Are Credit Cards Haram in Canada?

By Yuri Sychov | Published on 16 Aug 2023

Have you been wondering if credit cards are haram in Canada? In this article, we will dive into the debate around the religious and financially responsible use of these financial instruments. We’ll review Islamic scholars’ points of view on using credit cards and the potential financial risks associated with them so that you can make an informed decision about how to approach them responsibly and what credit cards to use. We will also offer insights on how to use credit cards without breaking Islamic law.

By taking the time to consider all aspects of this discussion, you can confidently come up with solutions for your financial situation that satisfy your spiritual needs and meet practical requirements. So what do Islamic teachings say about credit cards? Let’s find out!

What are the views on using credit cards by Muslims in Canada?

Credit cards are a popular form of payment in Canada, yet not all Canadians use them. Based on their respective interpretations of Islamic law, Islamic scholars have different opinions concerning the utilization of credit cards.

Usury & interest

One of the most popular opinions is that using credit cards is accepted as long as it does not involve usury or interest. Prof. Dr. Monzer Kahf states that credit cards are a “permissible practice” when used responsibly but that the use of interest-bearing credit cards is prohibited.

This idea has further been bolstered by the presence of Islamic financial establishments. Islamic Finance focuses on providing Shariah-compliant credit cards, home loans, and insurance policies.

Moderation

An alternate perspective is that credit cards should be avoided because of the potential to fall into debt. This view stems from the idea that Muslims must practice moderation in their expenditure, preventing excessive borrowing.

According to the OIC Fiqh Academy resolution no. 108, “It is not permissible to issue unsecured credit cards or use them if their terms involve the imposition of usurious interest. This is so even if the cardholder intends to pay within the moratorium period before charging interest.”. This resolution emphasizes that it is prohibited to use credit cards, even if you don’t pay any interest.

Discipline

Certain scholars, including Shaykh Faraz Rabbani, argue that using a credit card responsibly is achievable with the right conditions in place. These can include restricting use to necessary expenditures, paying off balances promptly each month, and avoiding any late fees or penalties associated with having a credit card. If these conditions are met thoughtfully, you may be able to enjoy all of the benefits of owning a credit card without putting yourself at risk of violating Sharia law. So, according to this view, having a credit card is not haram itself unless the card is used to engage in activities involving riba or other activities prohibited by Islam.

Consider alternatives

Considering that opinions on using credit cards by Muslims are quite polar, it is better to avoid using them whenever possible, and it is better to consider alternative solutions such as prepaid cards or debit cards. For Muslim individuals, this is especially critical as it preserves the integrity of their religious beliefs in regard to financial matters.

Emergencies

It is also worth mentioning that haram activities are not prohibited “in the case of necessity.” In certain cases, Muslims are allowed to do things considered haram, but what defines a necessity is up to individual interpretation.

What does make haram activities permissible, according to Quran?

Although some activities are considered haram in Islamic law, they can be permissible if certain conditions apply. According to Surah Al-Ma’idah – 93, “There is no sin on those who have faith and do righteous deeds,” suggesting that faithful believers following good practices will still receive rewards from Allah even if they participated in haram activities before.

Furthermore, Verse (2:173) of the Quran states: “He has only forbidden to you dead animals, blood, the flesh of swine, and that which has been dedicated to other than Allah. But whoever is forced [by necessity], neither desiring [it] nor transgressing [its limit], there is no sin upon him. Indeed, Allah is Forgiving and Merciful.”. This indicates that when basic necessities are at stake, some haram activities are permissible to Muslims.

Credit cards may be utilized in times of extreme need, such as sudden medical emergencies or unexpected financial hardship. In these circumstances, accessing a credit card can be considered necessary and permissible, even if the interest is charged.

Strategies for using credit while still adhering to Islamic principles

No matter which type of card you select, it’s essential to practice responsible credit usage that adheres to Islamic principles. Here are a few tips for keeping your credit under control:

- Pay off balances on time each month and dodge any penalties or late fees.

- Limit spending only to essential things such as housing, education, and medical needs.

- Select a card with zero annual fees and low-interest rates.

- Be conscious of extra costs linked with the credit product before signing up for it.

- Don’t use the card for luxury purchases or activities that contradict Islamic principles.

- Use prepaid cards and debit cards as much as you can to help limit your monthly expenses.

- Stick to saving and budgeting principles to maintain financial stability.

Adhering to these principles, you can make sure that your credit card usage follows Islamic law while still being able to enjoy the same convenience of using a traditional credit product. Credit cards are beneficial in managing daily expenses and, with sound financial management practices, can be used without violating Sharia law.

Halal Alternatives for those who feel credit cards are haram in Canada

Even if you follow all the recommendations and avoid paying riba while using a traditional unsecured credit card, there are still alternatives that fully comply with Shariah law. We are talking about prepaid cards and debit cards.

Prepaid cards offer the perfect budgeting solution by allowing you to pay with money that has already been loaded onto the card. With prepaid cards, there’s no risk of taking on debt as your spending is limited to the amount available on your card – so it’s an easy and effective way of managing finances for Muslims in Canada. Al-Ahli Bank declared that using prepaid cards is permissible according to Sharia law, given the absence of haram components in other types of credit cards.

Debit cards are another convenient Halal alternative to traditional credit cards. Debit card payments draw on the money in your bank account directly – so you can rest assured that there’s no risk of overspending or debt accumulation.

If you want to avoid interest payments, prepaid cards and debit cards are your best bet. These options allow you to experience the convenience of traditional credit cards without paying riba.

The best halal credit cards in Canada

Discover the best halal credit cards in Canada, designed to adhere to Islamic financial principles. These Sharia-compliant options offer ethical financial solutions for Muslim consumers, without compromising on convenience and security.

KOHO Prepaid Mastercard

KOHO Financial provides both Muslims and non-Muslims access to a halal prepaid Mastercard with a comprehensive chequing account service. This includes an integrated app plus the reloadable prepaid Mastercard. KOHO Financial offers users unprecedented convenience and peace of mind when accessing their financial needs.

Canadian Muslims looking for a comfortable and convenient way to control their finances while staying true to Islamic values will benefit greatly from the KOHO Financial reloadable prepaid card. Boasting no-fee accounts, intuitive applications, interest-free rates, and halal cash back rewards – this card is an ideal choice for preserving one’s religious values without sacrificing financial stability.

EQ Bank Prepaid Mastercard

For Muslims who need a reliable and secure payment option, the EQ Bank Card is an ideal solution. This prepaid card allows for effortless access to your funds with no foreign transaction fees and reimbursements of ATM fees – so you can make stress-free purchases without any additional costs. Furthermore, with every purchase, you are eligible to receive 0.5% cashback.

Get complete control of your finances with the EQ Bank Card – conveniently access money from your savings account, and rest assured that it is protected by secure chip technology. With just a swipe, you can be confident that your money is safe and protected.

NEO Financial Prepaid Mastercard

With the Neo Prepaid card, you’re guaranteed approval with no annual fees and rewards on your purchases. Plus, it’s easy to qualify! All you need is to be of legal age in your province or territory and a resident of Canada.

Get ready to maximize your savings with this card – you’ll get an average of 5% cash back at retailers across Canada and up to 15% cash back when shopping from select merchants. Plus, receive a welcome bonus worth $30 just for signing up.

CIBC AC Conversion Visa Prepaid Card

Looking for a reliable and safe payment method when travelling? The CIBC Air Canada AC Conversion Visa Prepaid Card has you covered! This one-of-a-kind, multi-currency card provides the convenience of locking in your exchange rate each time you reload it.

Plus, bring up to 10 different currencies with you on this single card! And get rewarding perks by earning 1% cash back on every purchase made from this card.

The CIBC Air Canada AC Conversion Visa Prepaid Card offers the perfect and secure payment solution for Muslim travellers who want to stay true to their Islamic values. Don’t worry about interest rates with this effective financial instrument.

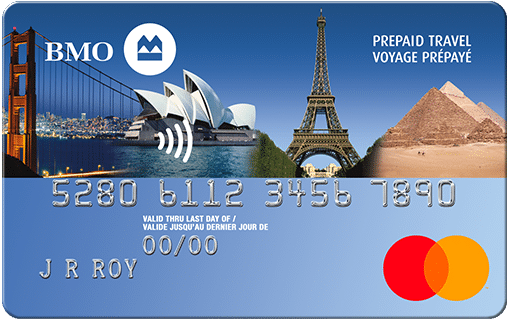

BMO Prepaid Mastercard

Muslims now have the luxury of purchasing items worry-free with the BMO Prepaid Mastercard. This card is compliant with Sharia law and free from any haraam elements commonly found in other forms of credit cards, such as interest fees or additional charges. With this innovative tool, Muslims can make purchases quickly and securely without hassle or stress!

With the BMO Prepaid Mastercard, you can enjoy some great perks, such as a low annual fee of $6.95 and an enticing rewards rate that makes it an ideal choice for those searching to make purchases without accruing interest or other associated charges. Furthermore, since this is a prepaid card, you won’t have any trouble managing debt or overspending.

Wealthsimple Prepaid Visa Card

With Wealthsimple’s Prepaid Visa Card, Muslims now have access to financial services with much ease. This card is accepted in numerous countries across the globe, except for Indonesia, Iran, Iraq, Kenya, and North Korea. Wealthsimple Cash Prepaid Visa Card helps users to maintain their finances with ease and comfort – no interest rates or additional fees!

Make purchases online or at any retailer that accepts Visa. Plus, this prepaid card is permitted under Islamic law, too – so it is a great choice for Muslims. Enjoy a stress-free financial experience today with the Wealthsimple Cash Prepaid Visa Card.

Wealthsimple isn’t just offering the Prepaid Visa Card but also an Islamic Finance Investing portfolio for those who need to comply with Islamic law. This individualized investment instrument is tailored to your goals and satisfies financial needs and religious expectations – providing you with a powerful pathway forward!