Cryptocurrency

If you're looking to learn about cryptocurrency, Bitcoin, Ethereum, mining, and how you can invest in crypto though apps and exchanges, then you've come to the right place.

Popular articles about cryptocurrency

The 10 Best Crypto Exchanges in Canada

Heidi Unrau - 01 Dec 2023

Bitbuy Review : Is This Canadian Crypto Exchange Worth It?

Heidi Unrau - 27 Nov 2023

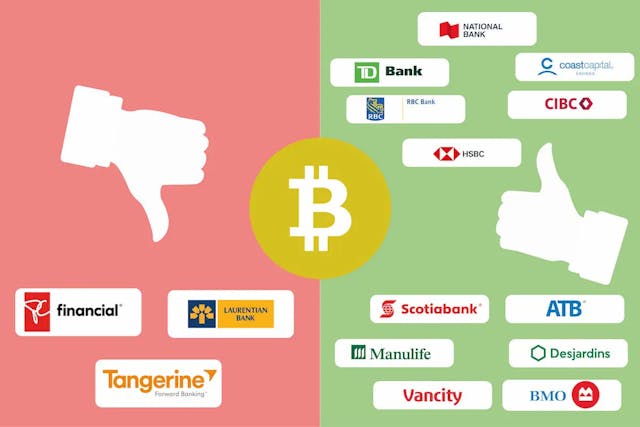

The 11 Best Crypto-Friendly Banks in Canada (and Some of the Worst)

Arthur Dubois - 26 Jul 2023

5 common DeFi scams and how to protect your crypto

Heidi Unrau - 24 May 2023

The 13 Best Crypto Wallets in Canada

Arthur Dubois - 01 Aug 2023

How to Buy Crypto With a Credit Card in Canada

Arthur Dubois - 07 Jul 2023

How to Buy Bitcoin Through a Crypto ATM in Canada

Arthur Dubois - 29 Jun 2022

Frequently asked questions about cryptocurrency

What is cryptocurrency?

Cryptocurrency is an online-only digital currency that is decentralized. That means it is not backed, controlled, or regulated by a central bank, like the Canadian dollar is. You cannot physically carry crypto coins in your wallet, or keep them in a bank account. They are created, used, and stored online on a new kind of digital database called a blockchain. You can use cryptocurrency as a form of payment, a store of value, or you can buy crypto an investment.