I Tried the Vanilla Visa Prepaid Card for You: Here’s My Take

By Julien Brault | Published on 08 Jan 2024

Prepaid cards, especially the Vanilla brand, have long been synonymous with the term “prepaid card.” Not too long ago, the market for rechargeable prepaid cards was sparse, and those with poor credit scores often had no choice but to use single-use prepaid cards for online shopping. That’s not the case anymore. However, many people still buy Vanilla cards and are surprised by their limitations. To give you a clearer picture, I purchased a $25 Vanilla Visa card (the minimum amount) and put it to the test.

-

Fees

-

In-Store Acceptance

-

Security

-

Ease of Use

At a glance

u003cspan style=u0022font-weight: 400;u0022u003eThe Vanilla Visa card is essentially a gift card using the Visa payment network and shouldn’t be seen as a credible alternative to free prepaid cards available online. Its activation fees, 2.5% foreign currency conversion fees, and the fact that many merchants refuse it make this card less appealing.

Hard-to-Justify Fees

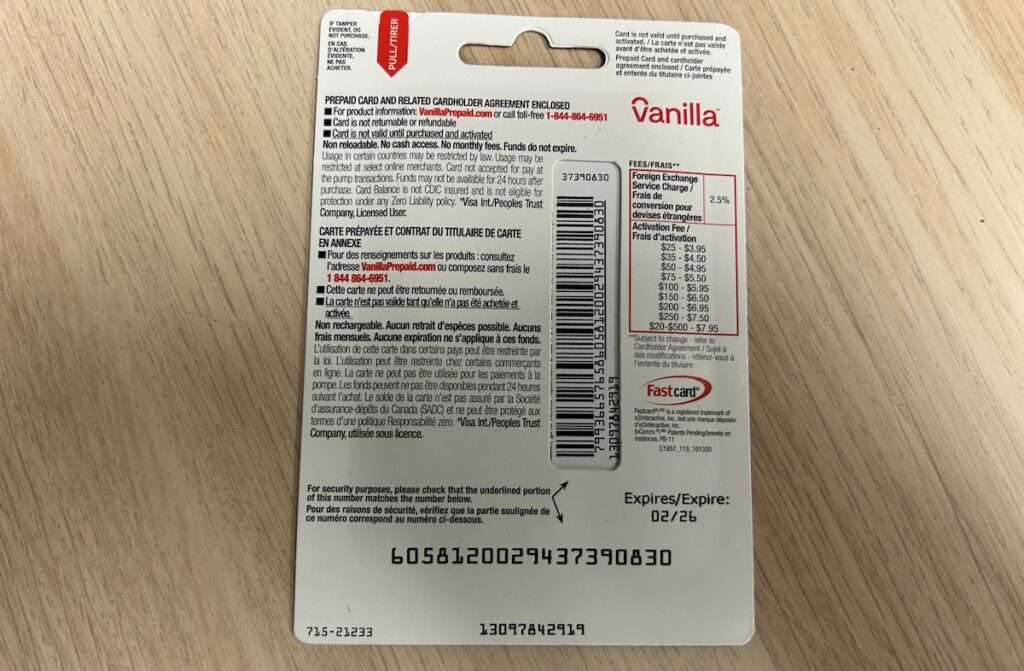

You’ll typically find Vanilla cards in displays near the checkout counters in most Canadian grocery stores and pharmacies. I bought mine at Jean-Coutu. Vanilla cards can hold between $25 and $500 and are available as a Visa or a Mastercard. I didn’t notice a significant difference between the Visa and Mastercard versions, so I randomly chose a Visa Vanilla…

When I paid at Jean-Coutu, I was surprised to pay a total of $29.54 for a prepaid card with a purchasing power of $25. That’s a total fee of $4.54 ($3.95 + GST/QST) on $25, which represents over 18% in fees!

Of course, the rate of fees decreases if you opt for a higher-value prepaid card. Nonetheless, it’s still high, considering there are fee-free alternatives available.

Fortunately, there are no monthly fees once the activation fee is paid. The only other fee that might apply is the 2.5% foreign currency conversion fee on purchases made in currencies other than Canadian dollars.

Many standard credit cards charge similar foreign conversion fees. However, it’s worth mentioning that the EQ card, a fee-free prepaid card, does not charge foreign conversion fees.

Shopping In-Store with the Vanilla Visa Card

Since the card is activated at the time of purchase in-store, the Vanilla Visa card is incredibly easy to use. Just take it out of the packaging and swipe it in a payment terminal to make a transaction. However, note that the card does not have a chip or PIN, so contactless payment doesn’t work, nor can you insert the card into a terminal and enter a PIN.

Since I haven’t swiped a card in a reader for years, I initially thought my Vanilla Visa would only work online. I was preparing for my payment to be declined while waiting at Tim Hortons, intending to pay with my Vanilla card. To my surprise, the payment terminals can still read the magnetic stripes of credit cards, and the transaction worked on the first try at Tim Hortons.

Despite this, the Vanilla Visa card is not accepted by all retailers. Furthermore, certain merchants, like restaurants, hotels, and car rental agencies, routinely pre-authorize a charge greater than the purchase amount on credit cards. If this pre-authorized total surpasses your Vanilla card’s remaining balance, the transaction will be automatically rejected. This makes such merchants a bit unpredictable for Vanilla card users.

Shopping Online with the Vanilla Visa Card

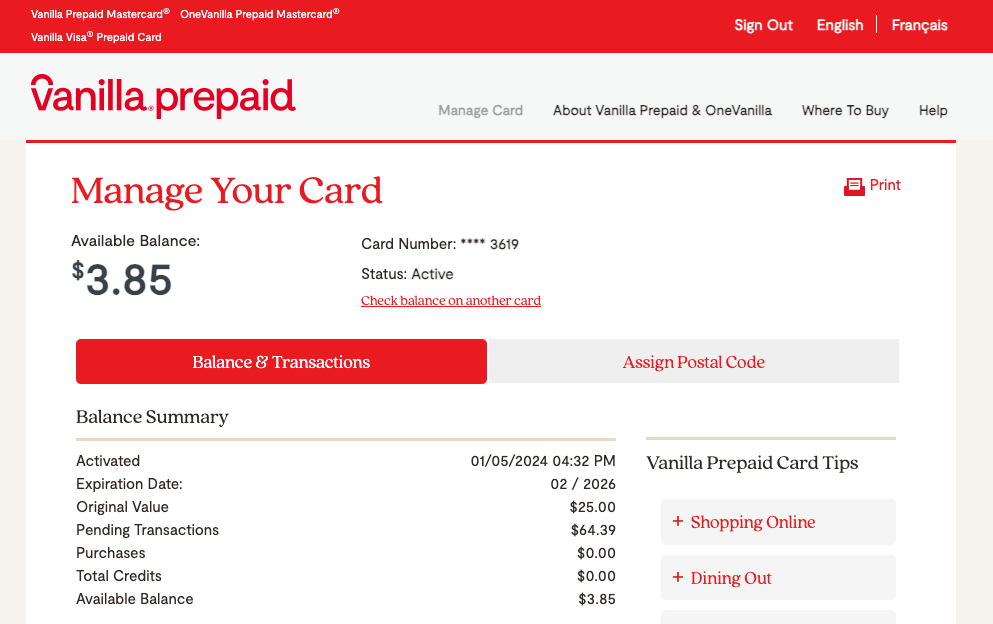

After buying a coffee and a donut at Tim Hortons, I checked my remaining Vanilla card balance and found I had $21.30 left. So, I set out to spend this amount online, a more challenging task than it seems. My first idea was to buy a book on Amazon, but after taxes and shipping, all the books I was interested in were more expensive.

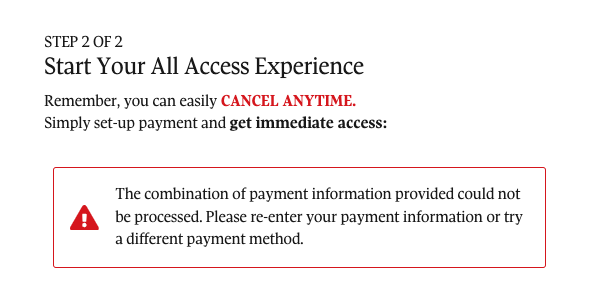

My second idea was to subscribe to The Globe & Mail, which offered a subscription at a promotional rate. I read the details, and the amount charged at the time of subscription was just $9.15. So, I had more than enough funds on my Vanilla Visa. Yet, the transaction was declined.

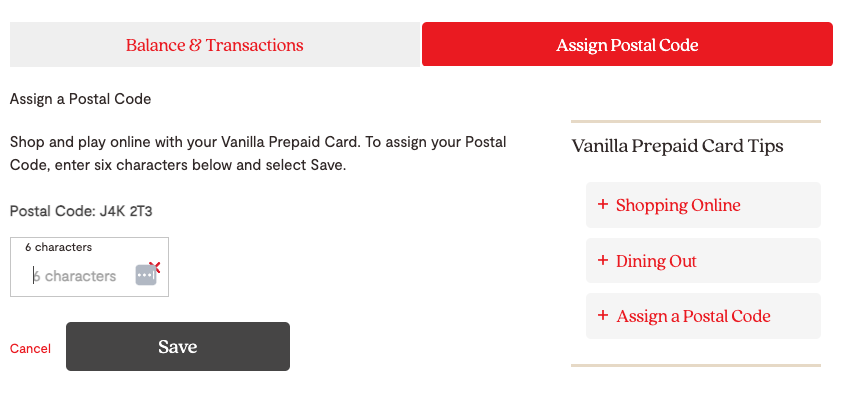

I logged back into my Vanilla account to see what happened. That’s when I discovered that some merchants refuse transactions with Vanilla cards because they aren’t associated with a postal code by default. However, you can add a postal code by logging onto the Vanilla website.

Once I added my postal code, I tried again and the transaction was declined. I realized that The Globe & Mail doesn’t accept Vanilla cards. In fact, most subscription services, including streaming sites, refuse non-rechargeable prepaid cards because their business models rely on recurrence.

I finally managed to spend my $20 on Temu, a Chinese retailer offering low-quality goods at low prices. I bought a pair of waterproof socks (yes, they exist) and two screwdriver pens (yes, those exist too!) for a total of $17.45.

How to Avoid Losing the Remaining Balance on Your

After my shopping spree, I checked the balance of my Vanilla Visa card again and found I had $3.85 left.

And since I can’t reload this card to make a significant purchase, this amount might be lost…

Apart from making an online purchase exactly worth $3.85, which wouldn’t be practical, the best way to avoid leaving money on the table (or rather in Vanilla’s pockets) is to go to a store and ask to split the transaction into two. For example, I could buy a $4 energy drink and make a transaction of $3.85 to empty my Vanilla card and another transaction of 15 cents on another card to pay the difference.

To be honest with you, I think I’m just going to forget about this balance…

Alternatives to the Vanilla Prepaid Card

If you need a prepaid card, know that there are much more advantageous prepaid cards available. The following fee-free prepaid cards don’t require a credit check or minimum income, but you must be a Canadian resident and have reached the age of majority to get them.

KOHO Mastercard Prepaid Card

The KOHO reloadable card has many of the same benefits as traditional credit cards and more. It allows you to pay your bills, use it for automatic and recurring payments, and make purchases online or in-store wherever Mastercard is accepted. In addition to the Essential plan at $4/month, there are other more expensive plans with even more benefits such as no foreign transaction fees and better cash back offers than other cards of the same type. To get KOHO Essential for free, you can set up automatic payroll deposit or deposit at least $1,000 per month into your account.

EQ Bank Card

The EQ Bank card is a reloadable prepaid Mastercard that can be used wherever Mastercard is accepted – online, in-store, and abroad. Every purchase earns 0.5% cash back and there are no foreign transaction fees, making it the ideal prepaid card for travelling abroad and shopping with foreign retailers. You can withdraw money from any Canadian ATM without having to pay any fees. In fact, EQ Bank will reimburse you for any network fees charged by the ATM provider.

Neo Money Card

The Neo Money Card is one of the best reloadable prepaid cards on the market, giving most users an average of 5% cash back when spending money at merchants that partner with Neo. If your average monthly cash back rate falls below 0.5%, they’ll top up the difference. The card can be used online, in-store, and abroad wherever Mastercard is accepted and you can withdraw cash from ATMs.