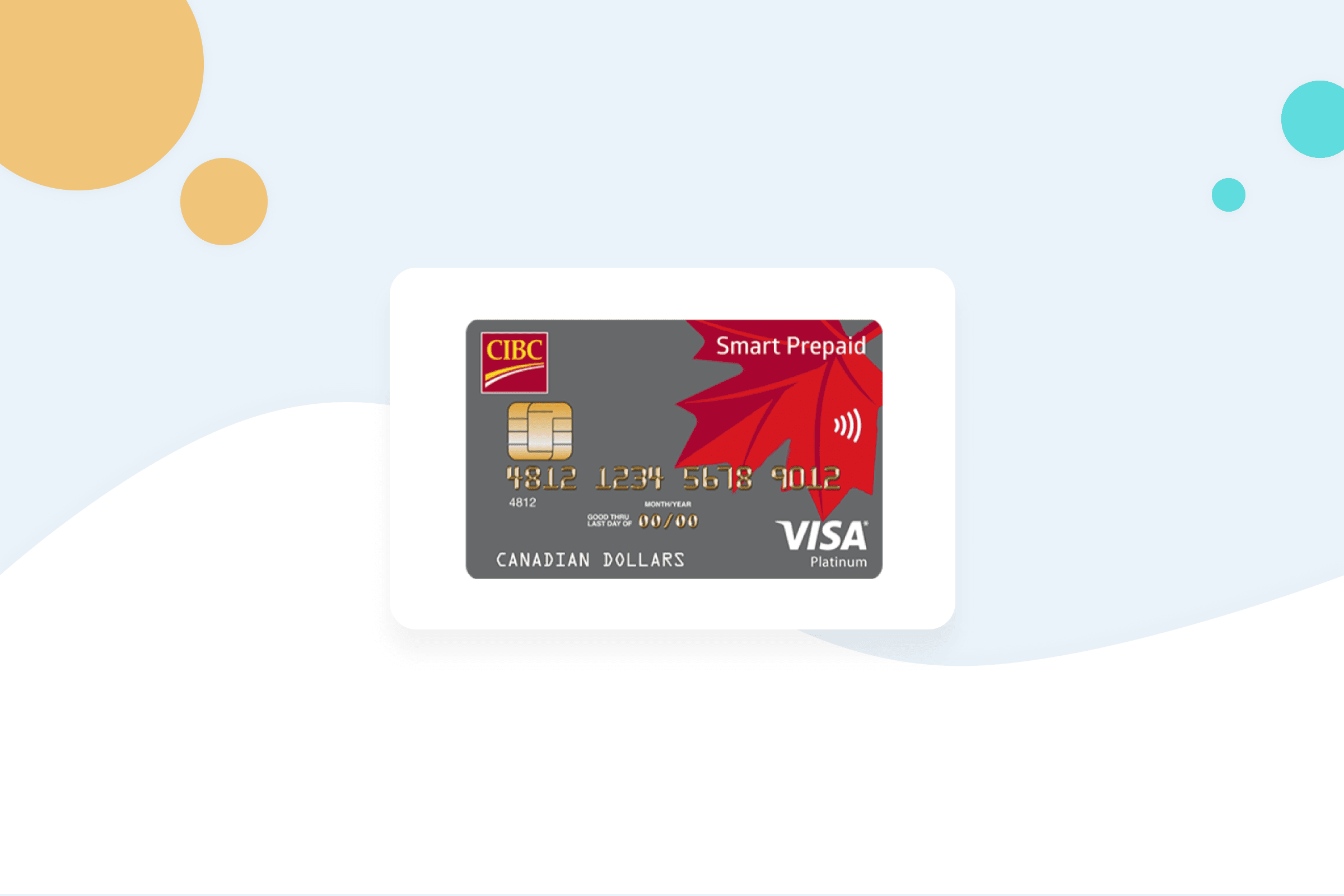

CIBC Smart Prepaid Visa Card: the Full Review for 2023

By Arthur Dubois | Published on 11 Jul 2022

Why are so many people in love with prepaid cards? Furthermore, why are so many Canadians talking about the Canadian Imperial Bank of Commerce (CIBC) Smart Prepaid Visa Card in particular? It comes with great benefits, which is likely the reason that the card one of the best prepaid cards in Canada.

So what are the pros and cons of owning a CIBC Smart Prepaid Visa Card? Is it free to use or are there fees and limits? In this review, we’ll cover everything. So are you ready? Let’s go.

Introduction to the CIBC Smart Prepaid Visa Card

The CIBC Smart Prepaid Visa Card is designed to make it easy to make online and offline purchases. Moreover, it also comes with the ability to shop online. The card works at all international and local stores that accept Visa.

The CIBC Smart Prepaid Visa Card acts like a traditional credit card but with additional benefits such as low fees. The card works at almost all ATMs in Canada and abroad and can be a great way to manage your finances. You only have to set a budget, add credit to your card to get started. While it is essentially a debit card, it offers the convenience of credit cards without having to worry about paying bills.

What is the Canadian Imperial Bank of Commerce

The Canadian Imperial Bank of Commerce is one of the most reliable banks in Canada with a rich history. It was formed in 1961 through the merger of two of the oldest Canadian banks then, the Imperial Bank of Canada and the Canadian Bank of Commerce. It is now the fifth-largest commercial bank in the country.

Currently headquartered in Toronto, Canada, the bank offers a variety of services including personal and business banking, commercial banking, and wealth management. The bank is known for offering excellent customer support and operates in not only Canada but abroad as well. Users appear to have a lot of faith in CIBC as it is a publicly-traded company with over 10 million customers.

CIBC Smart Prepaid Visa Card costs, penalties, and fees

Annual Account Fee: $0

Cost Per Transaction: $0

Other fees: Yes

The CIBC Smart Prepaid Visa Card is very affordable to own and use. While it is entirely free to apply for, you may have to pay a variety of charges. Depending on your habits, you can keep fees to a minimum or avoid them completely.

The card has no Annual Account Fee and no per-transaction fees to use it. You can use it at a local CIBC bank machine and there would not be a cost to withdraw funds. If you use it a local machine that is not for CIBC, that bank may charge a fee. Even though CIBC has great rewards programs, there are no rewards attached to the Smart Prepaid Card.

Now for the fees that you do have to pay. Naturally, it all comes down to how you use it, so you are in control to some extent. If you lose your card, there is a $14.95 CAD replacement fee, and the fees are different if you have a foreign currency card. For example, if it is for GBP, the replacement fee is £7.95. There is a foreign transaction fee of 2.5%, but that applies to debits or credits done in currencies that are different than that for your card. It should not apply to transactions made in USD using a USD prepaid card. In terms of International automated teller machine (ATM) withdrawals, you get one free withdrawal per month and are charged a fee that changes according to the currency of your card. For instance, if your card is in CAD, your extra foreign ATM withdrawals will cost you $3.50 CAD each.

The bank may revise these charges every year. Check the official website for the latest charges. While the CIBC Smart Prepaid Visa Card might be one of the most affordable choices in Canada, we suggest that you look at other options as well, especially if you are looking for a credit card. Make sure to compare available credit cards to ensure you get the best one.

How does the CIBC Smart Prepaid Visa Card work?

The CIBC Smart Prepaid Visa Card works like any other card with no extra steps or requirements. Consider it a gift card that you can use and reload again and again. It doesn’t work differently from other cards and a prepaid card looks exactly like a traditional card.

It will have your name, the date of issue, the date of expiry, bank name, and a CSV code. It works like traditional cards whether you’re at a physical store, bank machine, or online store. Simply swipe it or enter the required details to use the card.

Every time you use this card, the amount will get deducted from your balance until you reach $0, after which you will have to deposit more money to be able to continue using your card. That’s why it is sometimes called a reloadable card. You will also not be able to withdraw more money than what your card contains as there is no overdraft option with prepaid cards.

CIBC Smart Prepaid Visa Card features

Fees are only one aspect of a prepaid card. There are other advantages to consider as well.Here are some of the main features of the CIBC Smart Prepaid Visa Card that you might like.

Visa payWave

Visa payWave is a contactless payment technology that makes it possible to use your Visa card to pay for small purchases with ease by just waving the card. It has proven to be useful in these times and can even help you save precious minutes.

No Expiry

The amount you deposit into your card will never expire, however, cards come with an expiry date. Once your card expires, simply request a new one and the bank will transfer your balance at no extra charge. But, you will have to pay renewal charges.

Mobile App

You will be able to keep an eye on transactions using CIBC mobile app. Transactions are updated every hour and the app even provides analytics that can help you understand your spending habits. The app works 24/7 and is available for both iOS and mobile users.

Notifications

You will receive push notifications whenever a purchase is made using your card. This is a great way to keep an eye on your card and ensure there is no unauthorised access.

Security

It has fraud protections! The card is safe and secure as it uses chip technology. Plus, it comes with Zero Liability Policy, which means you will be protected if your card or card details get stolen.

Card Limits:

Like any other card, this one also comes with some limitations. You cannot deposit more than $3,000 in a day. This means it can take four days to deposit $10,000 into your card, which is also the maximum balance a card can have. Moreover, there’s a limit on POS purchases per day. It’s capped at $3,000. Similarly, the maximum ATM deposit in a 24-hour period is only $1,000. This makes the card a little less liquid than some other cards out there.

How can I get a CIBC Smart Prepaid Visa Card?

You can get a CIBC prepaid card for free as there are no issuance fees. However, if you choose to have your card couriered to you, you will have to pay charges that are usually around $15 CAD; again the fee changes according to the card currency. Visit any CIBC branch to apply for a card or submit an application online through the CIBC mobile app or online banking facility. Remember that one person can own a single card.

You’ll be asked to submit a form and some identity documents including your proof of identification, like a passport, driver’s licence, etc., and a proof of address. Both documents must be valid and address proof must not be older than 90 days. Applications are usually processed immediately unless there are some issues. If there are issues with your application, you may be asked to visit a branch.

In most cases, you will receive your new prepaid card within five business days. No credit check is required and you can apply even if you have a poor credit score. The card will be under your name and you must activate it before you can use it. Your new card will come with instructions on how to activate it. Once done, go ahead, add money to your card, and start using it.

CIBC Smart Prepaid Visa Card: pros and cons

Here are some of the main pros and cons of owning a CIBC Smart Prepaid Visa card:

Pros:

- Works like a regular credit card without the disadvantages of a credit card. You use it to shop offline, online, and over the phone.

- Comes with Visa payWave functionality for easy purchases

- Your money will never expire

- One of the safest Visa prepaid cards in Canada

- Comes with fraud protection

Cons:

- The bank does not offer supplement cards

- Limited deposit options

How to add money to the CIBC Smart Prepaid Visa Card

It is easy to add money to CIBC prepaid cards. You can choose to do so online or by visiting a CIBC Banking Centre. You must, however, be an active CIBC member to be able to do it.

The process is straightforward. Visit your nearest location, provide the required information, and the money will get deposited into your account. Alternatively, login to your online account, provide the required information, and the money will get deposited into your account. We believe that online banking is easier since you can login to your account from anywhere.

As stated earlier, the minimum amount is $20 CAD for the card in Canadian funds and you cannot deposit more than $3,000 CAD in a 24-hour period at a point of sale. You are limited to a daily $1,000 CAD withdrawal limit from an ATM, and that means a 24-hour period. Moreover, your card cannot accept a balance higher than $10,000 CAD.

Alternatives to the CIBC Smart Prepaid Visa Card

Exploring options beyond the CIBC Smart Prepaid Visa Card? There are numerous alternatives in the market that cater to diverse spending habits and financial needs. Dive in to discover some top contenders that might better align with your preferences.

KOHO Prepaid Mastercard

[Offer productType=”CreditCard” api_id=”637cf8206bbb7962c19ae225″]The KOHO Prepaid Mastercard offers a modern and hassle-free way to manage your finances. Earn as much as 2% cash back on essentials like groceries, dining, and travel, and up to a notable 4.5% interest on your deposits. The dedicated app offers intuitive budgeting aids and automated savings features. Plus, the prepaid nature means you spend only what you’ve loaded.

Being part of the extensive Mastercard family, KOHO promises universal acceptance, be it online or in brick-and-mortar stores. Its unique Round-Up feature lets each purchase automatically roll up to the next dollar, stashing the spare change into savings. Stay updated with real-time alerts, ensuring transparency and heightened security for your transactions.

Neo Money Card

[Offer productType=”SavingsAccount” api_id=”60fee79313fd2f260ff90749″]The Neo Money Card is tailored for today’s tech-savvy spender. The card and its accompanying Neo app are in perfect sync, offering a rewarding 1% interest on your balance and an impressive average of 5% cash back on purchases at Neo partners.

Your first buy with any of the 10,000+ partner merchants could get you an astonishing 15% cash back (sometimes more!). Locate cash back opportunities nearby directly from the app, ensuring you always snag top deals from cherished brands and small local gems. Stay abreast of your spending and balance with instant notifications.

EQ Bank Card

[Offer productType=”CreditCard” api_id=”63d2cb6a18196b6d2e1928c2″]Experience a banking game-changer with the EQ Bank Card. It grants instant access to funds from your EQ Savings Plus Account, just a tap away.

Besides being a portal to an attractive 2.50% savings interest rate, it also showers you with 0.5% cash back on every swipe, and no foreign transaction fees. Plus, you actually get reimbursed for all domestic ATM charges. The associated app is a powerhouse, letting you navigate your finances while on the move.

The crowning jewel of the EQ Bank Card is its absence of fees. Neither monthly nor transactional costs will weigh you down, making it perfect for those keen on maximizing their financial efficiency without the usual banking challenges.

This CIBC Smart Prepaid Visa Card review is great but you may still have questions. A review cannot be complete without answering the most commonly asked questions about these cards. Here are some to consider: