How to Check Your Vanilla Visa Balance in Canada

By Julien Brault | Fact-checked by Lois Tuffin | Published on 07 Jan 2024

If you received a Vanilla Visa card as a gift or can’t remember how much money you have on the card, it’s easy to check the balance. Here’s how.

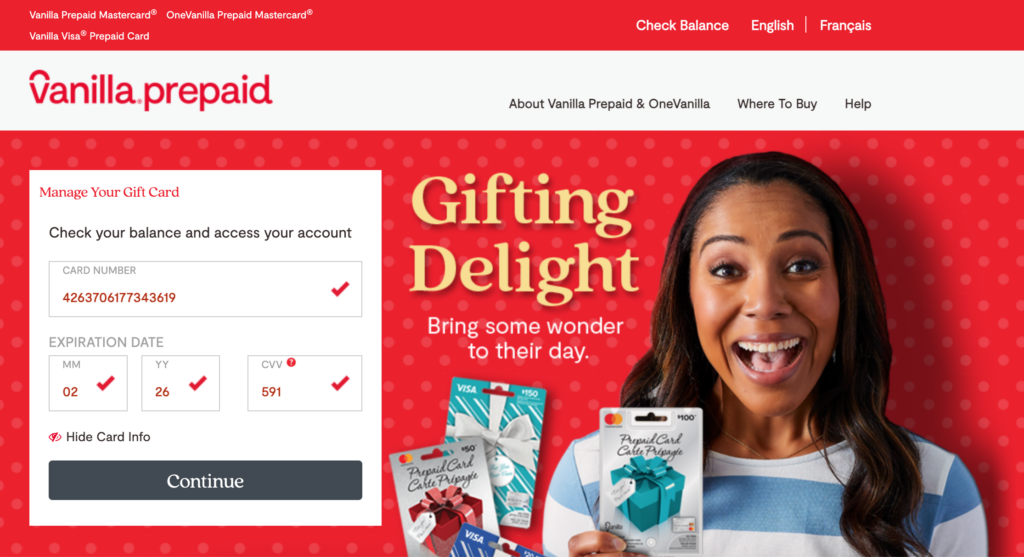

1. Go to the Vanilla website

Type Vanillaprepaid.com in your browser’s address bar. The home page of the Vanilla website displays the form you need to fill in to check your balance.

2. Enter your card details and click on “Continue”

You’ll find your 16-digit Vanilla card number and expiry date on the front, while the CCV number is on the back of the card.

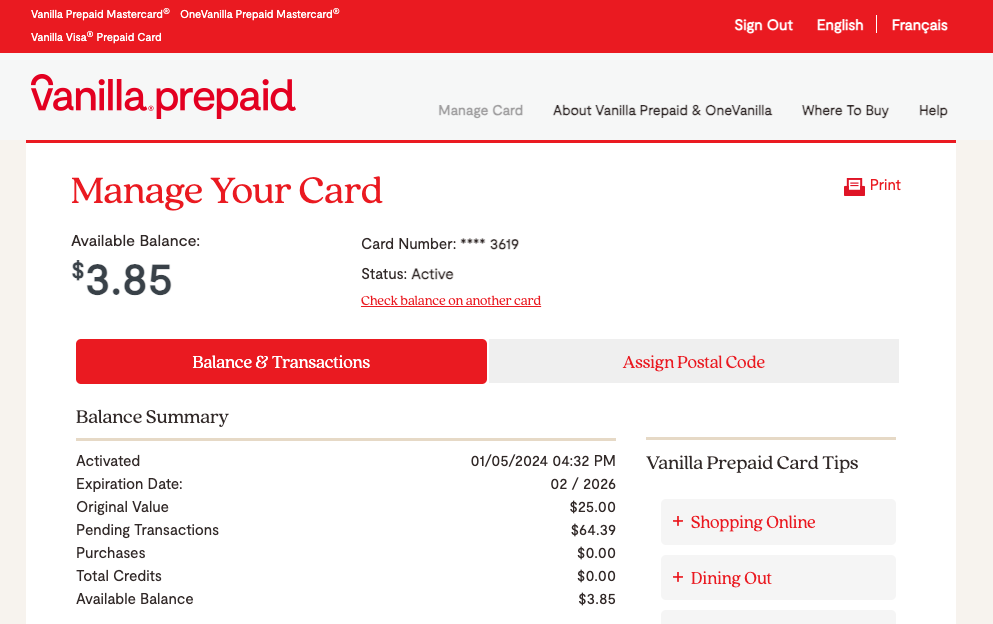

3. Check your Visa Vanilla balance

Your card balance and previous transactions should be displayed automatically.

Checking your Vanilla Visa balance by phone

In order to verify the remaining balance of your Vanilla Visa card, contact the Vanilla customer service line at 1-844-864-6951. To start, enter the prepaid card details, such as the card number, card verification value (CVV) code and expiration date. This step authenticates your identity, granting you access to the balance information.

Why you should avoid Vanilla cards in the future

Vanilla cards come with many fees and limitations that can be bypassed by getting a free reloadable prepaid card. In fact, Vanilla Visa cards require an activation fee of $3.95 to $7.95, are not reloadable and apply a 2.5% foreign currency conversion fee. What’s more, these cards are not accepted by all retailers. In comparison, options like the EQ card allow Canadians to benefit from a no-fee, reloadable card, that don’t charge any FX fees and is widely accepted.

[Offer productType=”CreditCard” api_id=”63d2cb6a18196b6d2e1928c2″]Transferring your Vanilla Visa balance to a new card

Like a normal credit card, your Vanilla Visa card has an expiry date. However, since the card has pre-loaded funds, the card itself could expire before you get a chance to use the entire balance. However, you can still recover the remaining money.

Fortunately, you can request to transfer funds to a new card with a later expiry date. If you find yourself in this situation, call Vanilla at 1-(844)-864-6951 or dial the number on the back of your card. The customer service representatives should send you a new card pre-loaded with any leftover funds.

If you end up taking longer to spend the card’s funds, you should keep an eye on its expiry date. Several weeks before that date, call customer service for a replacement or make it a point to spend the remaining balance. That way, you will not lose out on your money. In the event that you need to request a new card, you will have plenty of time to do so.