How to Get a US Credit Card in Canada

By Heidi Unrau | Fact-checked by Maude Gauthier | Published on 20 Jun 2024

A growing number of Canucks who have canadian credit cards are looking for ways to get a US credit card in addition, because of the unique benefits they offer. With over 76 million credit cards circulating in the Great White North, Canucks love their plastic. But we also love all the cool stuff America has that we don’t – like summer in December and Disneyland. US credit cards typically have better sign-up bonuses and can help you build a US credit history. Plus, there are significantly more US credit cards that don’t charge foreign transaction fees, whereas only a few Canadian cards do not charge forex fees. As the Globe and Mail explains, “Forex fees aren’t a big money maker for U.S. card issuers because most global credit-card transactions are conducted in U.S. dollars.” This can help you save about 3% percent of the transaction amount.

Step 1: Check if you can get a US credit card with your Canadian bank

Before we jump into how to get a US credit card, let’s prevent some confusion. Many Canadian financial institutions issue credit cards that are denominated in US Dollars, but they are not the same as a US credit card issued by an American financial institution. Here’s what to know:

- US credit card is issued by a US financial institution: TD Bank, BMO, CIBC and other big banks all have US branches. If you cannot get a US credit card with your bank, you will need to have a US address and a US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). We will get back to that at the end of the article.

- A USD credit card issued by a Canadian bank is beneficial for Canadians who frequently travel to the US or make many US dollar purchases: you can avoid exchange rate fluctuations because you pay your balance in US dollars. However, those cards usually don’t offer rewards.

We called Canadian banks to verify the information: yes, you can get a US credit card using your canadian credit score, withtout a US residential address. For instance, the customer service agent at TD was not sure at first but she asked her collegues and came back and told me I could get one. Access to a US credit card might depend on your personal situation. BMO, for instance, offers US credit cards to their private wealth banking clients only.

Step 2: Open a US bank account

You will need a US bank account to be able to pay off your US credit card bill. You can open a bank account in the US without having to leave Canada. Many Canadian banks have branches in the US. In most cases, you will have the option to open a US bank account when you open one in Canada.

CIBC, for example, has this feature. If you use the bank for personal banking, you will get the option to get a USA Smart Account that’s free with no monthly fee and gives you unlimited transactions. The bank is reliable and gives the option to manage your account online. Plus, you will be able to transfer funds from your US account to your Canadian account as well as access your cash through CIBC Bank USA ATMs.

Some other banks that offer similar features include TD Canada Trust, BMO, and RBC Royal Bank. All these banks give account owners the option to open a bank account in the US in just a few steps. In most cases, you will not even have to submit additional documents or wait for days to get a US account from Canada.

What to do if you cannot get a US credit card via your bank in Canada?

To begin, you will need a US address. It may seem a little daunting, but don’t worry. You don’t have to move to the U.S. to get a U.S. address.

Fortunately, the address doesn’t have to be under your name. If you have any friends or family who live in the US, you can ask them for help. If they agree, you can sign up using their address and ask them to send any mail with your name on it to your Canadian address.

If you don’t have any American friends or family to count on, then you will have to find a service provider that offers US addresses to get a credit card. There are several mailbox or mail forwarding services that come with a US address. Most companies only charge for delivery and offer addresses for free. Please remember:

- The address must be residential as banks do not approve commercial addresses or P.O. box numbers; verify this by going to the USPS address tool and entering your new US address.

- The service provider must allow bank correspondence.

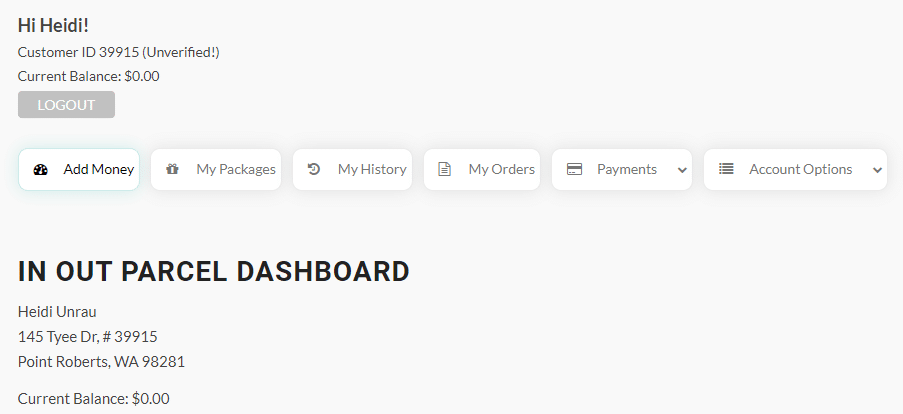

Have a look at some of the best package forwarding services and pick one that fits your requirements. Some of the top names include In Out Parcel and Shipito.

Most companies charge an annual fee as well, which is in the range of $70 and $120. Make sure to verify there are no additional charges for using the address to receive bank letters. Also, ensure the address can be used to open a credit card.

Apply for a US credit card through Nova Credit

Now that you have a US address and a US bank account, the next step is to apply for a US credit card in Canada through Nova Credit. There are a few US cards that partnered with Nova which you can use to start building a good US credit score. This is important because getting a credit card without a good history can be an uphill battle.

American Express has partnered with Nova Credit, a service that allows Canadians and other US newcomers to directly apply for a US card using their Canadian TransUnion file. The process is quite straightforward.

The service provided by Nova Credit will convert your Canadian credit report into the American equivalent. Simply visit the Nova Credit website and select Canada as your home country to see what US credit cards are available to you. For example, I applied as a new resident of the United States (thanks to my new US address) who does not yet have any credit history in this country.

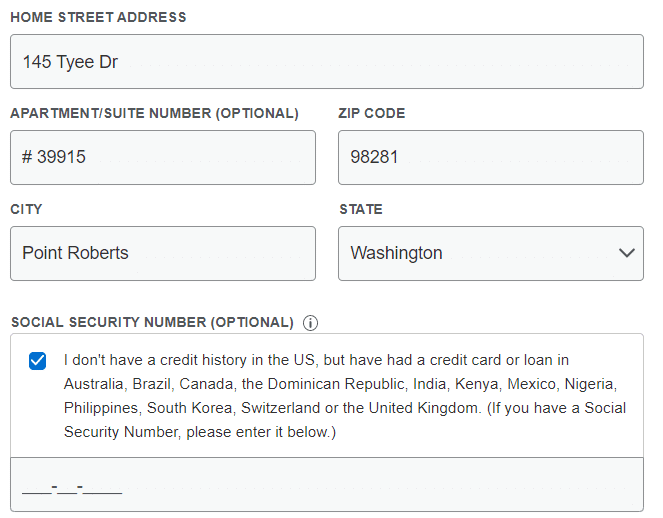

When prompted for a U.S. Social Security Number, keep an eye out for a checkbox option that reads: “I don’t have a credit history in the US, but have had a credit card or loan in (select your home county)”. You will need to tick the box and select your home country from the drop-down menu. Continue following the prompts and providing the necessary information.

The system will then ask you to select the country of your credit history. Available options include UK, Canada, Mexico, India and Australia. Since you intend to use your Canadian background, choose Canada. Then, provide the required information such as your US address, date of birth, name and Canadian TransUnion record.

Lastly, you will have to verify your identity by providing an identity document such as your Canadian driver’s license or passport. If you’re lucky, you’ll get approved right away. Conversely, in most cases, you’ll be asked to provide some more information to verify your data.

Already have a Canadian-issued Amex Card? Consider Transferring it

If you already have a Canadian Amex card, you can basically convert it into a US credit card. This method involves initiating an AMEX Global Transfer to the US from Canada. To be eligible, your existing Amex account must be valid, in good standing, and active for at least three months.

If you meet these requirements then get in touch with the AMEX Global Transfer office to request a Global Transfer from your Canadian card to your US credit card. The agent will ask you to apply for a US card on the phone and provide some details about the account. The process will take a few minutes and you’ll be asked to provide some information.

Get an ITIN

As you can see, it is quite easy for Canadians to get an AMEX US credit card. However, if you want to get a card from other issuers such as Citi, Chase, Bank of America, or Capital One, you will need an ID. In Canada, we have a Social Insurance Number (SIN) and in the US, they have SSN, short for Social Security Number. Personal credit reports in the country are associated with these numbers or identifiers.

If you’re lucky enough to already have a SSN then you don’t have to worry about this step and you can move ahead. Only US citizens or residents with special permits can apply for an SSN. Everyone else needs to get an Individual Taxpayer Identification Number (ITIN). The US Internal Revenue Service (IRS) issues these numbers. You will have to prepare a number of documents to submit your application. The process can be a little tedious but it is important to ensure you can get your desired US credit card.

There are a number of firms that can help you get an ITIN. They’ll charge a small fee for their services and you will get your ITIN in just a few days without much effort. Some of our favourite providers include Frugal Flyer and US Tax Resources. You might come across even better options if you look around. Expect to spend about $350 CAD on it.

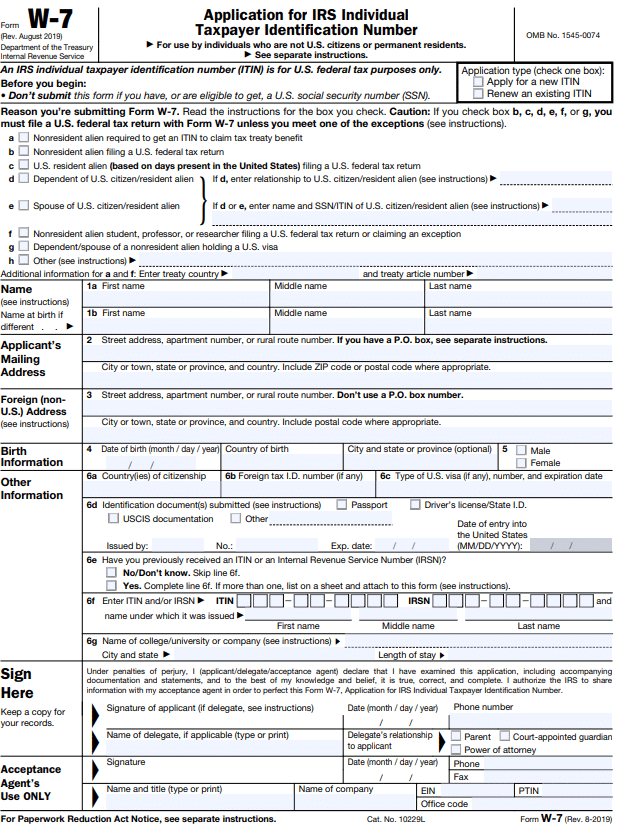

You will be asked to provide some information and the provider will issue a completed application form, also known as a W-7 form. You will have to prove why you need an ITIN. These companies can help you submit a tax return to justify your application.

Those who do not wish to hire the services of a professional firm can choose to apply on their own. This method is a little complicated and time-consuming but doable. Be careful when submitting your forms and even a small discrepancy in your form can result in a rejection. Fortunately, you will not have to wander for tips as the official IRS website provides all the information you need to get an ITIN. Go through the page to ensure you have all the required documents including:

- Document to justify an ITIN (for example, showing US-based income)

- A certified copy of your passport

- Correctly filled W-7 ITIN form

Also, getting in touch with a tax attorney for tax advice since submitting the W-7 form may have some tax implications.

Remember that the application cannot be filled out entirely online as you will have to mail your original passport or a certified copy to prove your status. Plan carefully as it can take around two months for the application to process. We suggest that you stick to certified copies since sending original documents is always risky. You will not be able to fly till you get your passport back. Plus, there’s a risk of losing it.

Once you have all the required documents, fill out the form and make sure there are no errors. Review it, collect all documents, put them in an envelope, and send it to the IRS at this address:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Before getting your ITIN

When it comes to getting your ITIN, a few legal complications come into play. Foreign residents who earn income in the US are eligible and encouraged to apply for an ITIN. You will have to prove your residency status if you wish to be exempt from US withholding taxes. Your Canadian passport and address can be enough to prove it. An ITIN can be of help and prove to be very useful not only in getting a US credit card but also in using US-based services. It doesn’t matter how you have earned money in the US, you should consider getting an ITIN number as it will make it easy to fulfill your obligations to the IRS.

Reporting income to the IRS

Money can come from a variety of sources including trying your luck at a virtual casino, using US-based stockbrokers, or trying a US betting company. You will have to self-report your income to the IRC. This way you will get to save hefty withholding taxes that are levied on dividends, royalties, and winnings.